FTX's DeFi reverberations and how Uniswap's volume compares with centralized exchanges

Plus Odds & Ends

Note: Dose will be off next week eating turkey for Thanksgiving!

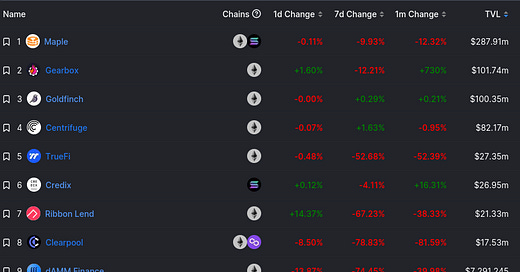

Tweet of the week: Declining loan demand

Given the events of the last few weeks, it seems like no trading desk is safe from the contagion of the FTX Collapse. DeFi fared well, because you can’t negotiate with a smart contract. Still, there will be repercussions to DeFi and on-chain activity. The bear market has already led to the lowest DEX volumes in two years.

The tweet above points to outflows from on-chain uncollateralized lending platforms as their target clientele (market makers) shrink back their involvement as credit tightens across the board. There might be other downstream effects on new DeFi products that may not find a market in this risk appetite environment.

Read more: [The Defiant] Unsecured DeFi lenders look shaky in face of FTX contagion

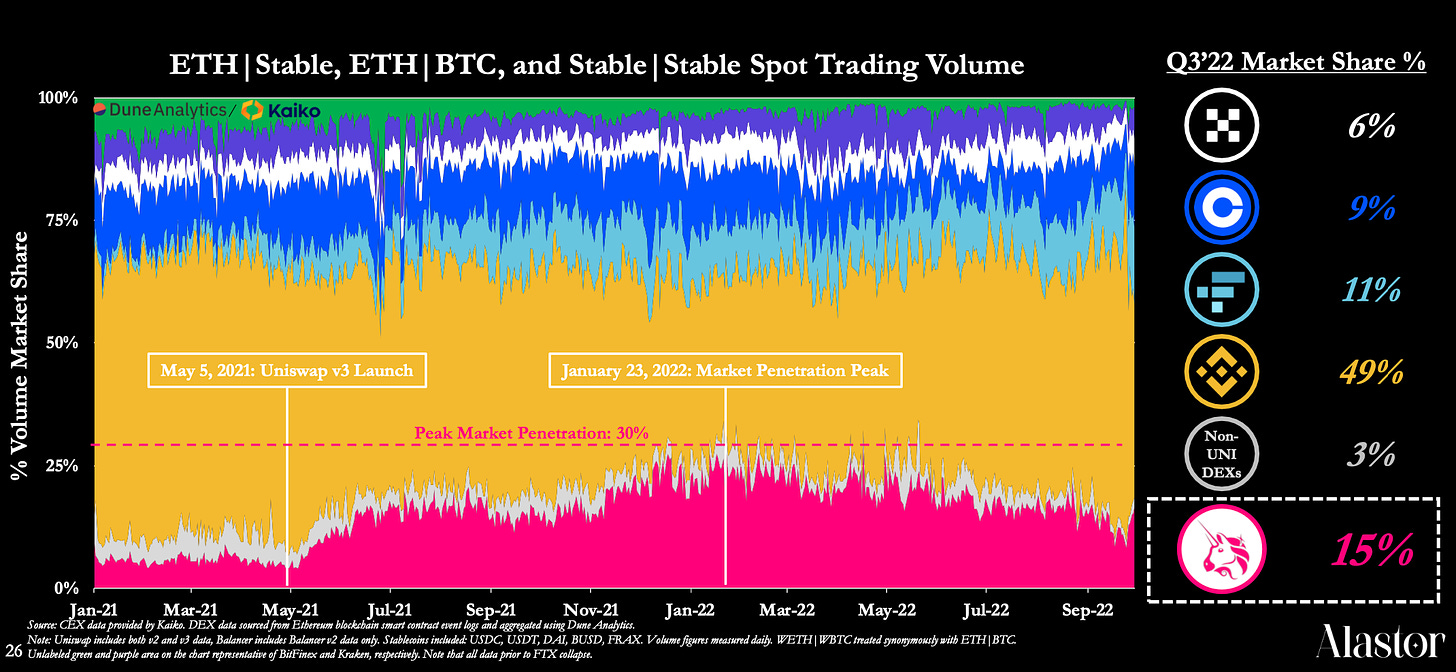

Chart of the week: Uniswap behind only Binance

Uniswap has no equal in the DeFi world, where it occupies more than 85% of the market share. Its competitors are the big CeFi exchanges. The chart above - taken from an Alastor report for Uniswap Governance - shows just how competitive it is with the centralized players with 15% of non-BTC/stable marketshare in Q3, second behind Binance. The collapse of the #3 exchange will be an opportunity for Uniswap to grow marketshare, especially as investors now understand the appeal of DeFi’s transparency and sovereignty. Given that Binance’s DEX probably occupies around 1% of overall market volume - I wonder what it expects the DEX/CEX market share split to be in 2-3 years?

The report from Alastor has lots of other great info, particularly on the fee market.

Odds & Ends

dYdX launches simple swap mode Link

MakerDAO tightens debt ceilings in wake of FTX fall Link

Yearn launches Cowswap solver, commits to settling strategies through CoW Link

Cosmos community fails to approve ATOM 2.0 whitepaper Link

Aave votes to free REN market because of links to FTX Link

Thoughts & Prognostications

It always was and always will be about decentralization [Joseph Lubin/Consensys]

The ZK everything report [Eshita Nandini & Jerry Sun/Messari]

How Alameda blew up [Michael Feng/Hummingbot]

The collapse of Alameda and FTX [Nansen]

Musings on current political dynamics in Washington [Nic Carter/Castle Island]

That’s it! Feedback appreciated. Just hit reply. Written in Nashville, where it is c-o-l-d.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.