Lido's monopoly on ETH staking and how LUNA becomes BTC

Plus Odds & Ends and Thoughts & Prognostications

Prelude: DXdao* is looking for a DAO Counsel, which will provide legal and regulatory guidance to DXdao stakeholders and contributors as well as insight into best on-chain governance practices for DXdao.

DXdao is approaching its 3 year anniversary and is at the bleeding edge of the DAO space. This is a great opportunity for any lawyer who is obsessed with DeFi and DAOs. Check out the full job description for more and reach out if you’re interested.

Chart(s) of the Week: Lido dominance grows

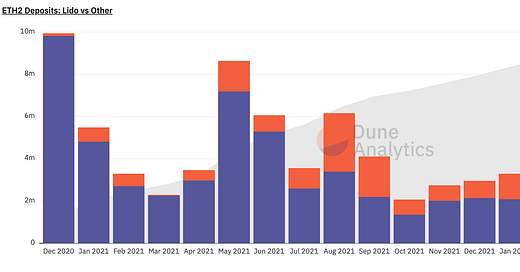

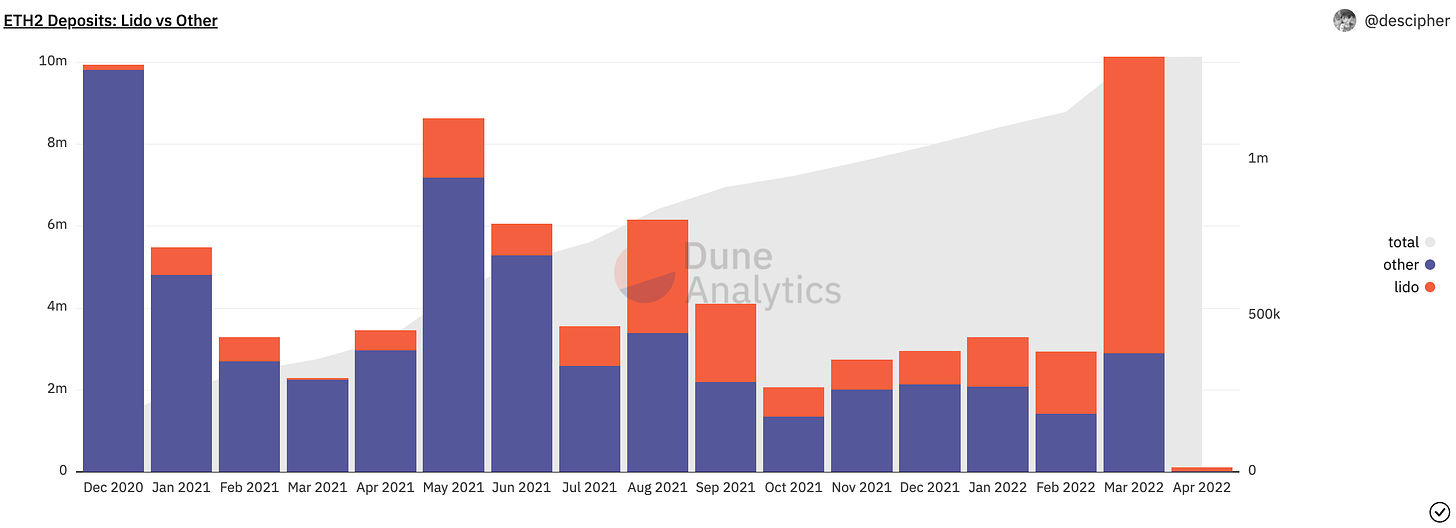

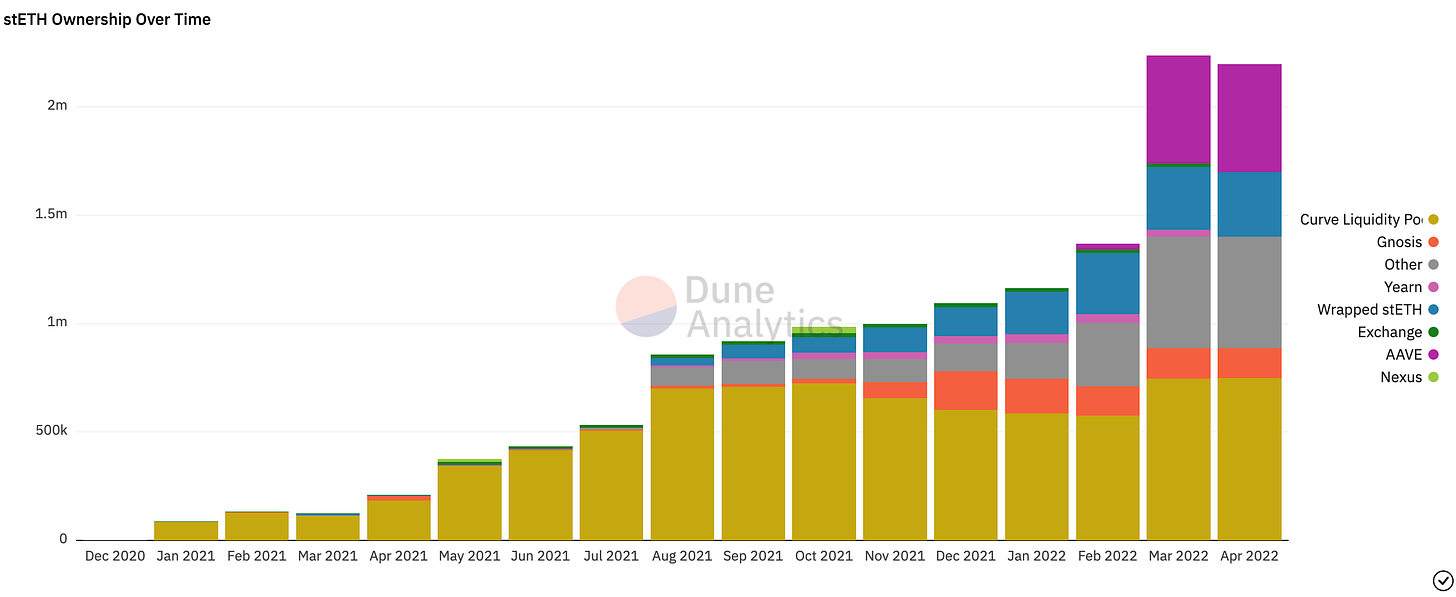

A couple charts from DeFi data OG @Vishesh on the still great Our Network newsletter on the growth (or dominance) of Lido in the ETH2 tokenized staking race. As the first chart shows, Lido accounted for over 70% of new ETH2 deposits in March. Overall, Lido has 27.3% of all staked ETH, but close to a 90% market share in the tokenized staked ETH market (Rocketpool is second with less than 5%). Lido CTO Vasiliy Shapovalov does not think “balanced diversity of liquid staking protocol is a worthy goal to pursue” but it does not seem like Lido has the decentralization to ward off the risks from such a large monopoly on Ethereum. Ryan Berkmans had a good thread on this a couple weeks back.

The massive growth in Lido ETH2 deposits in March may be to increased interest in the merge, but the more likely catalyst is the addition at the end of February of stETH as collateral on Aave, which now has almost $2bn in stETH deposits. Leveraged ETH staking is a hell of a drug, and regardless of the dominance of Lido, DeFi will soon be awash in a wide variety of ETH staking products. Nate Parton (@monetsupply) examined the governance implications of stETH in the always great Tally newsletter.

Tweet of the week: Do’s grand vision

We’ve steered clear of the constant chatter around LUNA, UST and Do Kwon, the pugnacious co-founder of Terra Labs, primarily because we lack perspective to add to the discussion, but boy is it fun to watch? Do is a showman who’s antics remind us of another eccentric CEO who just acquired 9.2% of Twitter. A Twitter-proficient CEO is a must in the meme-driven crypto world.

Anyway, the above tweet is a one in a longer thread about how Do and LFG may go about acquiring the BTC. In short, you want to burn Luna (to mint UST) instead of selling Luna, which would create sell pressure, and to do that, they need a deep liquid Curve pool so it can trade into other stablecoins on Ethereum and acquire the BTC. This is likely the motivation behind Curve’s new 4pool, which includes USDC, USDT, UST and FRAX. It’s a big step up for Frax but is 4pool enough liquidity to buy all that BTC? Well, make sure and say The Luna’s Prayer. Kerman Kohli also had a nice post that covered FRAX/UST.

Odds and Ends

The Curve wars go hot Link

Arbitrum releases Nitro upgrade on Goerli with reduced tx cost Link

OpenZeppelin: $15b rugpull in Convex uncovered and resolved Link

Boba investors down nearly 45% since most recent round Link

Sophisticated MEV attack using own capital over several blocks Link

Thoughts and Prognostications

In defense of Bitcoin Maximalism [Vitalik]

How to set an MEV trap [Pmcgoohan]

Terra vs. Maker: War of the worlds [Luca Prosperi/Dirt Roads]

Optimistic bridges: A new paradigm for cross-chain communication [Arjun Bhuptani/Connext]

Decentralization for Web3 builders: Principles, models, how [Miles Jennings/a16z]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where I’m pretty grumpy because it is cold and rainy.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao* and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.