Hiccups in scaling blockchains and Ethereum stablecoins (again)

Plus Odds & Ends and Thoughts & Prognostications

Another Swapr Prelude!

SWPR liquidity incentives are live on Arbitrum One! Swapr has already amassed $33m in TVL. There are nine pairs with farming rewardsTry out the one second block times and the (relatively) cheap fees of Arbitrum One by swapping and farming on Swapr!

Tweet of the Week: Arbitrum’s ‘downtime’

Daniel Goldman, a software engineer at Offchain Labs, which built and launched Arbitrum One, provides additional context on why it was inaccessible on Tuesday. The 45 minute downtime on Arbitrum One just happened to coincide with a larger and more problematic network outage on Solana, which was experiencing “resource exhaustion” from an overflow of transactions for an IDO. The network needed to restart completely after validators upgraded to a new version of Solana. Here’s a nice thread from the perspective of a Solana validator.

The hiccups are expected for new networks, and while I think Solana (and Arbitrum) will be fine, it’s situations like these that help educate people on how consensus actually works on these networks, and more specifically, helps explain the difference between Ethereum Layer 2’s and other chains. Daniel’s thread explains how even when the sequencers that process transactions on Arbitrum One are down, users could still submit a transaction on Ethereum mainnet that is “force-included on L2”. He admits this is a bit ‘hand wavey’ and not a realistic option for anyone at this time, but these ‘emergency fall-back options’ show how Layer 2’s inherit the security properties of Ethereum, which only becomes useful - but incredibly so - in a network outage.

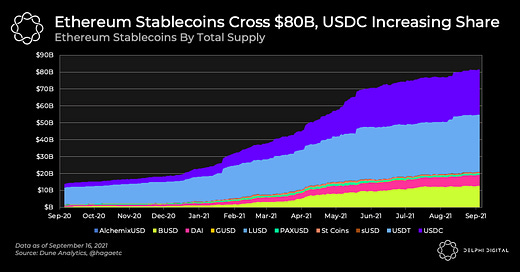

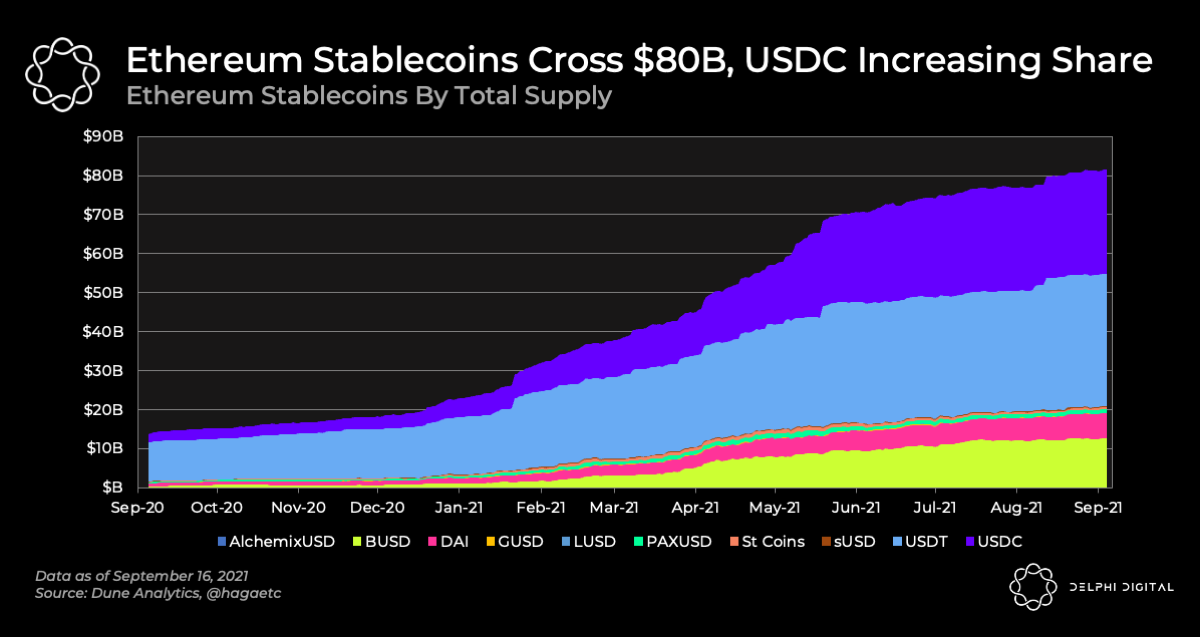

Chart of the Week: Stablecoin flavors

A colorful chart from Delphi Digital on that persistent growth over the last year of stablecoins on Ethereum, which have grow more than 700%. Not included in this chart are undercollateralized algorithmic stablecoins like Fei ($430m) and Frax ($330m) or non-Ethereum stablecoins like UST ($2.5bn in circulating supply), although USDC and USDT are growing outside Ethereum too.

Stablecoin growth has slowed considerably since June, and while Tether is still the largest, USDC has spent the last year making significant inroads into its lead. BUSD and PAXUSD have also had a quietly good year. Both are built by Paxos; BUSD may be the only bright spot for Binance over the last few months. The other stablecoin to note is Dai, just because it’s the fourth largest ERC20 stablecoin ($6.5bn) despite having all of the funds backing it up stored on Ethereum. It may have lost some of its decentralization luster, but it’s playing in the deep end.

Odds and Ends:

Yearn Finance Q2 report Link

Apple blocks Gnosis Safe update, cites App Store policies against NFT’s Link

Gnosis announces Zodiac, a DAO framework built on Gnosis Safe Link

Polychain and Three Arrows lead $230m investment in Avalanche Link

List of NFT marketplaces Link

Thoughts and Prognostications:

Blockchain Bridges: Building Networks of Cryptonetworks [Dmitriy Berenzon/1kx]

Why Gensler calls them “stable value coins” [Adam Cochran/Cinneamhaim]

Token Generation Events Using DeFi [Jason Choi/Spartan Group]

The Future of Venture Capital will be decentralised [Joel John/Decentralised.co]

Protocols don’t capture value; DAOs manage risk [Spencer Applebaum/Multicoin]

Clockwork Finance: Automated Analysis of Economic Security in Smart Contracts [Kushal Babel & Philip Daian & Mahimna Kelkar & Ari Juels]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. Not an ETH maxi :-x …. but biased towards Arbitrum because of Swapr and the DXdao base there. Musings on a multi-chain future coming in two weeks.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to DXdao* and benefit financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.