DeFi TVL across chains, another UNI governance hiccup

Plus Odds & Ends and Thoughts & Prognostications

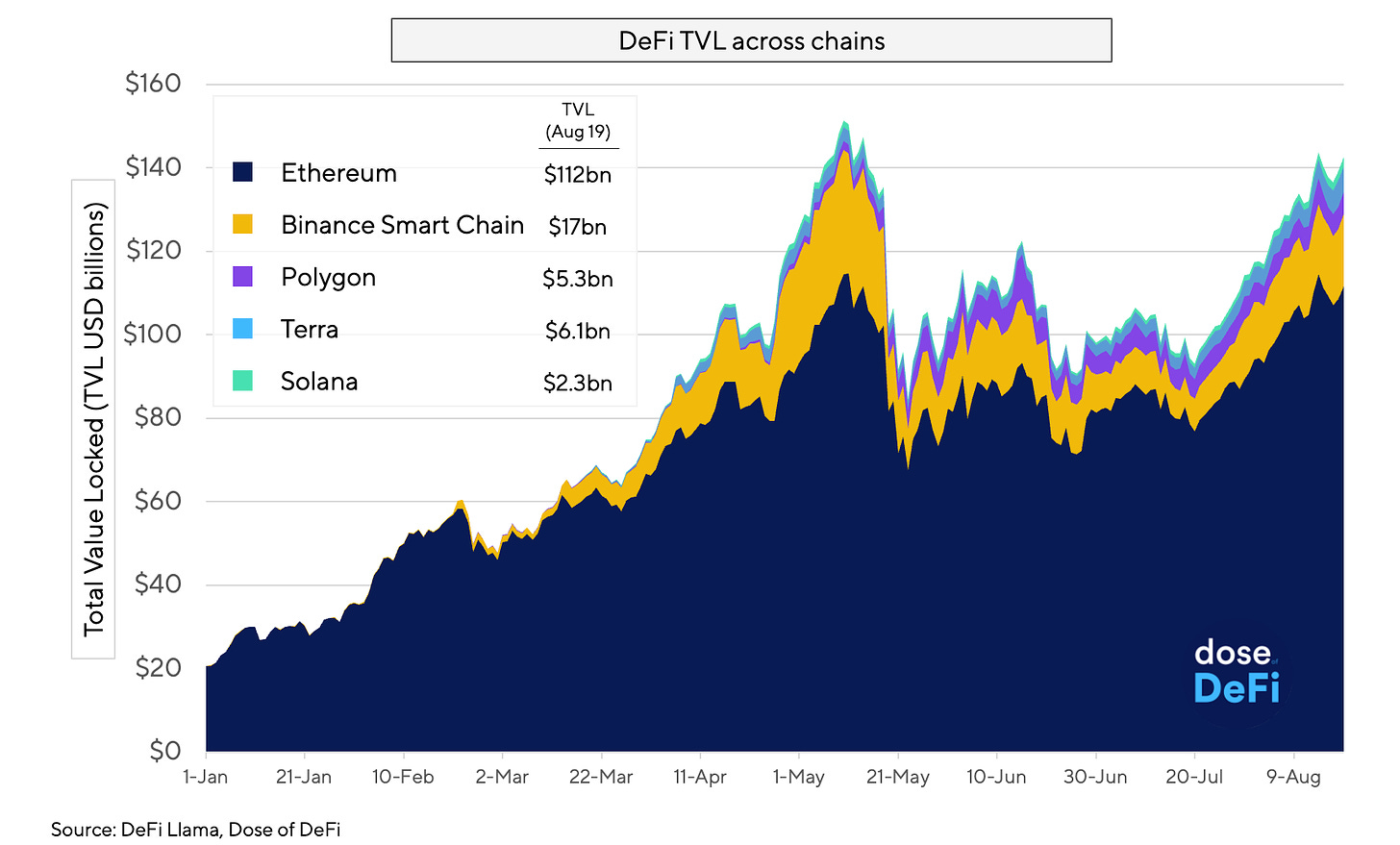

Chart of the Week:

Data from DeFi Llama on the TVL across different chains. While Ethereum continues to dominate market share and over DeFi liquidity, much of the story of the last six months has been the rise of the multi-chain world. Sidechains like Binance Smart Chain and Polygon found success as gas fees spikes, while the Ethereum community waits for beginning of the L2 era with Optimism ($108m in TVL) and Arbitrum’s imminent launch.

There has also been considerable growth and increased interest in DeFi on alternative Layer 1’s, most notably Solana and Terra and to a lesser extent Polkadot and Avalanche.

Solana has taken a bit of a victory lap this week as SOL reaches all-time-highs and appears to be the most formidable competitor to Ethereum, particularly for professional services.

Messari’s Ryan Watkins dove into the reflexivity of the Terra and LUNA ecosystem, while an anonymous researcher claimed this week that Terra’s Anchor Protocol advantages the core dev team for priority in liquidations.

Avalanche ($321m in TVL) just launched a $180m DeFi incentive fund with Aave and Curve announced as initial partners.

Tweet of the Week: UNI governance revolts

The tweet heard around the DeFi governance landscape. Uniswap governance is entirely devoted to distributing the gigantic UNI treasury, but it can’t seem to fund anything without major controversy. The latest is a now withdrawn proposal to distribute $25m to Flipside Crypto to fund Uniswap dashboards. The funds were to be deposited on-chain to earn ‘30% APY’ to continuously fund the initiative. Soon after this tweet, almost all major UNI holders/delegates came out against the proposal. Flipside’s CEO reflected on the failed proposal, while Revert Finance used the occasion to highlight its own struggles with the Uniswap Grants process. There was also a bug that led some ‘AGAINST’ votes to register as ‘FOR’.

Good governance requires legitimacy and it will take an awful long time for UNI governance to earn its legitimacy in the eyes of the community as long as major stakeholders take a backseat in public discourse.

Odds and Ends

Dad supply surpasses $6bn Link

Coinbase CFO says it has stockpiled $4bn in cash for ‘crypto winter’ Link

LyraDAO receives $1m contribution from Synthetix DAO Link

Polkadot-based Chainflip raised $6m to build cross-chain AMM Link

Nethermind brings MEV to xDai Link

Mitigating MEV with Gnosis Safe Link

Thoughts and Prognostications

A peek inside the MISO war room: $350m incident response story [Mudit Gupta]

JPEG Summer: Exploring the data behind the NFT Boom [CoinMetrics]

Polygon’s acquisition of Hermez and the effect on ZKsync [Alex G./Matter Labs]

Blockchains are the new app stores [Chris Dixon/a16z]

The way the Senate melted down over crypto is very revealing [Ezra Klein/NY Times]

The race for stablecoin transparency [JP Koning/CoinDesk]

The dangers of surprising code [samczsun/Paradigm]

7 indicators every investor should be using to evaluate NFT projects [Spencer Noon/Variant]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where I’m trying to juggle it all.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao. All content is for informational purposes and is not intended as investment advice.