Outside of gyrating markets and an ETH ATH, one of the big stories of the week was the launch of Saddle Finance, a Curve-like AMM backed by the who’s who of DeFi VC’s. Importantly, this is not a fork. Curve is unique in DeFi for having a restrictive software license for its code, so Saddle rewrote Curve’s contracts in solidity (Curve’s were written in vyper).

The narrative of a new VC-backed project “stealing” from a DeFi darling was great fodder for Crypto Twitter, but I’m not terribly interested in whether or not it was a fork. DeFi is big enough where good ideas will be recreated or copied with or without the approval of Crypto Twitter.

Lessons from the “stories” copycats

Snapchat was the first to come up with “stories”. Their ephemeral nature made them a hit in contrast to the picture-perfectness of Instagram posts. Snapchat was growing fast, in particular with younger users.

But then Instagram just copied Snapchat stories and didn’t even change the name. Instagram stories suddenly appeared on Instagram, and eight months after launch, Instagram Stories had more users than all of Snapchat. Now, almost every social media app has a stories feature (and no shame).

Alternatively, one could look at Netscape and Internet Explorer, the iPhone and Android, or go all the way back to Macintosh and Windows. The takeaway is clear: good ideas will not stay siloed in one product.

Investors love moats

Warren Buffet is credited with using the term “moat” to describe the distinct advantage that some companies have that protects its market share or profitability numbers from competitors.

In finance, liquidity is the ultimate moat. It’s easier to trade/borrow/lend in one venue because other investors are trading/borrowing/lending at the same place. In technology, this is referred to as “network effects” and it’s the moat that keeps the Web 2 incumbents firmly entrenched. Google search is a better product because more people use it, compounding the barriers to entry and erecting an impenetrable moat.

Why DeFi is different

Network effects existed prior to the internet, but only with the internet do we get the super “aggregators” that Ben Thompson has written so eloquently about. In his Aggregation Theory, companies can no longer simply own distribution:

By extension, this means that the most important factor determining success is the user experience: the best distributors/aggregators/market-makers win by providing the best experience, which earns them the most consumers/users, which attracts the most suppliers, which enhances the user experience in a virtuous cycle.

DeFi is different for two reasons;

Even lower switching costs - DeFi does not have “user accounts”, only decentralized applications (dapps) that interact with users’ wallets, drastically lowering the bar for a new dapp to be functional right out of the box. Imagine launching a new search engine now and competing with 25 years of Google data.

No lock-in network effects - dapp usage does not give a dapp a monopoly on user data. Dapps direct users to an underlying protocol, but the virtuous cycle that Thompson talks about does not exist. Uniswap is going to have to convince all its users to migrate to v3 (UNI will obviously help).

Liquidity is much stickier

DeFi’s separation of the front-end from the back-end allows new dapps to launch and piggyback off of existing protocols, but the underlying protocols still benefit from the network effects of liquidity accumulation.

Saddle finance isn’t trying to build a new front-end for Curve - it’s trying to compete with it on a protocol level. That is a much tougher task; it has to bootstrap liquidity and faces the same problem as any two sided marketplace.

This is still easier in DeFi than in Web 2.0 though, thanks to the magic of token incentives as Sushiswap so brilliantly illustrated with its “migration mining”. Saddle Finance also has access to “mercenary capital” or liquidity providers that may be willing to subsidize usage of the protocol because they can expect long-term returns from equity investments. Thesis founder Matt Luongo is an advisor to Saddle, so there may be KEEP rewards for tBTC pools on top of whatever token incentives Saddle introduces, much like Curve and Synthetix teamed up for double rewards on the sBTC pool at launch.

If it ain’t broke, don’t fix it.

Chart of the Week: dYdX in 2020

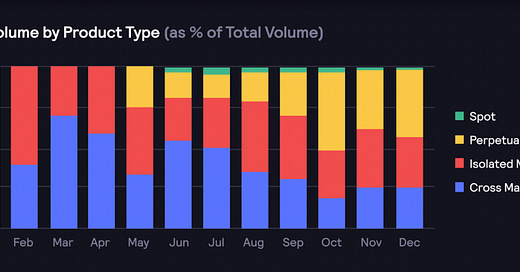

In 2019, dYdX was one of the top DEX’s and DeFi lending protocol. As its 2020 in Review shows, it had a successful 2020, even if it was not as flashy as the rest of DeFi. It didn’t do any yield farming and it’s probably the most prominent project without a token. Still, it did launch perpetual contracts for ETH-USD and BTC-USD in April and they now makes up around 40% of its volume. Perpetual contracts are a genuine innovation of the CeFi world (ty Bitmex). The continuously rolling nature are attractive to traders and the funding rate is a popular way to gain short/long exposure. DerivaDEX, MCDEX and Perpetual Protocol are also competing in this space. Token Terminal has a nice run down on the recent success of Perpetual Protocol.

Tweet of the Week: Fixed-Rate Lending & Maker

A forum post from Yield Protocol for a MIP (Maker Improvement Proposal) to introduce a new module to allow Maker governance to set (or influence) long-term fixed-rate Dai loans, rather than adjusting the stability fee for all Dai loans. Yield Protocol “tokenizes ETH-collateralized fixed-rate, fixed-term loans into a new class of tokens that have been named ‘fixed yield tokens (or ‘fyTokens’ for short). FyTokens are similar to zero-coupon bonds and provide a fixed payout at a future maturity date.” The proposed Term Lending Module (TLM) would have a standing offer to buy ‘fyDai’ tokens at an interest rate specified by Maker governance, so if Maker was targeting a 5% fixed-rate Dai loan, but Yield’s ‘fyDai’ tokens were trading at an implied 6%, a user could purchase fyDai on the market and trade it with the TLM for a profit (lower interest rate = more valuable).

Fixed-rate loans would attract new investors and create new innovation in the DeFi fixed-income space, but they suffer from an initial liquidity problem. Teaming up with MakerDAO, which also needs more tools to manage Dai, would help bootstrap initial liquidity. It would also help Dai compete with the USDC & USDT’s of the world. Notional Finance is another recently launched fixed-rate lending protocol. Their co-founders were recently on the Delphi Digital podcast.

Odds and Ends

Uniswap clocks in 300,000 monthly active addresses Link

MyCrypto’s 2020 review of major crypto security incidents Link

Kyber 3.0: Architecture Revamp, Dynamic MM, and KNC Migration Link

The Defiant: Yearn Overhauls Fee Structure in V2 Link

Set Protocol launches asset management suite Link

Curve averages $8m a day in cross asset swaps after Synthetix integration Link

StakeDAO is live Link

Thoughts and Prognostications

The Year in Ethereum 2020 [Josh Stark & Evan Van Ness]

Was there a Bitcoin double-spend on Jan 20, 2021 [Hasu/Derebit Insights]

DeFi Systemization of Knowledge (SoK) [Imperial College Academic Paper]

Regulate Bitcoin? Yellen Should Leave Crypto Alone for Now [Tyler Cowen/Bloomberg]

The Evolution of Token Distribution Models [Coinlist]

DODO v2.0: Will it Fly? [Jonathan Erlich/Delphi Digital]

DeFi Pooling Bringing Scalability to Existing L1 Projects [Starkware]

Fixed Income Protocols - The Next Wave of DeFi Innovation [Rahul Rai/Gamma Point Capital]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn where I’d like some snow or for it to get warm. Still gathering candidates for a part-time copy editor and a part-time analyst. Both paid, if you or someone you know would be a fit, get in touch.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao. All content is for informational purposes and is not intended as investment advice.