Solana's fee-market fork in the road

Economic activity on Solana is booming. But what does this mean for fee markets? And how will MEV factor? Increased economic activity has tested Solana’s fee market and also created MEV leakage.

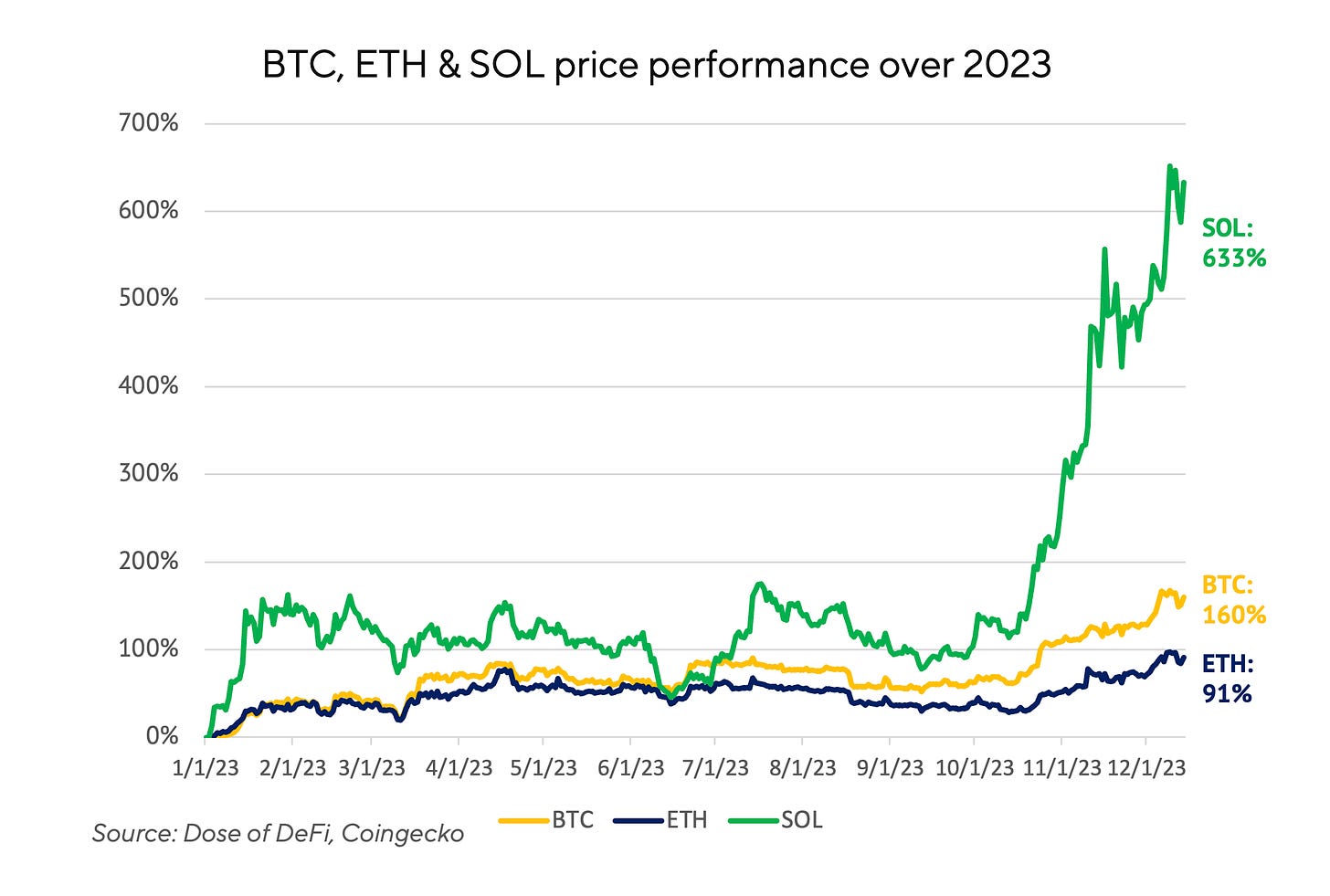

Solana’s rise has expanded the DeFi field. We’ve followed from afar, but never had a fresh take to offer. However, the last few months of frenzied activity on Solana has provided a new opportunity to look at its position in the market, and how it might evolve. Zhev has previously written technical explainers of AMMs and other DeFi primitives on his own substack. This month, we’ve teamed up with him for an in-depth look at Solana’s fee markets. MEV has come to dominate the fee market conversation on Ethereum, and as Zhev explores below, it will soon come to dominate on Solana’s as well.

Transaction fees are necessary to support even the most basic activities on a blockchain, as they enable users’ transactions to be granted validity and included in a block. The primary purpose of these fees is to disincentivize spamming; it’s also part of the subsidy paid to validators to build/validate blocks. In a sense, these network fees are analogous to rent; users are paying to access a commodity which is finite per unit of time. The commodity in this context is ‘blockspace’, and is exactly what it implies – space on a block.

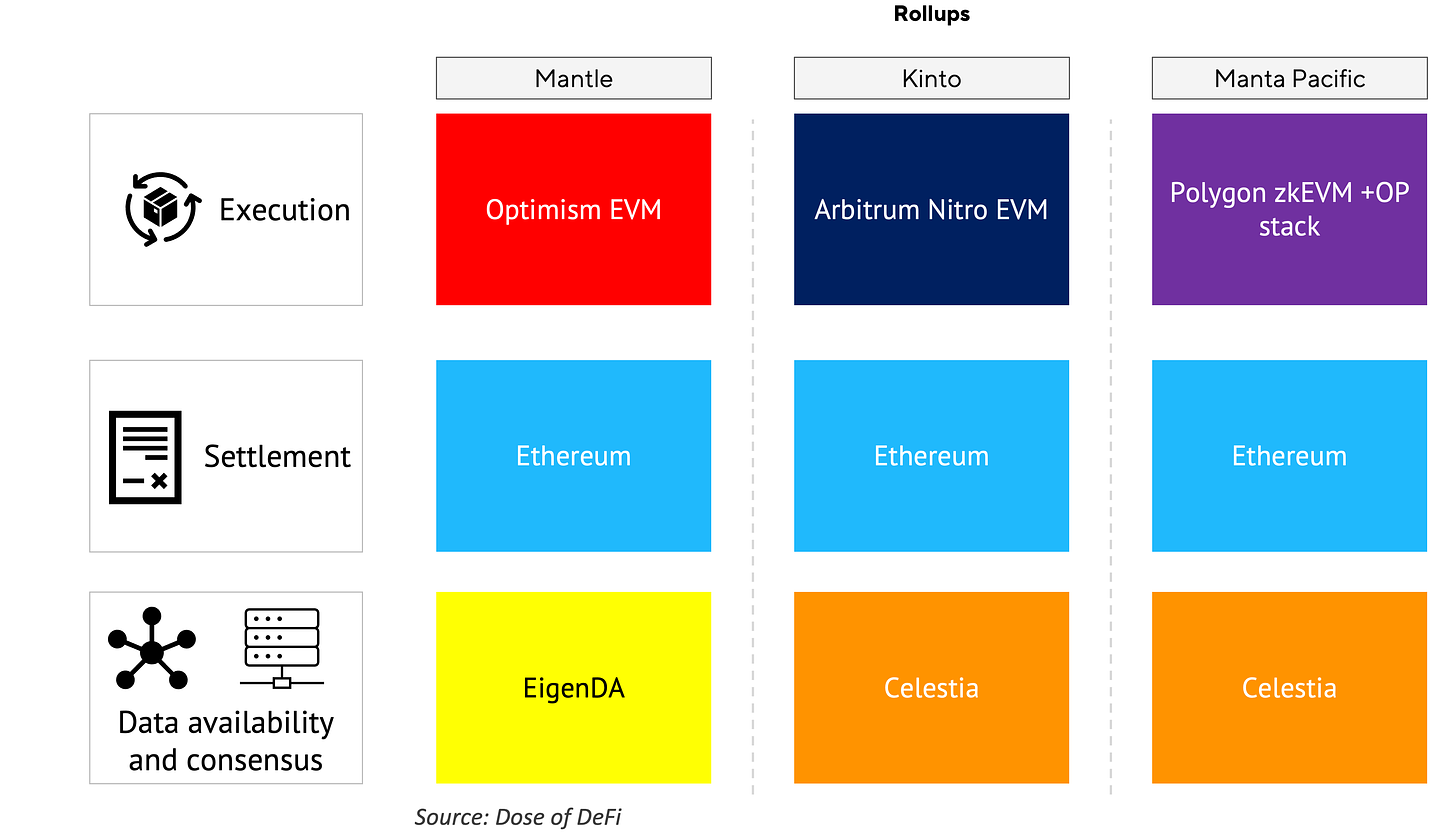

Here, we assess blockspace on the two biggest smart-contract blockchains, Ethereum and Solana. And as we look deeper, we learn that fee markets – designed both within the protocol and organically from the bottom-up – enable validators to leverage their access to blockspace.

Solana’s fee market was optimized for high performance and designed to avoid the issues that have arisen from Ethereum’s approach. Yet while Solana’s market may ultimately be more performant than Ethereum’s, it still needs to go through a similar MEV revolution to its peer’s (where validators begin to take advantage of their privileged position). Solana doesn’t have to go the same proposal-builder-separation (PBS) route that Ethereum chose, but it will need to settle on a holistic approach to stabilize its fee market long term.

The ABCs of blockspace valuation

Before we dive in, let’s try to understand how blockspace value is roughly determined.

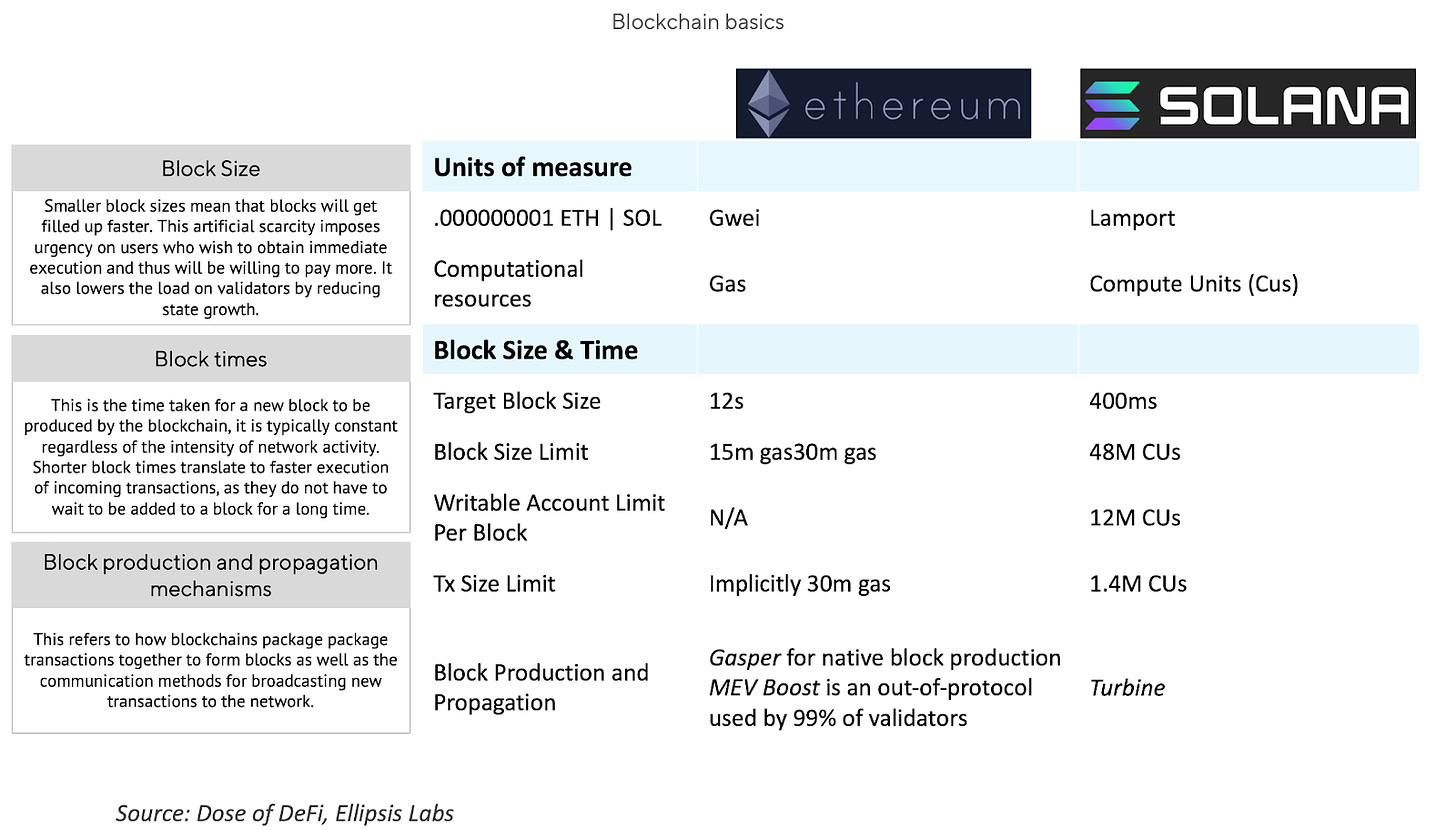

There’s both a technical aspect and a social layer (essentially, the entities whose collective trust in the blockchain affords it value). On the technical side, blockchains can adjust the block size, block time, and block-production and propagation mechanism. See the below chart for a more detailed description and comparison in approach by Ethereum and Solana.

The social aspect is the coordination of blockchain stakeholders to achieve the chain’s technical and fiscal goals. It could also be viewed as the chain's social status, which is subjective but nevertheless an important measure. Social pressure works, as does setting a particular culture for resolving issues – something Solana and Ethereum have both established. Recent examples of discussions around the social layer are the ongoing arguments over whether to increase Ethereum's gas limit and issuance per epoch, and the recent closure of Jito's mempool on Solana.

Now, let’s move on to a more detailed review and contrast of the fee markets on both Ethereum and Solana.

Ethereum's fee market: A summary

Ethereum's popularity is mostly due to its execution environment: the Ethereum Virtual Machine (EVM), which enables smart contracts. Another factor is that the permissionless nature of Ethereum has yielded various innovative applications across multiple cycles: the ICO craze of ‘17-'18, DeFi summer 2020, and ‘21-'22s NFT mania. The continuing presence of these applications creates value that is transferred to validators, who provide the blockspace for these activities.

Soon after economic activity proliferated on Ethereum, miners (this was several years before the switch to PoS) began exploring ways to use their position as block proposers to insert their own transactions when arbitrage opportunities arose.

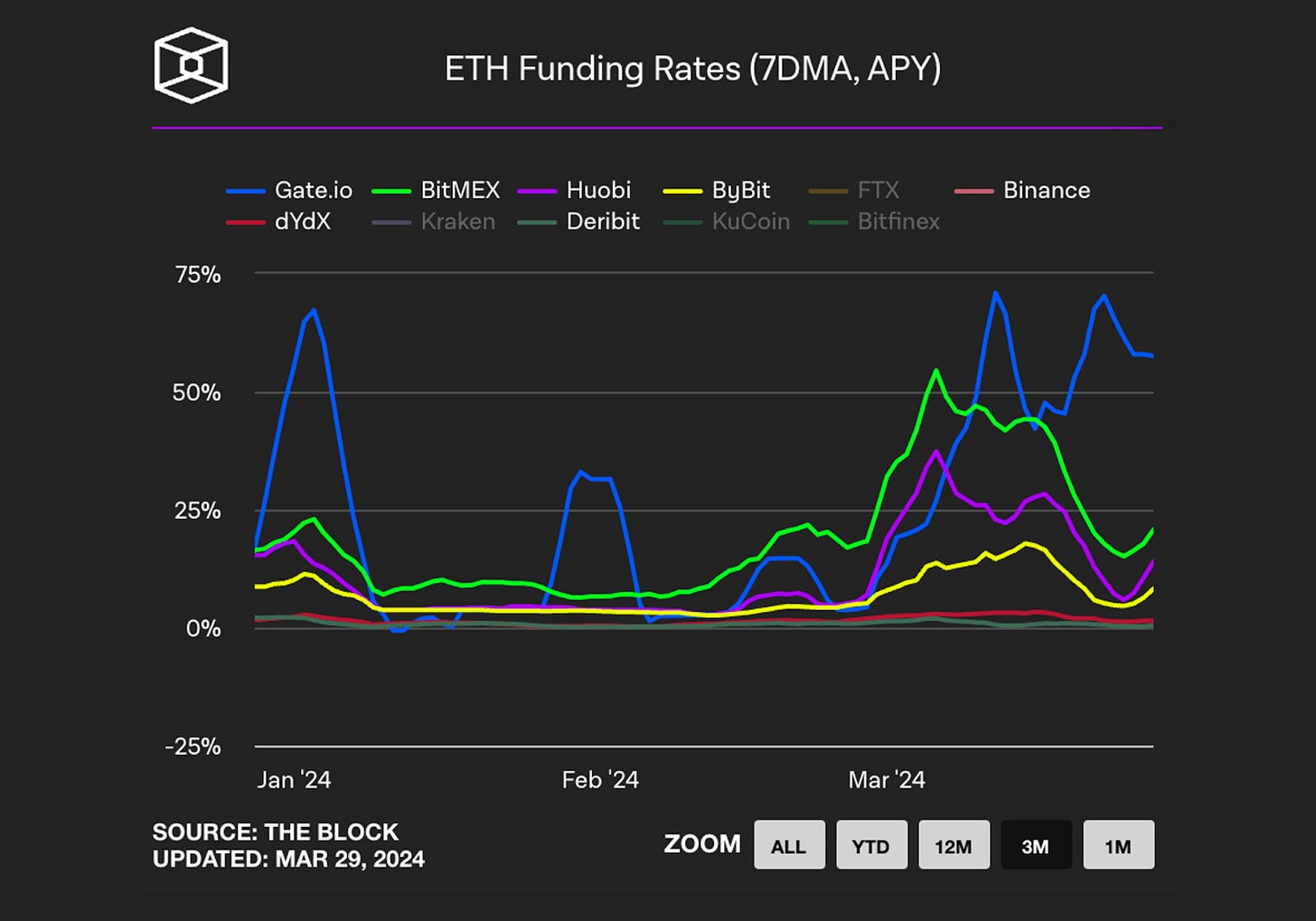

Phil Daian was the first to document this activity – which we now refer to as MEV – in his seminal paper, Flash Boys 2.0 in 2019. At the time, the Ethereum fee market only allowed higher gas prices as a way to incentivize transaction inclusion. These priority gas auctions (PGAs) clogged up the Ethereum network and raised gas prices until Flashbots (co-founded by Daian), launched. This then created a market for miners to get paid for transaction inclusion by searchers, who are on-chain arbitrage traders. Ethereum researchers subsequently realized that MEV extraction could be a more powerful motivator than in-protocol fees.

Perhaps the biggest change to Ethereum’s fee market was EIP-1559, which created a base fee (dynamically deterministic per epoch, disincentivises spamming, burned), and a priority fee (used to show urgency or specify preferences, and paid to the block proposer for transaction inclusion). An important point to note is that ‘priority fees’ are functionally different from ‘tips’. The former ensures inclusion and is mediated by the underlying chain, while the latter ensures ordering alongside inclusion and is mediated via a fee market.

Ethereum’s approach has continued to evolve; check out our two part deep dive on MEV from last fall. This has occurred through a combination of the social layer that is trying to decentralize a centralizing MEV industry, and the technical layer where MEV is now a key part of the technical roadmap (Vitalik calls this part of the roadmap, ‘The Scourge’).

Solana's fee market: The mechanics

Solana was built with an acutely different approach to blockchain architecture, especially regarding scalability.

Some of Solana’s notable innovations include:

The absence of a general mempool: In Solana, transactions are directly forwarded from the originating client to the current leader in charge of producing a block, eliminating the need for a mempool. This theoretically reduces the latency for transaction confirmation, but isn’t always the case in practice due to ‘jitter’, which is the variation in processing times that different validators experience when handling transactions or blocks.

State isolation: An extension of its lack of a mempool, enabling transactions on its dAPPs to be more independent of each other. This approach is analogous to the ‘adding more lanes to ease traffic’ principle; different types of transactions on Solana have a specific ‘path’ they have to follow from the user to the leader in order to be added to a block. This article provides more detail.

Parallel execution: Solana's ability to process non-overlapping transactions concurrently in the same block. This is aided by two factors:

Block production is (roughly) continuous in Solana, since leaders are expected to add transactions to blocks as they receive them.

The slot-leader role is deterministic, as they are scheduled in a queue beforehand, and leaders are also responsible for producing four consecutive blocks.

These two factors, alongside Solana's state isolation, enable transaction ‘multithreading’. This is where the current epoch leader schedules multiple packets of transactions to be confirmed at roughly the same time (on the condition that transactions in the same threads do not alter the same state) in the same way and at the same time.

Solana’s fee market: Cheaper ≠ better

Network fees on Solana are typically very low (although they’ve risen with recent demand). In contrast to Ethereum, Solana has a static base fee per signature measured in lamports. Its priority fee is then measured in microlamports per compute unit requested.

This means that while fees algorithmically scale with complexity and demand on the EVM, the SVM scales only its priority fees via simple demand. The technical issues arising from this non-dynamism are detailed here, but the gist is that pricing a commodity whose demand fluctuates wildly while its supply is deterministic in a static manner isn't optimal.

Solana’s fee market: The MEV inevitability

The social consensus on Solana is that its low fees are its distinctive advantage over other blockchains. This approach invites spam, so some have called for higher fees or a dynamic base fee for times of high activity (akin to EIP-1559).

Solana’s approach to date has been to implement localized fee markets in response to heightened demand. Since states are isolated, it’s trivial for the network to determine ‘hotspots’ or states that are experiencing a surge in demand. This hotspot-approach enables a blockchain to algorithmically price targeted transaction fees above the average for transactions compared to other less in-demand states. This approach – similar to the block-builder role on Ethereum – is done by a scheduler, which helps to place transactions in continuous blocks based on priority fees.

As part of the implementation of local fee markets, Solana built an in-protocol scheduler, which natively schedules transactions to be executed based on a first-in-first-out algorithm. Transactions are continuously streamed to the slot leader who then sorts the transactions based on the tips they offer.

The algorithm also requires that the slot leader shares the shreds they are building with some of the nodes they're connected to, based on the latter's stakes. However, as noted earlier, this process is disrupted by jitter. Specifically, scheduler jitter (arising from Solana's random assignment of incoming transactions to execution threads) and network jitter (from delays in P2P relay of incoming transactions and shreds).

These ‘jitters’ contribute to non-deterministic transaction ordering on Solana, which makes blockspace auctions economically viable. So, in other words, whenever there is jitter, validators have an economic incentive to insert or reorder transactions. For users, this means MEV leakage and for validators, MEV profits.

Solana vs. Ethereum

A quick MEV-Ethereum recap: on Ethereum pre-Flashbots, MEV activity crowded out regular blockchain activity, pushing up gas prices for all users through PGAs. On Solana, fees don’t spike because it does not have a shared state and a global minimum price like Ethereum, but it's incredibly difficult for regular users on Solana to land a transaction during heightened activity. Flashbots released MEV-GETH to deal with PGAs, creating a separate lane for MEV value to be auctioned off outside of the in-protocol fee mechanism. In the case of Solana, Jito launched a similar product for validators that gave them access to a psuedo-mempool and a customized scheduler that would order transactions in the most profitable way. Jito’s mempool was attractive to users, offering them guaranteed inclusion for the right to be front-run (aka, have their MEV extracted).

While a popular product, Jito’s mempool came under social pressure and was shuttered last month. This is likely for a similar reason as to why more than 20% of Ethereum transactions run through private mempools: users are tired of being sandwiched. Spamming is now back on the table as the sole mechanism for (probabilistically) guaranteed execution of time-sensitive transactions on Solana. And the absence of a mechanism for efficient blockspace bidding leads to uncertainty during high demand.

Since transactions on Solana are now streamed directly to the slot leader and the prioritization model has been broken, topology (and latency by extension) is the most important component users will consider for time-sensitive transactions.

A user's topology in the network may be understood as how ‘far’ they are from the leader, and is dependent on the weight of their stake and/or the stake of the nodes they are connected to. Thus, rational agents will seek to be connected to nodes which already control high amounts of stake, leading to centralisation.

As a short-term consequence of spamming, Solana is now so congested that it’s practically unusable for less-savant users because of transaction failures. And addressing the long-term consequences (co-location and centralization of network stake) has become even more important.

A more structured market?

Solana’s initial design philosophy was centered around eliminating user friction and allowing the validator network to meet demand in whatever way it could. What Solana missed was that markets do best when they have some underlying certainty about how they function. Fee markets provide a way to democratize inclusion by requiring users to pay more, moving the problem from a topological perspective, to an incentive-based one.

While this changes the user experience, embracing fee markets – particularly as they relate to MEV – is the best path forward for Solana and its users. Arguably,providing a cost-intensive avenue to inclusion, while maintaining a chain's integrity, is far better than no avenue at all.

Indeed, onchain activities are almost always time sensitive, especially when an agent seeks to extract value with little-to-no economic cost. Overpriced deterministic execution is better than cheap probabilistic execution.

The specialization of fee markets enables the bargaining and auctions for blockspace to occur at higher levels away from consensus and execution. Validators can thus carry out their duties without having to worry about optimizing for best outcomes to accrued blockspace value.

The impending MEV revolution on Solana

Solana is in the midst of a chain-wide conversation on how its fee markets should restructure (something Ethereum has been pondering for years, yet still not figured out).

Solana has yet to go through the necessary MEV transition. And while the recent increase in activity on the chain has attracted MEV players like Jito and Ellipsis to begin building MEV infrastructure, major validators have yet to cross the rubicon and start running their own Solana MEV strategies. This is in contrast to all major staking providers on Ethereum that run MEV boost. The Solana validator community is not as adversarial as Ethereum’s, so the handshake agreement to not extract MEV in order to prioritize the end-user experience has been held (so far).

This will not last; the social layer cannot police behavior forever. Blockchains must function in an adversarial environment with self-interested actors. Solana might fare better than Ethereum because it can solve some MEV problems without the heavy decentralization shackles that Ethereum wears. Yet it will have to answer thorny questions like, should all staked SOL get access to MEV rewards like Ethereum has achieved through MEV boost?

Some minimization mechanisms are already being explored with the aim to solve Solana's congestion problem. These include a dynamic fee structure, upcoming changes to the native scheduler specifications, stake-based limitations, and other optimizations at the application level. Things are moving quickly. Jito’s CEO recently acknowledged that a “small cluster of operators/searchers [are] sandwiching [and] running private mempools”.

MEV is a marker for economic growth and as such is unavoidable. In fact, even Bitcoin – whose simplicity is usually hailed as its greatest feature – is beginning to experience a reinvention following the rise of Ordinals and economic activity. Choosing to ignore solutions due to negative externalities (such as in Jito's case) does not eliminate said externality, it simply leads to an uncoordinated market.

The social layer is an effective tool for stopping predatory behavior, but only for a short time. Ethereum is experiencing the shortcomings of the social layer with the rise of timing games, a strategy where block proposers intentionally delay the publication of their block for as long as possible to maximize MEV capture. This weakens the security of the chain but makes economic sense from a validator perspective. Shame works for a little while, but protocol research is the only long-term fix.

It’s too early to say what Solana’s MEV supply chain will look like in a few years' time. But one thing we can be sure of for now is that most value will be captured by large validators.

Odds & Ends

Bitcoin halving dashboard Link

Frax Finance expands to Cosmos via Noble Link

Paradigm open sources Reth AlphaNet, an OP Stack-compatible rollup Link

Synthetix V3 goes live on Base Link

Highly anticipated restaking protocol, Eigenlayer launches on ETH mainnet Link

Alternative Layer-1 Monad raises $225m before launching its testnet Link

Senators Lummis and Gillibrand introduce new stablecoin bill Link

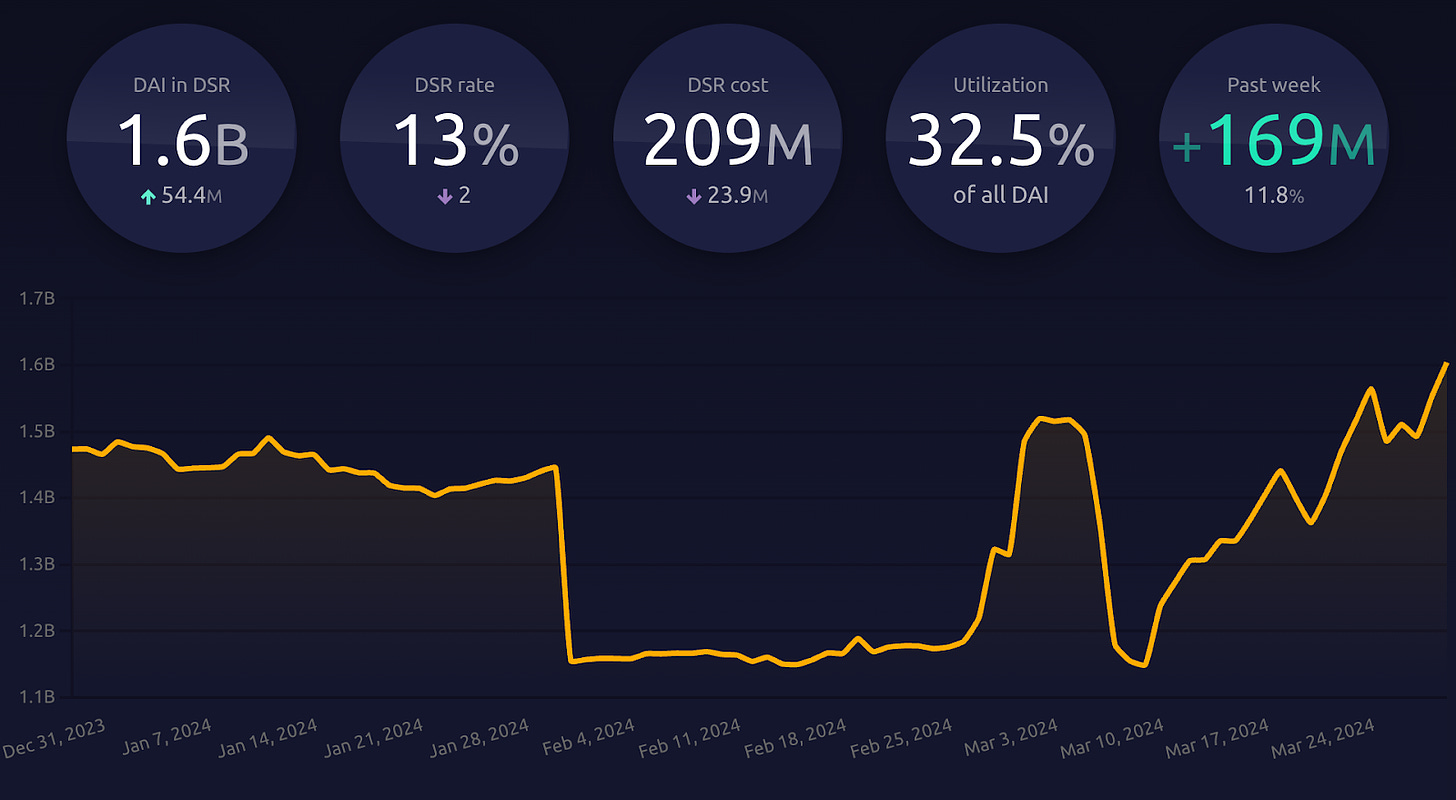

MakerDAO raises sUSDe & USDe debt ceiling to $1bn Link

Thoughts & Prognostications

Blobsplaining Part 2: Lessons from the first EIP-4844 congestion event [Blair Marshall/Blocknative]

Onchain finance is thriving; what’s next? [Mario Laul/Placeholder]

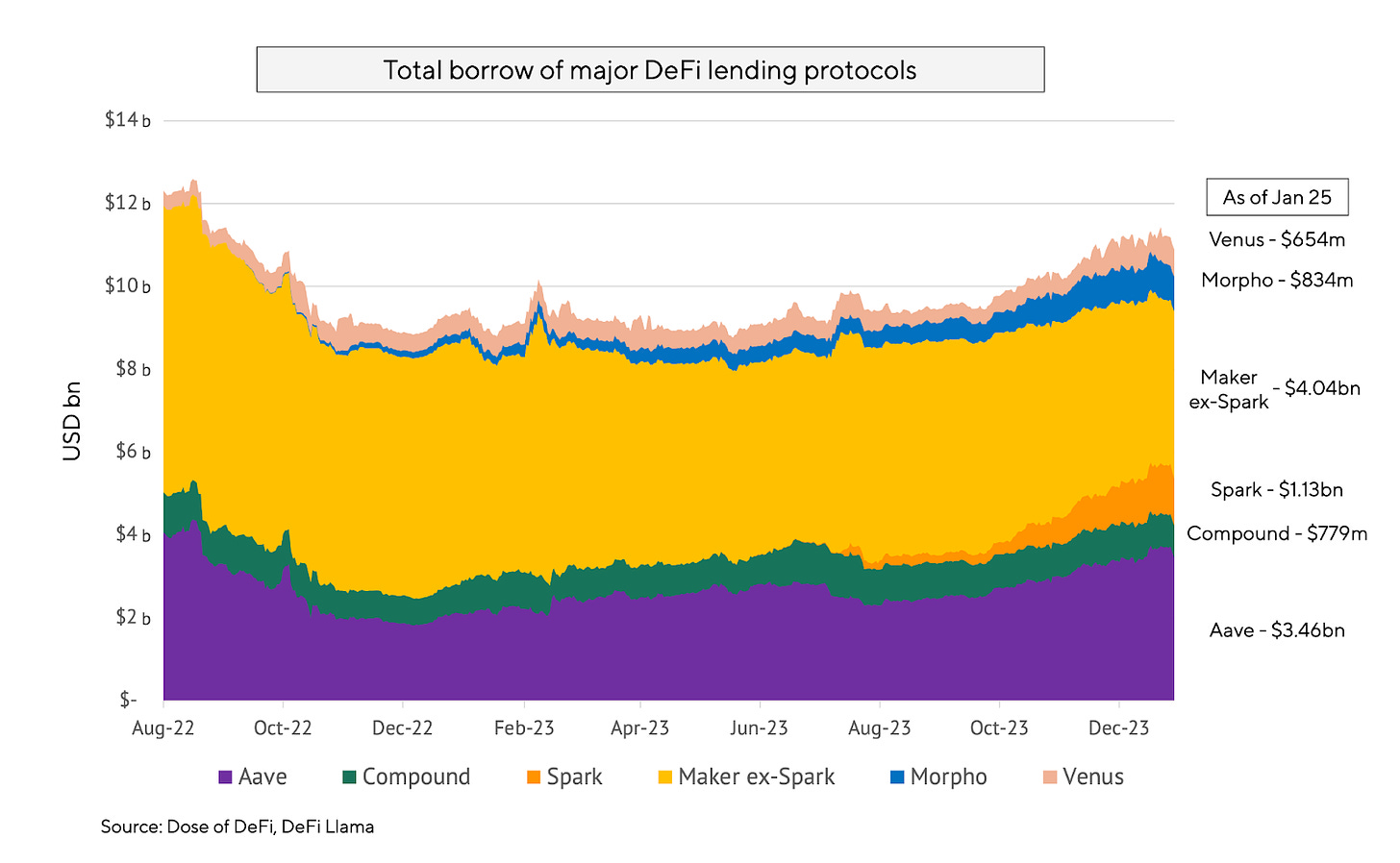

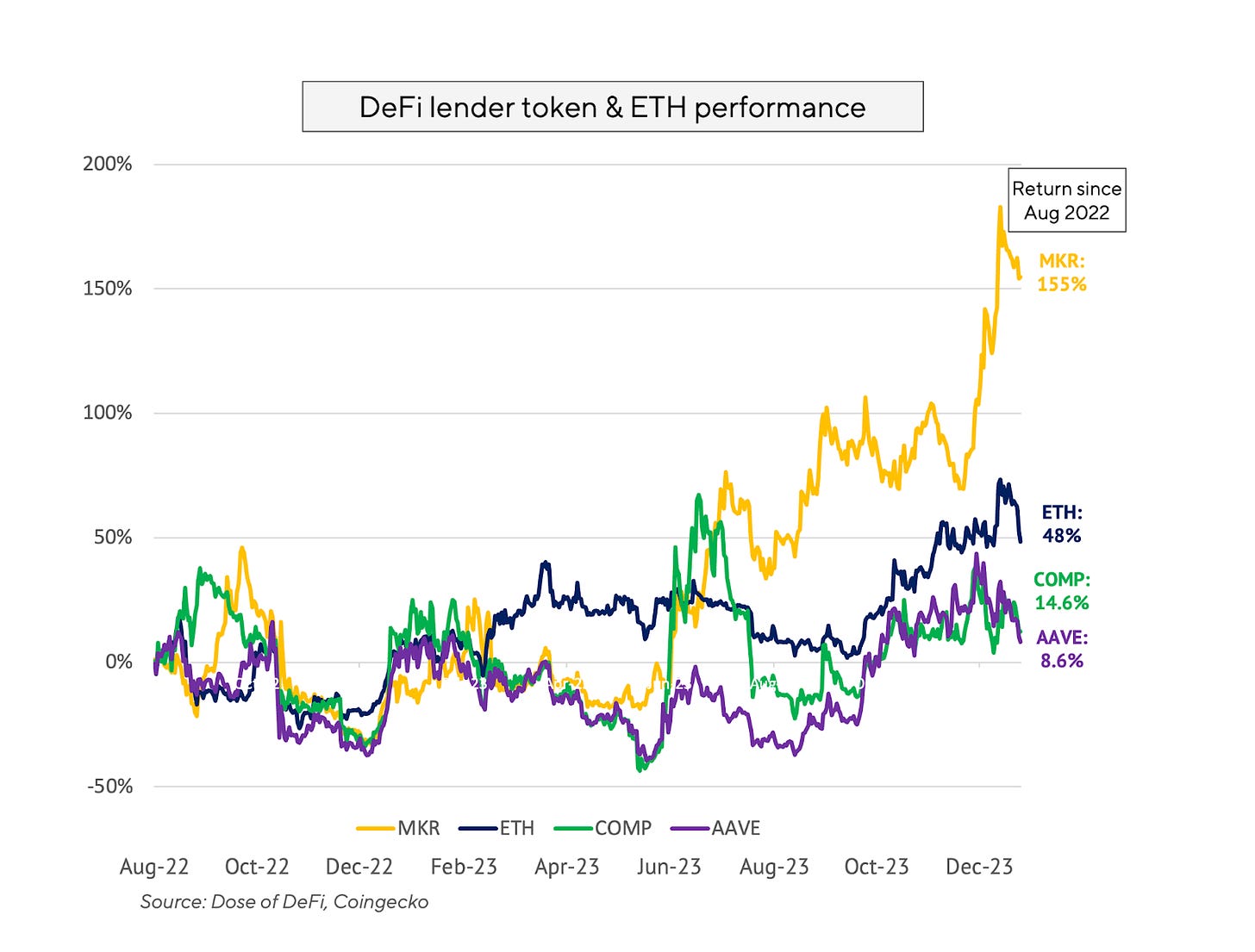

Lending protocols [Our Network]

On ERC-4337, Intents, and MEV [Ben Basche & Alex Watts/Fastlane]

Solana Uncovered: An introduction to the Solana Network [Caron Schaller/CoinMetrics]

"We Plan to Win" - Hayden Adams on Uniswap vs. the SEC [Bankless]

State of DeFi Q1 2024 [Toe Bautista & Kinji Steimetz/Messari]

That’s it! Feedback appreciated. Just hit reply. Great to finally get a deep dive on Solana on Dose of DeFi. I’ll be in Berlin next month at Dappcon & ETH Berlin

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to Powerhouse, an ecosystem actor for MakerDAO. All content is for informational purposes and is not intended as investment advice.