DeFi governance has been front and center since the summer. It’s hard to remember, but as little as six months ago, Maker was the only DeFi project doing token-based governance on-chain.

Compound changed that with the launch of COMP in June, ushering in the new era of “governance tokens”. These tokens have primarily been used as an incentive or reward mechanism, but they also control on-chain protocols (to a varying degree) and in many cases treasury.

Now, Compound is facing its first major governance test, asking COMP holders to vote on compensation for Compound depositors liquidated after the price of Dai on Coinbase Pro skyrocketed to $1.25, even though Dai wasn’t trading above $1.03 elsewhere in the market. Many depositors were farming COMP, by borrowing Dai, converting to USDC and redepositing it into Compound to maximize their COMP yield. Since Compound uses Coinbase Price Oracle, several COMP farmers were liquidated because the value of their Dai debt skyrocketed.

Now there is a proposal from kybx86 to compensate those liquidated from the high Dai price, by allocating 55k COMP (or $6.6m) from the comptroller to addresses affected.

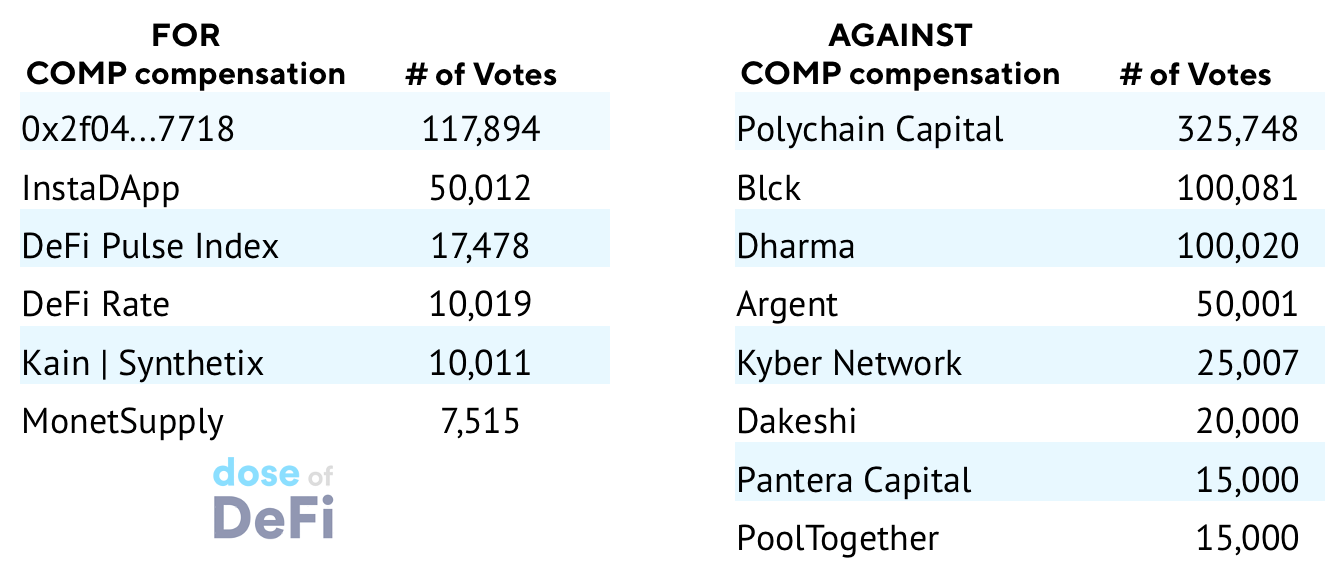

The proposal failed Monday Morning, with 681,290 COMP against and 212,592 COMP for the proposal. It is impressive that the proposal was submitted, given that 1% (100k COMP) is required to submit a proposal and then a 4% quorum must be met for it to pass. I guess it’s not surprising that aggrieved COMP farmers could scrounge up enough COMP to delegate and get a proposal on the docket.

The interesting thing is how the votes went.

Polychain is the second largest COMP holder and has been a relatively active governance participant (voted on 13 proposals). Eli Krenzke of Polychain explained the vote in the forums:

This proposal provides reimbursement before a clear path to fixing the issue has been established. We would like to see a little more clarity around potential solutions before finalizing any form of reimbursement.

This proposal reimburses users even when the protocol worked as designed, and may encourage further systemic risk. We do not want to set the precedent that tail risk should be subsidized by the COMP governance process.

This proposal suggests reimbursement denominated in COMP to a small group of users affected by the issue, despite displaying behaviors that are not aligned with the long-term interest of the protocol. We would prefer a reimbursement proposal denominated in the asset that was liquidated, but are understanding of the additional technical complexity.

Those voting FOR the proposal are rising protocol politicians and the address that submitted the proposal. Kain explained his FOR vote in a thoughtful tweetstorm citing the “indirect alignment between COMP holders and depositors”. Meanwhile, DeFi Pulse Index voted FOR the compensation on Compound, but its Snapshot page signals AGAINST compensation right now.

There are a number of notable abstentions to the vote. Compound founder Robert Leshner did not participate, sitting out along with a16z, Paradigm and Gauntlet Finance, which abstained because “it’s not a quantitative or risk-related vote”. Meanwhile Compound engineer Max Wolf abstained but cites “code is law” in preferring AGAINST. Strategy Lead Calvin Liu was perhaps the only team member to vote (against).

Tweet of the Week: Coinbase adds SNX, AAVE and BNT

Not exactly a memorable Tweet but big news with a Coinbase listing for Aave, Bancor and Synthetix. All three are 2017 ICOs, so represent a big development for Coinbase and regulatory attitudes to those assets. Coinbase will soon feature a robust array of DeFi coins for its millions of customers. Of course, it could never keep up with Binance and other exchanges in terms of listing speed, but that moat may be drying up as Uniswap increasingly becomes the first place with liquidity for a new token.

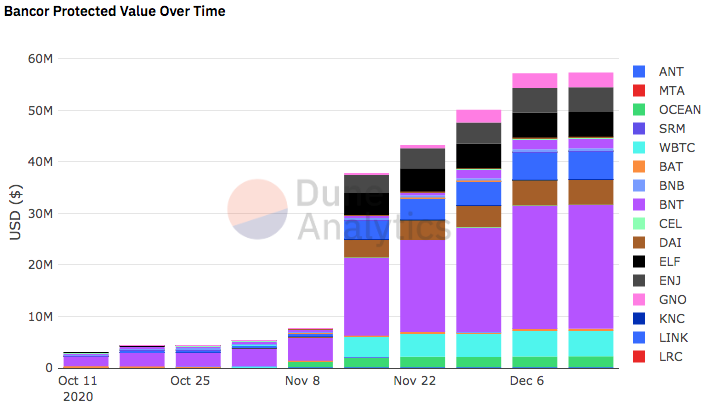

Chart of the Week: Bancor’s impermanent loss insurance attracts assets

Chart via Dune Analytics, ht Paul Burlage from Delphi Digital

Bancor launched v2.1 in mid October. This version features impermanent loss insurance, which allows investors to provide liquidity in a single asset by pairing it with an inelastic supply of BNT and splitting the fees. Since launching v2.1, Bancor’s TVL has grown 5x to over $100m, much of this thanks to a liquidity mining campaign it started on November 16. This campaign is specifically targeting single-sided liquidity providers. BNT has been the most popular token to cover, but WBTC, Dai and LINK all proved popular. More in Bancor’s November progress update.

Odds and Ends

Yield aggregator Rari Capital moving to Melon Protocol Link

Gnosis launches conditional token explorer and factory Link

(Re)introducing Colony, a DAO framework Link

Token Terminal proposes Smart Beta index to Index Coop Link

Multicoin invests in Swivel, a fixed-rate lending protocol Link

YAM teams up with UMA to launch uGas + new synthetics Link

DXdao* proposal in queue to launch Swapr Link

Odds and Ends

Electric Capital Developer Report (2020) [Maria Shen/Electric Capital]

Securities Law: Social & Community Tokens [Reuben Bramanathan/SeedClub]

ETH is not Money [Ryan Selkis/Messari]

Yearn Finance Q3 Quarterly Report [Yearn.Finance]

Challenges for institutional DeFi adoption [Mika Honkasalo/The Block]

The Bull Case for Decentralized Index Funds [Regan Bozman/Bankless]

Maker’s persistency illustrates the benefits of decentralized products [Nick Tomaino/1confirmation]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where it’s rainy. I’m looking forward to more sunshine. Stay safe and healthy. Happy Hanukkah!

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.