Frenzy, mania – perhaps we need to come up with a new collective noun to describe the gaggle of DeFi users across Twitter and telegram over the last week. The launch of YAM and CRV tokens set off a scramble for yield and widespread fomo to deposit assets into Yam.finance and Curve.fi in order to receive YAM and CRV – all amidst cripplingly high gas prices.

Once YAM and CRV are accrued, farmers must decide whether to harvest and sell to investors clamoring for the newly launched tokens, or keep their crops planted and avoid high gas costs.

Governance adds another layer of intrigue to the YAM and CRV saga. Of course, YAM famously flamed out after just 36 hours as elastic supply and governance don’t mix (yet), and CRV farming was launched when an anonymous account with the greatest Twitter handle of this decade – 0xc4ad – announced that he or she deployed the DAO smart contracts hours before the Curve team was able to do it themselves.

Just a Toy

Financial and currency blogger JP Koning likes to say, “Most people do not invest in Bitcoin. They play bitcoin.” While some of the activity over the last week could be considered investing, clearly most users are participating because it’s fun. This was especially true for YAM.

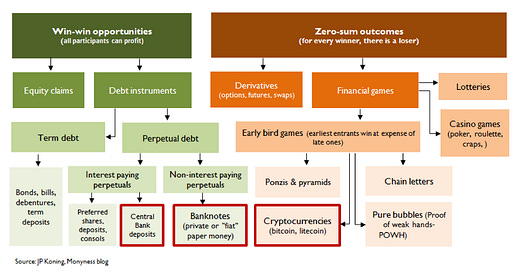

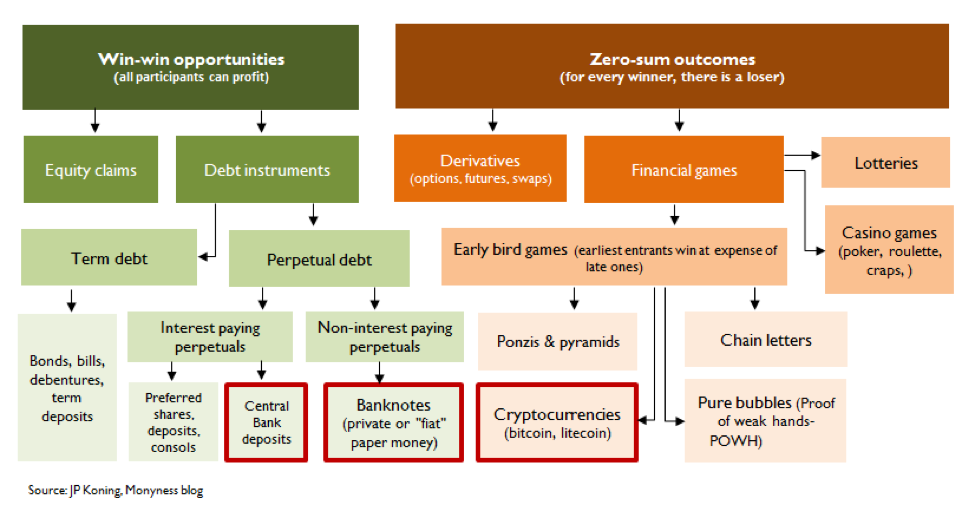

Koning created this helpful graphic to categorize Bitcoin and other financial assets into win-win vs. zero-sum games.

You could place CRV and YAM on a couple different places on the chart. Perhaps they have long-term value from governance that is similar to equity claims or debt instruments, but the token distribution frenzy surely has some elements of “Early bird games”. DeFi users rush to get the high yield of a new token and hope others will follow, plant crops and value that token.

Koning uses the game moniker for Bitcoin dismissively, but new technologies often start off looking like a toy. It’s fair to say that the YAM craze of the last week is not a preview of the financial revolution that many hope to be building towards, but that’s not to say that it didn’t show how programmable money can create global coordination schemes, which could actually revolutionize the financial system.

In addition to YAM, Based.Money also launched last week. It is more overt in positioning itself as a game, describing it as “a DeFi game of chicken” and “game theory for degenerates”. Like YAM, it uses the elastic supply technique pioneered by Ampleforth (Epicenter interview with founder Evan Kuo and a Gauntlet simulation of AMPL trading strategies).

The daily rebasing of the YAM, BASED and AMPL are prime opportunities for gambling, or as some would call it, a dopamine rush. Risk averse token holders can just hold the token through a rebasing, knowing that their tokens will own the same % of the network even if the supply of tokens changes, but token holders (or players) looking for a rush can use the rebasing as a trading opportunity.

Blockchain games have long been thought of as a promising breakout application, but this has focused on bringing existing games to the blockchain. The popular stock and option trading app Robinhood has exploded in growth this year, in large part because tit has made stock investing a game, but it may only be a preview of what’s to come. DeFi legos and programmable money give entrepreneurs a new toolset to gamify finance.

Distribution costs

CRV was not relying on gamification to drive interest and was less meme-ified compared to YAM. Curve has cornered the market for stablecoin & mirror asset swaps and already offers a better product than centralized solutions.

Like Compound, Curve had two goals:

Incentivize usage of Curve.fi

Distribute CRV tokens.

It appears to have succeeded on goal #1; its total value locked (TVL) more than quadrupled to over $1bn, while its weekly trade volume more than doubled to $511m (1st place Uniswap grew 65% WoW to $1.6bn). It’s notable that Curve is not incentivizing trades. The other DEX to launch a liquidity mining campaign, Balancer, also did not subsidize trading, but it needed to completely bootstrap liquidity from 0.

The verdict on Goal #2 (token distribution) is still out. Curve allocated 5% of CRV to early users of Curve that vests block-by-block over the next year, and then CRV accrued to yield farmers who staked the liquidity pool token from one of Curve’s pools.

CRV is distributed to Curve users, but the recent DeFi rush has brought in loads of new interest from the general crypto community, and within an hour of CRV launching on Thursday, Poloniex, Binance and Huobi all announced support for trading CRV. Curve also worked with 0x’s Matcha for on-chain trading.

Of course, since there is no pre-mine, the vested and harvested CRV is the only circulating supply to feed to the rabid trader base on centralized exchanges. With a limited supply & strong demand at launch, it’s no surprise the price of CRV skyrocketed.

This was a windfall for large whale farmers, who could sell off freshly harvested CRV at prices that would make CRV’s fully diluted market cap more than double Ethereum’s market cap. This led to a somewhat depressing first week price chart:

The current $4.35 price for CRV token would give it a fully diluted market cap of $14.4bn, which is more than double the same metric for COMP, MKR, BAL, SNX, and LEND combined. As more CRV vests and harvested over the next year, the sell pressure will continue. This may sour CRV holders on a bad first taste.

A high CRV price/valuation was (likely) not one of the goals of Curve’s liquidity mining campaign, and one could argue that there won’t be better price discovery until more tokens are unlocked.

The overriding question is whether Curve achieved goal #2 – wide token distribution? It’s rewarding loyal users to the platform with CRV, but they are strongly incentivized to sell those yields immediately because of the high demand and limited supply for CRV.

In a way, early Curve power users are serving as CRV distributors, but their motivation is profit, not selecting the best set of token holders to govern Curve.

Related:

YAM.finance V2 migration Link

YAM takeaways [Dmitry Berenzon/Bollinger]

How fully diluted market cap matters in crypto [Jason Choi/Spartan Group]

Aavegotchi, DeFi and NFTs [Linda Xie/Scalar Capital]

Token owners need agency [Brian Flynn]

Tweet of the Week: Foundational infrastructure

Coinbase’s Max Bronstein highlighting how YAM.finance could grow so quickly with just a few people behind it.

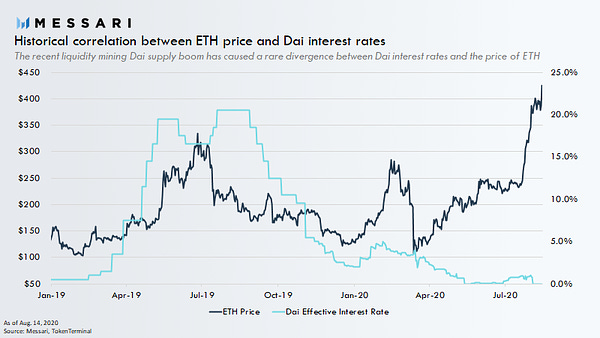

Chart of the Week: Dai rates and leverage

Also a tweet, but with a great chart that shows the difficulties of managing the Dai peg in this environment (link to full article by Messari’s Ryan Watkins). Typically, an ETH bull market meant that investors wanted to deposit ETH and take out a Dai loan and buy more ETH. Whereas in an ETH bear market, investors may pay off the ETH loan to maintain its collateralization ratio. The real driver of Maker interest rates is maintaining the peg. As the ETH price rose last summer, the price of Dai dipped below $1.00 and Maker governance voted stability fee increase after stability fee increase in order to encourage Maker Vault owners to pay off their Dai debt. This year, Dai has traded above its $1.00 peg since Black Thursday in March. But what can Maker do to spur more Dai demand when interest rates are already at 0? Welcome to central banking.

Odds and Ends

YFI: yinsure.finance a new insurance primitive Link

ycAssets: Stable Rates for Compound Link

Is there only $3.5bn locked in DeFi? Link

DEX aggregator 1inch raises $2.8m Link

Aave launches governance module on Ropstein test net Link

Introducing xSNX: Synthetix Staking Made Simple Link

Thoughts and Prognostications

Crypto-Native Insurance [Fred Ehrsam/Paradigm]

Exploring the Design Space of Liquidity Mining [Tushar Jain/Multicoin]

Why are People Moving Bitcoin to Ethereum? [Alex Svanevik/Nansen]

7 Things Every DeFi Investor Should Know [Spencer Noon/DTC Capital]

Opyn ETH Put Exploit Post Mortem [Opyn]

Kyber Ecosystem Report #17 [Kyber]

That’s it! Feedback appreciated. Just hit reply. Written in Cold Brook, NY overlooking the Hinckley Reservoir and Black Creek, where the weather was great but not as good as the stars.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.