Swapr Prelude!

DXdao* launched the SWPR token this week, conducting the first airdrop on Arbitrum One. The airdrop targets members from many different DeFi communities, including 1inch governance voters, BanklessDAO, StakeDAO and others. Check out the full announcement for more details.

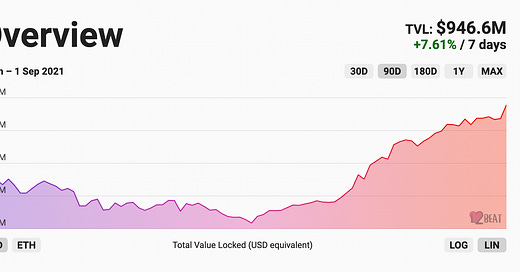

Chart of the Week: Layer 2 emerges

The primary chart at the banger site L2BEAT.com that tracks the total value locked across various Ethereum Layer 2 solutions, which is approaching $1bn, with a huge pickup in growth starting 6 weeks ago. The growth is being led by DeFi stalwart dYdX, whose TVL and volume for its perp exchange has exploded after the launch of its governance token and retroactive mining rewards. dYdX proves that composability may be overrated, but it’s not the only story in Layer 2 land.

This week, Arbitrum One launched on mainnet as the first open, permissionless EVM-compatible Layer 2. Arbitrum One only has $21m of assets two days after launch, which puts it in 7th place according to L2BEAT. Its primary competitor, Optimism, has been live on mainnet with restricted addresses for several months and already boasts $153m in TVL, primarily from Synthetix and Uniswap, which puts it in second place. There’s also Loopring, DeversiFi, ZKsync, the recently acquired Hermez network and others on the way. It may have come later than many expected, but Ethereum Layer 2’s are here.

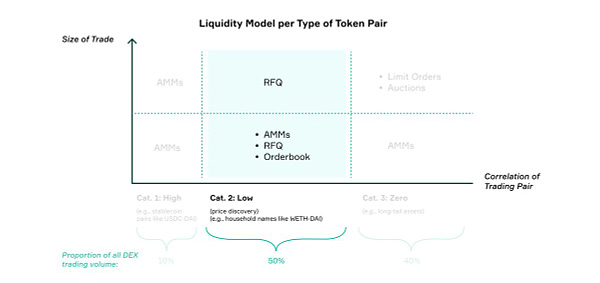

Tweet of the Week: Mature market makers

A snippet in a longer thread from Danial at 0x looking into the actions of DeFi market makers. While AMMs remain the largest trading venue on-chain, with more an more pools of capital on-chain and MEV opportunities rising, larger traders are opting for more sophisticated strategies, where 0x’s RFQ system is helpful. Not all trade pairs are created equal, and - as Danial points out - the distribution is massively skewed towards the larger pairs. This makes it appealing to professional market makers, but it also underscores that AMMs are most attractive for the long-tail of assets.

Odds and Ends

ChainLink node operators may be able to extract MEV Link

Cream exploited for $25m in flash loan attack Link

1inch looking is looking to raise at $2.25bn valuation Link

Polkadot-based Parallel Finance raises $22m led by Polychain Link

Loot explained Link

Thoughts and Prognostications

Building a parallel execution engine for the EVM [Brock Elmore/Nascent]

DeFi Uncovered: Hints of a multi-chain future [Luke Posey/Glassnode]

Solving the stablecoin trilemma [Tushair Jain/Multicoin]

Decentralized derivatives’ rise is inevitable [Fiona He/AT&T Capital]

DAOs need to start blitzscaling [Jack Purdy/Messari]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn with grandparents in the background.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to DXdao* and benefit financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.

Always enjoy the content and keep it up!

Do wanna point out that "1inch looking is looking to raise $2.25bn in series B" is not correct. The valuation will be 2.25b. Not the raise.