Dai Savings Rate and Maker's endgame

Dai Savings Rate

Next month, the largest and most important project in DeFi, Maker Dao, will launch a new protocol that features multi-collateral Dai (MCD) and the Dai Savings Rate (DSR). Many Dai holders earn interest on secondary lending platforms now, but Maker so far has only been a borrowing platform. The DSR will add lending to the Maker protocol.

Where’s the money coming from? As a refresher, in order to borrow Dai, one must deposit ETH as collateral into a collateralized debt position (CDP), and then to unlock that ETH, the Dai loan must be paid back – plus interest accrued.

The interest rate is determined by MKR holders who vote on what they call the “Stability Fee” (currently 9.5%). Interest must be paid in MKR tokens, which are then burned, benefiting all MKR holders.

In the new Dai Savings Rate model, interest payments to Dai depositors will come from proceeds from stability fees, as Maker said in a recent blog post:

“At the accounting level, Dai awarded through the DSR is recorded in the same line item as the one used to record Stability Fees collected. In other words, the Dai created for the DSR is recorded as an offsetting adjustment of Stability Fees collected for the Surplus Auction. If the total amount of Stability Fees collected in Dai does not cover the total amount of Dai minted for the DSR, the difference is recorded as bad debt, and MKR is printed to cover the cost.”

In a DSR world, the stability fee is used to compensate MKR holders for the collateral risk AND to compensate Dai holders for the instability of Dai.

Maker argues that a DSR gives them another tool to help stability the price of Dai If the price dips below $1.00, raising the DSR would encourage people to buy Dai just as raising the stability fee encourages borrowers to purchase Dai and repay their debt. Both are a blunt tool though. Adherence to the peg will depend on arbitrage opportunities.

Lending protocols already exist? Early signs indicate that the DSR will start around 2%, which is much closer to fiat bank deposit rates then the lending rates for Dai on Compound or Fulcrum. So why would a user deposit Dai in Maker DSR instead of Compound/Fulcrum?

In Maker’s view, these are products with different risk profiles. Compound and Fulcrum are actually lending out Dai, so there is a counterparty risk. Proceeds for the DSR are literally minted, so there’s no risk of default, what some might call a lender of last resort.

Complicating matters is that the long-awaited DSR is simultaneously being launched with the also long-awaited multi-collateral Dai. MCD is more ambitious and potentially riskier than the DSR.

The risk parameters included alongside ETH are important for stability and collateralization requirements. At launch, MCD will have only three – maybe two – sources of collateral, ETH, single-collateral Dai and – still TBD – BAT.

A 2% Dai savings rate and a miniscule addition of collateral does not appear to be a competitive consumer product in the current landscape. Maker, however has bigger plans, as Community Head Rich Brown put it:

“MCD symbolizes the fact that MakerDAO is now open for business. Up until this point, SCD has been a proof-of-concept. This protocol has huge aspirations, and MCD is the beginning of the real road to fulfilling these aspirations.”

The long-term vision of Maker is to create a decentralized financial services company with Dai as its native currency. This picture is becoming clearer, especially if one looks at the newly revamped Oasis DEX by Maker. Soon it will feature a full suite of trading, lending and borrowing products.

In the long run, Maker will be a cross-chain solution that securitizes real world assets into the digital world.

The question is whether they will deliver the financial product to the end user/investor, and thus regulated? Or, could they focus on building infrastructure and rely on regulated intermediaries to deliver products to end consumers?

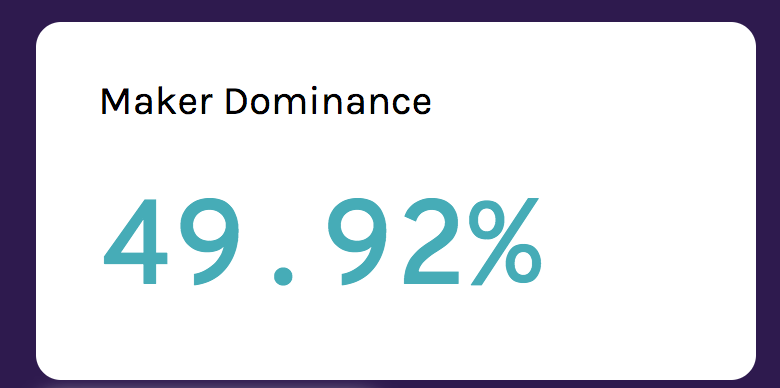

Number of the Week: Maker Dominance declines

Maker's impending launch of MCD and DSR occurs amidst a decline in Maker's DeFi marketshare, according to DeFi Pulse. The decline is largely attributed to the growth of $SNX token staked on the Synthetix Exchange.

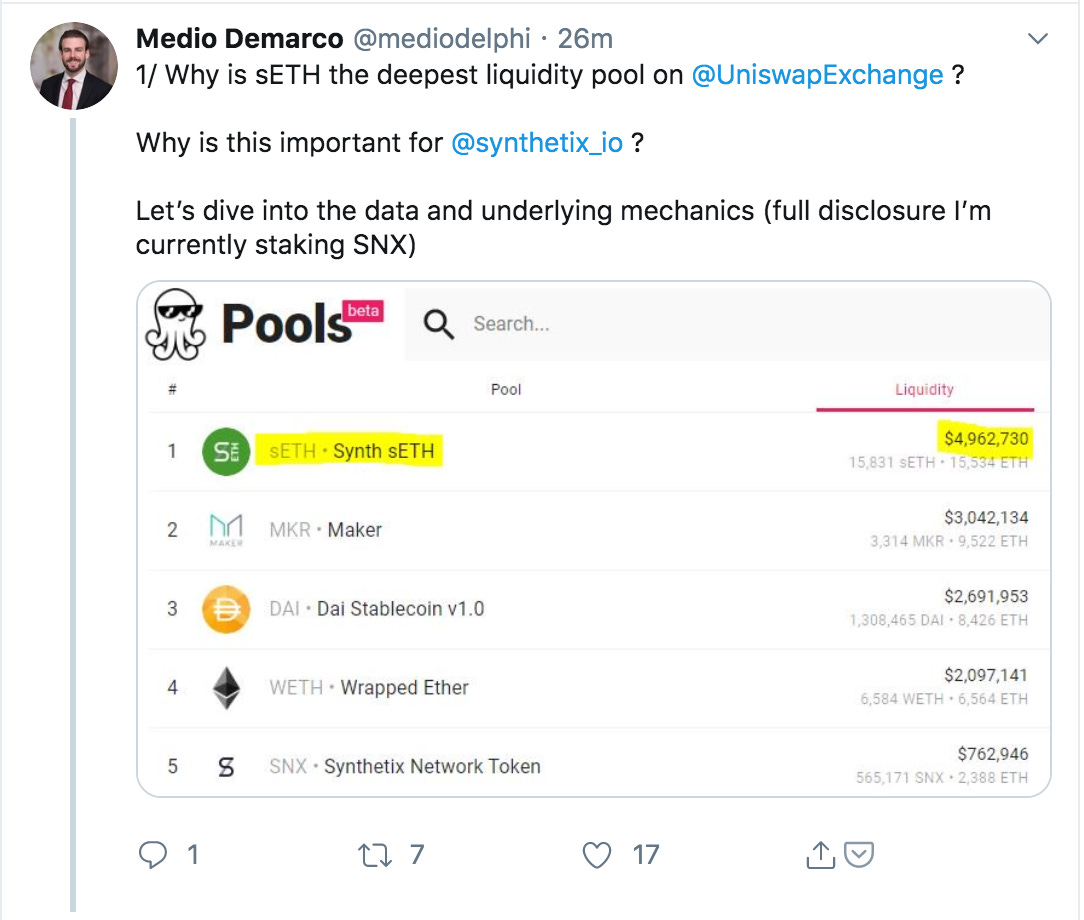

Tweet of the Week: sETH Uniswap pool

Delphi Digital's Medio Demarco explores part of the reason for Synthetix's success: it's sETH-ETH Uniswap liquidity pool. 70% of all sETH is pooled on Uniswap. More analysis in the thread, which relies on the excellent new Uniswap tool Pools.fyi.

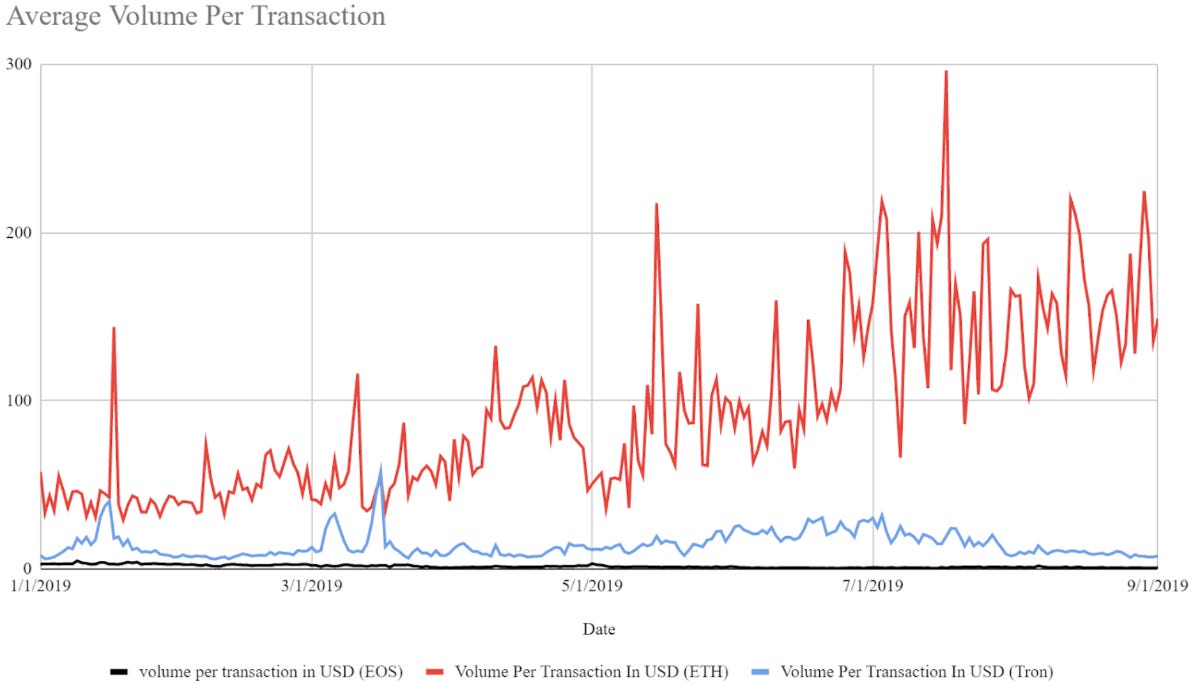

Chart of the Week: Size of transaction in DApps

Joel John does a deep dive into all things DApps, comparing Ethereum's activity to Tron and EOS. While Tron and EOS have higher transaction numbers and users from gambling and gaming DApps, the success of DeFi DApps on Ethereum has led to a higher overall volume per transaction.

Odds and Ends

Intro video on how DeFi lending pools generate interest Link

Google sheet of all San Francisco Blockchain events Link

Unspent now offers Uniswap integration Link

Chainalysis APAC Cryptocurrency Report Link

MyEtherWallet adds ENS support for BTC and LTC addresses Link

Overview of the crypto wallet landscape Link

Alethio: The DeFi Series — Statistics Around DAI Stablecoin Link

Dai Card on Connext v2.0 Link

Thoughts and Prognostications

Fire Before Growth: The Likely Fate Of Ethereum Killers [placeholder]

Algorithmic Trading and Token Economics [Tarun Chitra]

Structural US Bankruptcy [Messari/TwoBitIdiot]

Fireside chat with Olaf Carlson Wee and Kevin Wang [Link]

The rise of DeFi robo-advising [destiner]

Digital Currencies, Stablecoins, and the Evolving Payments Landscape [The Fed]

Mutability in Crypto and Recent Moves by the SEC [a16z]

Agoric and the Decades-Long Quest for Secure Smart Contracts [Epicenter]

Long read of the week: DeFi outside of Ethereum

Token Daily Capital's Mohamed Fouda pens another piece on what a future DeFi landscape could look like. In particular, Fouda shows how some smart contract platforms, most notably Tezos, is pivoting focus to DeFi-related projects and initiatives.

Listen of the Week: Weaponized Interdependence

"Bitcoin – I think overrated.

Bitcoin purports to be a technological hack. It’s reall an effort at a sociological hack, and I don’t think it’s particularly worked.

I think it succeeded amongst a significant enough community that it will be around for a while. I don’t think it’s going to take off beyond that community"

Henry Farrell playing "Underrated or Overrated?" on Tyler Cowen's podcast Conversations with Tyler. The two cover a wide range of topics that are more than tangentially relevant to DeFi/crypto, from Facebook's Oversight board to China/NBA.