Over the past month, Bitcoin has penetrated the mainstream once again. As always, the price is the story, but over the years, Bitcoin has honed it narrative and message for widespread consumption.

The “digital gold” meme is accepted by the community, used by investors now, and most importantly, “digital gold” is appealing and easy to understand to a general audience.

Ethereum is far behind on the narrative front, but ahead where it matters: price. ETH has outperformed BTC over the past week, month, quarter and year. If BTC spurs another round of mainstream speculation, it will be impossible to ignore ETH.

The question is what narrative will attract new entrants and ETH speculators. DeFi benefits enormously from a broader ETH market, but DeFi won’t drive investment decisions for those buying ETH for the first time. DeFi is what the Ethereum community uses ETH for, but you have to hold ETH first.

There are two narratives quickly emerging that will drive Ethereum usage and ETH ownership:

ETH2.0 and the rise of Proof of Stake (PoS)

Stablecoins and the proliferation of crypto dollars

PoS has institutional appeal

After years of slow progress, Ethereum’s Proof of Stake implementation has turned into overdrive over the last few days with the deposit contract hitting the minimum 524,288 ETH threshold, setting off a December 1st ETH2.0 launch.

PoS was in the original Ethereum whitepaper in 2014, so the recent success is a fulfillment of an early promise and a rebuke to the ETH haters. PoS could also catch on with a broader narrative about environmental protection and energy consumption.

More importantly, PoS provides an easy answer to the normie question, “What does ETH do?” ETH secures the Ethereum network, of course.

The technical details may be hard to grasp but PoS could deliver a new, mainstream narrative that hardens the ETH meme as Bitcoin did with “digital gold”.

PoS turns ETH into a capital asset with yield properties that make it appealing to sophisticated investors. There is a growing cottage industry seeking to help large institutional players with ETH staking. Staking infrastructure and services will be a strong tail-wind for ETH pitches to family offices, hedge funds and financial advisors.

Simply put, ETH staking is an easier sell to the uninitiated than “just hold ETH”, “open a loan on Maker” or “use it to pay gas fees”. What’s more, the new regulated infrastructure to service BTC buys can just as easily be used to purchase ETH. All it needs is an impetus.

That impetus appears to be an ETH run that outpaces a strong BTC run and the ETH2.0 launch and a new narrative for ETH as an asset.

Here’s a great thread from Jeff Coleman on ETH PoS’s technical achievement.

Crypto dollars have retail appeal across the world

If ETH secures the Ethereum network, then what runs on the Ethereum network? The top gas guzzler on Ethereum over the last 30 days was Uniswap with $12.7m paid to Ethereum miners, but right behind it was Tether, with $10.5m in gas costs.

Crypto dollars – okay, stablecoins – have been the most boring development on Ethereum. Many purists scoff at stablecoins – why raise the white flag on decentralized money? Moreover, dollar stablecoins increasingly are backed by a physical dollar in a bank, reinforcing censorship risks.

Perhaps because of these concerns in the community, the appeal of crypto dollars has been underrated, but they are a product that can be used by large swaths of the world’s population now.

The latest testament to the Crypto dollarization thesis is Venezuela and this development from USDC/Centre:

This brings up an interesting and larger discussion on the role of USDC in furthering U.S. Government policy (and how CBDCs fit into the discussion).

Regardless, stablecoin usage is likely to continue to grow and Ethereum is well positioned to serve as the global settlement layer for them. In particular, crypto dollars are an opportunity for Ethereum to onboard more retail users.

EIP 1559 is an important part of the puzzle. It will change the Ethereum fee market structure, so ETH the asset accrues value from the economic activity transacted on top of it.

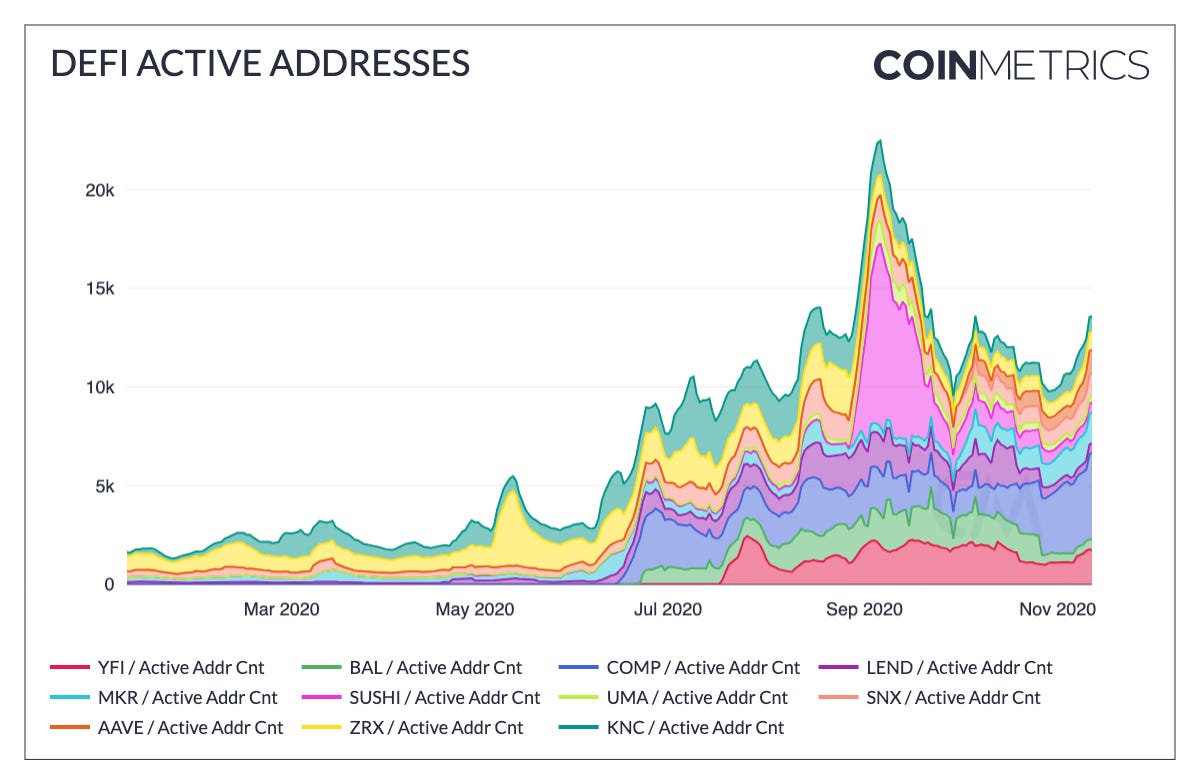

Chart of the Week: DeFi market sizing

One of several great charts in CoinMetric’s newsletter from last Tuesday, focused exclusively on DeFi. Nothing terribly surprising, but it does a great job of providing clean market sizing data for the space. From the chart above, it looks like Balancer and Sushi have declined the most since September highs.

Tweet of the Week: Trading volatility using AMMs

Big Brain Tarun with an interesting idea to create long-exposure for a YFI volatility trade. Of course, options exist in DeFi and could be used, but they are not capital efficient, because the locked assets are not being put to work. The use of Uniswap LP shares as collateral ensures that the underlying assets are earning a return from trading fees. There are challenges to liquidating LP shares, but Aave has plans to add support for Uniswap LP tokens in v2, while Maker is considering accepting DAI/ETH, USDC/ETH and WBTC/ETH LP tokens as collateral. Collateral management is an area where DeFi could improve greatly.

Odds and Ends

Flashbots: Frontrunning the MEV Crisis Link

Gnosis announces GnosisDAO, to manage 150k ETH treasury Link

Synthetix: Virtual Synths and where to find them Link

Introducing the Umbrella Protocol from Yam Finance Link

The Block: How a money laundering crackdown in China is ensnaring crypto OTC trading Link

Ledger now offers support for Compound loans Link

DEX.AG Rebrands to Slingshot After Raising $3.1M Link

Thoughts and Prognostications

A brief (critical) thread on the new IMF paper on the law of CBDC [Rohan Grey/Willamette University]

A look at the on-chain activity of Three Arrows, Polychain and Jump [Nick Chong]

Unlike 2017’s bull run, ETH is now a Store of Value [DCinvestor | Aftab]

Investing in Balancer [Franklin Bi & Kristie Huang/Pantera]

The Vampire Diaries – A SushiSwap Case Study [Deribit Insights]

Pickle Finance hack explainer [orb_x_ball]

Why should UNI liquidity mining rewards be restarted? [Dan Robinson/Paradigm]

That’s it! Feedback appreciated. Just hit reply. Written in Houston. Congrats on impending ETH2.0 launch! Hard not to write a bullish take on ETH right now.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.