Curve v2 takes on Uniswap, BTC on Ethereum grows

Plus Odds & Ends and Thoughts & Prognostications from the last week

Tweet of the Week: Curve v2’s best explainer

Curve founder Michael Ergorov released a whitepaper for a new AMM model that many are now calling “Curve v2”. The whitepaper is heavy on math but the tweet above has the quickest explainer. Uniswap v3’s capital efficiency improvements also come from a concentrated liquidity in a particular price range. Curve v2 is similar but whereas in Uniswap users need to readjust their price ranges when asset prices change, Curve v2 uses an internal oracle to automatically adjust the range where liquidity is provided. Uniswap’s Hayden Adams argues that it’s better for other projects (like Harvest Finance) to build price range rebalancing products, rather than build it into the underlying protocol. Coindesk has a nice article explaining it in more detail.

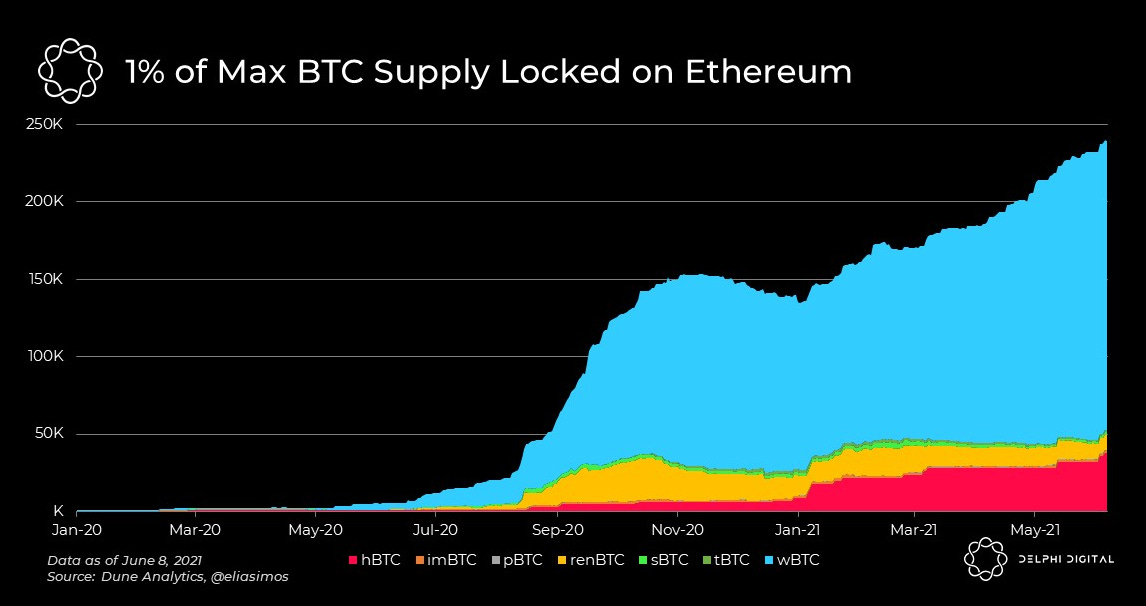

Chart of the Week: Lots of BTC on Ethereum

Lots of Bitcoiners in Miami this past weekend and a lot of Bitcoin on Ethereum as demonstrated from this great chart from Delphi Digital using data from this Dune dashboard curated by Elias Simos. The growth of BTC on Ethereum has been the most consistent trend over the last year. Perhaps the only surprising thing is how WBTC has captured almost the entire market. hBTC from Huobi has creeped up over the last few months, while renBTC has dropped off a cliff and sBTC and tBTC have failed to take off. Elsewhere in DeFi BTC land, there was some controversy over a new Bitcoin-based DeFi project Sovryn over their TVL metrics.

Odds & Ends

DXdao* Month in Review Link

DEX revenue declines from market peak, lending revenue remains stable Link

Alchemix Farm Migration Post Mortem and alETH Update Link

Blockchain Valley Ventures: DeFi Projects Beat VCs, Market for Returns Link

OlympusDAO and Frax team up for joint liquidity campaign Link

Tornado Cash to launch on Binance Smart Chain Link

Impossible Finance raises $7m as incubator focused on BSC Link

Thoughts & Prognostications

There’s a New Vision for Crypto, and It’s Wildly Different From Bitcoin [Joe Weisenthal/Bloomberg]

DeFi is the Killer App for Crypto [Tyler Cowen/Marginal Revolution]

MEV in eth2 - an early exploration [Alex Obadia & Taarush Vemulapalli/Flashbots]

Decentralized Finance: (DeFi) Policy-Maker Toolkit [World Economic Forum/Wharton School of Finance]

Treasury Building Blocks: Stablecoins [monetsupply/Tally]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn on a beautiful Summer day.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao. All content is for informational purposes and is not intended as investment advice.