Appchain hype and DeFi lenders' reliance on token incentives

Plus Odds & Ends and Thoughts & Prognostications over the last week

Tweet of the week: Appchains & DEX’s

Tweet from Parsec founder Will Sheehan, commenting on the increasingly popular topic of app-chains. Nascent’s Dan Elitzer wrote about the inevitability of UNIchain and the release of Cosmos’ Whitepaper 2.0 is shining a light on the benefits of running your own chain.

Sheehan - like Menai’s Lanre Ige - argues that apps with physical settlement are a poor candidate to transition to an app-chain. Those that rely on cash settlement - like dYdX - make sense because they don’t have to bridge tokens into a new chain.

In many ways, the appeal of app chains has driven by the rise of MEV. On Ethereum and other EVM chains, apps like Uniswap do not see any of the value from MEV, which flows entirely to validators and searchers, but apps could tap into this value if the app token was also used to secure the underlying network.

Sheehan’s argument is that best execution won’t necessarily win out. There is often much better execution on CEX’s or RFQ systems, but many users still prefer DEX’s. And for spot trading, the most important thing is where the tokens are.

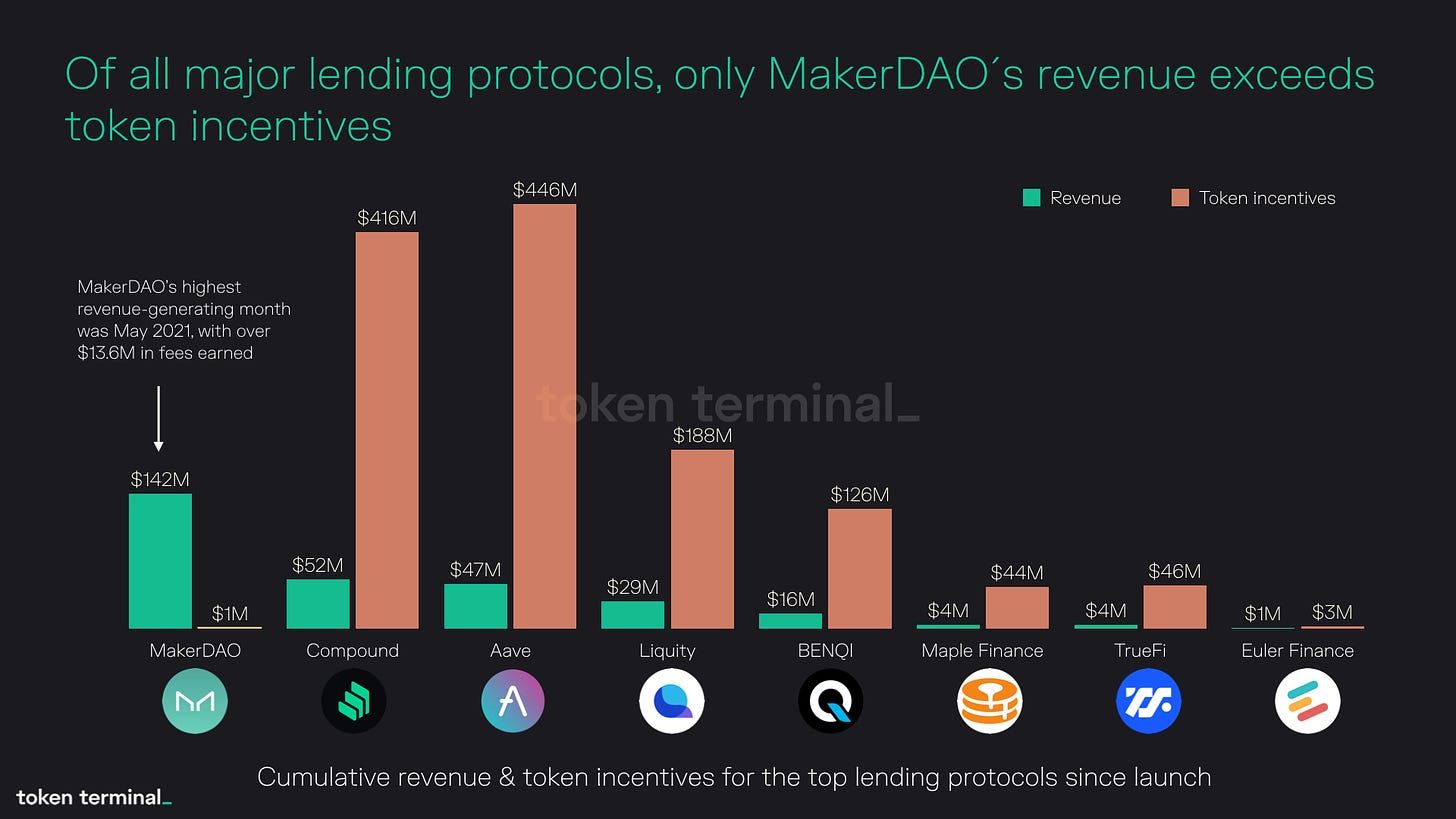

Chart of the week: Revenue and token incentives

Lending protocols are the lifeblood of DeFi. Leverage is still DeFi’s #1 use case and the loan liquidation market basically birthed the MEV. The chart above from Token Terminal shows how much of DeFi lending is from token incentives.

Maker ($7bn) has a higher TVL than Aave ($5bn), but $3.4bn of Maker’s TVL is from USDC in the Peg Stability Module (PSM), which is earning no fees so not really lending. Still, as the above chart shows Maker has achieved its position without any token incentives, which none of its competitors can claim. Of course, MakerDAO has spent $50m a year on a big team to help grow adoption (that also received MKR as compensation).

Massive subsidies to early users to build a network effect was pioneered by Uber. Tokens are more effective than discounts, but at least with Web2 subsidies you’re not paying in equity.

Dive deeper: Variant Fund’s Mason Nystrom has a nice Twitter thread on the projects “Token Acquisition Cost”

Odds & Ends

BlockSec releases new transaction explorer for EVM chains Link

Compound Treasury launches borrowing for institutions Link

Chainlink releases prototype of Fair Sequencing Services (FSS) Link

Token Terminal: Introducing Sound Business rankings Link

Someone hacked into dYdX’s npm account Link

CFTC pursues first case against a DAO (bZx) Link

Skip raises $6.5m to build MEV solutions Link

Thoughts & Prognostications

Cosmos History — Part I — Inception to PreLaunch [Interchain]

Macroprudential considerations for tokenized cash [Gordon Liao/Circle]

DeFi lending: intermediation without information? [Bank of International Settlements]

Breaking down the second generation of DeFi lending protocols [Mikey0x/1kx]

Why finality matters [foobar/The Variable]

Regulate web3 apps, not protocols [Miles Jennings/a16z]

An unreal primer on real-world assets (RWA) [Jack Chong/Frigg.eco]

That’s it! Feedback appreciated. Just hit reply. Written in Austin, Texas where 90 degrees is balmy.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.