Fei launch and the enduring allure of stablecoins

Plus demand vs. capital efficiency and the resurrection of YFI

The Fei Protocol launch had all of the markings of a mega launch. Part of it was the timing; the bull market is in full swing with an unending supply of new and existing capital pouring in to token launches, yield farming and project fundraising.

Some of it was the novel launch mechanism, which bootstrapped Fei, the stablecoin, and distributed Tribe, its governance token, while trying to be as “ape and whale-resistant” as possible.

But a lot of the hype and anticipation is because Fei is a next-generation stablecoin protocol, and stablecoins are by far the most important asset in crypto after Bitcoin and Ethereum.

Collateralizing Fei and distributing Tribe

The dust is still settling on the Fei launch but here’s what we know:

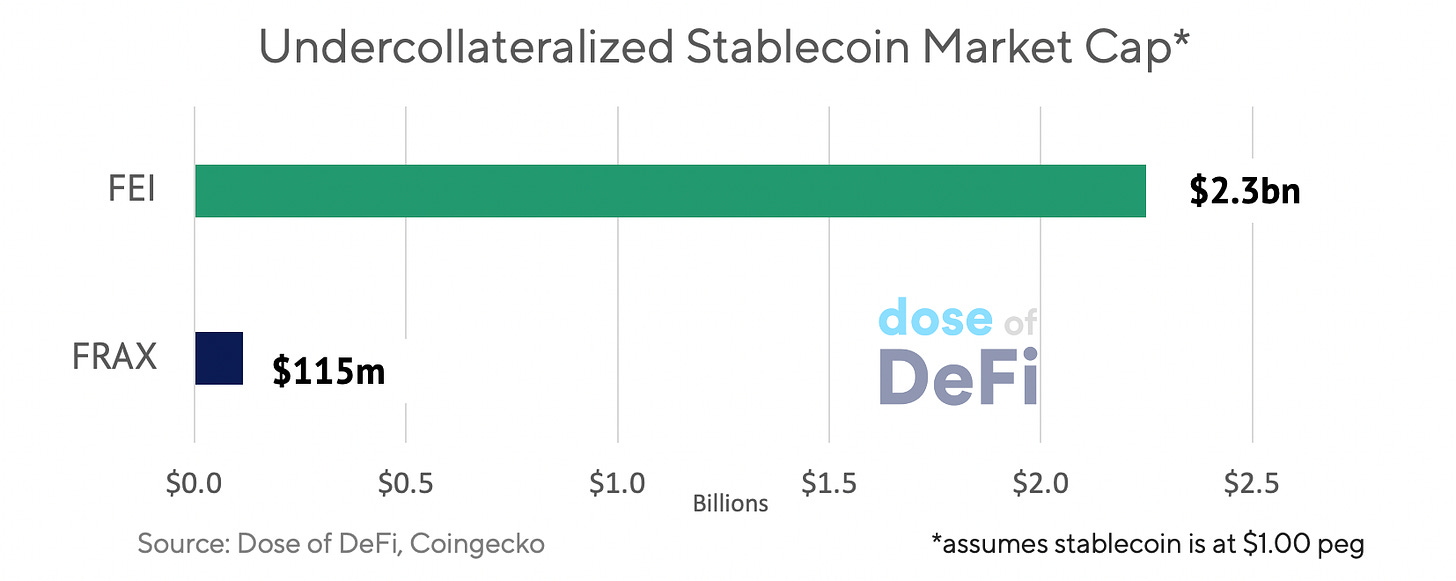

$1.3bn in ETH was contributed to the “Protocol Controlled Value” or PCV, which minted more than 2.3bn Fei. Fei is an undercollaterlized algorithmic stableoin with a pool of capital backing it, instead of over-collateralized loans in individual vaults like Maker uses to back Dai. Fei an automated central bank and the PCV is the balance sheet it uses to enact monetary policy. Fei’s bonding curve plus periodic re-weighting give it more granularity.

62% of the ETH contributed also committed to a Fei <> Tribe swap. This was available to those that committed during the genesis event, but there was a massive 650 ETH “arb” as soon as Tribe launched. Like many new crypto launches, the price pumped and then fell, benefiting those with programmatic trading skills. The price is still trading down to $1.73, giving Tribe a FDV of $1.7bn - Maker is just over $2bn.

Fei is struggling to maintain its peg, trading at $0.92 three days after launch. The protocol is relying on direct incentives to restore the peg by penalizing all trades on Uniswap below the peg and providing rewards to those that mint Fei. This is meant to brute force Fei back to its peg, but skittish investors still keep selling Fei.

Like all algorithmic stablecoins, instilling investor confidence is the name of the game; the most efficient way to restore the peg is to get everyone to believe the peg will return. It’s still too early to see how it shakes out. Fei’s protocol design may be able to overcome its rocky start. The latest from the team says that they have “patched a vulnerability found in the incentive calculation of Fei”. Gulp. Good luck.

Three great threads related to the Fei launch

Stablecoin liquidity is just as important as collateralization/redemption [Sam Kazemian/Frax Finance]

Retail was not REKT in Fei [Freddie Farmer]

Protocol Controlled Value (PCV) explained [ZΞUS/OlympusDAO]

Emerging Stablecoin Landscape

The launch of Fei served as a recalibration of the stablecoin market. “Crypto Dollars” (as I tried to meme them) have been on an unstoppable growth path over the last two years and are the unsung hero of DeFi’s success and crypto’s wider adoption.

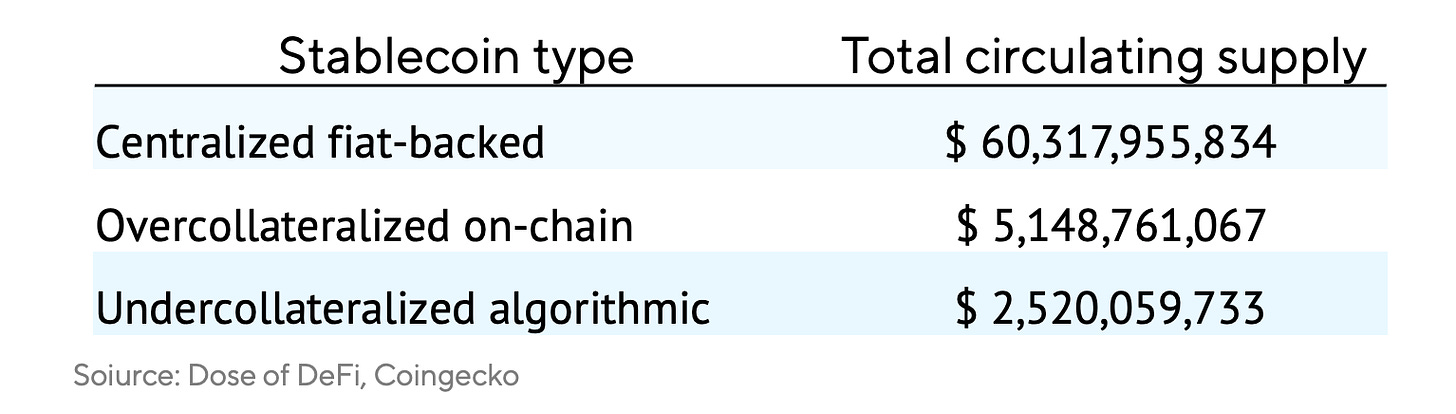

Current Blogger JP Koning categorizes the existing landscape:

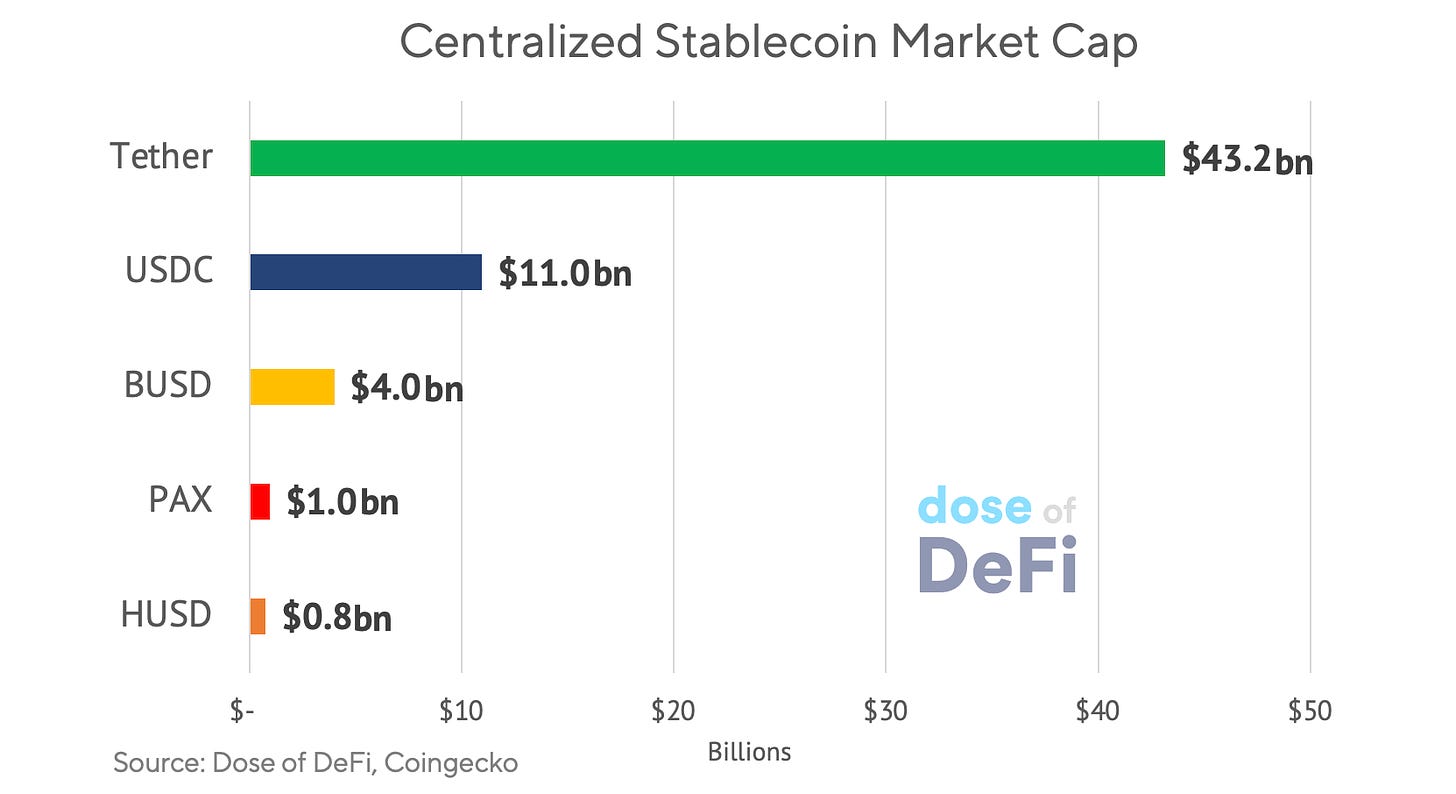

This is a helpful framing. Most of the interest in purely algorithmic stablecoins (ESD or AMPL) have shifted towards semi-collaterlized models like Fei and Frax. Centralized stablecoins are by far the largest:

With Tether as the dominant player overall with 64% of the overall market share, with USDC as the closest:

Overcollateralized means the collateral in the protocol is always more than the value of outstanding stablecoins.

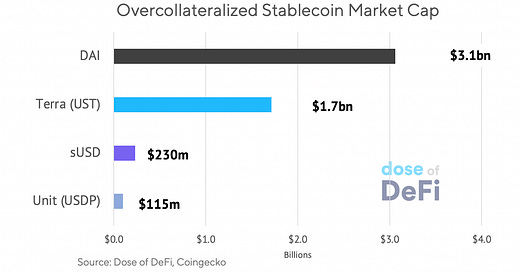

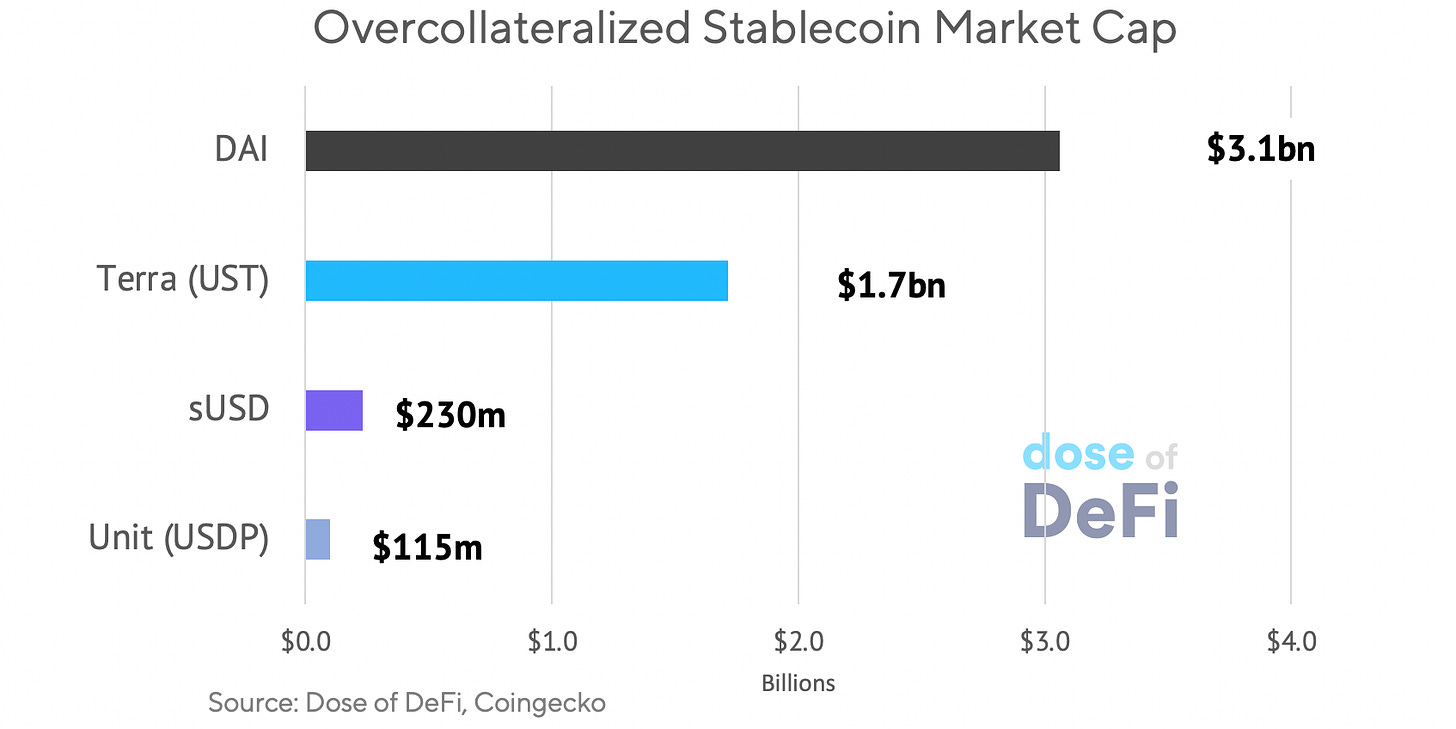

Dai is a DeFi OG and has significantly expanded its supply over the past year to over $3bn in circulation. sUSD has also grown but it’s not clear how much more it can scale. Terra is a similar model but it runs on its own blockchain and the elastic supply of Luna makes it somewhat algorithmic. Terra just launched Anchor, a savings protocol, with 20% deposit returns for UST.

Liquity is the latest lending protocol, launching on mainnet this week, minting a stablecoin LUSD. It aims to be hyper-efficient, offering collateralization ratios of 110%.

The holy grail is a type of fractional reserve system where the stablecoin’s circulating supply is worth more than the assets backing it.

Fei’s monster launch puts it in the same category as the largest collateralized stablecoins and even rivaling the smaller centralized coins. Of course, most is tied up now in the Uniswap pool with penalties for selling Fei below market rate. Frax is a similar algorithmic, partially collateralized design but opting for a slower growth to boostrap liquidity.

You could also put Float, RAI (Reflexer Labs) or OHM (Olympus DAO) in the last category, but don’t call them pegged coins. They also utilize Protocol Control Value to support their stable asset, but RAI and OHM aim for stability independent of the US dollar. Messari’s Ryan Watkins has a good thread on them.

Tweet of the Week: Demand over supply

Governance whisperer MonetSupply making an apt comparison between optimizing efficiency versus driving demand. In the stablecoin space, liquidity and maintaining the peg is paramount and that comes from usage, either from payments or trading. Stablecoins’ go-to market strategy is just as important as its mechanism design. Adoption begets liquidity, which begets scale. Dai’s advantage is not its capital efficiency but its 2 year head start at integrating and building liquidity. MonetSupply is throwing shade at the algo stablecoins and undoubtedly subtweeting Fei, but the genesis event was impressive at creating a huge circulating supply. Now it just needs to get that used. Terra has perhaps been the most forward at driving demand, focusing on the non-crypto market in South Korea.

Tweet of the Week: YFI TVL rises

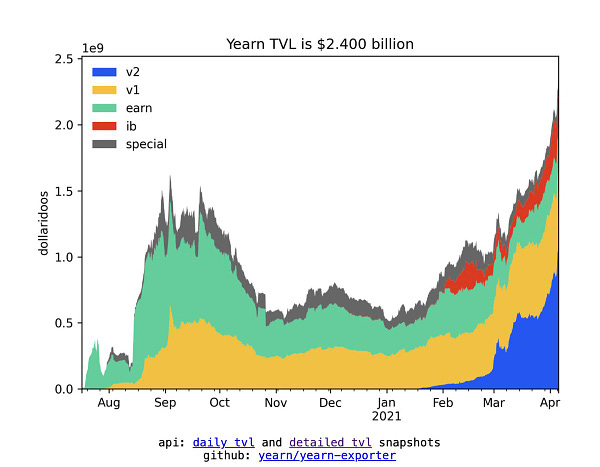

Framework Partner (and huge YFI bag holder) Vance Spencer highlighting the growth of YFI over the last month, driven by the adoption of Yearn’s v2 vaults. YFI has been relatively quiet after a boisterous first couple months on the scene. It’s still the leading programmatic manager on-chain. It benefited enormously from the yield farming boom but it has always been an optimization engine at it’s core. Andre built Yearn for stablecoin interest rates but with more and more specialized liquidity pools in Balancer v2, Uniswap v3 and L2 pool bridges, Yearn’s strategies are likely to have plenty of opportunities to offer some aggregated alpha. YFI is up 17% over the last week to $41,691.

Odds and Ends

DXdao* Month in Review Link

Greenwood, an AMM for interest rate swaps, launches Link

xToken aims to offer fungible positions in Uniswap v3 liquidity Link

Kyber launches dynamic market maker Link

Dharma launches new DeFi-focused skin with gas rebates Link

Starkware announces Caspian, an L2-Powered AMM Link

imToken raises $30m in Series B Link

Thoughts and Prognostications

The DEX to rule them all [Will Sheehan/Parsec Finance]

Will we see a multi-chain world? [Aftab Hossain/The Catalyst]

DeFi: what’s working, what’s not [Naval Ravikant, Anton Bukov, Haseeb Qureshi & Robert Leshner/Clubhouse]

The lack of toxic liquidations in DeFi signals inefficiency [Charlie Noyes/Paradigm]

Radicle’s Liquidity Bootstrapping Pool examined [Stanislav Kozlovski/Balancer]

Introduction to Decentralized Finance [Corbin Page/Consensys]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where open streets means happy life. Problems with posting this; substack kept saying “post is invalid”. Kept deleting links until it went through.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.