Maker Crashes, Dai Liquidity Crunch, USDC to the rescue?

Black Thursday fallout and Maker's rush to fix it

When it rains it pours. As the world struggles to contain the COVID-19 pandemic, markets everywhere are crashing on expectations of a quarantined world. No asset class has been safe. Stocks, Oil, Gold, Bitcoin, and of course, ETH.

Early Thursday morning, the price of Ethereum plummeted 40% in a matter of minutes, which strained the Maker system and ultimately left it $5.4m undercollateralized after its collateral auctions malfunctioned.

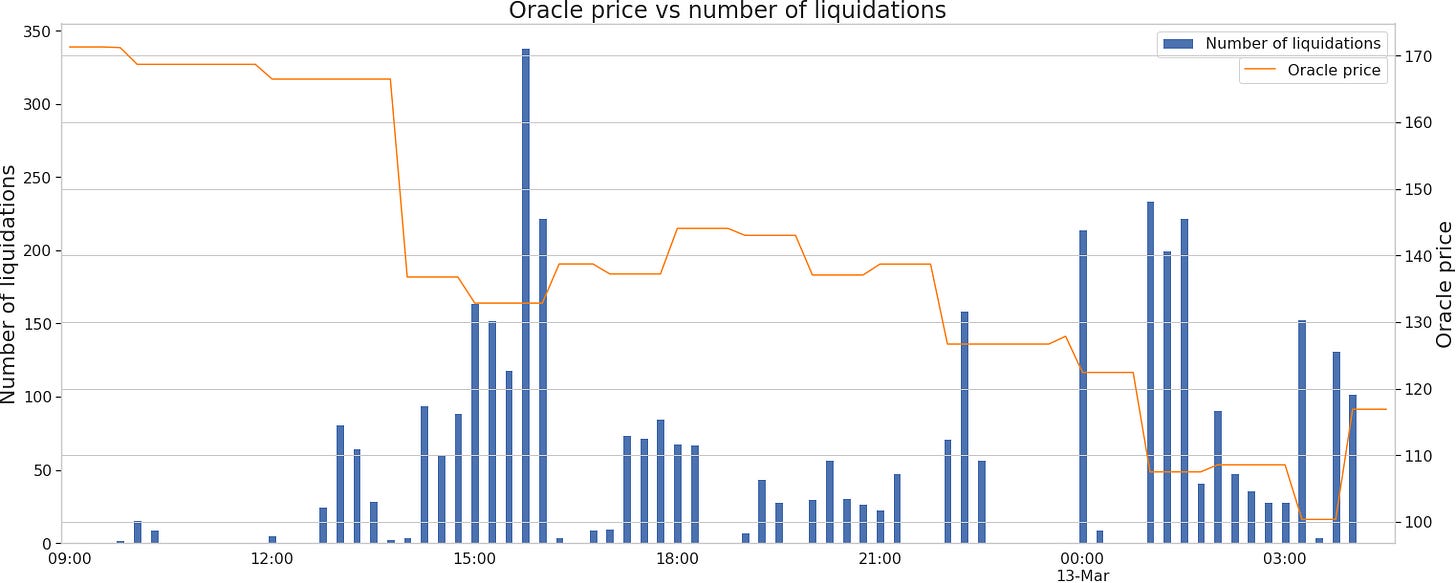

Here is a chart from whiterabbit with the declining price of ETH and liquidations:

The dust hasn’t settled yet but so far we know oracle pricing was delayed and the Keeper auction, which liquidates collateral, failed.

Why did the auction fail? Atomica co-founder Renat Khasanshyn on Reddit:

Root cause #1: Catastrophic liquidity crunch. Keepers simply ran out of DAI to bid in the collateral auctions due to

I believe some Keepers were unable to continue Keeper operations due to inability to liquidate ETH fast enough for DAI.

Some Keepers shut down due to squeeze (bought ETH for 170 DAI, and hours later can only sell for 130 DAI at a loss - which is way more than 13% liquidation penalty).

Root cause #2: Network congestion. This brought many Keepers to its knees. Even with liquidity, many were unable participating in auctions due to stuck transactions & high gas costs. In addition, issues like longer client sync times + some Ethereum clients (like Parity) sufferring from known problems of keeping transactions stuck in Mempool for a very, very long time, amplified this problem.

Typically, when a Vault’s ETH collateral dips below 150% of its Dai loan, Keepers bid to liquidate the ETH for a 13% fee, but as ETH tanked on Thursday, the market for Keepers evaporated. They didn’t have enough Dai for the auction and their bid transactions were getting stuck because of high gas prices.

As auctions failed to get filled, some Keepers started lowering their bid price and increasing their gas to get their bids in. Eventually, a single Keeper liquidation bot won several auctions with 0 Dai bids.

What now?

There are three issues facing the MakerDAO system

It is undercollateralized by $5.4m

A liquidity crunch has caused Dai to lose its peg on the upside

Several Vault owners got hosed

Usually, Keepers only sell enough collateral to cover the loan, leaving Vault owners with the remaining collateral minus the 13% liquidation penalty. But with 0 Dai bids, several Vault owners were left with nothing. No word on how Maker will deal with lost funds but their stories are already circulating.

The most pressing need is to stabilize the system. In the event of under collateralization, the Maker system is designed to auction MKR for Dai, diluting MKR holders and using the fresh Dai to recapitalize the system.

Unfortunately, problem #2 is preventing problem #1 from being resolved. There’s little Dai liquidity on the market at the moment so a MKR auction for Dai might end poorly or further distort the price of Dai.

Like any liquidity crunch, investors are hoarding cash and a capital injection is needed, but what tools can MakerDAO use to bring more Dai onto the market?

Stable Genius

As phone notifications buzzed with the market crash, investors rushed to buy Dai and pay off their Dai debts before liquidation. This put a squeeze on Dai liquidity across the system, sending Dai to as high as $1.14. While a price increase is good for other assets, not so for a pegged asset, especially since Maker debt is denominated in Dai.

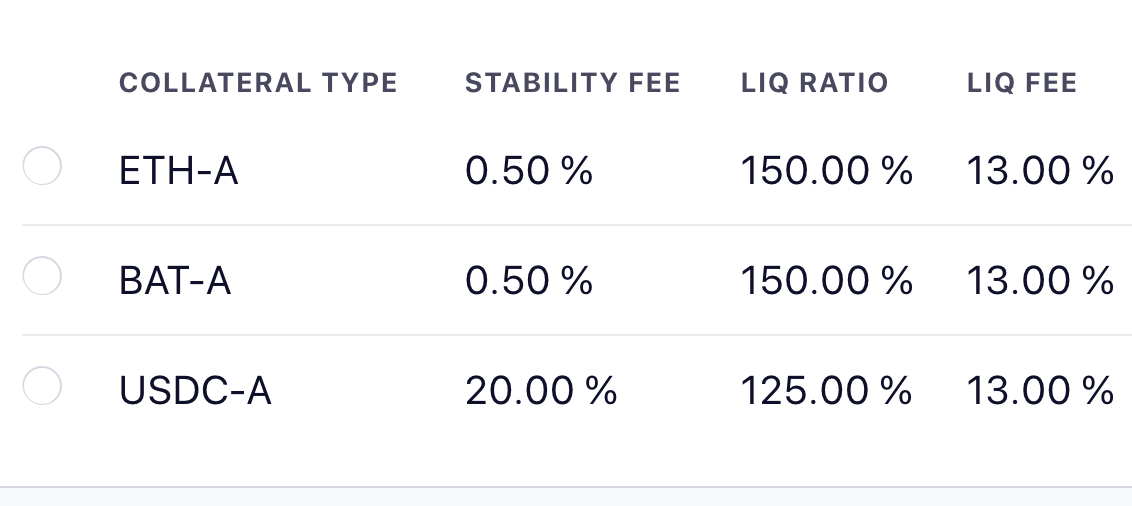

Soon after, Maker moved to use its limited monetary tools to drive down the price of Dai, namely lowering the Dai Stability Fee to 0.5% and slashing the Dai Savings Rate (DSR) to 0%. The stability fee rate cut is intended to incentivize more Dai loans, while moving the DSR to 0 should make holding Dai – in the DSR or in a secondary platform like Compound or dYdX – less appealing.

This has helped but Dai is still trading ~ $1.05 with liquidity tight and big spreads across DEXs and centralized exchanges. Many fear that if ETH continues to fall, there won’t be enough Dai liquidity for Keepers and lead to more 0 Dai collateral auctions.

So how to get new Dai into the system? Centralized fiat stablecoins of course.

USDC to the rescue

On Monday, after another big ETH drop, the Maker Governance and Risk team conducted a call to discuss the possibility off adding USDC as an additional collateral, alongside ETH and BAT.

While some raised concerns about introducing regulated, real-world assets into the decentralized stablecoin system, an Executive Vote to add USDC as collateral passed late Monday night and the Oasis app is now accepting USDC as collateral with a 20% Stability Fee and a 20m debt ceiling.

Why would Maker rush through an upgrade that adds a competitor as collateral?

Because USDC-as-collateral provides the fiat-on ramp that Dai never had.

Maker hopes that market makers, Keepers and Vault owners that are short on Dai can get USDC from Coinbase, lock it up in a Maker Vault to generate Dai and pay down debt or use it in liquidation auctions, and while Dai’s trading above its peg, you could deposit USDC, mint Dai and sell it for a small profit.

This virtuous feedback loop should drive down the price of Dai and provide additional liquidity for the collateral auction and the upcoming MKR auction.

MKR holders are on the hook for the system’s imbalance

Maker is essentially a financial institution with bad debt on its balance sheet. In such an event, MKR holders are responsible for recollateralizing the platform through an auction of MKR for Dai which is set for Thursday.

MKR price has taken a beating since last week, down more than 60% over the last week to $210 at the time of writing. Prices may be attractive but the market is in no mood to absorb an additional token offering, especially given the last week for Maker.

Still, Maker is well known in the Ethereum and broader crypto investor community and should find some appetite. Paradigm, a large holder of MKR, announced that it would be participating in the auction.

Additionally, an organic Dai Backstop Syndicate has emerged to be a “MKR buyer of last resort”. A group of DeFi projects and developers just released a smart contract spec that would allow individuals to deposit Dai and participate in the auction at a set price for the pool (Likely $100/MKR).

DeFi’s Black Thursday

The volatility last week was not unique to DeFi or ETH, Bitcoin also plummeted and several exchanges (Bitmex) had trouble dealing with order flow and liquidation.

Price discovery was moving quicker than the transaction processing.

Three concluding thoughts:

Lending protocols are three-sided markets. Liquidators are just as important as lenders and borrowers. Also, why not use Uniswap?

Maker and other DeFi projects should better highlight downside risks to regular users, particularly when the protocol malfunctions. Vault owners need answers.

The MKR auction on Thursday (and who buys it) will be the first indication of how USDC as collateral will be accepted by the Maker community. An early Maker developer has spoken against it.

Odds and Ends

Synthetix Product Roadmap Link

Balancer, a Uniswap like protocol, open sources its contracts Link

Cool visualizer tool for Maker Vaults Link

Dune Analytics adds dYdX to its DEX volume statistics Link

Thoughts and Prognostications

Mea Culpa [Kyle Kistner/bZx]

Additional risk considerations for USDC in Maker DAO [Allison Lu/UMA]

Dollarization through stablecoins [Jeremy Allaire/Circle/On the Brink]

DeFi Audit #1: Synthetix [DeFi Weekly]

Building the Post Liquidation era [Marc Zeller/Aave]

Ethereum is an emergent structure [David Hoffman/Bankless]

Algorithmic stablecoin Celo cofounder on MakerDAO’s black swan [Twitter]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn where it looks like I’ll be for a long time.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.