It appears that everyone has settled on liquidity mining as the meme to describe incentive programs that reward investors for storing assets in a DeFi protocol to bootstrap liquidity (some still want to make liquidity farming happen).

I wrote about these programs and Balancer’s new liquidity mining initiative last week (“DeFi Liquidity Wars and Capital Efficiency”), and here’s an update from The Block’s Teo Leibowitz:

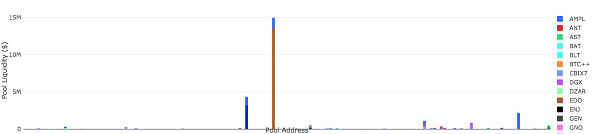

$13.5m is a lot for a single token with a small market cap. Almost 30% of RPL now sits on Balancer (with only 10 addresses), presumably to drive liquidity for RPL and earn BAL tokens (Balancer CTO on the RPL pool). The 90/10 split offers much more functionality to a huge chunk of (presumably) illiquid RPL. Still, even without RPL, Balancer’s TVL would put it in the top 10.

Of course, Balancer distinguishes itself from Uniswap with the ability to deposit assets in any proportion. While this can be used to customize a deposit pool according to a specific portfolio (personal ETF), teams are also using it to offer cheaper liquidity for project tokens by putting up less Dai/USDC (or WETH). DegenSpartan explains:

With any incentive program, there is always the chance that someone can “game” the system, and Balancer’s added functionality expands the attack vector. Balancer has already altered its BAL distribution algorithm to issue rewards by a pool’s trade volume, rather than a pool’s liquidity size, which favors evenly balanced pools that see more volume and are more exposed to impermanent loss.

MKR listed on Coinbase Pro

Coinbase announced on May 29th that MKR would be available to Coinbase Pro customers and starting accepting MKR transfers today. MKR rallied on the news and is up 59% since the announcement, erasing all of the losses from the fallout from Black Thursday and earning a handsome profit for those who participated in the subsequent MKR auction.

The move is not surprising as smaller DeFi projects like Kyber and 0x already trade on Coinbase Pro. MKR has always been a thinly traded asset (by design?) and following the $27.5m MKR sale to Dragonfly and Paradigm in December, it is now ready for a wider distribution to institutional investors through Coinbase Pro.

The DeFi hype does not yet match up with large crypto investors’ exposure to DeFi. Some promising projects, like Compound and Uniswap, are only accessible through traditional VC equity investments (for now). 0x and Kyber, meanwhile, did ICOs in 2017 before “DeFi” was a thing. Those tokens went to the moon and back but are now more in line with project growth and development.

MKR on Coinbase Pro won’t change much right now, but it’s a step to give DeFi a wider investor space.

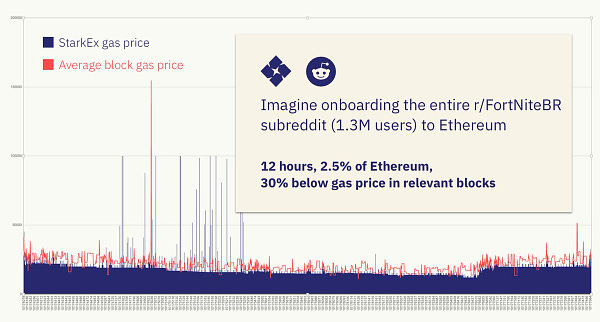

Layer 2….so hot right now

A bunch of different Layer 2 scaling solutions are in various stages of launching:

Payments and algo traders are the new DeFi markets that layer 2 solutions enable. Dharma is also trying to do payments, looking outside crypto. Loopring’s ZK-rollup DEX, DiversiFi and Synthetix OVM L2 demo provide validation that a centralized exchange like experience can come to Ethereum through layer 2 solutions.

These growth opportunities could lead to a more fragmented DeFi landscape, with liquidity siloed off. There are transaction costs to go from Loopring’s L2 DEX and DiversiFi’s L2 DEX just as there are switching costs to go from Kraken Binance.

Composability remains important, but it will no longer be a growth driver as projects look to use L2 solutions to cater to a particular market segment.

Tweet of the Week: DeFi Returns

As the thread explains, these tokens outperformed ETH (+81%), which outperformed BTC (+31%). MKR (+19%) lagged as well as SNX (-29%). March’s volatility requires this to be taken with a grain of salt, but Kybe (KNC), Loopring (LRC), Aave (LEND) and REN have all also had strong fundamental growth to support the price increase. They should have more company with the recently launched UMA token and recently announced COMP and BAL.

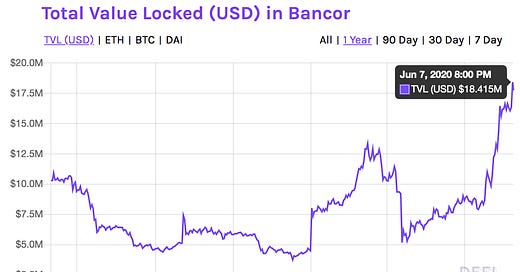

Chart of the Week: Bancor’s resurgence

Lost in the liquidity wars is Bancor, which launched the first automated market maker (AMM) after its successful ICO in 2017. The additional liquidity is also showing up in volume. Over the last 3 weeks, Bancor has seen $23.5m in volume, but had $26.1m of total volume from Jan 1 - May 17, according to Dune Analytics.

Bancor was early to the liquidity incentive game with a major airdrop last December to entice new liquidity providers. In April, it announced a v2 upgrade slated for release sometime over the summer. It aims to use Chainlink price oracles to eliminate impermanent loss, while allowing liquidity providers to get exposure to a single token. Head of Growth Nate Hindman explains this in more detail in a post this week.

Odds and Ends

Coinbase cuts rewards on USDC stablecoin holdings by nearly 90% Link

Argent limits “free gas” usage after rising Ethereum gas costs Link

Consensys reveal Chainanalysis-like tool for tracking ERC20 transactions Link

The Fed comes out in favor of an Ethereum-based alternative to Libor Link

Opium launches futures product for unlaunched $BAL tokens Link

SafeKeep app joins crowded DeFi skin market, offers multi-wallet support Link

Panvala starts community staking program for Gitcoin Grants Link

1inch introduces Chi Gastoken Link

Thoughts and Prognostications

Taking advantage of illiquidity + finding alpha in altcoins [Jason Choi/Spartan]

DeFi’s Invisible Asymptotes [Kyle Samani/Multicoin]

Capital Management & Digital Assets [Richard Galvin/Digital Asset Capital Management]

COMP Distribution Design Will Incentivize Phantom Growth and Open Pandora’s Box [Henry He/SesameOpen]

Why most of us probably shouldn't worry about Impermanent Loss [Hugh Karp/Nexus Mutual]

DeFi is Still Dominated by Rich Tokenholders [Ashwath Balakrishnan/Crypto Briefing]

Bitcoin cycles and their downstream effect on ETH-ERC20-DeFi tokens [Kain Warwick/Synthetix]

On 2008 vs 2020, and what it means for crypto(currency) [Vitalik]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, which feels stronger than ever. Subscribe to Govern This.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.