Governance can't be avoided forever

DeFi protocols look to pave a different path than Ethereum's main chain

The DAO has long been Ethereum’s most formidable experience. Crises early in a startup or movement’s history often have an outsized effect on the culture and values as it develops, and the hack and loss of $50m (when ETH was $15) instilled two key lessons for the young Ethereum community:

1. Security is tantamount with trust in the protocol

2. Significant changes to the protocol can be implemented when there is overwhelming, informal consensus.

In order to fix the DAO hack and recoup the loss, the Ethereum community decided to hard fork and return the stolen funds. There was a vocal minority that followed the original chain – now referred to as Ethereum Classic – but the overwhelming majority of Ethereum community members supported the new chain, in part because 14% of all ETH at the time was invested in the DAO (by contrast, there is less than 3% of ETH locked in DeFi).

The DAO hack illustrated the perils and promise of smart contracts, which come with a higher level of responsibility and security. Former MyEthereumWallet and Current MyCrypto CEO Taylor Moynahan, a veteran of Ethereum’s early days, carried the security-first banner into DeFi last month with a talk at ETH Denver and a series of public critiques of the bZx’s risk and security standards.

Meanwhile, since the DAO hack, Ethereum’s reliance on overwhelming, informal consensus has worked surprisingly well, and many expected the rickety governance model to be just enough to get it to the ETH 2.0 upgrade.

This loose governance structure, however, can only solve black and white issues, which is why the Ethereum community is in an uproar over ProgPow, because it can’t value the political contribution of users, investors and developers that are building on top of Ethereum, to say nothing of EIP-1559.

Even with the recent contentious debates, there is little support in the Ethereum community for any type of on-chain governance, but that hasn’t stopped DeFi from pushing forward with it to live up to its decentralized goals.

$COMP token and Compound’s simple governance process

Compound aims to create a governance structure that would allow it to be a piece of financial software that is “permanent and upgradeable by the community”. The $COMP governance structure, which was unveiled last Wednesday, will set a precedent for post-ICO token governance and influence Uniswap and dYdX’s decentralization plans.

Not all details about $COMP governance structure have been released but this is what we have so far:

$COMP tokens will initially be distributed to Compound shareholders; $COMP is not a fundraising tool.

1% of $COMP is required to submit a governance proposal, which must be executable code

There is a 3 day voting period for all $COMP holders, who can also delegate their voting rights

If > 50% and a 4% quorum, then the proposal is queued and implemented after 2 days.

The voting period and 2-day timelock delay are lessons learned from Maker governance, and the 1% minimum threshold is a smart anti-spam measure. Compound only envisions standard proposals that could add a new asset, change an asset’s collateral factor or change a market’s interest rate model.

The Compound governance contract has been audited by Open Zeppelin and is currently running on the Ropsten testnet, but there are two clear unknowns that Compound will have to answer in the future:

1. What value will $COMP have?

2. How will $COMP be distributed?

$COMP is not meant to be a fundraising device, but there must be a reason for someone to hold it, some benefit that it brings them. Compound argues that businesses that build on top of the protocol – including Compound and its shareholders – will hold $COMP tokens so they can influence the protocol and protect their business interests.

This sounds awfully familiar with 0x’s original token model, which it scraped in favor of a staking system. That’s not to say it won’t work. 0x’s problem wasn’t bad governance; it was the token price. ZRX token holders saw value in an increase in the token price, not from a functioning platform with a separate revenue line that depends on it. Its token model had to change to reflect the interests of its token holders.

Compound governance’s success depends on who holds $COMP and how it is distributed. Early token holders will establish governance norms and need to place the long-term development of the platform over short-term price fluctuations.

Who gets $COMP? The Compound team and shareholders will be early recipients, followed by developers building on top of the platform, at the discretion of the team. And then it will need to distribute tokens to its users; it will likely use earned interest by address, as it did for additional asset voting, to weight the initial distribution.

Compound can draw on its these core constituencies to form an initial governance community, but as soon as $COMP is freely tradable, people will want to speculate on it and get a piece of the 2nd largest DeFi project.

As such, Compound will do whatever in its power to ensure that velocity of the $COMP token remains low. I expect Compound’s governance and decentralization push to move slowly and include lengthy lock-up periods for distributed tokens.

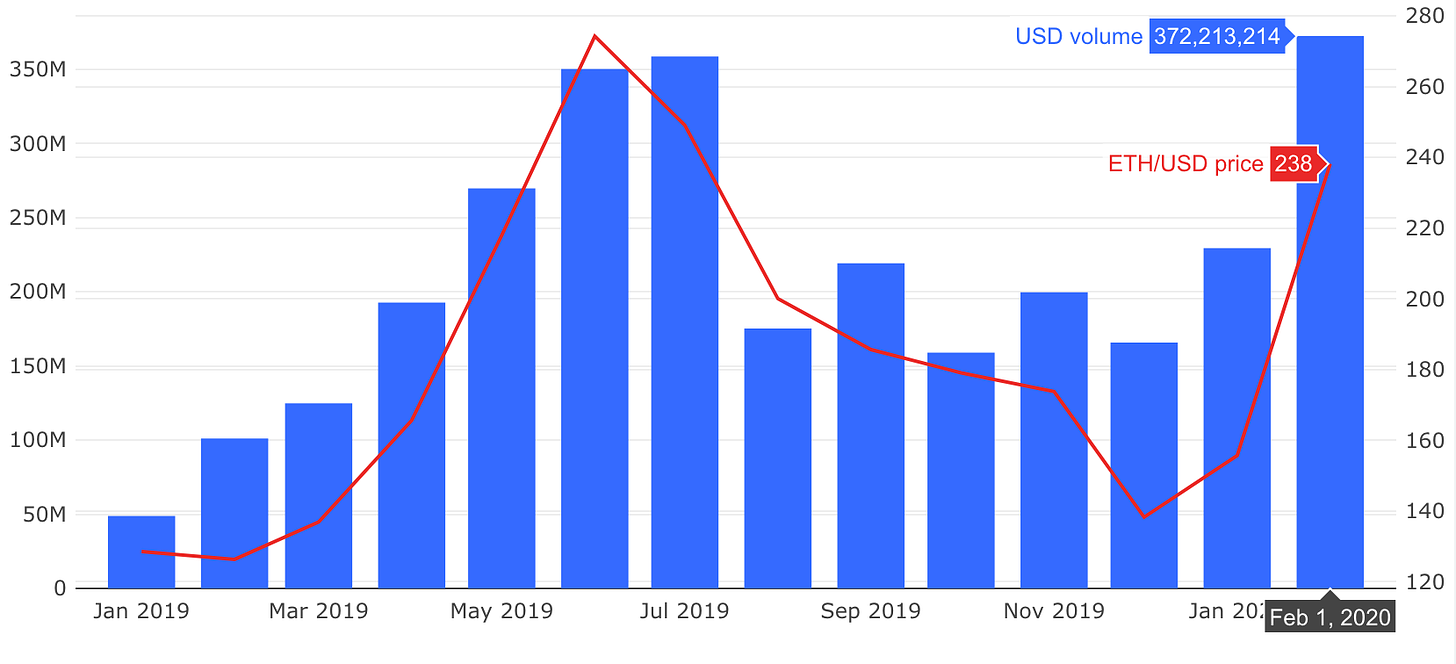

Chart of the Week: DEX volume peaks

February may be the shortest month, but decentralized exchanges (DEX) had their best month of volume ever, with over $372m in volume according to Dune Analytics. The DEX wars twitter bot put the number at $439m but neither of those include dYdX, which reported $160m in volume in February. The volumes are in line with what centralized exchanges saw in February and is not evidence of a shift to DeFi protocols by existing crypto users but does demonstrate their staying power.

Building secure applications in a collaborative environment

Crypto Twitter and Telegram were abuzz this past weekend because an integration (iEarn) with the promising stablecoin liquidity pool swap Curve experienced a trade with massive slippage, leading to iEarn’s founder leaving the space. The above poll from 1kx’s Lasse Clausen is split 50/50, with half claiming that responsibility lies with the developers and the other half putting the onus on the users. While the current debate may be mixed, the next million DeFi users will surely not take responsibility.

Odds and Ends

Synthetix uses Gnosis’s dFusion for SNX auction to restore sETH/ETH peg Link

0x updates on staking, liquidity API and off-chain orders Link

Making Maker: February 2020 Link

Loopring launches first zkRollup-enabled decentralized exchange Link

Top 5 DeFi apps by active Ethereum addresses Link

Drip aims to bring Coinbase’s Earn to DeFi education Link

Thoughts and Prognostications

Stakeholder Analysis: KNC pumps to 18-month high [Santiment]

Flash Loans: Why Flash Attacks will be the New Normal [Dragonfly/Hasseb]

How zk-SNARKs Solve the Biggest Problem Threatening the Blockchain Revolution [The SNARK Age]

Bug Hunting Isn’t Enough; DeFi Code Should be Financial-Attack Proof [The Defiant/Quantstamp]

Steven Seagal’s Crypto Blessing Was Bought [Money Stuff]

Bitmex Funding Rate Arbitrage [Falkenblog]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. Today’s sun made me forget the weekend’s cold. I’m in Boston next weekend for MIT Bitcoin Expo, let me know if you’re around.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own and do not necessarily reflect the opinions of others. All content is for informational purposes and is not intended as investment advice.