Composability in Ethereum; DEX Market turns into three way race

Threats to Composability

The world of Ethereum has descended upon Osaka. Sadly, I’m not there to partake, but the conversation on Twitter has revolved around the move to ETH 2.0. While some have focused on how the transition relates to the founding of Ethereum, the switch to a new blockchain is a herculean task, especially one that that secures tens of billions of dollars.

Amongst the Ethereum community, composability is the biggest concern. According to Wikipedia, a composable system “provides components that can be selected and assembled in various combinations to satisfy user requirements.” DeFi has flourished because developers can launch smart contracts that interact with other smart contracts without having to ask for permission.

It’s why InstaDApp didn’t need permission to build a bridge between Maker and Compound. The composability features in DeFi have also been referred to as Money Legos:

The concerns around composability concern how the existing Ethereum blockchain (ETH 1.0) will interact with ETH2.0, who’s base layer consensus and overall design are completely different. The value, businesses and smart contracts currently being built on Ethereum will likely not be able to interact natively with ETH2.0. As Chief Robotocist of Gitcoin, Kevin Owoki tweeted:

Much of the focus in the Ethereum community has focused on ETH2.0 design for the last several years, but now that the architecture and key milestones are set, focus should now turn to the upgrade process. Given the multitude of projects operating on Ethereum right now, there is likely a business opportunity to provide such services over the coming years.

DEX Market: Three-way race

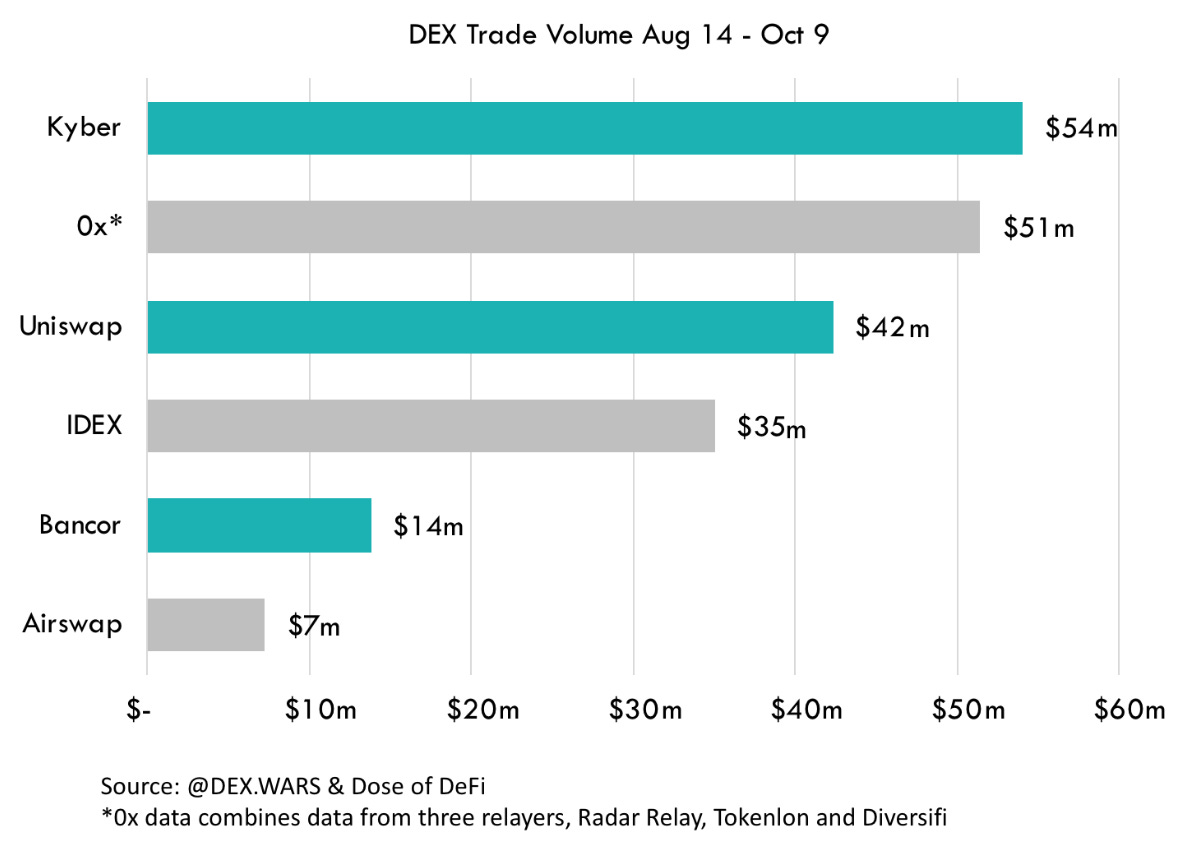

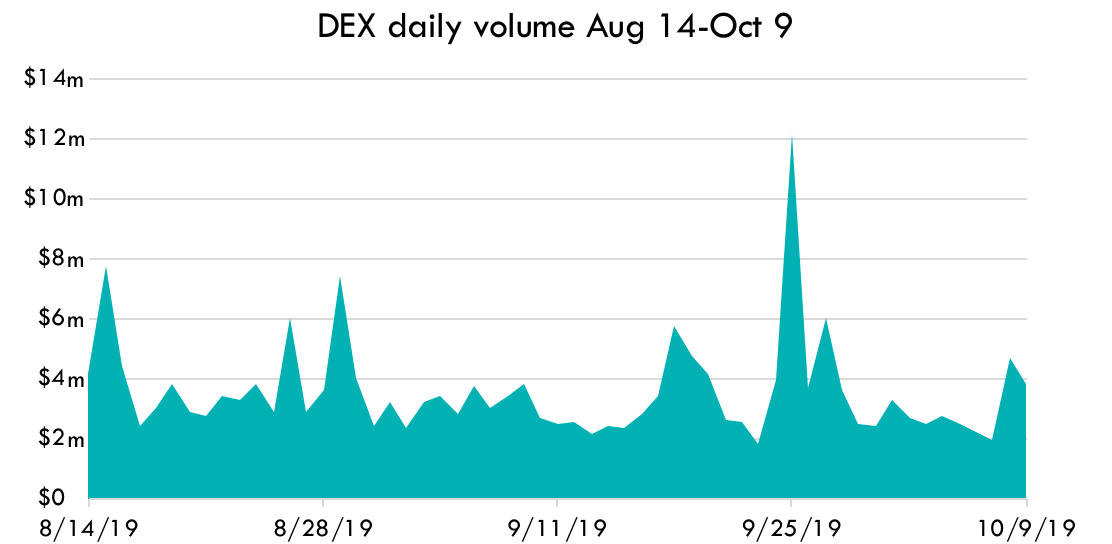

While lending platforms have grown the fastest in 2019, decentralized exchanges (DEX) have a longer history and are showing signs of maturation. The invaluable @DEXWars bot has been tracking stats across Kyber, Uniswap, 0x, IDEX, Bancor and Airswap over the last two months and I’ve compiled that data here. Total trade volume surpassed $204m over 57 days, for an average of $3.6m a day.

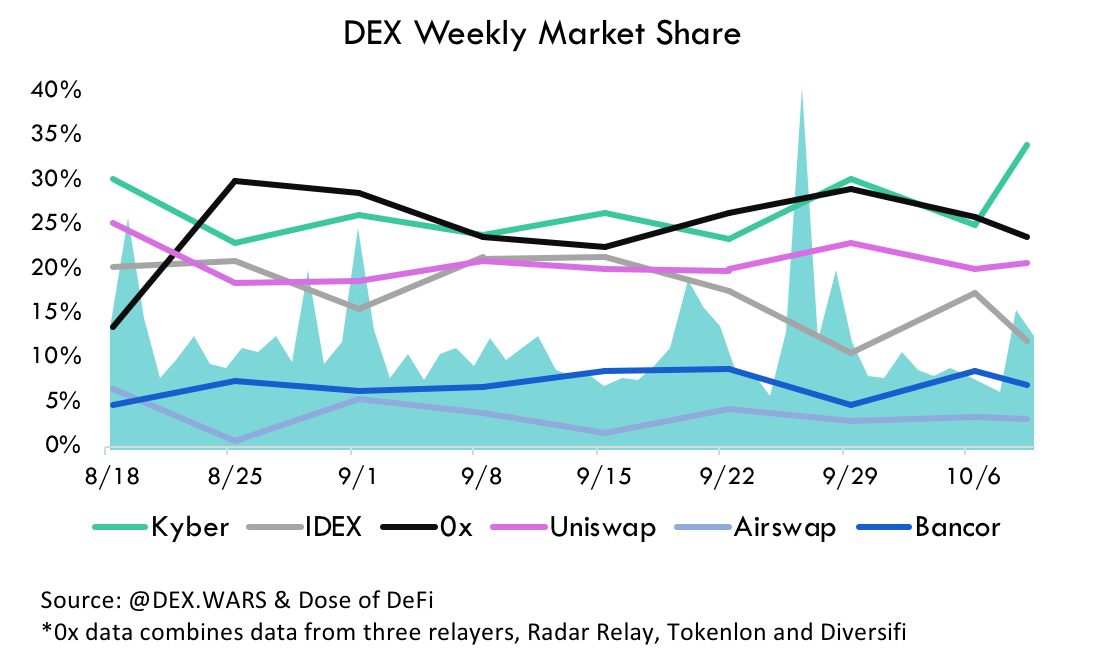

Kyber has been the market leader for the entire year and maintained that supremacy over the past two months. 0x is not far behind but its volume is split amongst three relayers. Over the two months, when volumes spiked, Kyber, 0x and Uniswap were the recipients of the additional flow.

IDEX is DeFi-lite as it only settles on chain. It has been around for a long time but its growth has stagnated over the last 6 months. Bancor and Airswap have also been around for over a year. Their volumes are low, but consistent. The DEX market is still in its infancy any existing project could easily capture significant market share if volumes 10x.

What could catalyze such growth? Wallet integrations are one. Uniswap and Kyber are linking up with wallets and DApps to provide easy liquidity. The wallets and DApps target retail investors who may be trying DeFi products for the first time. Alternatively, growth could come from institutional investors, or even (gulp) security tokens.

Tweet of the Week: Mutli-Collateral Dai is near

Maker CEO Rune Christensen with the big announcement yesterday at Devcon 5: Mult-collateral Dai is coming on November 18. Rune also took the time to lay out future plans for real world assets to be used as collateral in the Maker system, which has raised concerns about more attack vectors.

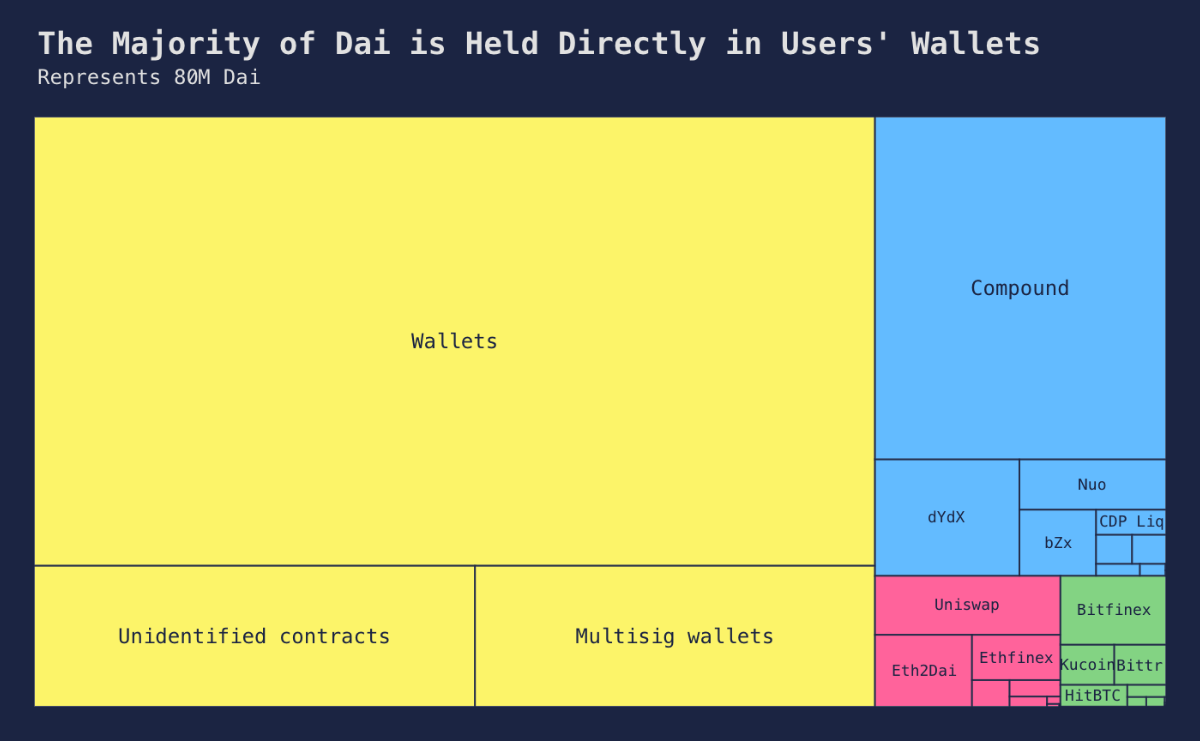

Chart of the Week: Who holds Dai?

The Maker team is out Dai in Numbers Q3 report. With Dai approaching its two year anniversary, clear trends are starting to emerge regarding activity. The chart above shows how popular lending platforms have become but also how much is idle on users wallets. Multisig wallets are likely projects using it as a treasury, while the small amount held at exchanges affirms the DeFi ethos.

Odds and Ends

1confirmation joins smart contract insurer Nexus Mutual Link

Kyber Ecosystem Report #7 Link

Synthetix deploys Canopus upgrade to prevent frontrunning Link

Enable Credit (aka Kiva for DeFi) offers first loan on mainnet Link

Bancor adds ERC20-stablecoin liquidity pools to avoid impermanent loss risk Link

Uniswap previews layer 2 solution, Unipig.exchange in Osaka Link

Thoughts and Prognostications

Central Banks don't need their own digital currencies [Tyler Cowen]

Ether: A New Model for Money - #EtherealTLV Presentation [David Hoffman]

Twitter thread on Dai in Numbers Q3 report [Max Bronstein]

The eth1->eth2 transition [Vitalik]

Compound for beginners, an overview [Floatify]

Listen of the Week: The Revolution with Andreas

The blockchain educator, Andreas M. Antonopoulos, stops by the Decentralize This podcast. They talk a lot about Libra and the guy who literally wrote the book on mastering Bitcoin and Ethereum does not disappoint. The discussion helps explain the value that decentralized networks provide.