How the Dai Savings Rate will affect DeFi Lending

Utilizing idle capital

The Dai Savings Rate (DSR), implemented last month, is not the first place Dai holders could earn a return by locking up their Dai in a smart contract, but it is, what one might consider, the first risk-free rate in DeFi.

The DSR, which is currently set at 4%, is funded by, but not dependent on, stability fee payments. In the words of Maker’s Head of Risk Cyrus Younessi, “The DSR has the same risk profile as holding regular Dai.”

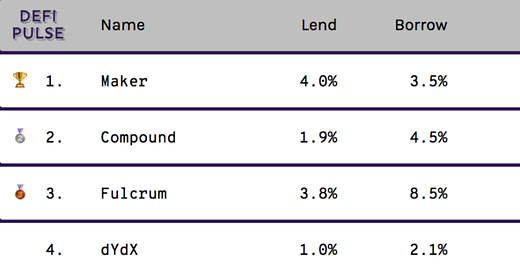

While Maker ended the year with Multi-Collateral Dai and the DSR, much of Dai’s success this year was from secondary lending platforms, which created a vibrant lending market for Dai. Below are the largest open lending protocols, according to DeFi Pulse.

Whereas MKR holders vote to set the DSR and the stability fee, in DeFi lending pools, interest rates are set by market forces, to an extent.

Like any bank, the returns from Dai borrowing rates determine the interest rate paid to Dai lenders. High deposit rates incentivize more flows into the liquidity pool, which decreases the cost of borrowing. Alternatively, low deposit rates may lead to outflows from the liquidity pool, driving up borrowing rates.

In practice, the most important component for lending protocols is the utilization rate, or how much of the liquidity pool is being lent out or put to work, or assets borrowed divided by assets deposited.

If users lock $10m of Dai in Compound’s smart contract, some of that $10m needs to be lent out in order to earn a return, and since users can redeem their Dai continuously, some of that $10m needs to remain in the smart contract. The more that is lent out, the higher the return for the overall pool, but the higher the risk of a bank run.

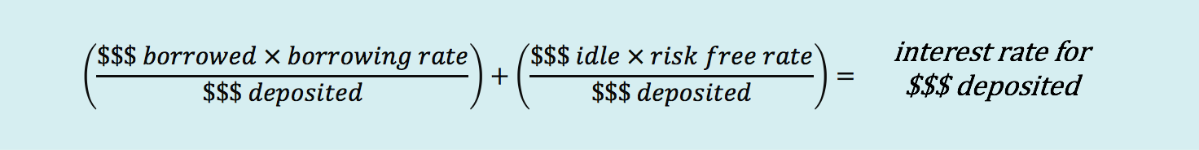

For lenders, a simple way to think of the interest rate earned on deposited assets is:

Each lending protocol has a different algorithm that determines borrowing rates based on the current utilization rate of the pool. To protect against a bank run, deposit rates need to quickly adjust to incentivize additional flows, so the algorithm needs to determine the optimal interest rates for any level of utilization.

In the equation above, to determine the interest rates for $$$ deposited, one only needs the borrowing rate and the utilization rate, which can be calculated with just the current balance of $$$ borrowed and $$$ deposited.

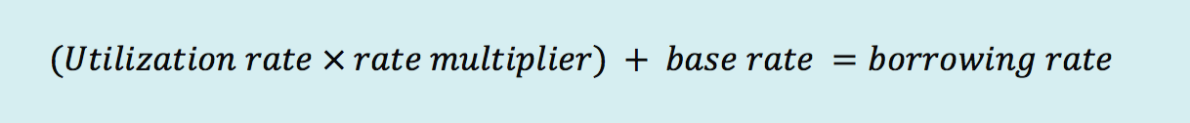

The borrowing rate, however, is much trickier and the algorithms differ greatly amongst lending protocols. Their goal is the same: adjust rates to incentivize demand. Modeling how investors respond to rate changes is tricky, and most of the design follows some version of the following model:

As mentioned, the utilization rate is easily calculated on chain, but where the heck do the rate multiplier coefficient and base rate come from?

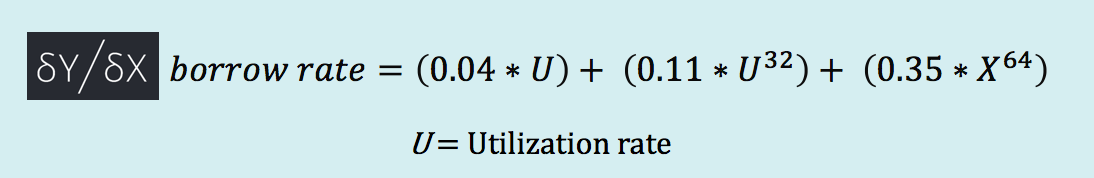

Compound, dYdX and bZx are all self-sustaining money markets who’s interest rates are determined from current supply/demand AND two numbers plucked out of the air that are supposed to model market behavior. Here is dYdX’s scary-looking algo:

The team has adjusted its interest rate model several time because, as Co-Founder Antonio Juliano said in their Telegram:

Essentially, dYdX is backing into its interest rate model by figuring out how to lend out as much of its pool as it can. This appears to have worked: dYdX borrowing rates have been lower than Compound’s over the last 3 months.

Over that same time period, investors have taken out $152m in loans on dYdX, while Compound saw just $42m loan origination, according to Loanscan.

While they appear to be competing head to head, dYdX is trying to be a margin-trading platform and Compound hopes to be a money market, so it makes sense that dYdX’s wants to maximize trading activity on its platform by offering the lowest lending rates.

Still, capital will flow to the most liquid and efficient markets, so how does Compound plan to respond to dYdX’s competitive rates? The Dai Savings Rate.

With the upgrade to Multi-Collateral Dai, Compound is implementing two new key features to its interest rate calculation:

The Dai Savings rate will serve as the base rate for the interest rate model, meaning that MKR holders essentially set the Compound borrowing rate.

Dai that is not lent out will be locked in the Dai Savings Rate smart contract, passively earning interest

The first change will keep lending rates lower and help answer questions about the governance for cDAI, but the second one will have a much larger effect on how liquidity pools are designed going forward.

dYdX attracted assets it allowed for a higher percentage of Dai in its pool to be borrowed; the high utilization rate meant more loans and more fees paid to depositors.

Compound is trying to attack it from the other side. Rather than changing its interest rate calculation to allow for more assets to be lent out, Compound intends to extract additional yield from the assets that are not being lent out by locking them in the Dai Savings Rate.

The previous equation could also be represented like this:

But of course, idle Dai in liquidity pools is not earning any rate of return right now, so that’s always been 0. The DSR, however, builds interest directly into Dai, allowing all Dai deposited in Compound to earn a yield even if it’s not being lent out.

As an example, consider a $10m Dai pool with a 50% utilization rate and an 8% borrowing rate, and a 4% DSR (or risk free rate).

That is a big difference for depositors and ensures that Compound’s rates can remain competitive attractive regardless of whether it increases its utilization rates. In this vein, lending protocols are acting like regular banks who make loans to individuals but also invest idle cash into T-bills to generate a higher yield for depositors.

The current low rate environment obfuscates some of the opportunity (remember double digit deposit rates over the summer?), but the model forming shows how the Dai Savings Rate could enable better borrowing and lending rates than fiat-backed stablecoins.

Addendeum: bZx appears to have just integrated with the DSR by using Chai as its idle asset. Compound does not use Chai but integrates directly into the DSR. It also announced plans to add cDAI as a collateral option.

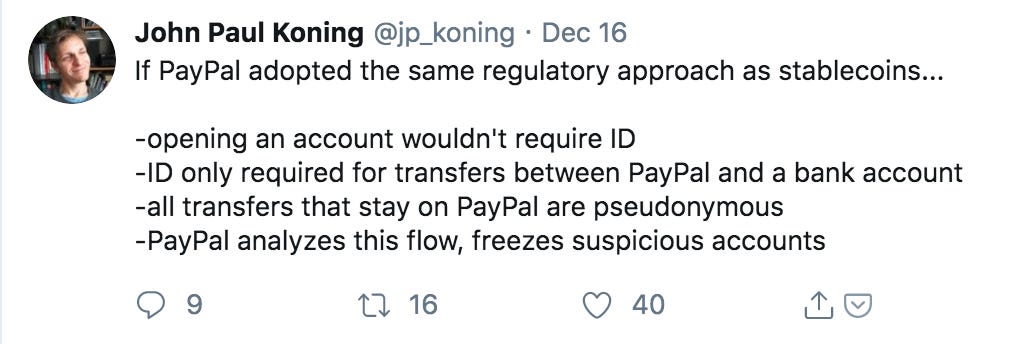

Tweet of the Week: Stablecoins and PayPal

John Paul Koning contemplates the regulatory differences between PayPal and stablecoins. With JPM Coin, Libra and the litany of fiat or algorithmic stablecoins, the regulatory environment should be an interesting one to watch. Koning also had a nice write up on free speech and payments.

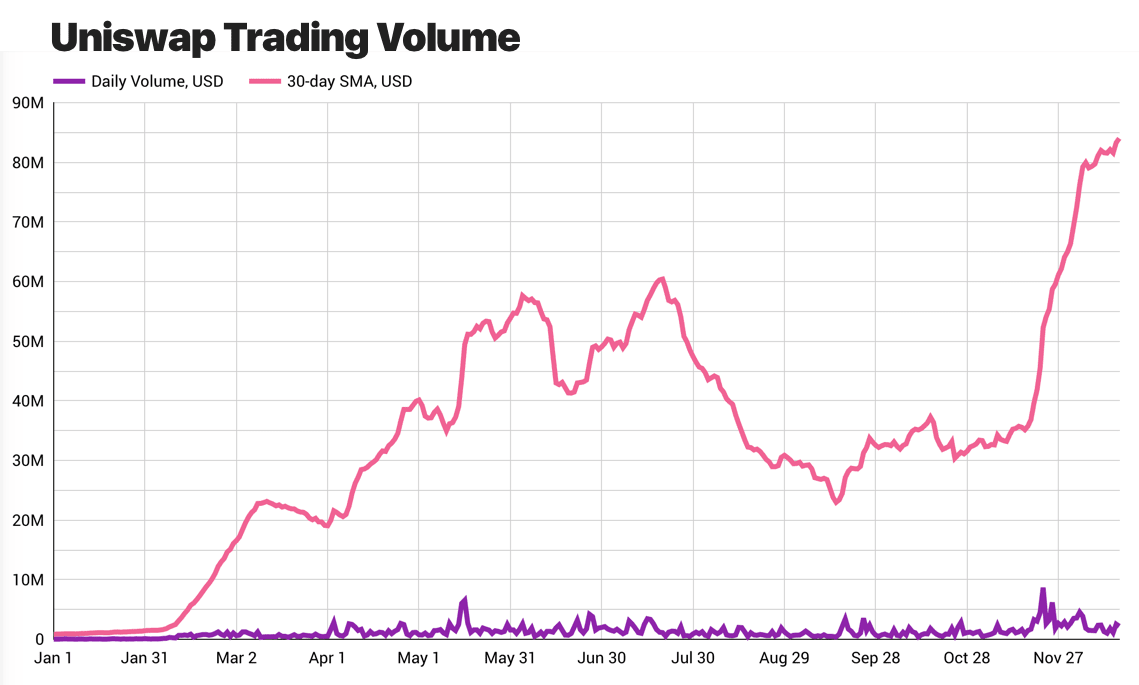

Chart of the Week: Uniswap and Our Network

Uniswap Trading Volume has grown sharply since the beginning of November. Blocklytic's Caleb Sheridan writes in the first edition of Spencer Noon's Our Network, "a weekly newsletter where top blockchain projects and their communities share data-driven insights about their networks." First edition also features a nice dive into Compound.

Listen of the Week: Product gaps facing DeFi

"The problem with all of the [decentralized liquidity solutions] like 0x, Kyber, Uniswap or Bancor, is that they only work for ERC20 tokens. Bitcoin, Litcoin, Monero, ZCash, there are a lot of assets that by definition don’t work there. That alone is a major hindrance.

Eventually we will get to the point where we have cross exchange, atomic swap DEXs that work magically, but I don’t think we’re close to that in reality."

Multicoin's Kyle Samani sits down on the Chorus One Podcast and discuss where value will accrue in DeFi and crypto more broadly. Kyle is bearish on consumer-facing DeFi apps like Nuo and InstaDApp and thinks that exchanges like Binance may move quickly to grab market share.

Odds and Ends

Dragonfly and Paradigm purchase $27.5m of MKR from Maker Foundation Link

Kyber announces protocol upgrade and changes to token model Link

Sablier, protocol for streaming payments and continuous salary, launches Link

MetaCartel releases whitepaper for Venture DAO Link

Vitalik tries out Chai Link

Ramp and Nuo team up to make DeFi fiat on-ramps easier Link

OKEx becomes the first major exchange to integrate Dai Savings Rate Link

Is this the first scam listed on Uniswap? Link

2020 Predictions and 2019 in Crypto

What DeFi needs next year: three priorities [Hasseb Qureshi]

The Web3 Stack, 2019 edition [Kyle Samani]

Four DeFi trends to watch out for in 2020 [DeFi Pulse]

Crypto Theses for 2020 [Ryan Selkis/Messari]

This was a year of steady infrastructure progress [Jake Brukhman]

As we hunger for viability, let's stay true to our values [Taylor Monahan/MyCrypto]

Thoughts and Prognostications

The DeFi Deja Vu [Placeholder]

Are PlusToken scammers driving down the price of crypto? [Chainanalysis]

The smart contract risk in DeFi [Nervos]

Kyber ecosystem report #9 [Kyber]

Beginner's guide to decentralized finance [Binance]

Long Read of the Week: 18th Century Dai

Re-sharing one of my favorite long reads from this year. Hunter Gebron tells the story of a MakerDAO-like system that helped soft-money proliferate in the American colonies. At the time, gold was in short supply on the continent but land and other valuables that could be used as collateral were abundant. The system features 18th century versions of oracles, debt-ceiling and maintaining parity with a pegged asset.