Over-collateralized lending powers DeFi's growth

Plus Odds and Ends and Thoughts & Prognostications

Tweet of the Week: DeFi’s big secular trend

Nexus Mutual Founder Hugh Karp with what one might call a “contrarian take” but over-collateralized loans are DeFi’s beating heart. Undercollaterlized loans power the traditional finance world, so we assume that it is a more efficient market structure, but over-collateralized loans may be revolutionary for two reasons, 1. It unlocks new lending opportunities, which grows the overall market 2. The loans can be in any synthetic asset, not just $$$. Right now, over-collateralized loans are used to create stablecoin synthetics (like MKR and SNX) but in theory this pool of capital could earn a higher yield if the asset was useful or earned fees.

This isn’t unique to Ethereum. Bitcoin-backed loans are popular and have created a different credit market structure. collateralized loans may be more important as a DeFi primitive than a consumer-facing product.

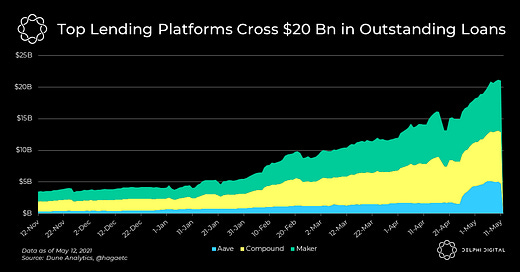

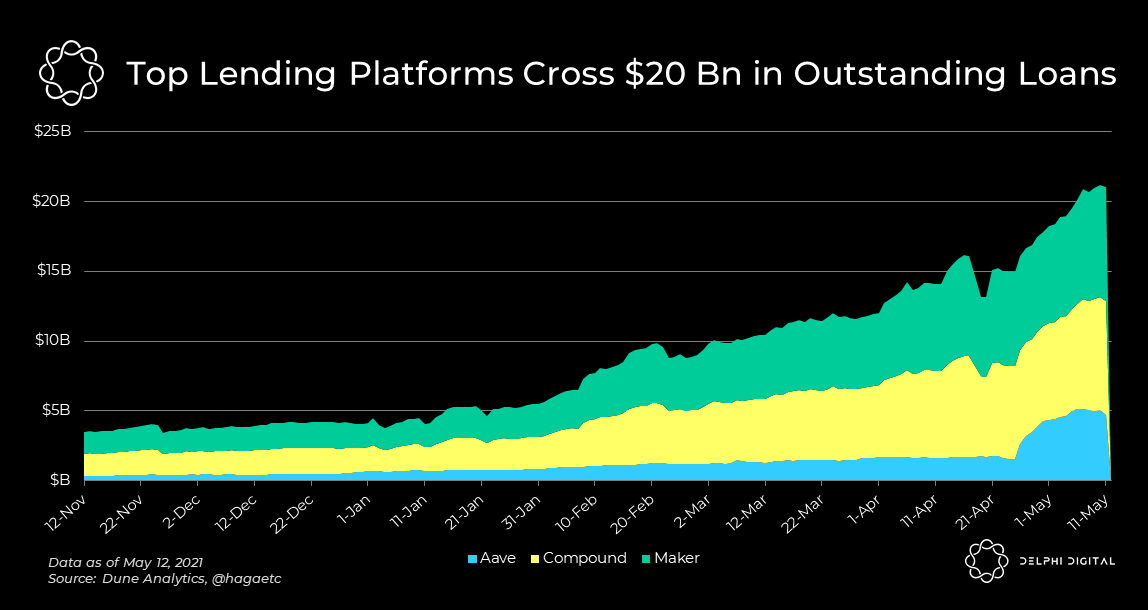

Chart of the Week: DeFi Lending’s Big Three

Simple chart from the guys at Delphi Digital in a recent research note that shows the three largest over-collateralized lending platforms in DeFi total more than $20bn in outstanding loans. Of course ETH’s meteoric rise was the primary driver of this growth but lending platforms have expanded their collateral base too. Maker has shown consistent growth despite it’s lack of token incentives, in part because it has novel collateral options, like DAI-ETH and ETH-WBTC LP shares. Perhaps no project is positioned as well as Maker to capitalize on future growth in over-collateralized lending. It completed its first loan using Real World Assets last month with the help of Centrifuge.

Odds and Ends

Coinbase Wallet releases browser extension to compete with Metamask Link

Zapper raises $15m in Series A led by Framework Link

xToken exploit post-mortem Link

Arbitrum plans to open L2 mainnet to developers on May 28 Link

UMA’s Optimistic Oracle launches Link

Coindesk: Millennium, Matrix and Point72 Standing Up DeFi Funds Link

Thoughts and Prognostications

FLOAT’s daily auction is a better peg stability tool than interest rate adjustments [Will Sheehan/Parsec]

Everlasting Options [Dave White/Paradigm]

Single Vault Model - The Lego Baseplate [Jacob Goh & Bailey Tan/Deribit Insights]

The Emerging World of Decentralized Finance [Wharton School Research]

Snooping through Mark Cuban’s Ethereum wallet [Bay/zoomer money]

Legitimacy [Vitalik/Bankless Podcast]

Even VitalikButerin can't escape the monsters of the dark forest [Robert Miller/Flashbots]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. I’m grateful for the warm sunshine this past weekend.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.