Modular architecture and its role in Ethereum’s Endgame

The growth of rollups makes data availability paramount to a base layer’s chance of success

Ahoy! Dose of DeFi is looking for a part-time paid researcher. This person would contribute to research and link gathering as well as authoring and publishing their own deep dives. More info here. Send resume & one research sample to careers@caneyfork.co.

Below, Denis returns to take stock on the state of the modular blockchain space. He first looked at the market opportunity in November 2022, and then how rollups were advancing in May 2023. Since then, the pendulum definitely swung towards Solana and the monolithic design, but already so early on in 2024, the modular narrative is oscillating back.

This issue of Dose of DeFi is brought to you by:

There’s a better way to deploy and manage Uniswap v3 positions. Try Oku.trade out today for a better liquidity provision experience. Follow Oku on X.

A monolithic era?

Solana is all the rage these days, and rightfully so. It’s gone from the dark days of the Alameda crisis, to strong price action, and from frequent halts to successfully handling one of the busiest airdrop claims in history – all while maintaining incredibly low fees. From the perspective of onboarding new users, Solana is a good choice: Ethereum L2s still charge up to USD1 per transaction (and we really don’t think starting from BSC or Tron is a good idea).

Another of Solana’s strengths is its single global state that instantly reflects all market signals, without the arbitrage and bridging hops between rollups or shards. It’s as if trading on all global exchanges was seamless 24 hours a day, with events instantly reflected in price changes on all exchanges, no matter the geography or time zone.

These are the benefits of a monolithic chain at its best, but there remain downsides to this design choice. Most notably, that the Solana validator set trends towards centralization due to very high hardware requirements. This happens because Solana monolithically handles all three layers of blockchain: execution, consensus, and data availability.

On the other end of the design spectrum, modular architecture – and specifically the outsourced data availability layer – is rising in popularity. This approach lowers transaction costs while maintaining low hardware requirements (although MEV threatens this). A modular design also allows for more specialized chains and hardware for specific applications, with dYdX being the best example.

At the forefront of the modular movement is Celestia, a chain optimized for rollup data efficiency. Ethereum, on the other hand, has arrived at a modular approach in a more piecemeal manner, building the plane whilst already flying. We believe rollups are the key to scaling and cheaper transactions, with the battle for data availability layers (and the rest of the modular stack) now on.

Scaling and the data hurdles

The data availability problem was first identified in the early race to scale blockchains. The focus was on minimizing the amount of data to store in order to maximize the number of nodes in a network. The same dynamics underpinned Bitcoin’s block size wars. Data availability refers to a blockchain’s ability to make its data accessible to all network participants. The key breakthrough in solving this problem was the introduction of data availability sampling (DAS), as Bridget Harris explains:

“With DAS, light nodes can confirm that the data is available by participating in rounds of random sampling of block data rather than having to download each entire block. Once multiple rounds of sampling are completed – and a certain confidence threshold is reached that the data is available – the rest of the transaction process is safe to occur. This way, a chain can scale its block size yet maintain easy data availability verification. And considerable cost savings are also achieved: these emerging layers can reduce DA costs by up to 99%.”

Celestia, Avail, NearDA, and EigenDA are the most important DA projects. They don't need to verify transactions, but simply check that each block was added by consensus and that new blocks are available to the network. They rely on third-party sequencers to execute and verify transactions. Celestia was launched in October 2023, Avail and EigenDA have their mainnet in coming months, and Near has most recently announced its DA solution. Let’s review the unique features of each:

Celestia chose the fastest road to market with fraud proofs (which are also used by optimistic rollups). The tradeoff is that in the current configuration, Celestia won’t be able to support ZK rollups. Celestia’s team claims that around 70% of all new Arbitrum Orbit chains are using Celestia for data availability.

Avail (ex Polygon Avail) as a standalone blockchain provides a fast and secure data and consensus layer that gives developers what they need to launch a rollup (whether a ZK or optimistic).

EigenDA is probably the most Ethereum-aligned, because it’s a DA module, not a blockchain. Also, the restaked ETH in EigenLayer will be available to secure rollups using EigenDA. Its weakness is that it’s not using data sampling or data availability proofs.

NearDA enables saving on a rollups’ data availability fees, by storing data on Near’s sharded blockchain. NearDA leverages an important part of Near's consensus mechanism, which parallelizes the network into multiple shards.

Launching a sea of rollups

And then we have the rollups themselves. Of the rollups that build on these DA providers, there are a number of tools to make it easier to launch a rollup:

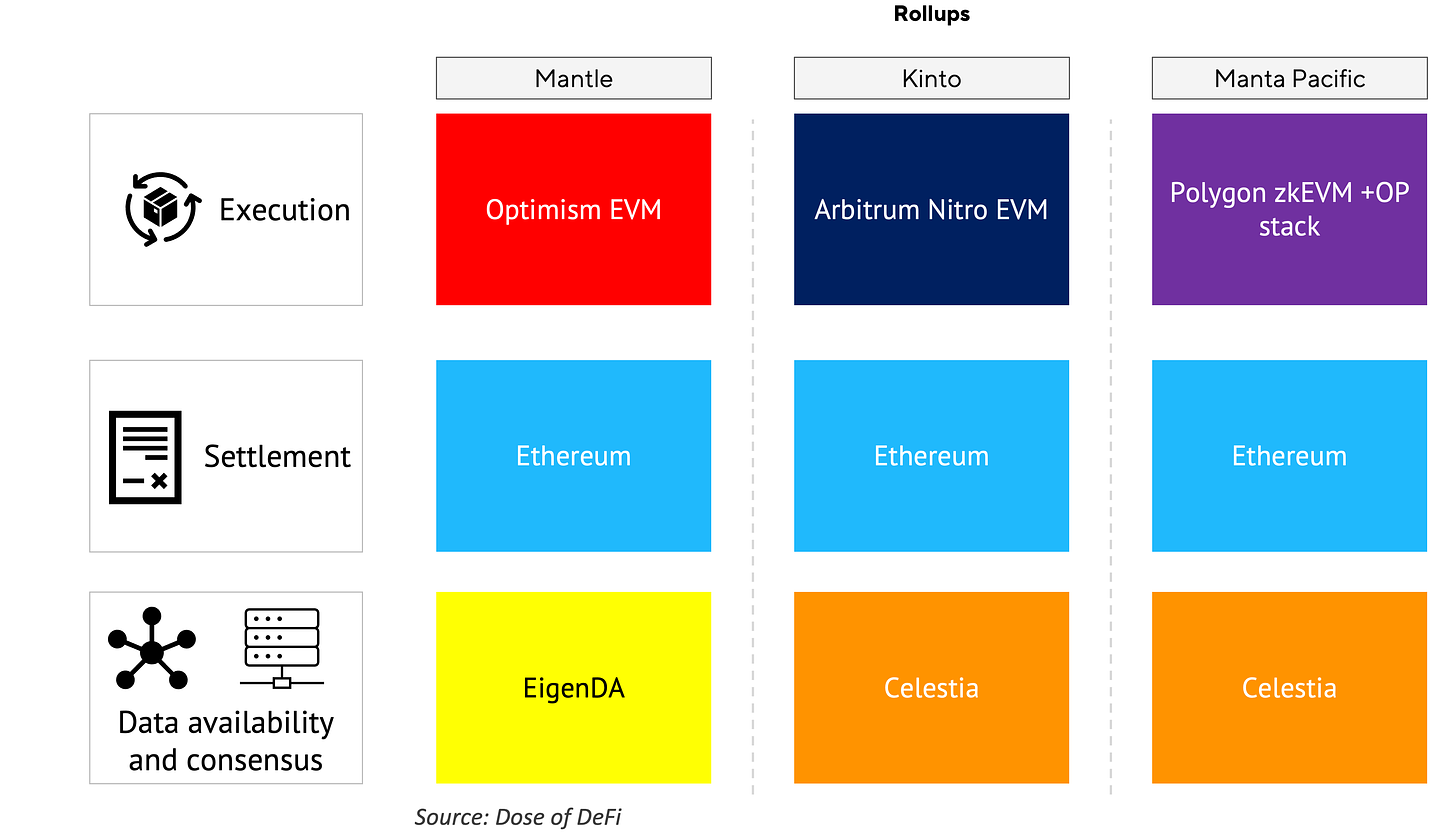

By harnessing Celestia's modular data availability, Manta Pacific provides significantly lower costs compared to monolithic L2 solutions, and has already saved $1million in Ethereum gas fees. Manta also uses custom opcodes for verifying ZK technology, which makes it really cheap for them to have privacy and native randomness in the protocol.

The Mantle Network is constructed upon a modular architecture that merges an optimistic rollup protocol with the data availability solution from EigenDA. This integration enables the Mantle Network to inherit Ethereum's security while also providing more affordable and readily accessible data availability.

Kinto is a KYC’d chain where every user and developer must complete a passport KYC process before transacting on the network. It uses Celestia to drive down costs.

In a truly modular way, modules of each layer are chosen based on specific needs. The variety of combination options can be seen here:

Rollup-as-a-service projects like Eclipse make it even easier to launch a rollup, where the developer chooses which technology to use for each of the three modules.

Similarly, Conduit allows you to deploy a rollup in 15 minutes, with Optimism, Arbitrum Orbit, and Celestia as the supported stacks. A monthly hosting infrastructure fee is paid to Conduit, and there's a separate data availability fee paid to the provider.

The wealth of possible combinations that modularity creates is certainly a major step forward. Is it akin to the difficulty of building an early website compared to the ease and customization of Squarespace today?

But then the tradeoffs

Despite the growth in DA projects, many have reservations about outsourcing DA. Vitalik made his clear: “Your data layer must be your security layer.” Dankrad Feist, another member of Ethereum Foundation, concurs: “If it doesn't use Ethereum for data availability, it's not an (Ethereum rollup) and therefore not an Ethereum L2.”

We agree. Rollups with outsourced data availability will be less secure than those using the same chain for data and consensus (and really should be referenced as “validiums”), although secure enough for certain applications. Short-term projects using such rollups will emerge and fade quickly, making it a good experimentation and testing ground. However, for long-term holding of financial assets, L1s such as Ethereum or rollups using them both for data and consensus will remain the networks with the lowest risk profile.

Ethereum is going modular

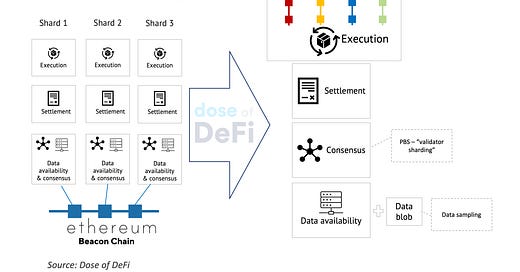

While skeptical about outsourced data availability, Ethereum is big on modular architecture. The early vision of scaling via sharding was abandoned in favor of modular.

The three main updates needed to implement the vision are rollups (we talked about these before), proposer-builder separation (“instead of a block proposer generating a ‘revenue-maximizing’ block by itself, it delegates the task to a market of outside actors (builders)”), and data sampling. The latter is a way for light nodes to verify that a block was published by only downloading a few randomly selected pieces of data. This is technically more challenging than the other two and will require two to three years to ship.

Important note: EIP-4844 was the first step in improving Ethereum’s data availability layer before data sampling goes live. As discussed earlier, enhancing Ethereum is similar to building the plane whilst flying; once the Ethereum Foundation recognized the need for rollups (aka when Vitalik dropped the famous rollup-centric future), the team opted to extend blocks with blobs (a dedicated space tailored specifically for rollup data). Blobs are expected to reduce the cost of rollup transactions up to 10 fold. EIP-4844 is scheduled to go live with the Dencun upgrade in March/April. While this is a temporary solution to keep Ethereum competitive for two to three years, the long-term solution will be supporting validity proofs on mainnet itself, which will make rollups orders of magnitude cheaper.

While Solana might be strongly defending its philosophy of monolithic architecture (and they might prove right for many use cases), the industry seems to be converging on modularity. In the case of Ethereum, only modular architecture will enable a future where:

1. Transactions are cheap for millions of users thanks to rollups (scalability);

2. The network is protected from censorship and threats like 51% attacks (security); and

3. An average PC or even a mobile can run a node to verify transactions (decentralization).

One might ask if Ethereum’s modular architecture solves the blockchain trilemma that was supposed to be unsolvable? Technically it doesn’t, because Ethereum is not a monolithic network anymore, but as a modular network, it does.

Of these three, we think decentralization is the most important part of the trilemma to solve. Innovation will eventually drive down transaction costs; prioritizing decentralization (especially geographic) is the only way to ensure long-term security for the network. Ethereum is leading in decentralization by having the most distributed validator set, with more than 800,000 validators. At the same time, with the modular approach, it can adapt to new design innovations through customized rollups that launch on top. Celestia and others certainly share this vision. The question remaining is whether Ethereum can move in this modular direction fast enough to keep up with the competition, which is building from scratch, and not fixing the plane whilst flying.

Odds & Ends

Uniswap Foundation proposes fee switch for token holders in governance Link

Superstate launches on-chain, regulated fund tracking TBills Link

DEX aggregator Jupiter airdrops $700m to Solana users Link

Synthetix 2024 roadmap Link

Dirt Roads writer launchs M^0, “money middlware for the digital age” Link

CoW DAO releases MEV-capturing AMM Link

Lending protocol Morpho sees huge growth Link

a16z invests $100m in EigenLayer Link

Thoughts & Prognostications

Leaderless Auction, a decentralized auction with no auctioneer [Dave White & co./Paradigm]

OFAs are a bad idea [Snoopy_mev]

How Polygon is changing the game with AggLayer [Peteris Erins/Auditless]

Introducing the Chain Abstraction Key Elements (CAKE) framework [Ankit Chiplunkar & Stephane Gosselin/Frontier Research]

Should we be taking Tron seriously? [Michael Nadeau/The DeFi Report]

Unbundling staking: Towards rainbow staking [Barnabe/ETH Research]

On Stablecoins [Our Network]

At the crossroads: Bitcoin ETFs & Coinbase earnings [Tanay Ved & Matias Andrade/CoinMetrics]

That’s it! Feedback appreciated. Just hit reply. I’m in Denver next week, get in touch if you’re around.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to Powerhouse, an ecosystem actor for MakerDAO. All content is for informational purposes and is not intended as investment advice.

Thank you for sharing the AggLayer article :).

Got any sources on evidence that the Solana validators are trending to centralization?

Last I checked it actually has been growing immensely in how many validators are running. Seems to be quite okay.