Denver prelude!

I’ll be in Denver next week for ETH Denver and the festivities prior. It would be great to connect with any of you who may be in town. I’m supposed to be speaking on a panel…but seems there is still some programming to be done. There will be some fun drinks on Wednesday if you’re around. Get in touch. Also, there will be no DoD next week.

- Chris

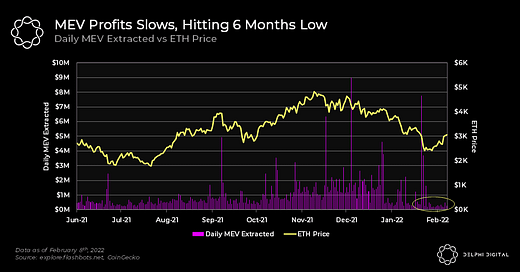

Chart of the Week: MEV profits decline?

A chart from the folks at Delphi Digital taken from explore.flashbots.net. The chart’s decline in MEV profits is a sharp contrast to the recent conversations on Crypto Twitter around the easy money that is to be made in MEV land. It’s hard to read too much into this data, because quantifying MEV remains challenging, but the decline is likely due to depressed volumes and a shrinking number of transactions to extract MEV. Almost all sophisticated Ethereum users are taking measures to limit their MEV exposure, but the shift to a multichain world and L2s opens up a whole new set of MEV possibilities.

The MEV long game remains uncertain. It’s hard to imagine it being eliminated. Diminished? Pushed to trusted entities? Some speculated that MEV searchers will start acquiring wallets for better access to order flow - a recreation of the Robinhood/Citadel relationship.

If you’re looking for more: MEV: Standoff, truce, or a never-ending saga? [DoD]

Tweet of the week: A stablecoin by any other name

Currency blogger John Paul Koning with an astute comparison between PayPal and Circle. It’s a helpful framing because the two companies share some basic functions. They both store real physical dollars for customers and give them a digital representation of that dollar.

The similarities end there, however. Obviously, Circle is in hyper growth phase and not worried about profits vs. Boomer PayPal with quarterly earnings demands. But more importantly, the business model for stablecoins will be very different than the business model for PayPal.

It’s not clear what USDC’s business model is but it’s probably not based on payment or transaction fees. They may make some money from the float, but they will probably need to build up a suite of products & services to monetize USDC users.

Check out: Comparing and contrasting PayPal balances with USDC [Gyges Lydias]

Odds and Ends

Uniswap v3 TVL surpassed ATH, approaches $4.5bn Link

Compound proposal to raise TUSD collateral factor fails Link

Gnosis proposes launching SAFE token for multisig wallet Link

Dune dashboard for LooksRare vs. OpenSea Link

Fixing a critical bug in Optimism’s Geth fork Link

Thoughts and Prognostications

Thoughts on the DeFi lending market [Mike 0x/1kx]

Exploring OpenSea Analytics Using On-chain Data [Nate Maddrey & Kyle Waters/CoinMetrics]

A Quantitative Analysis of DeFi Option Vault Strategies [Samneet Chepal/Ledger Prime]

The market cap of the Ethereum ecosystem [Brunny.eth]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where I’m over the cold. Looking forward to Denver.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to DXdao* and benefit financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.