Gas Prices Decline and USDT growth outside of Ethereum

Plus Odds & Ends and Thoughts & Prognostications

Tweet of the Week: Gas Price chatter

Talking about gas prices on Ethereum is like talking about the weather in the real world. Gas prices were in the teens over the weekend and even during Monday’s U.S. business hours, prices hovered around mid 50s GWEI. Hasu lays out the three explanations succinctly. #2 & #3 seem like the main culprits, in part because of the economic or arbitrage opportunity they are exploiting. Those transactions are willing to pay gas prices that are orders of magnitude higher than the typical DeFi or Ethereum transaction.

Fees will be high whenever there are juicy arb opportunities to be found, which is why James Prestwich is skeptical of the gas savings from L2, arguing “[In DeFi], arb gas usage expands to fill the available chainspace”.

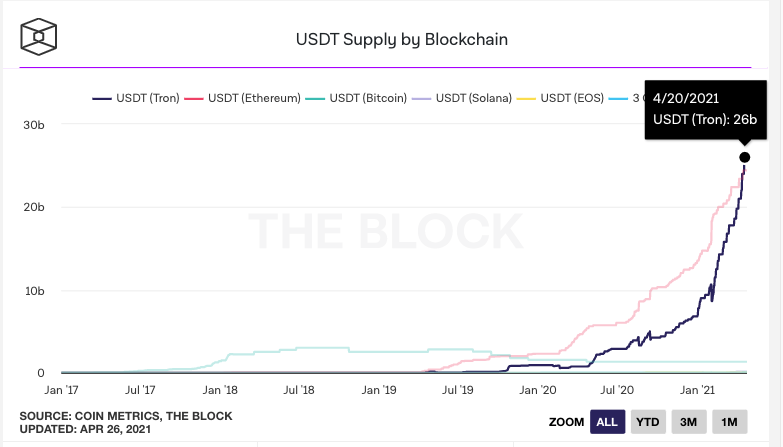

Chart of the Week: USDT growth on T ron

I saw this on Twitter and it made me do a double take, but yes, Tether has grown faster on T ron than on Ethereum, where its circulating supply is almost twice as big USDC ($13.7bn).

Although it has a lot of users, T r o n is not a hot bed of DeFi activity - but neither has Tether (USDT). Tether has grown because it is the stablecoin of choice amongst OTC desks and exchanges, like Binance and FTX. Originally, most Tether was issued on Omni, a Bitcoin sidechain, but issuance shifted to Ethereum in 2019, but high gas fees have likely pushed Tether’s trader- and exchange-based activities to a lower-cost option, T ron.

Tether continues to be a dominant force in crypto, with a significant but not outsized impact on Ethereum. This type of activity may also migrate to Ethereum Layer 2’s as they come online. In other Tether news, it started trading on Coinbase Pro last week.

Odds and Ends

Coindesk: MKR passes $4k as Maker brings on real assets Link

Balancer deploys V2 contracts to mainnet, plus 1000 ETH bug bounty Link

Archer Swap aims to bypass MEV, prevent front-running Link

Loopring’s Ethport tries to enable L2 -> L1 transaction/calls Link

Aave introduces liquidity incentives for Aave v2 Link

DexGuru raises $1m Link

Optics is a new cross-communication design from Celo Link

Thoughts and Prognostications

DAOs and the pitfalls of progressive decentralization [0xMiel/Gardens]

Governance Extractable Value [Leland Lee & Ariah Klages-Mundt/Galaxy Digital & Gyroscope]

The Fundamentals of DeFi are Strong [Danger/Today in DeFi]

On Staking Pools and Staking Derivatives [Georgios Konstantopoulos & Hasu/Paradigm]

Ethereum L2 Rollup Debate: Optimism, Starkware, Arbitrum and zkSync [Delphi Digital]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. Hope everyone and their family are safe and healthy, thinking particularly of India today. More problems with substack links. Think it’s Tron….

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.