Curve’s Moat

Automated Market Makers (AMMs) have been described as DeFi’s “zero to one innovation” because the efficiency gains create new opportunities and open up new markets.

Whereas a traditional order book model relies on attracting a steady stream of buyers and sellers in order to build liquidity, AMMs, such as Kyber, Bancor, Uniswap and – most recently – Balancer – use a pricing algorithm to give immediate liquidity for any sized trade because the price dynamically adjusts to supply and demand.

This is said to go after the “long tail” of tokens, because it gives liquidity to small tokens cheaply. AMMs are useful for a $500 trade, but they do not scale particularly well to large trades because of the high slippage as the price adjusts to the new supply/demand dynamics.

The launch of UMA, COMP and DeFi Money Market's governance token illustrate the promise of “Initial DEX offerings” that use AMMs to distribute tokens and provide liquidity much cheaper than through a centralized exchange.

Curve, which launched at the beginning of the year, is an AMM specifically focused on stable assets like stablecoins. It differs from the token-agnostic AMMs in two major ways:

The slope of the supply/demand curve in its pricing algorithm assumes a trade pair will stay within a certain price range most of the time. Kerman Kohli has a great video explainer on how Curve’s curve 🤔 differs from Uniswap’s. Essentially, if a Curve pool has only stablecoins, the pricing algorithm can offer lower slippage because it assumes that it will not trade outside a band (say, $0.95 - $1.05).

It lends out unutilized assets to Compound or iearn.finance. The first generation of AMMs only generated yield for liquidity providers through trading fees, but often times only a fraction of a pool’s reserve is needed for trade execution. Unlike most tokens, there is a robust lending market for crypto dollars. When they are not being used for trading, stablecoins in Curve pools are deposited into lending protocols to earn interest, giving liquidity providers yields from lending + trading fees.

Curve’s Product Market Fit

DeFi critics love to label it as a ‘toy’. Centralized exchanges and OTC desks are superior options for traders, especially large orders, and centralized lending services offer more security (and sometimes yield) than DeFi now.

By focusing on stablecoins, Curve may have been the first DeFi project to find product market fit, offering deep liquidity that already surpasses that of centralized exchanges or OTC desks.

That was on June 20, when total volume on Curve $46m before climbing to $60m the next day, the highest one day volume by any DEX ever. And a couple days later, the Synthetix Foundation executed a $2.5m sUSD-USDC trade with only $50 of slippage and a $1.77 paid in gas.

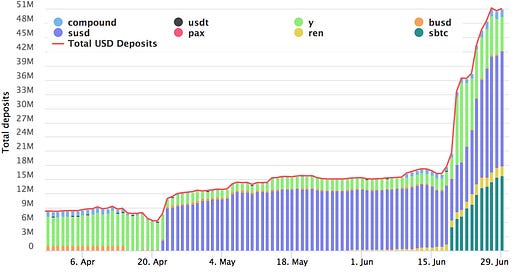

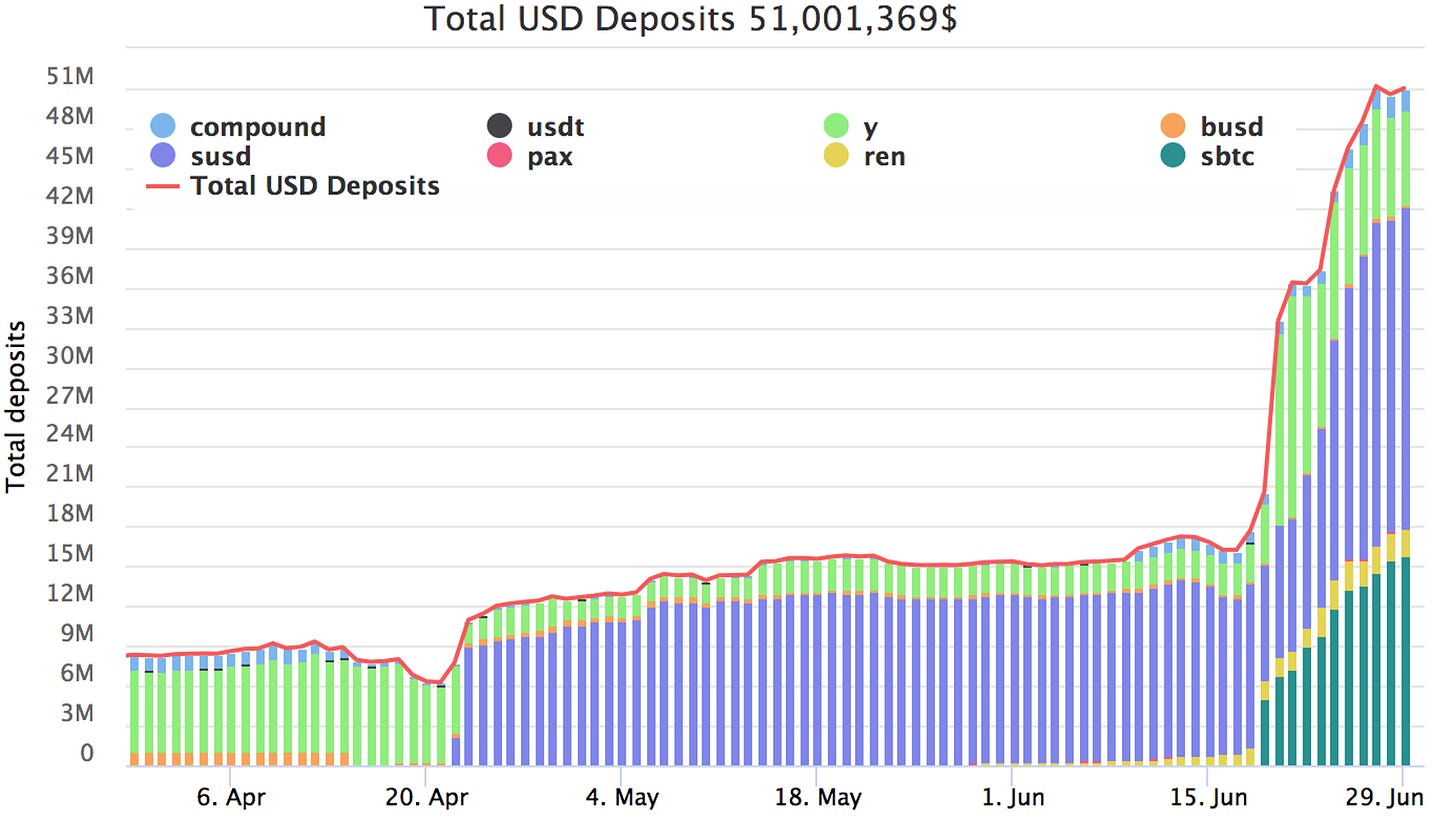

What’s more, the trading highs also corresponded to a surge in deposits into Curve, which will allow it to scale to even larger trades:

The deposit growth was not just from stablecoins. Curve’s design is intended to allow low slippage trades between any two tokens that trade close to par. This makes Curve a perfect liquidity venue for mirror assets or synthetic tokens designed to track the same asset, such as the US dollar or Bitcoin.

Crypto dollar growth shows no sign of slowing down, while the exodus of BTC to Ethereum may have only just begun, but both may just be a harbinger for the onslaught of synthetic tokens to come to Ethereum (Synthetix and UMA have been the most forward-looking here). All synthetic tokens need liquidity and to maintain a 1:1 peg with the tracked asset.

Curve’s Moat

A first-mover advantage does not always exist in DeFi (see Compound and MakerDAO), but it does when it comes to network effects. Curve may be able to achieve this on both the demand and supply side:

Liquidity begets liquidity - Best execution means best price; the demand to trade on Curve will persist as long as it offers the lowest slippage. Barring another capital efficiency breakthrough, its hard to imagine a smaller competitor with tighter spreads.

Integrations with synthetic tokens - Unsurprisingly, Synthetix has pioneered the go-to market strategy for synthetic tokens with Curve’s sBTC pool, which also includes WBTC and renBTC. The barrier to create a synthetic token is low, and maintaining the peg is paramount. Curve may become the standard tool to maintain the peg of a synthetic token, and much like Dai, that should give it some lock in.

When CRV

the sBTC pool incentivizes yield farmers with SNX, REN and CRV. Although details are scant, Curve is expected to start distributing CRV sometime in the next couple of weeks and issue CRV retroactively to liquidity providers in proportion to the interest earned on the platform since inception. Just today, the team revealed the design for the CurveDAO.

Tweet of the Week: Standardize the standard

Not all ERC-20 tokens are created equal and Concourse Open’s Scott Lewis pleads for some regularity in token design after Balancer saw $500k drained from one of its pools. The attack was possible because one of the tokens in the pool had a fee transfer (also known as deflationary token). It harkens back to the Dforce attack, which exploited the ERC777 design. Balancer announced it would reimburse LPs who lost funds. No specifics yet. More details on the exploit from Balancer’s blog post and from 1.inch. There was also an attack this morning on Balancer pools with unclaimed COMP.

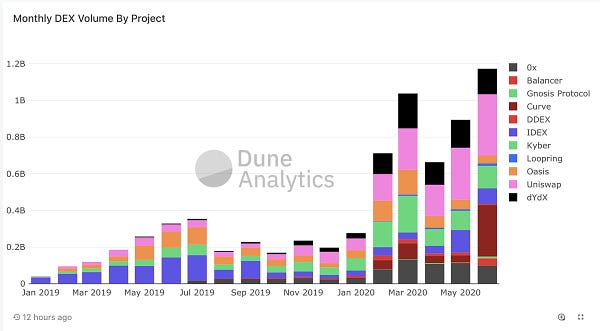

Chart of the Week: DEX volume > farming

Yes, it’s a tweet, but the chart highlights the most unappreciated part of the recent DeFi boom: DEX trading volume. Uniswap, Kyber, and dYdX have powered the growth, but it’s also been aided by new entrants like Curve, Balancer, Loopring and Gnosis. This Dune page remains the best place to track DEX activity.

Odds and Ends

KNC and ZRX added as acceptable collateral in Maker protocol Link

UMA launches yCOMP to enable COMP shorts Link

PlutusDefi to launch the first-ever bridge-bonding curve listing Link

mStable unveils plans for MTA liquidity incentives Link

Ethereum DeFi apps struggle to keep up with surging demand Link

Kyber Announces Katalyst Upgrade for July 7th

Compound Governance Proposal 11: COMP Distribution Patch Link

Thoughts and Prognostications

Upcoming COMP farming change could impact Dai peg [Cyrus Younessi/MakerDAO]

Understanding DeFi valuations [Ryan Watkins/Messari]

EIP 1559 and Creating a symbiotic relationship [Anthony Sassano/The Daily Gwei]

Robinhood and HFTs and how DeFi’s market structure will evolve [Tarun Chitra/The Scoop]

5 Contrarian Takes with Degen Spartan [Bankless]

Melonomics: Upgrading the token economics of the Melon Protocol [Tom Shaughnessy/Delphi Digital]

Remaking the Maker Protocol [Ross Ulbricht]

That’s it! Feedback appreciated. Just hit reply. Written in Texas. Wear a mask and subscribe to Govern This.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.