Institutional DeFi and UMA's Initial Uniswap Listing

Plus automated market makers and DeFi revenue

Click here to subscribe to GovernThis, a newsletter exploring governance in DeFi, DAOs and blockchains.

Are all DeFi investors the same?

Institutional and retail are categories many financial analysts use to identify customer segments. They use different financial tools and have different investment preferences, but the biggest difference is size.

Institutions operate on another scale to even the largest retail operations, because user and asset acquisition cost do not scale with growth. It’s cheaper to raise $1 billion dollars from 100, $10m investors than to raise $1 billion from 10m, $100 investors. Crypto obfuscates the retail/institutional split with “whales” having a foot in each camp.

DeFi is mostly a “retail” game, which is less a comment about the investor size, but more about the investor sophistication. Yes, DeFi users are sophisticated but they are individuals and not professional crypto funds. There are some exceptions to this – Framework and 1kx come to mind, but DeFi products and services revolve around the retail user.

This is in large part because DeFi serves ETH-heads, from developers to Ethereum ICO participants, who have the assets and the technical know-how to form a sustainable market for ETH liquidations.

If DeFi hopes to expand to other assets, it needs liquidity in those assets on-chain (most notably Bitcoin) and that will likely come through institutional (or professional) investors.

In this context, two big pieces of news on the DeFi institutional front:

Coinbase launches on-chain price oracle:

Starting today, anyone can use the Coinbase Oracle API to get signed price data for BTC-USD and ETH-USD markets. The price feed is sourced from Coinbase Pro — one of the most liquid crypto exchanges in the world — and updates each minute. Anyone can publish the prices on-chain and since the data is already signed by Coinbase’s private key, there is no need to trust the publisher. Using the Coinbase Price Oracle public key, anybody can verify the authenticity of the data.

And CoinList launches a WBTC off- and on-ramp:

At CoinList, we solved this problem by allowing our users to instantly convert BTC for wBTC, and vise versa, directly via your wallet. Since launching the wBTC/BTC service for institutions in February, CoinList has minted 25% of the total wBTC supply ever in existence and traded 20% of the ADV (average daily volume). Now, we are opening this to all our users.

CoinList is a new entrant to the DeFi space. It primarily serves “professional investors” if not institutions and specializes in compliant token sales.

The WBTC announcement, which Coinlist titled “Building DeFi’s bridge to Bitcoin”, comes at the same time that WBTC is hoping to be added as acceptable collateral in MakerDAO. Representatives from Coinlist, WBTC and WBTC’s custodian Bitgo were all on Maker’s Risk and Governance Meeting on Thursday.

If all goes as planned, WBTC’s inclusion as collateral in Maker will solidify it as “DeFi Bitcoin”, although that is an increasingly competitive market. Keep Network announced this week plans for the launch of tBTC:

This Friday, the 24th, the MakerDAO community will vote to finalize their first ETHBTC feed, deployed specifically for tBTC, and agree to whitelist the future tBTC contract. This is a huge step toward bringing the super-collateral of Bitcoin to MakerDAO’s multi-collateral DAI.

The executive passed and tBTC is set to launch on mainnet on May 11th. Even if it (or RenBTC) are superior technologically, WBTC’s market liquidity gives it a leg up, given the importance of collateral liquidation to the use of Bitcoin on Ethereum. WBTC has had more than a year head start and the CoinList integration may boost that further. Tech is cool, but liquidity is king.

Coinbase: DeFi’s silent booster

With its new on-chain oracle, Coinbase provides another foundational infrastructure element for DeFi. Dai has long been the darling of DeFi, but USDC is a staple of almost every DeFi platform and provides a critical fiat on ramp to many DeFi products. It also contributes directly to DeFi liquidity through its USDC Bootstrap Fund.

The on-chain price oracle will likely fit in the DeFi ecosystem in the same way as USDC: a reliable, if centralized option that exists alongside decentralized upstarts with more interesting functionality.

It’s hard to say whether this is better than Chainlink or Maker’s oracle system and tougher to define what “better” is. Reliable? Decentralized? The oracle problem is tough because it’s almost impossible to study in the wild. The only data point is Black (Swan) Thursday.

To today’s DeFi protocols, “solving” the oracle problem likely means inspiring investor confidence in them, particularly large professional investors, and a Coinbase-branded oracle will surely go a long way in building confidence in the ecosystem.

Related: Futureswap, a decentralized futures market with 20x leverage, announced they had achieved $1.3m TVL and $17m in trade volume over their 3 day alpha. With anonymous founders, Futureswap is definitely not targeting the institutional space and shows the market can support both.

UMA announces Initial Uniswap Listing

Token distribution remains an intractable problem for any project. When there are channels for widespread distribution, they are run by gatekeepers who may charge a fee (centralized exchanges) or make the compliance process to expensive and cumbersome for small projects.

Decentralized derivative contract platform, UMA, hopes to avoid these issues with their Initial Uniswap Listing on Wednesday, April 29 at 15:00 UTC time, when it will deposit 2% of its new token along with $535k of ETH into a Uniswap pool, which gives it $26m market cap (and the same valuation of seed investors).

This is, of course, in contrast to the high-flying days of ICOs and Binance listings and demonstrates how far the market has swung in the other direction. In 2017/18, every token project believed that more liquidity and more token holders were crucial to a token’s values. Of course, many soon realized that token listings are only a sugar high, and liquidity can feel as bad on the way down as it felt good during the Bull run.

Liquidity is necessary, but not sufficient. That’s where Uniswap comes in, because it drastically lowers the threshold for creating liquid markets. Tokens on orderbook exchanges need to rely on professional market makers to kickstart a liquid market, but a Uniswap listing seeded with some ETH (or Dai/USDC in Uniswap v2) can bootstrap liquidity much more cheaply.

UMA’s approach is closer to DeFi darlings MKR and SNX, which have benefited from low liquidity on centralized exchanges. The downside is that it’s very hard to do large trades, but for a project that’s trying to distribute tokens and provide some liquidity it’s a promising strategy.

Synthetix and Maker give retail investors most of the liquidity they need whenever they want (say under $5k) and then the projects themselves negotiate large token trades with strategic investors, as Maker did with Paradigm/Dragonfly and Synthetix with Framework, which gives them much more control over their cap/token table.

There may be additional initiatives to attract liquidity to the Uniswap pool as Synthetix did, but regardless, UMA’s initial token listing should be an interesting case study for anyone interested in token distribution.

Tweet of the Week: AMMs a step forward or backwards?

SNX Spartan Overlord Degen Spartan responds to Multicoin’s Kyle Samani who said “AMMs are by definition a losers product” The Twitter discussion on Automated Market Makers (Uniswap, Balancer, etc) was prompted by a piece from Dmitriy Berenzon entitled Constant Function Market Makers: DeFi’s “Zero to One” Innovation, which provides a definitional and structural framework for the growing sector, although I think “AMM” might stick. Or something with “liquidity pool” in it.

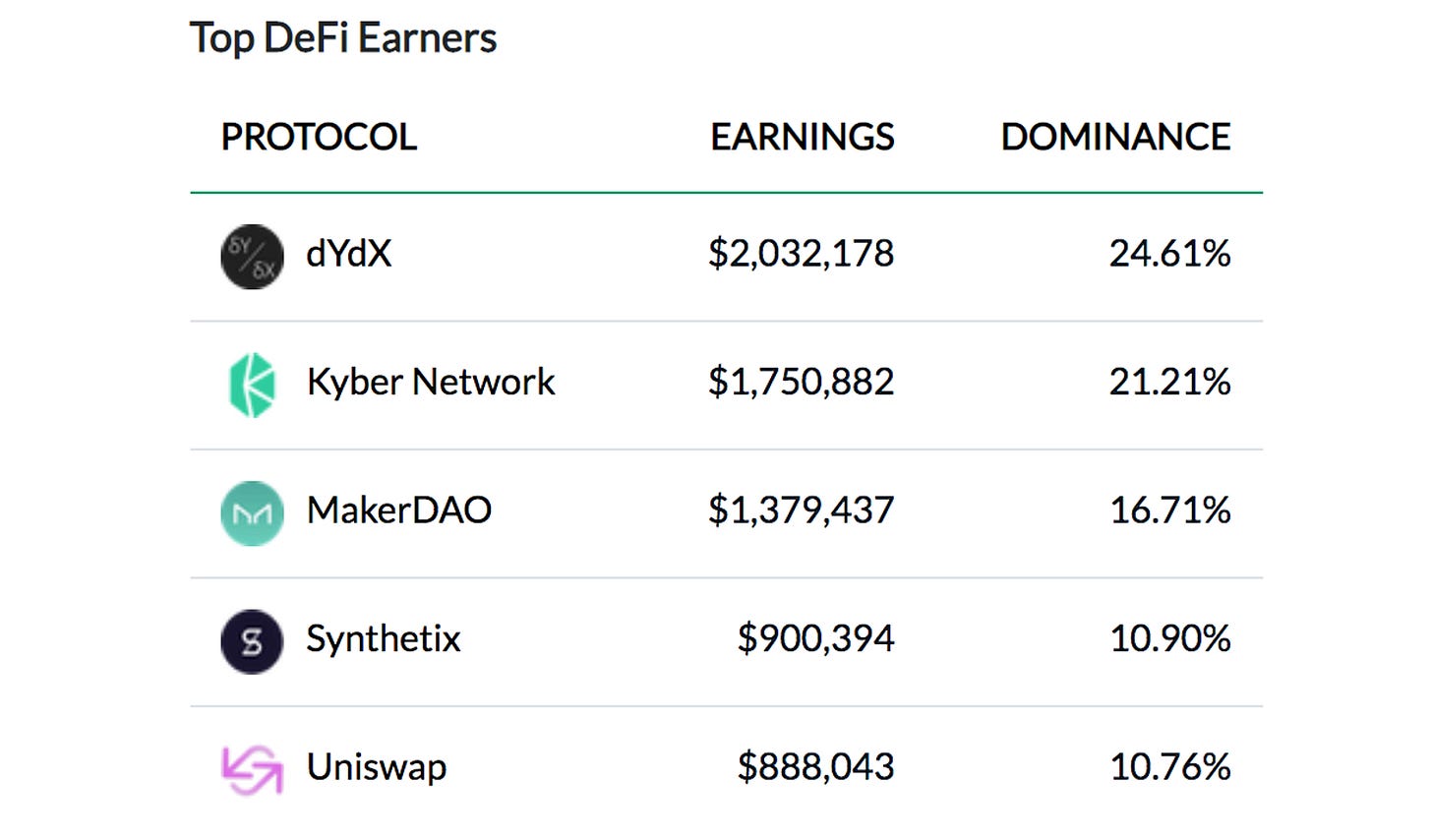

Chart of the Week: DeFi Revenue

H/T Spencer Noon, Token Terminal tracks the on-chain fees by DeFi protocols (stability fee payments for Maker, Uniswap LP rewards or the new trading fees for dYdX). The list is another metric to compare across DeFi protocols and will be interesting to watch as more and more protocols look to implement some type of on-chain revenue solution.

Odds and Ends

PoolTogether launches Pods to allow users to gift tickets Link

Zerion launches DeFi SDK for one-stop integration in DeFi protocols Link

The .DeFi TLD sells for $9k on Handshake Link

Aave Introduces Risk Framework for Asset Selection Link

Lendf.Me Hack Resolution Part I: Asset Redistribution Plan Link

Intro primer on stablecoin AAM, Curve finance Link

Metamask opens applications for dApp browser listing Link

SNX debt pool is persistently short ETH Link

Thoughts and Prognostications

The State of L2 Investments [Mohamed Fouda/Token Daily]

Towards machines as first class citizens in the world of money [Ben Chan/My Two Gwei]

Is Argentina The Next Venezuela? [Matt Ahlborg/dlab.vc]

The Democratization of Value [Jacob Horne/Bankless]

The price of gas on Ethereum during Black Thursday [Will Price/Flipside]

THORChain’s comments on Uniswap v2 design [ThorChain]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn (again). Don’t forget to subscribe to Govern This.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.