DeFi lending rates decline and China's digital currency: hype or reality?

More Debtors Wanted

MakerDAO’s stability fee was abruptly lowered to 5.5% this week, thanks to a single address that accounted for 94% of the vote. The stability fee was as high as 19.5% just three months ago but Dai’s peg has stayed close to or above $1.00 since then.

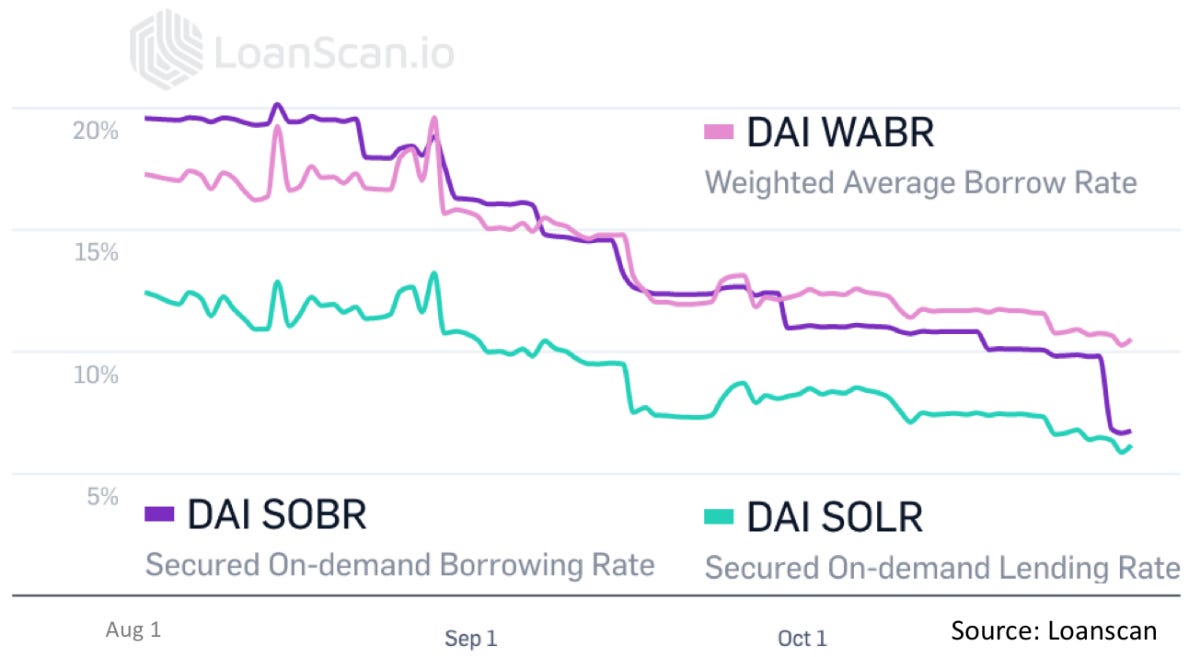

The move comes ahead of the upgrade to Multi-Collateral Dai, the launch of the Dai Savings Rate and a broader decline in interest rates:

DeFi’s entrance into the crypto mainstream and its cross-over potential is due to the appeal of interest-bearing stablecoin accounts. The 6-14% interest rates are attractive, especially compared to anemic bank rates.

A checking account is the most common financial product in the world and just about everyone could use a high-yield savings account. For Dai or USDC lending, the market for depositors is almost endless.

More lenders will drive down rates. Smart Contract wallets like Argent are targeting the masses, while Dharma just unveiled a new UX to attract new lenders and dozens of startups are trying to offer aggregated (and predictable) yields. With additional flows into lending protocols, deposit rates will come down – unless someone finds more borrowers.

It’s no secret that the lending protocols are serving traders eager to lever up. Their usage and rates go up in a bull market as traders look borrow Dai or USDC and buy more ETH. This is an easy market to service but it is also a very small market.

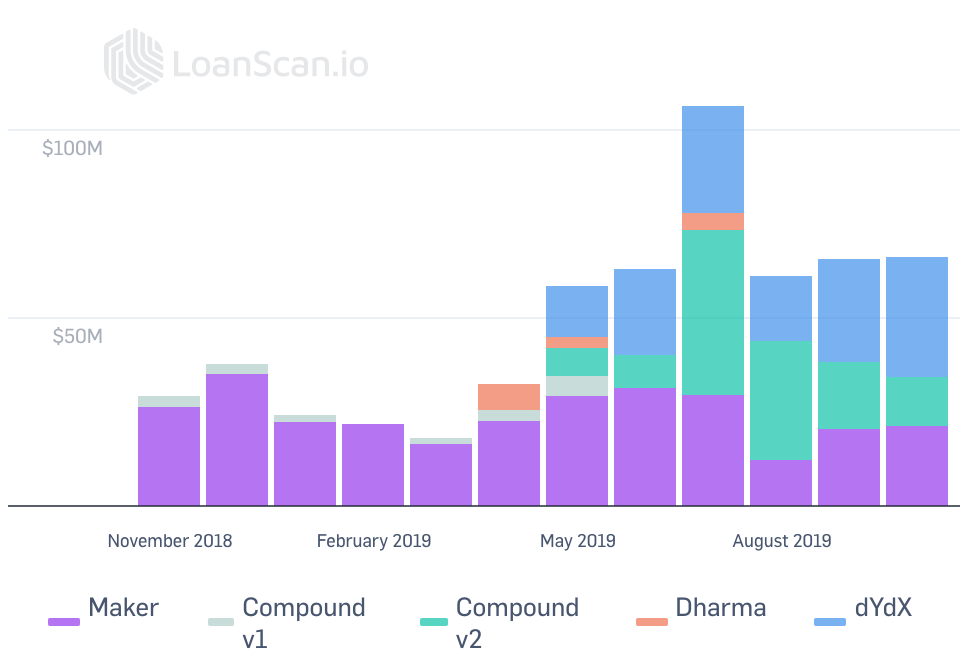

There’s less than $100m of stablecoins deposited in lending protocols but it’s easy to see how you could find enough lenders to grow that to a $1bn market, but it’s not clear who they would lend to.

Loans origination has stagnated over the last three months despite falling rates:

A note on China

In a previous life, I spent my time reading the Chinese finance regulatory tea leaves regulators in order to determine what – potentially monumental – reforms would be enacted as the country liberalized its financial markets.

So I watched with great interest this week as the crypto world was abuzz on the statements from China’s President Xi Jinping promoting ‘blockchain technology’.

Like most commentary on China, most overrate the ability of the Chinese government to will a market into existence but underestimate the deep influence that a simple statement from Xi or the CCTV evening news can have.

China is no stranger to bold reforms and changes. The reform and opening up period saw significant structural change from a controlled to market economy, while its mobile payment system has grown from nothing in just a few short years.

But like all politicians, there are plenty of examples of empty rhetoric and false promises.

The Shanghai Free Trade Zone (FTZ) was unveiled in 2013 with the aim of opening up China’s financial markets as the Special Economic Zone in Shenzhen first opened up China to foreign investment in the 1980s. The FTZ has done almost nothing to liberalize China’s capital account as the government could not balance opening up with its desire for control.

Similarly, for the past decade Beijing has promoted the internationalization of the RMB through various lending and investment programs like RQFII, dim sum bonds or the One Belt One Road Initiative. Despite the government’s efforts, use of RMB in financial markets or in trade finance has not materially increased.

How does this apply to Xi Jinping and blockchain technology?

The key is to examine what China can control vs what can it incentivize. China is very good at implementation because it has influence at every level, but it struggles when it tries to incentivize other parties to act.

The goals for a central bank digital currency (CBDC) for China can be simplified as:

Retake control over monetary policy and re-balance power between banks and WeChat/Alipay

Promote the RMB as an international reserve currency

Given its control of the banking system, Chinese policymakers will soon have more innovative tools to enact monetary policy and regulate the payments system, but a new payment system will likely not be enough to incentivize widespread use of RMB without other geopolitical forces.

But remember, many thought China would not be able to create a Chinese version of the internet but it did. The same may be true for blockchain and cryptocurrencies.

Tweet of the Week: Uniswap arbitrage bots

Synthetix CEO Kain on tweeting on the arbitrage bot activity in the SNX market on Uniswap via pools.fyi. SNX has seen large price movements over the past two weeks but volumes have remained under $500k but the arbitrage bots help avoid slippage in the Uniswap pool.

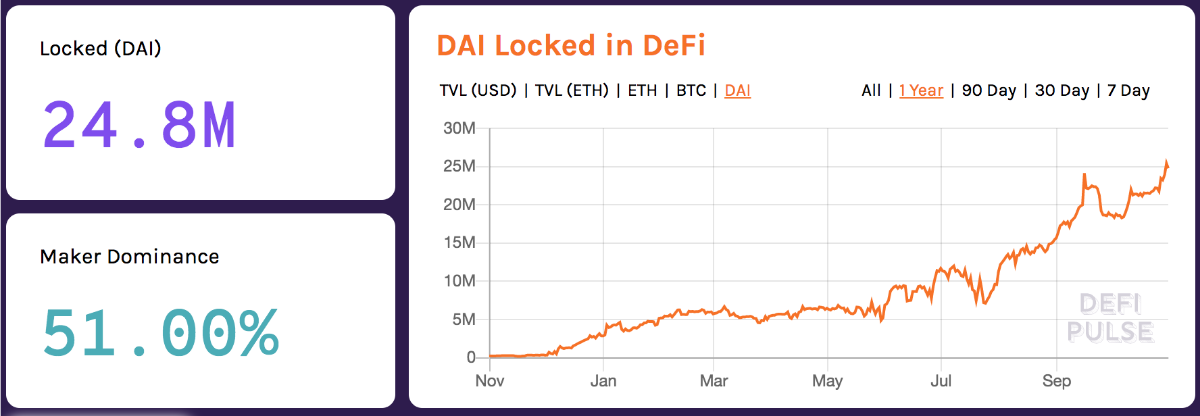

Chart of the Week: Dai locked in DeFi

Despite the fluctuations in rates and market volatility, the Dai locked in DeFi is on a stead trajectory up. Compound is the biggest beneficiary but the dynamics regarding the outstanding supply of Dai are much different than even at the beginning of the summer.

Odds and Ends

Crowd-powered asset manager Betoken's November development update [Link]

Uniswap analytics report Oct 22- Oct 29 from Blocklytics

Structured ETH converts ETH into structured fixed income products [Link]

Synthetix raises $3.8M from Framework Ventures [Link]

0x v3: the liquidity based API [Link]

bZx announces support for fixed-rate indefinite term loans [Link]

Aave protocol released on Kovan test network [Link]

Thoughts and Prognostications

Exchanges are open finance [Multicoin Capital]

Decentralized liquidity strategies [Ambo Group]

Review of Gitcoin Quadratic Funding Round 3 [Vitalik]

Why the Xi-China blockchain news is bullish for crypto [Maple Leaf Capital]

Why are gold and bonds rising together? [JP Koning]

Interview with InstaDApp co-founders [The Defiant]

Digital The next wave of DeFi users: A UX research study [Gossamer Group]

Long read of the week: On Carney's Globalcoin

Self-described "Anarchostatist Shill" Ciaran Murray examines the monetary effects of a 'globalcoin' - the dollar competitor proposed by the former BoE and super central banker Mark Carney.

Listen of the Week: Custody explained

The custody elements are solved from a technical perspective.

From a regulatory perspective, there’s still some clarity that the space still requires.

Anchorage co-founder and CEO Diego Monica on Delphi Digital's Chain Reaction podcast discussing the state of crypto custody. Custodians will be crucial in order to allow investors to utilize the functionality of crypto assets.