Amsterdam! I’ll be there from Monday to Thursday morning and will be speaking about DAO Sovereignty at The DAOist’s Global Governance Gathering on Tuesday at 12:40pm.

Also, DXdao* is still looking for a DAO Counsel to help it navigate the regulatory and legal waters. If you know of a good candidate, reach out.

- Chris

Tweet of the week: Inflation-resistance and debt

Frax has had a big April. Luna enlisted it in its quest to usurp Dai, deepening Frax liquidity with the new Curve 4pool. And then this week it released a new stablecoin (FPI) that isn’t pegged to a dollar, but instead the price of a basket of consumer goods, which in theory would make FPI inflation-resistant. It’s hard to think of a better environment to launch FPI than with the dollar posting an 8.5% inflation rate this week, the highest in 40 years.

0xHamz, a self-proclaimed “former goldman current NYC heggie” that’s been cranking out content lately, is skeptical on the prospects of FPI, pointing out that money is money because debt is denominated in it. Frax founder Sam Kazelman was on Bankless this week, and did a great job tying the current DeFi and stablecoin discussion with the longer history of money and central banking.

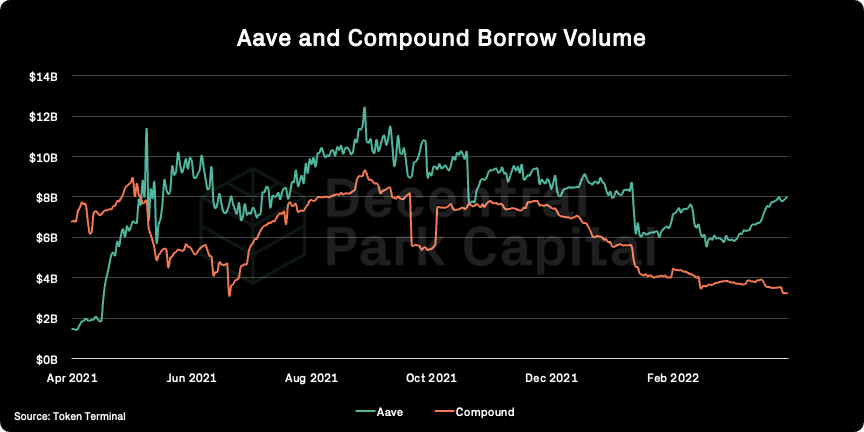

Chart of the week: Aave surges, Compound slows

In DeFi lending, there’s Maker and then Aave and Compound, all three of which have been miles ahead of any other competitors throughout DeFi summer through 2021. Their success - best illustrated by outstanding borrow - was highly correlated throughout 2021, but as the chart shows, there’s a divergence starting in March.

Aave’s outstanding borrow has surged, primarily due to the release of Aave v3 and the addition of stETH as collateral, leading to a rush of new collateral deposits. Aave’s outstanding borrow is nearly twice as big as Compound’s. In addition to stETH and v3, Aave has also been much more aggressive than Compound in expanding to more chains, which has limited the borrowing market for Compound.

BTW, an excellent chart from an excellent newsletter, The Weekly.

Odds and Ends

DXdao* month in review for March Link

Reuters: Treasury launches campaign to educate public about crypto risks Link

Sen. Toomey (R-PA) announces legislation for stablecoin regulation Link

Maker governance passes emergency executive Link

Connext unveils Amarok release for bridging modular interoperability Link

Algod and Do Kwon make $1m wager of future price of LUNA Link

Coindesk: US Officials say North Korea behind Ronin & Axie $625m hack Link

Thoughts and Prognostications

Breaking down the design space of money market liquidations [Genevieve Yeoh/Delphi Digital]

Why I’m bearish on real-world assets in DeFi lending protocols [Teddy Woodward/Notional Finance]

Atoms, institutions, blockchains [Josh Stark/Ethereum Foundation]

Nomad, Stargate and the state of crypto bridges today [Aya Kantorovich/FalconX]

A look into Euler Finance [Token Terminal]

Diving into Celestia, the first modular blockchain network [Can Gurel/Delphi Digital]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, on an impeccable day of sunshine. Looking forward to Amsterdam!

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao* and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.