MCD: Good for Maker, Good for Dai, Good for DeFi?

A new Dai is upon us

After months (years?) of anticipation, MakerDAO will launch Multi-Collateral Dai (MCD) next Monday, November 18th. The DeFi world is abuzz with anticipation because the upgrade will affect the entire ecosystem as lending protocols, exchanges and other DApps will need to migrate from Single-Collateral Dai (officially now “Sai”) to Multi-collateral Dai (officially “Dai”).

The terminology changes – CDPs are now referred to as ‘Vaults’ too – may seem like just a facelift but the migration is no easy upgrade and the reception from the existing DeFi community has not been especially warm. Here’s dYdX founder Antonio Juliano:

There’s also been pushback on the increased risk from the inclusion of additional assets and Maker CEO Rune Christenson’s strong hints that real-world assets will be accepted as collateral eventually.

Good for Maker, good for DeFi? Maker isn’t just the largest project by total value locked and the largest by its token market cap, it’s the essential building block for all any Ethereum project that involves economic transactions outside of sending Ether.

As Kyle Kistner, Co-Founder of bZx put it, “Single collateral Dai is the most battle-tested smart contract on Ethereum.” A permissionless tool like Sai is essential to enabling an army of independent developers to hack away on new ideas. To many in the community, Sai doesn’t need to do much more than it’s doing now.

Maker, however, has big plans for Dai. It does not see itself as just a decentralized central bank. Instead, it sees Dai as the native currency for the Maker financial ecosystem that includes lending, trading and a new gateway into crypto through the tokenization of real-world assets. So, what’s in store on November 18?

Not much additional collateral There won’t be any real world assets on Day 1, in fact the “multi” in Multi-Collateral Dai may be aspirational. As I wrote three weeks ago, only the native token for the Brave browser, BAT, will be acceptable alongside ETH as collateral.

Given that Ethereum’s market cap is almost 60x that of BATs, the new collateral should not be a growth driver in the short term. BAT is already accepted as collateral on Compound, and Maker is already approaching its self-imposed debt ceiling of $120m despite raising it up from $100m just a week ago.

The killer app of the upgrade is the Dai Savings Rate (DSR), which will allow anyone to earn an essentially risk-free rate of return on Dai by locking up Dai in a new portal that built on Maker’s Oasis protocol.

The DSR could be a huge growth driver for Dai. Stablecoins are proliferating out of every corner and exchange in the world. So far, Dai’s distinguishing feature was that it was decentralized, completely collateralized onchain and permissionless. Those appeal to Ethereum and DeFi enthusiasts but they are not as important to Dai growing 100x.

A currency with an interest rate baked in could find appeal in a mass market, especially in the developing world, and it also helps Dai stay competitive against other stablecoins.

The DSR will also give MakerDAO another tool to manage the $1.000 peg. When Dai struggled to maintain the peg in the spring and summer, Maker was forced to raise its stability fee because it was its only instrument to generate demand for Dai.

With the DSR, Maker could raise the DSR, which is a more direct route to incentivizing demand for Dai without having to squeeze borrowers. The DSR is expected to be above 0% but below rates offered on secondary platforms like Compound or dYdX.

With a lower-than-market-average interest rate and little new collateral added, why is Multi-Collateral Dai important? First, in a basic sense, it represents the final, shipped Dai. Many potential partners have held off integrating Dai precisely because of all the headaches in upgrading and switching to MCD Dai.

Second, it’s the foundation for Maker to become the Coinbase of the DeFi world. Maker is not trying to tokenize real estate or security tokens, but they’re building the infrastructure to provide them usability when they arrive.

More about how the upgrade to MCD is affecting DeFi projects:

[Maker] What to expect with the launch of Multi-Collateral Dai

[DeFi Nation] The Future of MC Dai - Panel Discussion with Rune Christensen

[Kyber] Migration to Multi-Collateral Dai (and phasing out Single-Collateral Dai)

[Compound] Support for multi-collateral Dai

[InstaDApp] MCD Migration for Compound Users and Whale CDPs

Chart of the Week: New DeFi Metrics

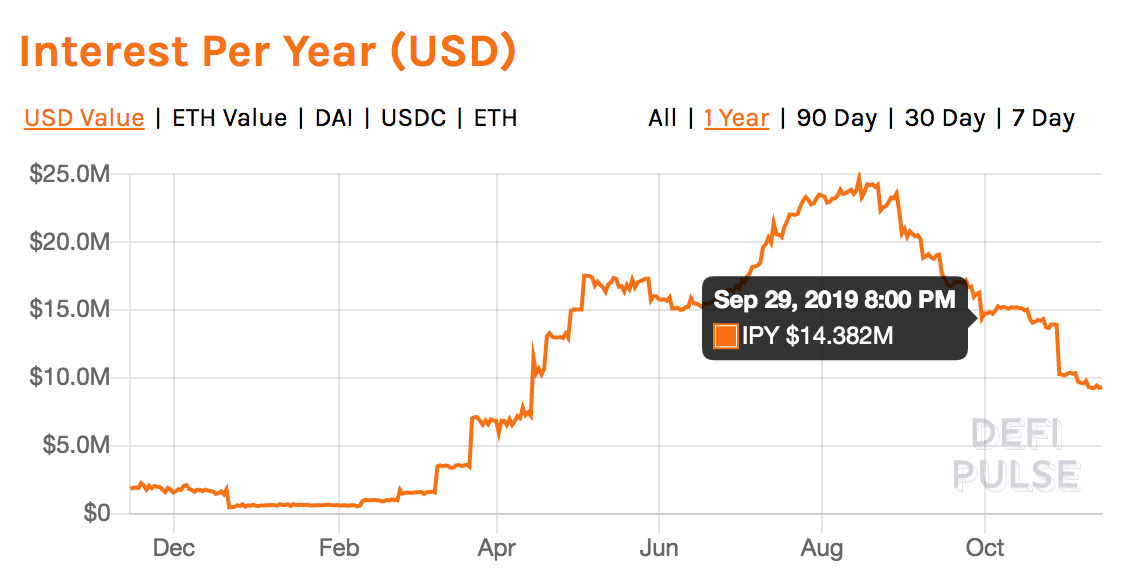

Shameless plug: DeFi Pulse is out with a new metric, Interest Per Year (IPY), which tracks the amount of lending activity by looking at the amount of interest collected on an annualized basis. Like TVL, this is an onchain metric that is difficult to manipulate.

Tweet of the Week: DeFi rankings reshuffle

Synthetix CEO, Kain Warwick, commenting on the reshuffling in DeFi Pulse’s TVL rankings, with Synthetix surpassing Compound. Synthetix's TVL has grown because of an increase in the price of its SNX token, which is the only collateral accepted within the Synthetix platform.

Long read of the week: Headless Brands

An intriguing piece from Other Internet on the rise of it caslls ‘headless brands’. Bitcoin’s brand is headless, but its hard to imagine any project besides Ethereum that could make a similar claim. But DeFi may be more headless than Ethereum.

Odds and Ends

rDai launches on mainnet, promises programmable interest Link

Ren Protocol launches ChaosDEX, hoping to bring Bitcoin to DeFi Link

Dharma unveils smart wallet with multi-device support and account recovery Link

a16z announces Crypto School to bring more technologists into Crypto Link

New DeFi primitive, oTokens, aims to build fungible, ERC20 options Link

The 25 biggest gas spenders on Ethereum over the last month Link

eToro acquires crypto portfolio tracker, Delta Link

Thoughts and Prognostications

The Defiant's Cami Russo interviews Vitalik [ETH Waterloo]

Are blockchain voters 'dummies'? [CoinFund]

Binance is Blitzscaling [Multicoin]

Good engineering alone cannot ensure success of a blockchain [Ben DiFrancesco]

Tokenizing PoolTogether [POV Crypto]

2019 Crypto Trends Report [Coinshares]

Listen of the Week: Balaji and Glen Weyl

Bloomberg’s Joe Wesenthal sits down with Peter McCormack on the What Bitcoin Did podcast to discuss whether or not Bitcoin is selling out. Joe highlights certain contradictions within the Bitcoin community but is not dismissive of Bitcoin or cryptocurrencies entirely.