Former Bitcoin core dev lead Gavin Andresen:

Bitcoin on Ethereum is the holy grail for DeFi. Products and services need on-chain assets to trade and use as collateral. Bitcoin is the most widely traded crypto asset and backs billions of dollars in collateralized loans.

Of course, investors need a financial incentive to move BTC onto Ethereum, and even then, concerns over centralization and security need to be overcome. Having said that, DeFi may finally have gotten through to Bitcoiners:

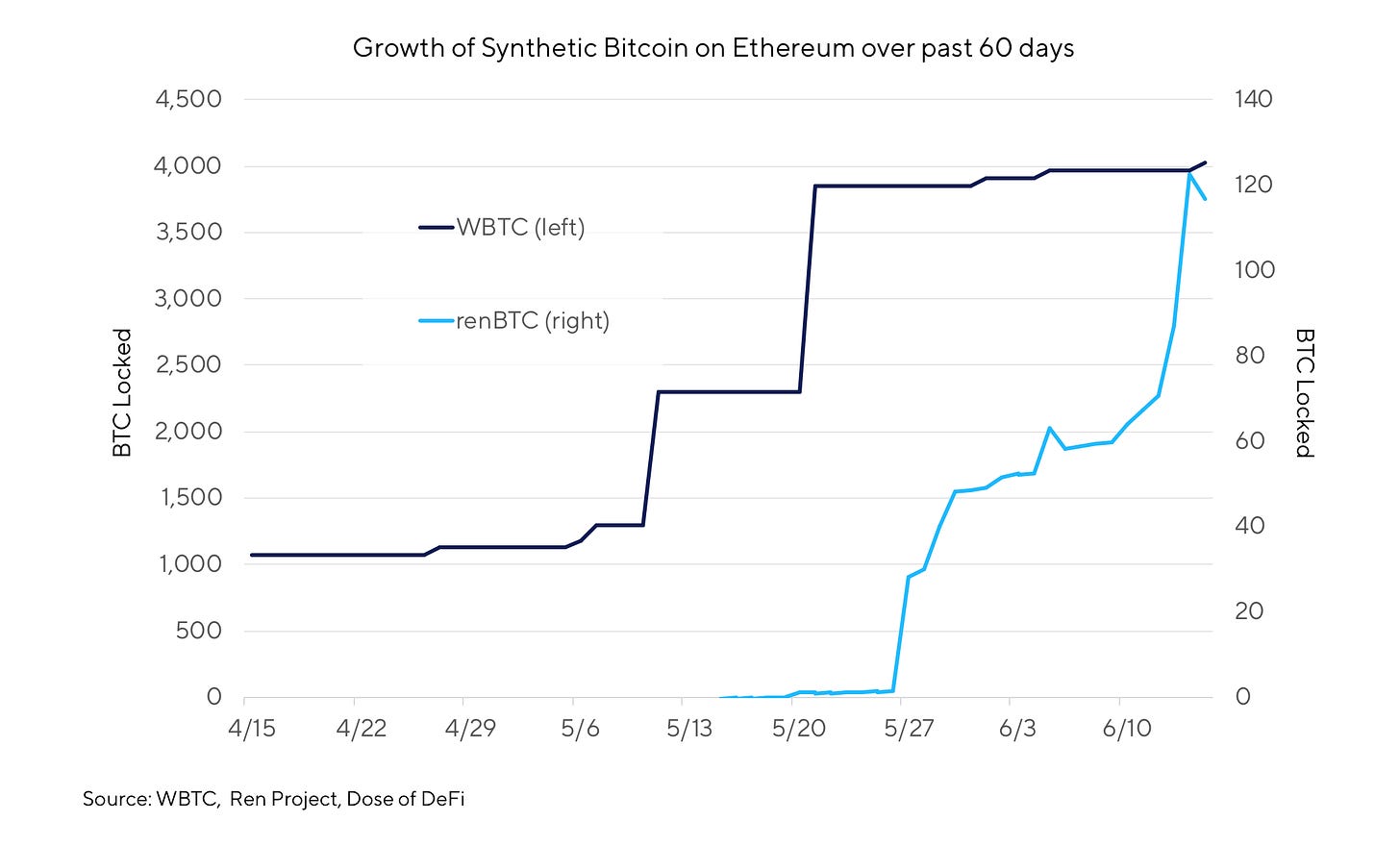

The chart does not include HitBTC or imBTC, which reports 550 BTC locked up but they are still dealing from fallout from the ERC777 re-entry attack exploited on Dforce in April.

WBTC and renBTC have grown exponentially since May. WBTC’s growth can be attributed to its inclusion as acceptable collateral in MakerDAO on May 3. The sharp jumps are from new minting, primarily from CoinList which launched a WBTC on- and off-ramp in April. Almost all of the WBTC is flowing into MakerDAO, which holds 68% of all WBTC supply.

renBTC, meanwhile, just launched on Mainnet this spring, and although it is much smaller, it is the first project to create a trustless, no KYC bridge to Bitcoin (tBTC, another trustless Bitcoin synthetic, plans to relaunch after an emergency pause last month). The RenBridge has already processed more than $1m in BTC, ZEC and BCH onto Ethereum.

What’s driving the growth?

Liquidity mining and yield

WBTC’s surge was driven by a couple of large BTC holders looking to refinance a BTC-backed loan through MakerDAO, such as Nexo, which has a $9.3m Dai loan in a Maker Vault paying 1% interest, cheaper than any BTC-backed loan.

I suspect renBTC’s growth was driven by ETH-heads moving their BTC over to Ethereum. Almost every ETH holder also owns Bitcoin, but even DeFi-addicts felt no need to move their BTC away from the Bitcoin blockchain. Why hodl in Metamask?

Because BTC on Ethereum is more capital efficient. Curve.Fi’s renBTC - WBTC pool allows a user to deposit either Bitcoin synthetic and idly earn trading fees, while the liquidity mining rush is driving DeFi activity across the board. Balancer features several pools for earning fees on BTC synthetics while also rewarded with BAL tokens for being an early liquidity provider.

COMP launches

A lot of numbers and all of which will likely be wrong by the time you’re reading this. There is a tool to estimate your rewards.

To take a step back, there were two major Compound events today:

COMP began distribution to its users based on borrowing and lending on the Compound protocol. Interest earned and accrued (in Dai, ZRX, etc) earns a corresponding amount of COMP tokens proportionate to total usage of the platform. Full details here.

COMP began trading on Uniswap today at 0.08 ETH and is already up 5x to 0.42 ETH, surpassing MKR as the largest DeFi token according to defimarketcap.io

On top of the COMP incentives, of course, are interest rates that respond to supply and demand from borrowers and lenders. Bots try to arbitrage differences in lending rates across protocols, but it will now need to account for the (current?) value of COMP.

If the value of COMP continues to go up, might that mess up the economics of borrowing and lending? As long as it doesn’t affect liquidations and collateralizatoin, the Compound Protocol should be fine, but it will have a huge effect on DeFi lending markets - potentially all crypto markets given that Tether holders earned 75% of COMP on the first day.

This demonstrates the robustness of liquidity mining as a distribution strategy as the increased frenzy and interest will only drive further usage of the platform - particularly borrowing.

Tweet of the Week: Auction Innovation

Maker’s Keepers failed on Black Thursday. They made some incremental adjustments after but Keepers remain difficult to run even for the technically gifted. A Dutch auction is more capital efficient and should have prevented the 0 Dai bids of Black Thursday. In a decentralized world, fair auctions are integral to democratizing access to finance, especially as concerns grow over Miner Extraction Value (MEV).

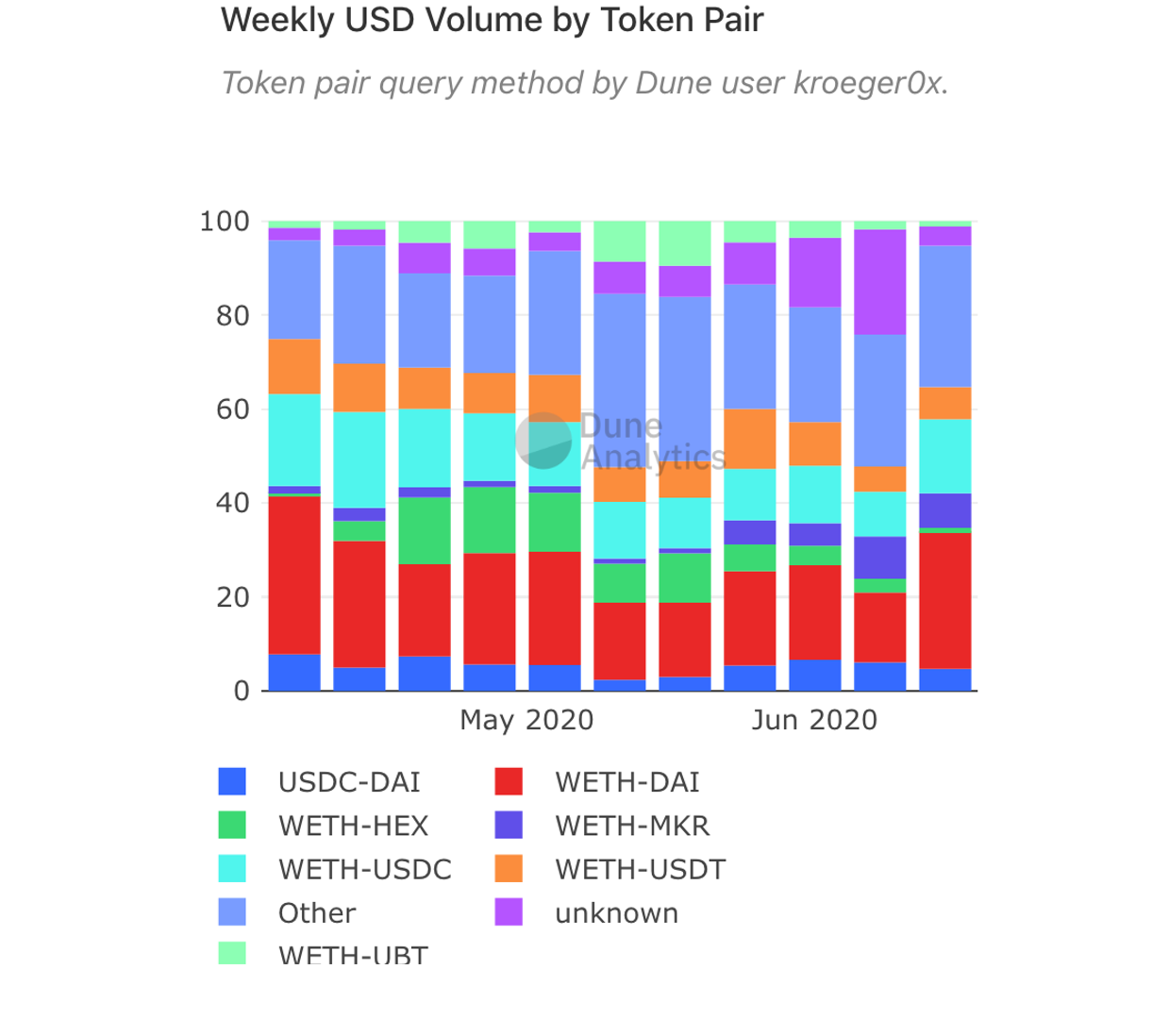

Chart of the Week: DEX Trade Pairs

A lot of nuggets in this chart from Dune Analytics DEX page, created by Alex Kroeger. WETH and stablecoins mostly and you can see HEX volume evaporate. MKR has picked up, from price fluctuations after the Coinbase listing. There is a small uptick in ‘unknown’ and ‘other’ over the last month or so, which could be the bump in trading volume for alts. Dai, USDC and USDT all vying for the most liquid DeFi stablecoin.

Odds and Ends

Circle launches MoneyHacks hackathon for USDC products Link

DeFi robo-advisor Rari Capital announces launch Link

Kyber releases Fed Price Reserve for professional market makers Link

UMA ETHBTC experiences first liquidation Link

Earn double matching Gitcoin grants with Panvala Link

Curve Finance integrates RenVM Link

Thoughts and Prognostications

The Evolution of Utility on Ethereum [Wilson Withiam/Messari]

Analysis of EIP 1559 [Hasu & Georgios Konstantopoulos/Deribit Insights]

Liquidity Black Hole in DeFi [Andrew Kang]

Money Legos with Options [Rafi Baraldo/Pods Finance]

IDEX trade volume and token value accrual [Matt Casto/CMT Digital]

Liquidity Mining Bubble Will Eclipse the ICO Craze [Nick Cannon/Ethereum Price]

Validium and the Layer 2 Landscape [Ben DiFrancesco]

Governance as a Service [Ingamar Ramirez]

That’s it! Feedback appreciated. Just hit reply. Fresh logo + colored links, yea or nay?Written in Brooklyn, which is clinging onto spring. Subscribe to Govern This.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.