There’s a common trope where a Bitcoiner – typically an American male – admonishes an inflation-ravaged country and preaches the gospel of Bitcoin and its fixed supply. From his comfortable perch on Twitter, he speaks of how Bitcoin is the solution to a developing country’s woes, if only the people would appreciate hard money and Austrian economics.

So far, Bitcoin has not been a savior to any economy. Its censorship resistant P2P payments have given individuals in repressed regimes an important lifeline, but it has not been adopted at scale in Venezuela, Zimbabwe or other inflation-challenged countries.

Why we can’t have nice things

Independent of the rise of cryptocurrencies, the last 25 years has also seen the rise of dollarization in countries whose populations have lost faith in their local currency. Some currencies, like the Hong Kong Dollar or Saudi Riyal, are pegged to the USD to ease trade with the global economy.

Other countries have simply replaced their local currency with the U.S. dollar. Sometimes, this is initiated in a top-down fashion – as was the case in Zimbabwe – where the government demonetized the local currency and adopted the U.S. dollar to stave off runaway inflation.

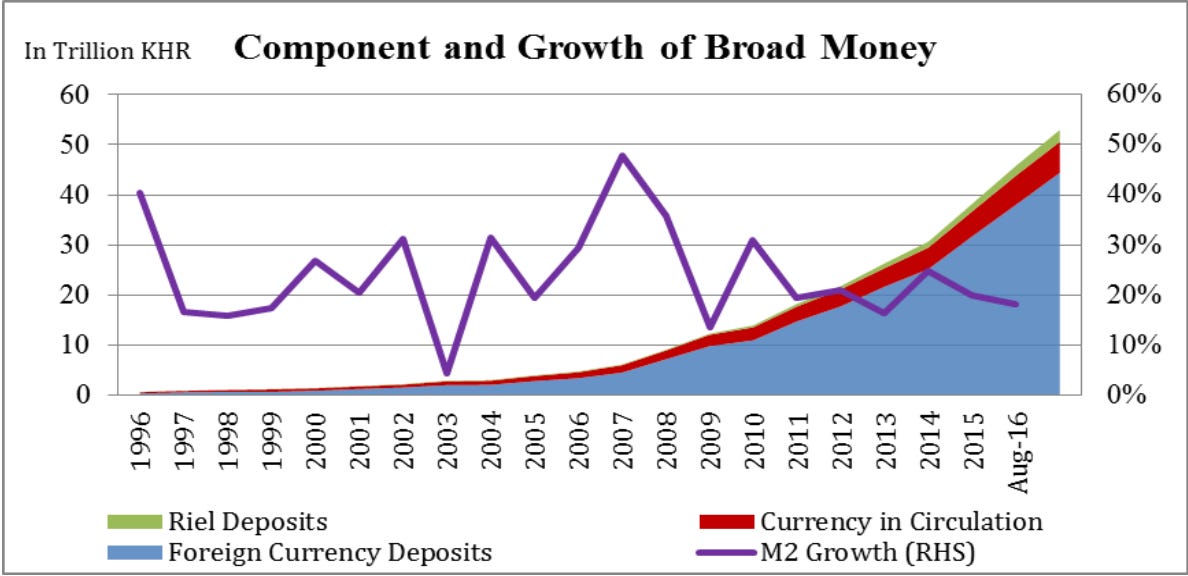

In other instances of dollarization, the process was more bottom-up. In Cambodia and Ecuador, the local populace, frustrated with the fluctuating price of the local currency, began using U.S. dollars for daily transactions. An influx of U.S. dollars from tourists and international aid funded an unofficial dollar economy, which grew and grew until the governments begrudgingly accepted dollarization and made it official policy.

Ecuador no longer has a national currency after it embraced dollarization in 2000, and in Cambodia, over 90% of bank deposits are U.S. dollars compared to less than 10% in the Riel, its national currency.

Dollarization hurts local governments revenue coffers and inhibits their ability to enact monetary policy, although perhaps that is a good thing for the population. More dollars in the local economy make it more attractive to foreign investors. Both Ecuador and Cambodia saw a decade of consistent economic growth after the switch to the dollar.

Once dollarization occurs, it’s difficult to go back. Even if de-dollarization is better for the country as a whole, it’s a collective action problem: for any one individual, it makes sense to save and transact in dollars. Last year, Zimbabwe re-introduced the Zimbabwe dollar a decade after abandoning it, but the inflation fears have reappeared and the government’s efforts to require the use of the Zimbabwe dollar have largely failed.

Have you heard of Bitcoin?

Bitcoin has a great brand. Ask anyone on the street and they likely have some vague understanding of it as a “digital currency” that’s not that different from a Bitcoin Maximalist on Twitter.

Its penetration cuts across geographic and socio-economic lines, but as pervasive as Bitcoin’s brand is, it’s nothing compared to the U.S. Dollar, which can already be used to pay for goods and services in nearly every country in the world.

We often conflate Bitcoin’s role as a monetary experiment (fixed supply) with its innovation as a payments technology (a global decentralized network trustlessly processing transactions). The monetary experiment will play out over the coming decades, but initial failures of Bitcoin as a daily currency are not rejections of global, decentralized payment networks.

Dollarization requires dollars (duh). In the past, local dollar economies were constrained by the amount of hard currency circulating in the country, but with the rise of stablecoins and smart phones, individuals in struggling economies should have a much easier time acquiring and transacting in U.S. dollars.

We thought they wanted Bitcoin, but maybe it was just the U.S. dollar?

DeFi? DeFi!

So how does this relate to DeFi? While most of DeFi’s current users are ETH-heads, digital dollarization will bring a global userbase to DeFi products and services.

Jill Carlson argued late last year, “the primary utility of cryptocurrency lies in engaging in financial activity that is otherwise suppressed or prohibited.” In many cases of dollarization, U.S. dollar transactions were prohibited, because they are seen as a challenge to the national currency regime.

A globally accessible USD savings account is the best contender for “DeFi killer app”. It’s also seen as a destabilizing force by almost every authoritarian country in the world. If U.S. dollar accounts were widely available, dollar transactions would inevitably rise at the expense of the local currency and the government’s seignorage.

DeFi could enable unofficial dollar economies to scale and interact with the global economy, even if their local governments discourage or ban the use of the dollar.

A dollar savings account is just the first step. There’s also high demand for U.S.-listed stocks by populations who can’t access them, and trade with other countries (digital and physical) would likely increase if a U.S. dollar stablecoin could be used for daily transactions within a country.

Another American Male Opinion

There still are two large unknowns:

1. How to get the dollar stablecoins into the country?

2. How will the U.S. government view dollar activity outside the U.S.?

Dollar stablecoins don’t grow on trees. They can enter an economy through exchanges for local currency, gifts, or payments for goods and services. The easiest way – exchanging for local currency – is typically restricted by governments concerned about capital flight. Perhaps there will be more opportunities for individuals to earn digital currency, but this remains a difficult distribution problem and on- and off-ramps still matter. Western Union, Moneygram, Transferwise and other money remittance businesses have unappreciated distribution.

Regarding #2, Americans are mostly concerned with themselves, and while some have begun to understand how the dollar can be weaponized, there is not yet an appreciation in the U.S. for the world’s demand for the dollar and dollar-denominated assets.

It isn’t clear how stablecoin use will be regulated in the U.S., let alone in other countries. A bank-backed stablecoin like USDC could be freely transferred and used for saving by those outside the U.S., even if the physical dollar was custodied by Coinbase in the U.S.

Of course, USDC transfers could be frozen by the U.S. government, so it might only be allowed in countries that are hostile to the U.S.

MakerDAO’s Dai, on the other hand, does not rely on any bank regulated in the U.S and there technically aren’t any US Dollars involved. Dai is a synthetic asset backed by ETH (and BAT…) that tracks the dollar, and its peg is not too different than the Hong Kong Dollar or Saudi Riyal, except that Dai is 1:1 with the USD.

Of course, if the synthetic dollar economy grows considerably, the Fed may try to regulate it or just undercut it by making an official U.S. digital dollar more accessible.

Stablecoins have grown considerably in crypto terms, but they are still small in the broader macro economy sense. At the moment, they are primarily used by crypto traders, but as additional financial services (DeFi and CeFi) are built, stablecoins could find a much larger market in developing countries with an insatiable demand for stable U.S. dollars.

If you prefer a personal take and a video: Maker’s Mariano Conti spoke eloquently at Devcon 5 about how Dai helps him fight 50% inflation in his home country of Argentina. While Mariano is an ETH-head, his talk shows how dollarization and DeFi can grow together.

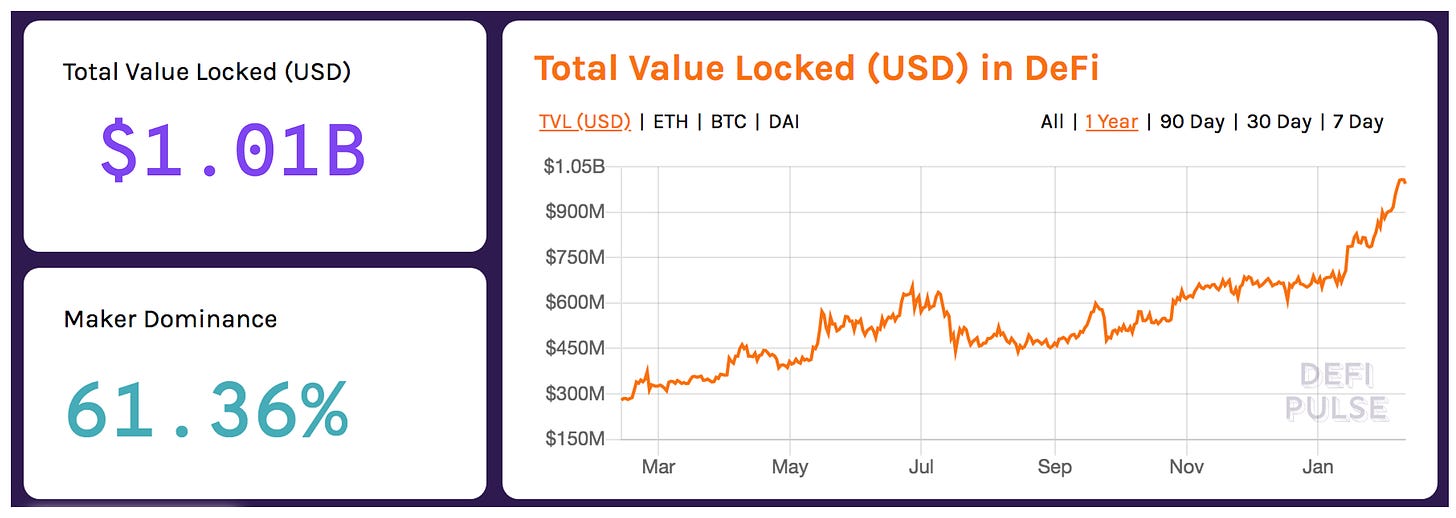

Number of the Week: $1bn locked in TVL

It’s hard to pick another number this week; the DeFi community celebrated as the Total Value Locked in DeFi passed the symbolic $1bn, according to DeFi Pulse. The growth has been fueled by a rise in the price of ETH, but also from organic flows of more ETH, Dai and USDC deposited into DeFi protocols. The industry wide growth comes despite a TVL decline at Synthetix, which slipped back to 3rd behind Compound in DeFi Pulse’s rankings.

Odds and Ends

PoolTogether raises $1m to help fuel growth Link

Dr. Li, Coronavirus Whistleblower, memorialized on Ethereum blockchain Link

Curve Finance aims to lower slippage on trading stablecoins Link

Blocklytics introduces NFTs for Digital Ads Link

DEX.AG v2 launches with multi-DEX orderbook Link*

Dharma launches dTokens to help fund development Link

DeFi’s first ‘Collateral Swap’ Link

New Maker governance vote for Dai Savings Rate and Stability Fee change Link

Thoughts and Prognostications

Announcing MetaCoin – Governance-Minimized Stablecoin [Ameen]

Why is Uniswap a good oracle? [Guillermo Angeris/Gauntlet]

How Memes Can Help Crypto Go Mainstream [Linda Xie/UnChained]

Why is RAY allocated to Compound when bZx seems higher? [Staked]

The Risks of Unknown DeFi Admin Key Opsec [Chris Blec]

Aztec Brings Confidential Transactions to Ethereum [Ben DiFrancesco]

DigixDAO: A Divorce Story [Ryan Yi/CoinFund]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. I have yet to see snow this winter; maybe at ETH Denver this weekend - holler if you’re around.

Dose of DeFi is written by Chris Powers. All content is for informational purposes and is not intended as investment advice.