Lending protocols, namely Maker and Compound, drove DeFi growth in the first half of 2019, but lending was also a 2019 success story for the broader crypto markets.

Genesis Capital and BlockFi generated significant revenue from crypto-backed loans, primarily using Bitcoin as collateral. For comparison, Genesis Capital, the largest centralized lender, had $870m of new loan originations in Q3 while the three largest DeFi lending protocols (Maker, Compound and dYdX) combined for $150m over the same time period.

The Arrival of MCD and the Dai Savings Rate

In November, Maker launched Multi-Collateral Dai and the Dai Savings Rate. The former was intended to grow the collateral base, while the latter was meant to encourage Dai usage and help manage the dollar peg.

Currently, there is $4.3m worth of BAT locked up as collateral in MCD against $1.6m in loans and $400m of ETH in Maker CDP/Vaults, which is being used to trustlessly lend $126m.

The BAT number is nothing to sneeze at. In addition to demonstrating the technical capability of multiple collateral, Maker has attracted 1.3% of all BAT in just 2 months – not too shabby.

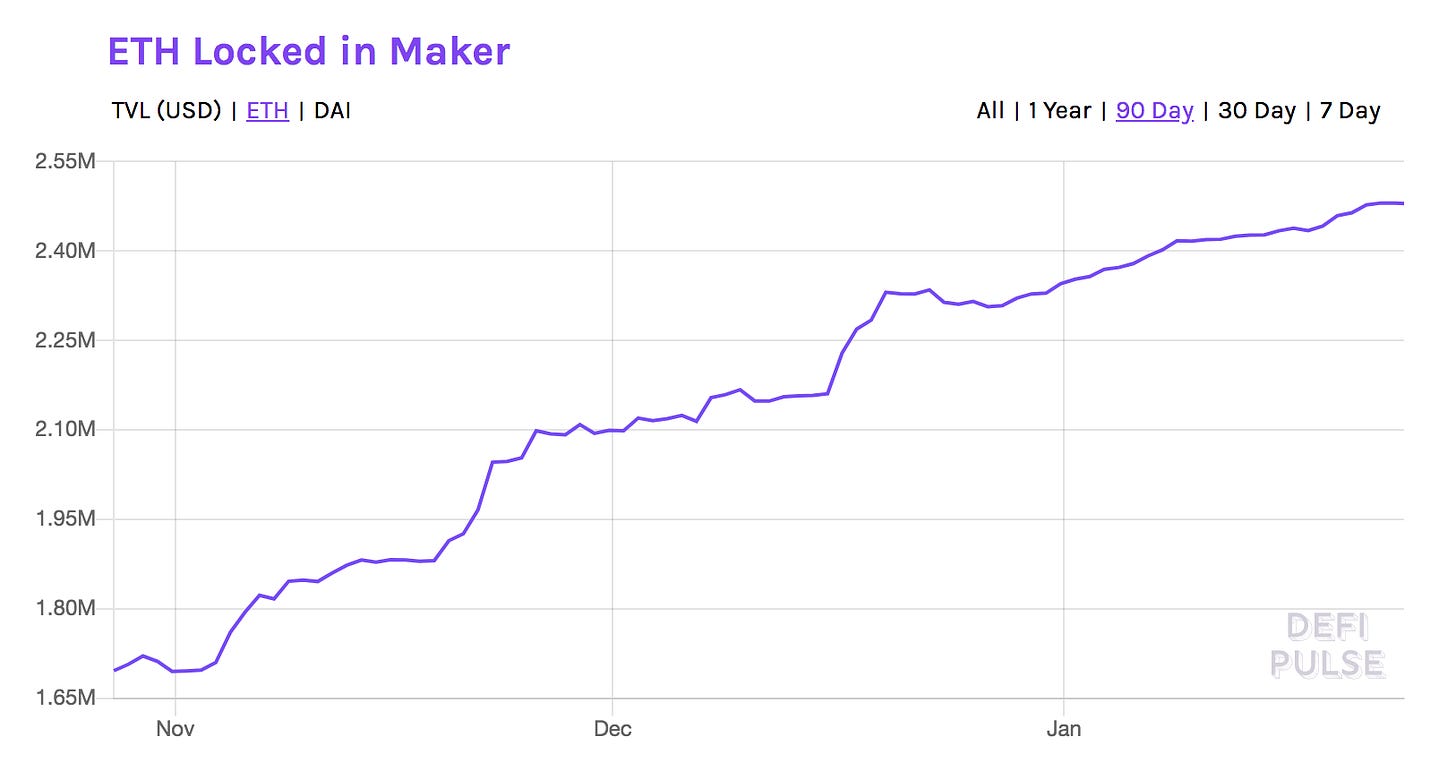

In terms of ETH locked in Maker, the number in absolute terms has climbed to 2.48m ETH, up from 1.88m just before the launch of MCD.

The steady climb of ETH locked in Maker during this month’s price action suggests that Maker loans are used as leverage by traders (duh). Maker still has a $100m debt ceiling for Dai generated from ETH, so much of the overall increase in ETH locked comes from two Maker protocols – Multi-Collateral Dai (1.95m ETH & $100m Dai) and Single-Collateral Dai (550k ETH & $26m Sai). More stats at MakerBurn.com and DaiStats.com.

Dai in Secondary Lending Platforms

The more significant change, at least in the short-term, was the addition of the Dai Savings Rate. Prior to this, the only way to earn interest on Dai was through a secondary lending platform like Compound and dYdX. Maker hoped to capture this market and keep users on its Oasis finance portal.

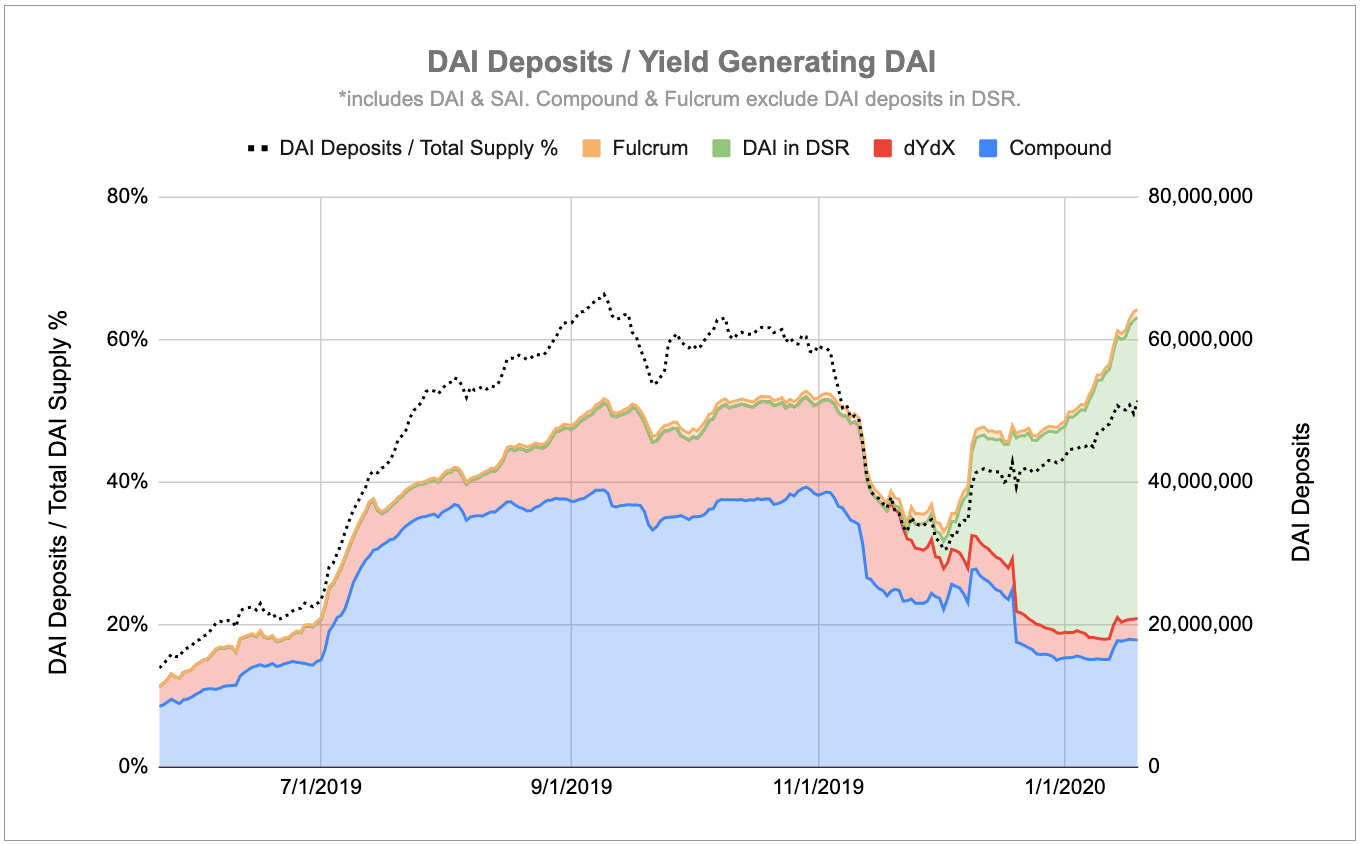

And in this regard, Dai has been extremely successful. 40% of all Dai is now locked in the DSR, which has eaten into the marketshare of secondary lending platforms, as seen from this chart from Maker’s Primoz Kordez in the Our Network newsletter.

One can see introduction of the DSR in mid November and then a spike at the end of December in the Dai in DSR and a subsequent decline in dYdX and Compound’s share of Dai deposits.

While it may appear that Compound’s market share has suffered with the introduction of the DSR, it – along with Fulcrum – is using the DSR to generate yield for lenders on its platform.

Secondary lending platforms generate yield by charging interest on outstanding loans and funneling that to depositors, but as I wrote about in more detail last month, interest on Dai deposits on Compound and Fulcrum come from interest on outstanding loans and interest from the DSR for Dai that is not lent out.

For Compound and Fulcrum, the yield to lenders should never go below the DSR, while borrowers will pay slightly more than the Dai stability fee (or borrowing rate on Maker). As Compound’s founder Robert Leshner said, “MakerDAO will effectively control the interest rates of cDAI through the MKR voting process.”

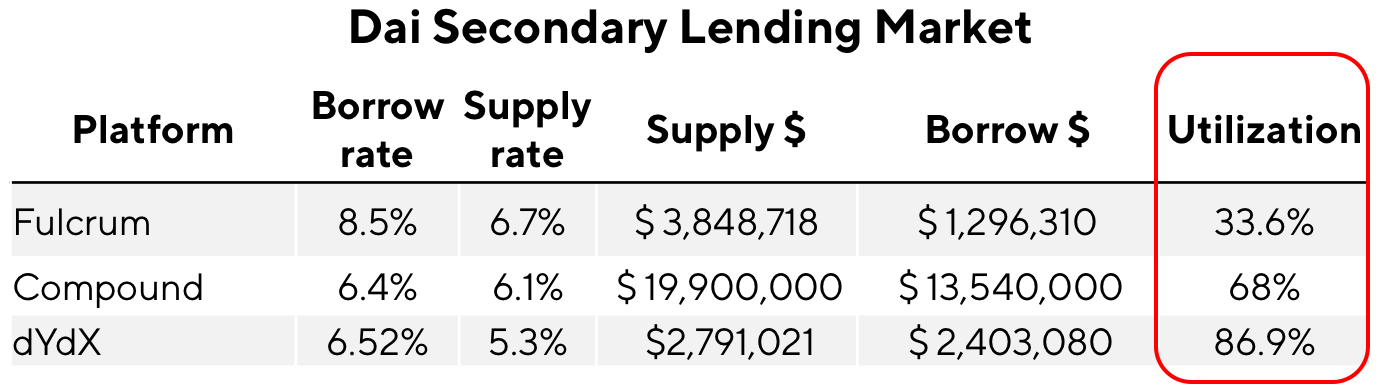

dYdX, meanwhile, chose not to integrate the DSR into its trading platform. If Compound wants to maximize the yield given to lenders, dYdX prioritizes low interest rates for borrowers. It judges its success not from assets deposited, but from borrowing and trade volume. Whereas, Compound may only lend out 50-60% of deposits, dYdX has a utilization rate – the amount lent out divided by total supply – of 80-90%.

In this model, dYdX could have Dai borrowing rates lower than Maker because its rate is entirely determined by borrowing demand for Dai, rather than what MKR holders determine the borrowing rate. But if we imagine DeFi as an efficient market (not yet by any means), borrowing and lending rates should stabilize across platforms.

In fact, dYdX’s Dai rates were consistently lower than Maker & Compound throughout December and early January (the closest thing to free money) but are now in line with Maker’s stability fee. Here is a current snapshot of rates, supply and utilization across the three platforms.

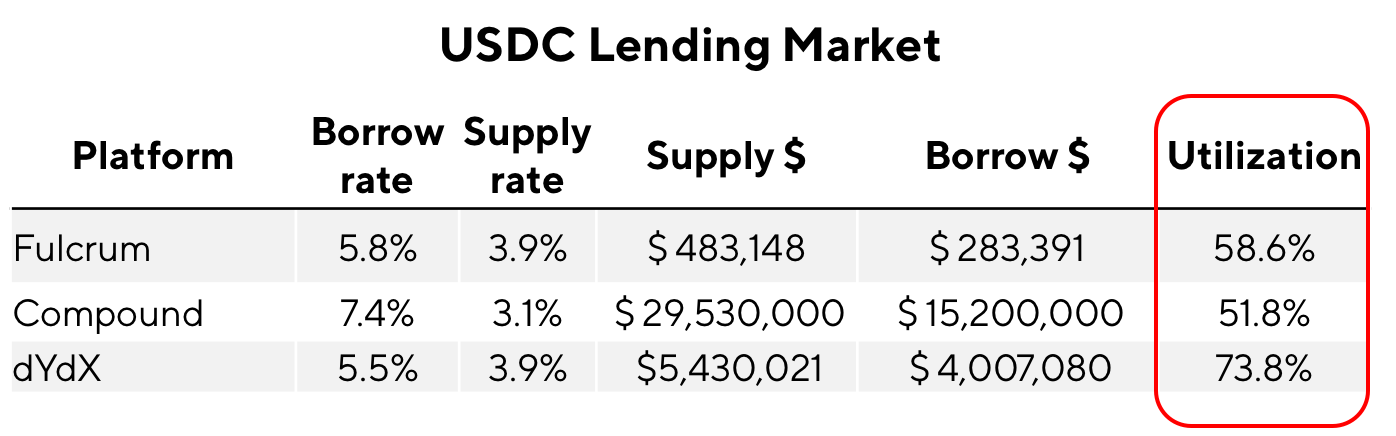

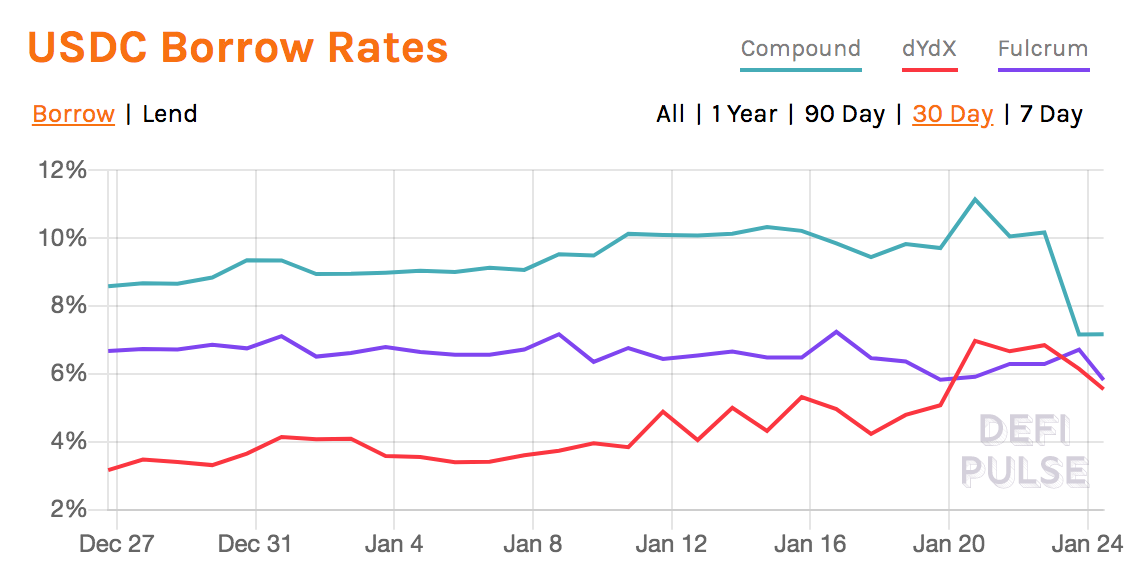

While Dai is a decentralized stablecoin, the lending markets for the fiat-backed USDC are actually more market-driven because there’s no one setting a USDC borrowing rate (besides the Fed). It’s here where we can see the difference in the protocol’s design.

Fulcrum, like dYdX, aims for a high utilization rate, which leads to tighter spreads between the lending/borrowing rates.

Fulcrum and dYdX consistently have lower borrowing rates for USDC, although Compound’s decreased somewhat dramatically after it updated its interest rate model.

Lending protocols will continue to see fundamental changes to their design as they try to find a market niche. Three other lending snippets that are interesting:

DSR may be raised to almost 8% - MKR holders are voting on whether to raise the DSR from 6% to 7.75% and raise the ETH and BAT stability fee from 6% to 8% in addition to a debt ceiling raise. The high DSR is likely a move by Maker to attract additional retail interest, but it should be an interesting test for how the increase will shake out across different secondary lending protocols, who are interested in keeping borrowing rates low, and how it will affect USDC rates.

Aave – a liquidity-based lending protocol like Compound or dYdX, but instead of a collateralized, indefinite loan, Aave has flash loans. Users must borrow, use and return the funds within the same transaction. These could be used for liquidations, rebalancing assets or whenever a large amount of capital is needed to unlock other assets. Aave’s aTokens are 1:1 with the underlying stablecoin. Interest is streamed to the account rather than through token appreciation, as Compound and Fulcrum’s cTokens and iTokens do.

Cherry Swap – If “double bonding curve liquidity pool as an automatic swap market maker” doesn’t get you excited, you might be in the wrong business. Cherry Swap is the trying to bring interest rate swaps to DeFi. CherryDai is an ERC20 that receives interest from an automated market maker liquidity pool offering swaps. Holders of the tokens are not betting on interest rates themselves, but funding a liquidity pool that does. Rho is a similar model but still in design phase.

Market Chatter

Slow week; returning to normalcy – crypto markets retreated for the week after two weeks of strong growth. ETH & Bitcoin dropped 7% in an hour and a half on Sunday, recovered for two days before a slow slide from Tues-Thursday. Notably, ETH gained on BTC during the slide as it decreased slower than BTC – a role that BTC typically plays in market retreats. ETH/BTC ticked up slightly over the past week to 0.192 ETH/BTC.

SNX struggles continue – in contrast to the broader market, SNX has declined 30% over the past month after tripling the previous three months. It hasn’t tracked BTC or ETH price increases, but instead price movements are triggered by SNX rewards claiming. SNX stakers can only receive trading fees and protocol inflation when their account is at 750% collateralization. It also announced (in its discord) that it would be delaying the Achernar upgrade, which was scheduled for January 30th and is supposed to add ETH as collateral.

Notable movers – there continues to be significant separation between smaller tokens and ETH/BTC. Augur (REP) nearly doubled two weeks ago before retreating but REP once again up 10% over past 24 hours. Augur is moving forward with their v2 launch and has seen an uptick in interest as the political season enters prime time. DeFi asset management protocol, Melon (MLN) has been moribund since….forever, but suddenly shot up 20% on Friday, perhaps after it was included in a Messari chart about DeFi returns. Kyber (KNC) also moved on Friday, up nearly 7%. It’s still a far away from 2017 highs (before it launched) but KNC has nearly doubled since it announced changes to its token economics in November.

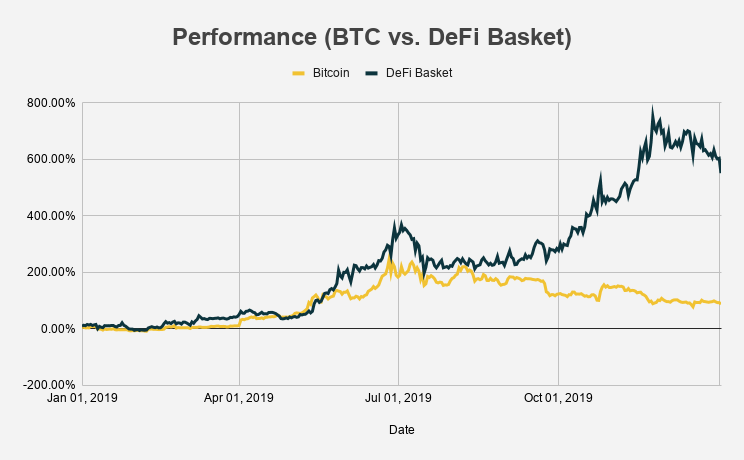

Chart of the Week

The above chart by @0xLucas was in response to another chart that showed Bitcoin vastly outperforming “DeFi tokens”, but that chart did not include the two strongest performing DeFi tokens, SNX and LINK, and when included, the returns are much more promising. Still, MKR, KNC & ZRX all had a great 2019 in terms of development and adoption, but a bad year for their token prices. Full analysis at DeFi Rate.

Odds and Ends

Set unveils social trading platform to track public portfolios Link

Ethereum Classic a ‘better platform than ETH for DeFi projects’ Link 🤔

DeFi boom raises new questions for tax season Link

How MakerDAO flourishes in China Link

Tether to launch gold-backed token Link

Introducing Rocket: get a loan against your NFTs Link

DeFi Saver in 2019 — a year of building and growth Link

Thoughts and Prognostications

The State of Synthetix [Kain Warwick/Synthetix]

ZRX Token Model, Price and Value [Sigil.Fund]

The Year in Ethereum 2019 [Josh Stark/Evan Van Ness]

What to Expect When Launching your own Moloch DAO [Peter/Meta Cartel]

Liquidity Fundraising – A New Fundraising Model for DeFi [David Iach]

Rollup Roundup: Understanding Ethereum’s Emerging Layer 2 [Ben DiFrancesco]

How Not to Critique Ethereum [Daniel Goldman]

That’s it! Feedback appreciated. Just hit reply. Written in Nashville in the dead of winter.

Weekly Dose of DeFi is written by Chris Powers from Concourse Open. Opinions expressed are my own and do not necessarily reflect the opinions of Concourse Open. All content is for informational purposes and is not intended as investment advice.