A couple of exciting new additions to the Dose of DeFi family:

First, over the moon on the arrival of my newborn son! He and mom are doing fantastic and we’re all thrilled.

Second, excited to announce two key members of the Dose of DeFi team:

Denis Suslov - Denis has been translating DoD into Russian for over a year and providing help on research and analysis. He’ll be featuring his first Dose of DeFi deep dive later this month.

Financial Content Lab - led by Sarah Datta, Financial Content Lab is supporting DoD with editing and content production.

Very excited about these additions!

— Chris

Tweet of the week: Solana’s conundrum

Parsec Finance founder Will Sheehan highlighting that the distribution advantages of that FTX affords the Solana ecosystem may harm efforts to build native, on-chain liquidity. Solana has built an impressive list of stakeholders, and most importantly, entrepreneurs are raising capital to launch products on it. FTX, which is building a DEX (Serum) on Solana, faces a classic innovator’s dilemma - the success of its centralized product makes it difficult to divert resources to supporting an new product with little-to-no revenue right now.

Will is also highlighting a truth about capital formation in DeFi. Given the abundance of capital, it is often better to slowly build liquidity as the project matures. Some projects, most notably Maker, benefited from having its token traded on decentralized exchanges years before a CEX listing. Acquiring an asset listed exclusively on a DEX creates a “proof of legitimate interest”, leading to a more curated token distribution.

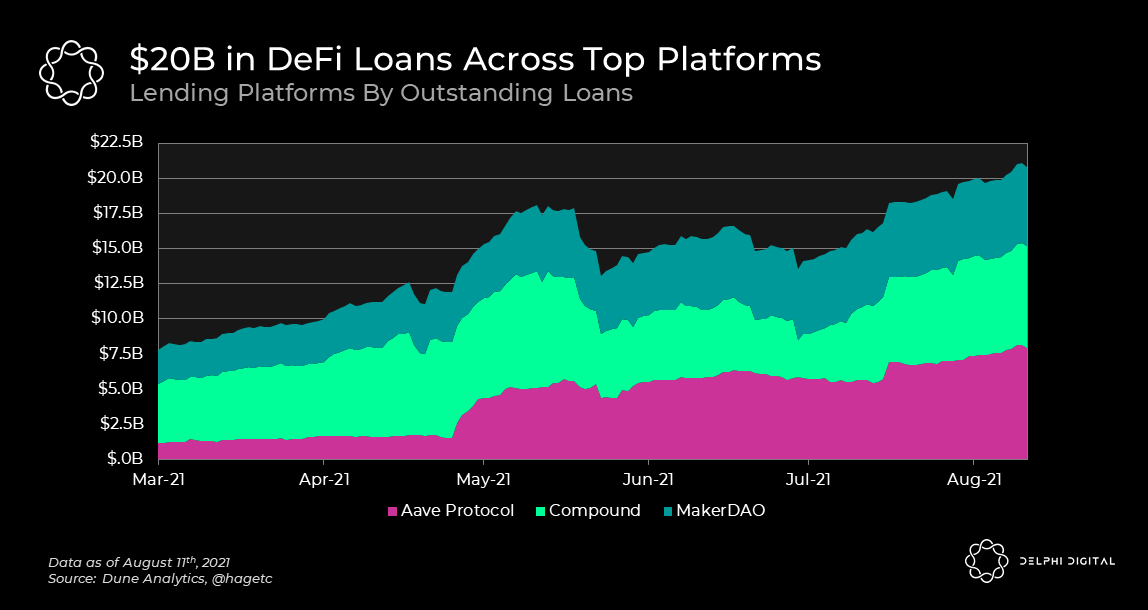

Chart of the week: The loan market’s steady rise

There aren’t many charts with such stable growth over the last six months than this one from Delphi Digital (via Dune - which also raised $8m led by USV) on outstanding loans on the three major DeFi lending platforms. Aave has emerged as the leader with $8.3bn in outstanding loans, followed closely by Compound with $7.3bn and MakerDAO with $5.7bn. Lending remains the most competitive DeFi market, and while these platforms are dominated by traders levering up, the growth throughout 2021 shows that new capital is coming into the system, both in the form of collateral as more and more ETH gets locked up and the ERC20 market size grows, but also from the flood of stablecoins, which has suppressed yields even with the explosion of DeFi borrowing.

Odds and Ends

Arbitrum plans for full mainnet launch in August Link

Jump Trading acquires DeFi infrastructure firm Certus One Link

Reorg.wtf agenda, slides and video Link

Tether releases Q2 reserve makeup, 85% of assets in cash or equivalents Link

The Block: At least $611m stolen in cross-chain DeFi hack Link

Tools for NFT summer Link

Tally raises $6m led by Blockchain Capital & Placeholder Link

Thoughts and Prognostications

Stablecoin regulatory strategies [JP Koning/Moneyness]

Analyzing EIP-1559’s ETH burn [Nate Maddrey & Kyle Waters/Coin Metrics]

Why SushiSwap is becoming DeFi’s most powerful DEX platform [Christian Murray/DeFi Pulse Farmer]

That’s it! Feedback appreciated. Just hit reply. Written in between feedings while trying to stay cool. Enjoying my new role immensely! And grateful for all my new coworkers ;)

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao. All content is for informational purposes and is not intended as investment advice.