L2's guzzle gas & how the market crash reveals DeFi's strengths

Plus Odds & Ends and Thoughts & Prognostications

Hope everyone is staying safe and getting some fresh air. We are one week away from Dose of DeFi: Brooklyn. Enjoy a more civilized conversation on this side of the East River. The last batch of general admission tickets are released tomorrow. Thanks to Hudson River Trading and Caney Fork for sponsoring.

Tweet of the week: DeFi’s hidden strength

It’s hard to peel away from the meltdown playing out on Twitter with Celsius and 3AC. It’s very entertaining to chase the gossip crumbs on who’s exposed to who, but the uncertainty paralyzes the entire space. Throughout the last week as prices tumbled and heads turned, the most reliable place to get signal of what was going on was on-chain activity. Celsius and 3AC have loan books with everyone, but only their Maker/Aave/Compound positions are available for all to see. This information was the guiding light as everyone scrambled.

The DeFi world also does not give special treatment. While CeFi tries to @ Su Zhu on Twitter before liquidating his margin loan, liquidation prices are the same for all DeFi lenders and no one has inside information on liquidations still to come.

There aren’t many positive things to say about the last week, but DeFi stood out as a model for a more transparent, global and digitally native financial system.

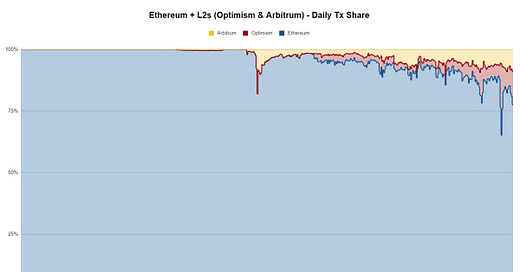

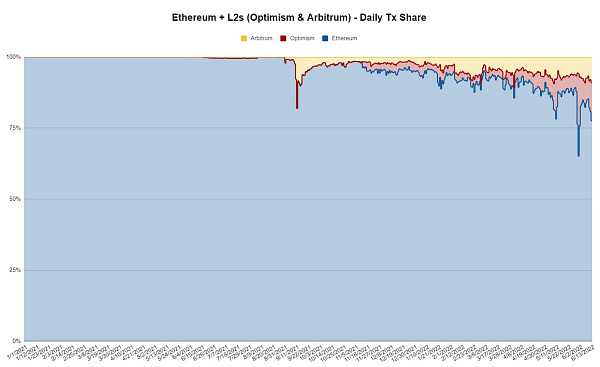

Chart of the week: L2 tx count rise

Chart from on-chain sleuth @mhonkasalo highlighting the growth of Optimism and Arbitrum as a share of overall transactions on Ethereum. L2’s were so hotly anticipated that it felt like a disappointment when usage didn’t take off at launch. This underestimated the amount of infrastructure needed to get core DeFi apps on L2’s and then how to get liquidity on there. All of this is slowly coming together for Optimism and Arbitrum, which now have organic communities and a token (Arb?) and with zksync/Starkware to follow, we are still in the early stages of the L2 race.

Odds and Ends

Circle launches Euro Coin Link

Interest Protocol, a new base layer lending protocol, launches Link

MakerDAO votes to freeze Aave’s DAI Direct Deposit Module (D3M) Link

Coindesk: Texas, other states investigate Celsius after account freeze Link

Thoughts and Prognostications

MEV beyond crypto: value extraction is everywhere [Victor Sint Nicolaas]

Slippage during the UST depeg [0xWailord/Integral]

Connext - speeding up secure bridges between chains [Arjun Bhuptani/Epicenter]

Interest Protocol can challenge Maker [Makerman/Maker Forums]

22,000 ETH embezzled over and over ten projects failed: The story of Machi Big Brother (Jeff Huang) [Investigations by ZachXBT]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where it’s grade-A summer.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao* and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.