Cosmos has been around for years now, yet only started breaking into the crypto mainstream last year. We therefore think now is a good time (especially given the recent snowball-success of Terra on Cosmos) to take a closer look. In this month’s piece we review the basics of Cosmos’s architecture, and explore why it’s different to other ecosystems we’re already familiar with.

Let’s start with a quick definition. According to its website, Cosmos is the internet of blockchains, an ecosystem of apps and services that exchange digital assets and data using IBC (Inter-Blockchain Communication) protocol. But what does this actually mean?

As we previously stated, a decentralized system has to have three layers of technology to function:

Execution

Data availability

Security.

“...Ethereum in its current form does all three of these. There’s the EVM (execution), the ever increasing size of Ethereum state (data), and the Proof-of-work consensus layer. ”

In the case of Cosmos, the Cosmos-SDK more or less covers points 1 and 2, and Tendermint BFT (consensus plus networking) supports security. Where Cosmos is perhaps unique though, is that its technology also provides a framework for building out independent blockchains. As such, any kind of execution can be placed on top of the Tendermint consensus for a blockchain to then join the network. Here, we discuss what such architecture means for validators and bridges, and also review the current state of the Cosmos ecosystem.

The validator conundrum

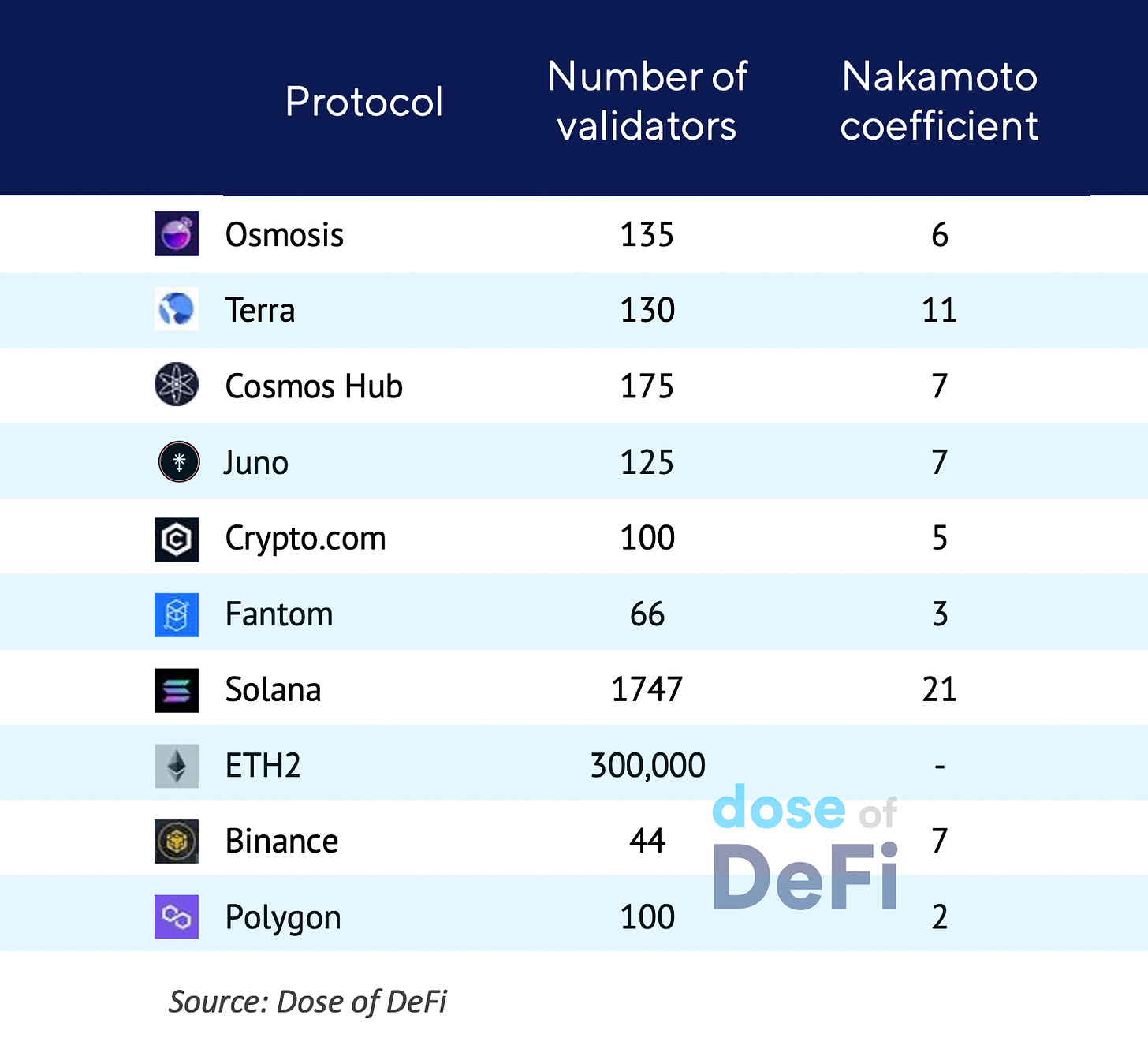

Since Cosmos is essentially a network of blockchains, each chain has to pay for its own security and come up with its own set of validators. Yet building a validator set that is widely accepted as decentralized enough is no easy task. In a multichain future where the Cosmos-model dominates, there would be hundreds or thousands of chains (roughly a chain per app, so for scale, consider every large project on CoinGecko, that’s how many would be needed) and each chain would have to attract a decentralized set of validators.

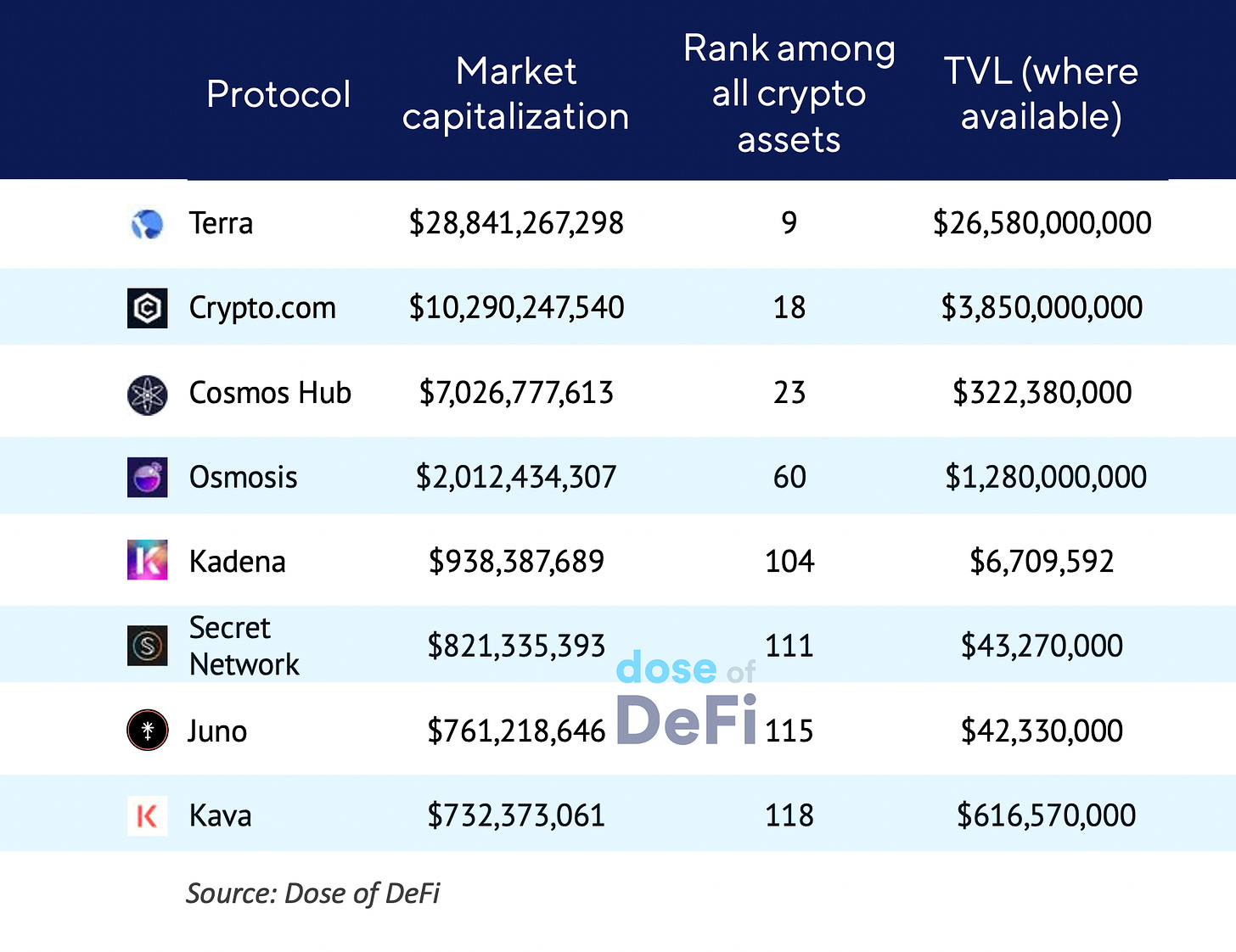

In addition, these chains would have to make sure their tokens retain value and APY remains sufficient for validators to stay, so that staked capital is then large enough to secure a chain’s TVL. Or, as Cosmos’s team wrote in a blog, “TVL has to stay lower than the cost of corruption.” If it doesn’t, validators’ economic incentive will not be aligned with user interests.

As well as extra work for project teams, there are implications for users too. For example, when using 10 apps on 2 chains, users will have to be aware of security consensus for 2 chains – but for Cosmos, this requirement would extend to 10 app-chains. Right now, most users have an approximate mental scale of how secure Ethereum/Arbitrum/BSC is, but if there are hundreds of chains, will it be possible to stay up-to-date with the security level of each app used? Plus, security levels can shift over time: validators might leave a chain, or even collude to attack it.

Recruiting a decentralized validator set is hard. Cosmos’s team is currently working on a solution to help chains on its network simplify the validator search, with something called “interchain security”. With this solution, validators of a “parent chain” would validate “child chains”, in a sense, renting out their security. Token holders of the parent chain would also earn rewards from child chains. This approach makes sense, as existing validator teams can then add more networks at little extra cost. The release of interchain security is planned for the end of Q2, and initially, Cosmos Hub will be the main parent chain for the ecosystem (or at least derived from its validator set).

A natural lead on bridging

We've talked about multichaining a lot at Dose of DeFi – and Cosmos's architecture is multichained at its core. And this, as we're increasingly aware, goes hand in hand with bridging. When chains are app-specific, bridging becomes ubiquitous. Every time a user wants to use an app with assets not native to that chain, the first step is to bridge this asset over (for example all tokens swapped on Osmosis DEX are bridged, except for the native OSMO token). Users are gradually becoming accustomed to bridging in crypto (largely via EVM bridges up until now). With Cosmos, bridging is part of the experience from day one.

An important Cosmos quirk to mention is the concept of “channels”. Consider an example of bridging ATOM from Cosmos Hub to the Osmosis chain: a channel would specifically need to be selected. The most popular channel for bridging ATOM to Osmosis is Channel-141, so ATOM on Osmosis is called “ATOM Channel-141” in all interfaces. This need to select a channel – and to be aware of how a token bridges – seems perhaps too complicated for mass adoption. Yet it is similar to the bridging experience outside of Cosmos, where users need to know which bridge was originally used to bridge back and receive the native assets.

In short, bridging is not quite yet user-friendly enough for mass use, neither on Cosmos nor on EVM chains. However, the difference for the former is that Cosmos has set an ecosystem-wide standard for bridging, IBC. In general, bridges vary in security and decentralization levels, so a user has to conduct a risk assessment when using a bridged asset. But with Cosmos, it’s enough to trust the single standard (IBC). In this sense, Cosmos already has bridging standardization, something that crypto more broadly (with its motley crew of bridges) doesn’t. Also, with the introduction of interchain accounts expected in the future, users will be able to directly interact with apps on other chains, making bridging simply intrinsic to the Cosmos experience.

Ecosystem review: DeFi legos and innovators

We now turn to the current state of play on Cosmos and its ecosystem. There’s plenty going on, but for simplicity sake here, we’ve considered the noteworthy developments under three general categories:

Decentralized exchanges:

One of the most prominent projects on Cosmos now is Osmosis – an AMM using the Balancer model (customizable pool proportions). Its notable innovation is “superfluid staking”; 50% of the OSMO token in liquidity pools goes into staking, where it secures the chain and earns staking rewards for providers. Plus, Osmosis uses cryptography for MEV protection. Juno is another chain with a focus on DEX, though it also positions itself as a chain for other apps too; another feature is the support of the CosmWasm CW-20 token standard. Emeris is a cross-chain exchange, which means that tokens on any of Cosmos chains can be swapped, though first the tokens are bridged to Cosmos Hub. This bridging takes approximately one minute, a longer waiting time than the familiar intra-chain swaps (think a normal Uniswap transaction). Nevertheless, such a seamless cross-chain swap based on a trusted bridging standard is a first for crypto.

Stablecoins:

On the stablecoin front, UST is reigning its victor flag. Terra was one of the earliest Tendermint-based chains to break into the mainstream, and naturally UST has quickly established itself as the dominant stablecoin of the Cosmos ecosystem (16.5 and 0.3 bln UST on Terra and Cosmos, respectively). We expect established stablecoin issuers such as Tether and Circle to start minting on one of Cosmos’s chains too. Cosmos seems to be lacking fractional reserve projects like Frax or PCV protocols like Rai/Olympus, though.

Other toe-dippers: Some other notable experiments are Agoric (which supports smart contracts written in JavaScript) and Archway (which distributes incentives to developers directly from smart contracts). There’s also Cosmos’s EVM chain, Evmos, discussed in our earlier article. Gravity Bridge will connect Cosmos with the outside world with focus on Ethereum, and Axelar bridge is taking on the ambitious goal of connecting everything. Incentivized cloud computing, privacy, naming services, and NFT platforms are all coming up similar to other ecosystems.

These design decisions – superfluid staking and cryptography for MEV protection on Osmosis, JavaScript support on Agoric, and developer incentives embedded in smart-contract deployment on Archway – make these app-chains incompatible on execution level, yet connected to a single network. This is something possible only with the multichain architecture of Cosmos. More details on the benefits of app-specific chains are available in the official Cosmos docs.

Final thoughts

Overall, Cosmos is an interesting experiment, and definitely a rather different experience from what crypto users are accustomed to. Bridging is a major differentiator, being hardwired into the network. And while the current bridging experience is more complicated than it should be, a unified standard for a large network of chains (as per Cosmos’s IBC) makes bridging safer, and is a first for crypto.

At present, its community of investors, teams, and users seem to be separate from crypto more broadly. Perhaps this is because the effort and cost required to adjust to a new mental model of architecture are a bit too high. This could be good for user stickiness though, which should position Cosmos well as we move more definitively to a multichain world.

Odds and Ends

DXdao* launches KPI-based awareness mining campaign with Carrot Link

Bridging protocol Connext announces $NEXT token Link

OCC revokes Anchorage's digital asset license Link

UST surpasses BUSD to become 3rd largest stablecoin Link

Ethereum Foundation financial report Link

Thoughts & Prognostications

The stability of algorithmic stablecoins [Matt Levine/Bloomberg]

The war for eyeballs (and what Twitter governance can learn from the Curve wars) [Anthony Lee Zhang/UChicago]

Ethereum's centralization dilemma through Lido staking [Dap/Sure Sats]

Measuring the impact of hidden DEX costs [0x]

ApeCoin & the death of staking [Cobie]

DAOs as novelty search engines [Olly.eth]

That’s it! Feedback appreciated. Just hit reply. Written primarily in a locked-down Shanghai, edited in Madrid and published in Brooklyn. Great to see many of you in Amsterdam.

Dose of DeFi is typically written by Chris Powers, but this week it was the work of Denis Suslov, with help from Financial Content Lab. Special thanks to Hama Kolak for Cosmos research. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao* and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.