Binance Smart Chain begins the multi-chain DeFi era

BSC will not replace, but may expand DeFi on Ethereum

Crypto Twitter often feels like meme warfare. Products and chains need to attract users and investors to be real, so supporters must sell a narrative based on a future reality that does not yet exist. This reflexive cycle pits chain against chain, meme against meme, with price the only thing tethered to reality. DeFi (on Ethereum) has been the undisputed champion for the past year plus, taking up all oxygen in the crypto ecosystem.

The sudden emergence of Binance Smart Chain (BSC) and the mainstream attention that NFTs have garnered are the first successful narratives to break out after Bitcoin and DeFi. So how do these affect DeFi on Ethereum?

Binance Smart Chain enters DeFi

The overnight success of Binance Smart Chain (BSC) is due to Ethereum’s astronomically high fees and Binance’s clout as the largest player in crypto. PancakeSwap, a Uniswap Clone, reports over $3bn of assets locked up and over $750m in daily volume after just launching a few months ago.

We should be extremely skeptical of these numbers, but at the same time, not underestimate the type of liquidity that Binance can drive - Binance.com is averaging $15bn of volume a day in 2021. It also has more incentive to innovate; it needs a long-term solution to its regulatory cat and mouse game.

BSC is actually Binance’s second attempt at a blockchain. Binance Chain or Binance DEX launched almost two years ago; it used Tenderbmint BFT for consensus for never found traction. With the growth of Ethereum and the DeFi boom, Binance pivoted and launched BSC, a new, EVM-compatible sidechain where 15 of the 21 nodes are controlled by Binance.

Like xDai, it is a sidechain, so it is only as secure as the nodes powering the network and is reliant on a bridge, and like xDai it comes with Metamask integration and all the same developer tooling as Ethereum. Binance is betting on a multi-chain future and hoping BSC can be one of many EVM compatible chains that help Ethereum scale.

It’s not a bad bet but it’s certainly a crowded field. How will it be different? One negative and two positive things going for Binance:

[Positive] BSC will compete for non Ethereum-native assets. There are still a lot of blockchains with large valuations, many of which trade heavily on Binance.com. They all want a liquid token for DeFi, and BSC could be the best EVM chain to trade BCH, DOT, XRP, ADA or even BTC. Lending markets and the expanding market for on-chain collateral are very important.

[Negative] Developers and users are suspicious. To state the obvious, BSC is not pushing decentralization forward. While users/investors are ultimately looking to make money and will gravitate towards useful products, BSC is specifically targeting Ethereum developers and users by using its wallet and tooling. Non-crypto developers may be a better target, but they don’t know Solidity or use Metamask. BSC can capture volume from Ethereum’s overflow but will new projects launch first on BSC?

[Negative] Token issuance drives native liquidity. Building products and attracting users is great, but the chain where tokens are issued will maintain a liquidity edge. It’s hard to overestimate how important the ERC20 token standard is; multi-billion dollar protocols store their cap table in an Ethereum smart contract. Even if trading and lending move away from Ethereum’s base chain, token issuance may remain or move to a secure Layer 2. Binance actually has experience here, but I don’t think Binance Launchpad rivals the ICO boom or DeFi summer. It’s hard to imagine any independent project using BSC as a home base.

Calvin Chu had the best Twitter thread laying out the bull case for BSC, followed by Fiskantes’ CeDeFi explanation of BSC. Defiprime has a rundown of all the product and infrastructure pieces still missing on BSC.

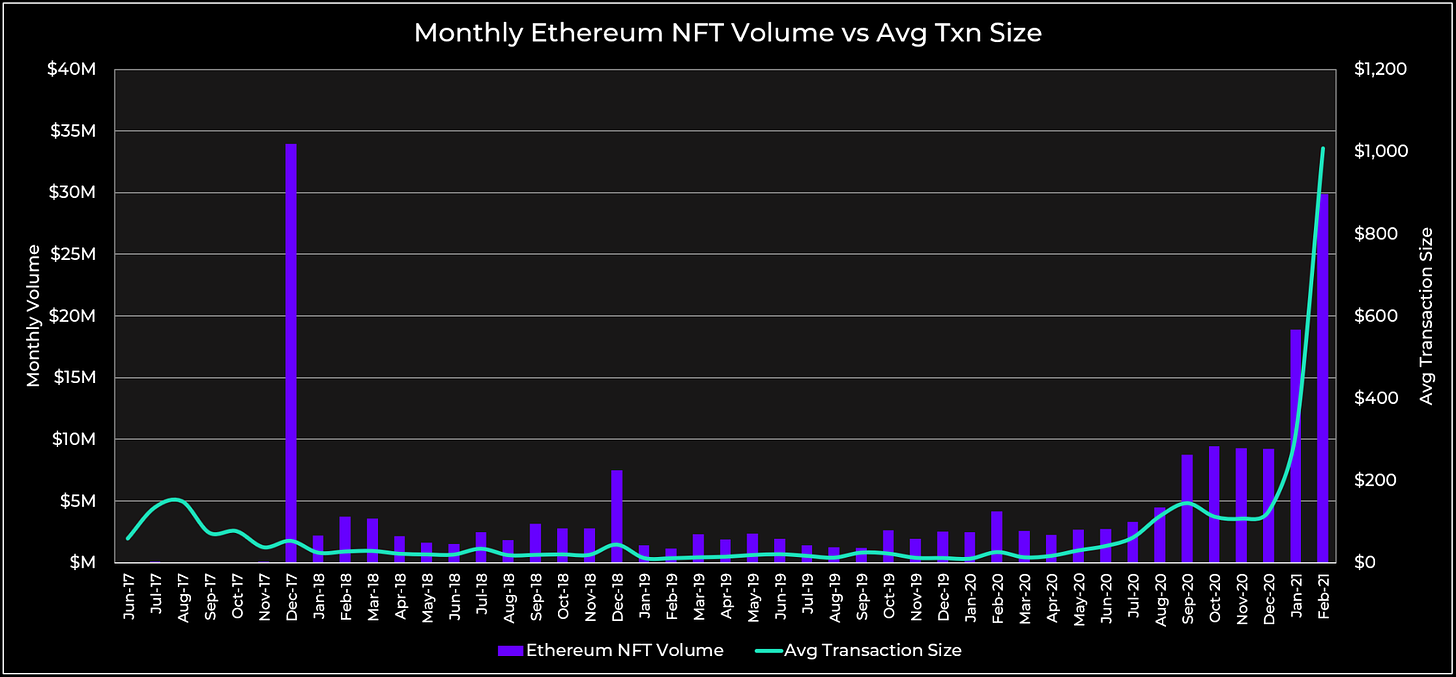

Chart of the Week: NFT’s meteoric rise

A lot of ways to say “NFTs are hot” but this chart from a Delphi Digital update (paywalled) does it best. This month is shaping up to be the first month that NFT volume on Ethereum will surpass the CryptoKittie craze of December 2017 and the largest NFT volume is off Ethereum, NBA Topshot on Flow by Dapper Labs (the team behind Cryptokitties). I don’t have anything insightful to say about NFTs other than that they are very cool.

The NFT economy will need on-chain financial services, so it’s hard to see this as anything other than a multiplier for DeFi. Some still wonder what the financial activity does for the world besides feed speculative appetite. In the Not Boring newsletter, Packy McCormick dives into how NFTs could power the creator economy and go mainstream.

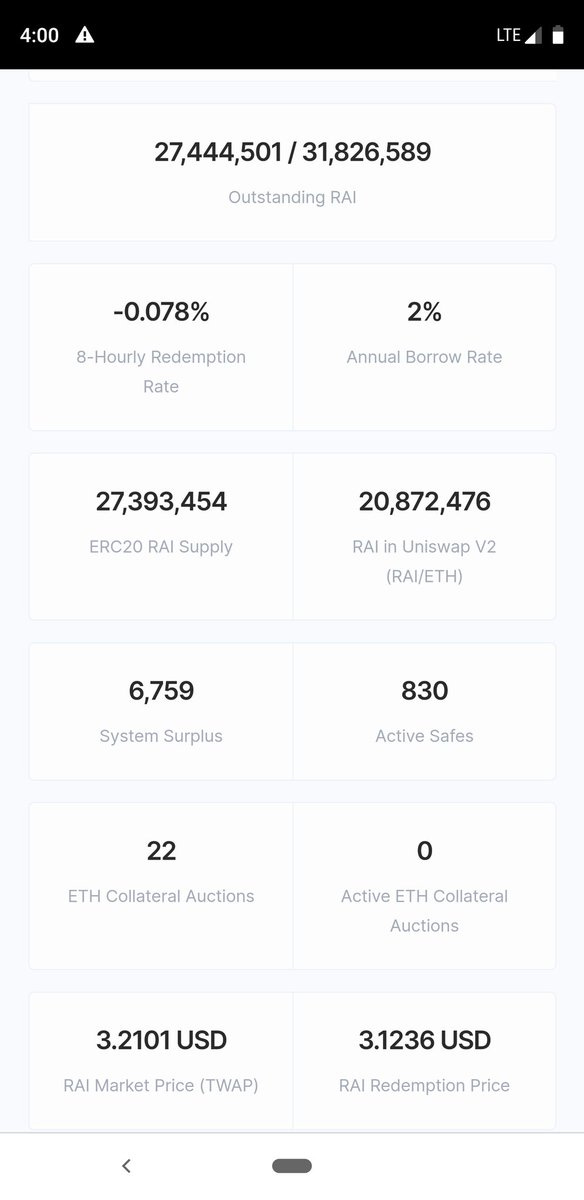

Tweet of the Week: RAI goes negative

Reflexer Labs (Ameen and Stefan are both cofounders) just launched RAI, which it describes as a “non pegged, ETH backed stable asset. It is useful as more ‘stable’ collateral for other DeFi protocols (compared to ETH or BTC) or as a stable asset with an embedded interest rate.” The goal is for RAI to stably track its collateral (in this case ETH) through the use of interest rate changes that respond to the price of RAI. The negative interest rate Ameen highlights is because RAI is massively overpriced, in large part due to the liquidity mining rewards on the Uniswap pool. The RAI redemption price $3.12 is lower than the market price ($3.21) and will continue to drop every 8 hours to encourage RAI holders to redeem until the price target is met. Amidst the recent mania, RAI is a new primitive that will be interesting to watch in the wild.

Odds and Ends

The Block: Monday liquidations were second biggest ever for DeFi Link

Continuous ESD announces two token seigniorage shares model Link

Chainlink Spring 2021 Virtual Hackathon with $80k+ in prizes Link

PoolTogether airdrops governance token Link

Alpha Homora and CREAM announce plan to recollateralize exploit losses Link

Gyroscope: a new crypto-native self-stabilizing money Link

Layer2.finance aims to roll up Layer 2 tx on existing DeFi protocols Link

Thoughts and Prognostications

Quantifying MEV: Introducing MEV-Explore v0 [Alex Obadia/Flashbots]

Prediction Markets: Tales from the Election [Vitalik]

CRYPTO ANONSENSE [Molly Wintermute/Hegic]

Deep Dive Analysis into the Cosmos, Polkadot and Near Protocols [Kent Barton/Shapeshift]

How DeFi Exploits Impact Price and TVL [Mira Christanto/Messari]

The crypto art world is exploding — so here come the tech moguls to screw it up [Joon Ian Wong/The Business of Business]

An analytic approach to maximize profit and identify risk in AMM liquidity pools [Araon Briggs/DeFi Prime]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where the snow is now dirty and unwelcome. Big news this week…

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao. All content is for informational purposes and is not intended as investment advice.