The whir around UST's death spiral is still echoing through crypto. At a minimum, the saga will dent risk appetite, and will likely soon lead to a US-led regulatory push around stablecoins. There’s been a lot of ink spilled and podcast tape used on the collapse of UST and what it means for the future of DeFi. Among the many repercussions and lessons learned, to us, there is one clear takeaway: the unavoidable necessity of peg management for stablecoins.

At first, stablecoin designers focused on ensuring that a crypto asset was theoretically stable, but soon realized that traders want a stablecoin that can always be traded for its stated value, and not what it should trade at.

This is a lesson that could have been gleaned from traditional finance (TradFi), which has a long history of managing – but more often than not breaking – pegs. When maintained, pegs lubricate investment flows, but even a small deviation can shatter investor confidence.

In DeFi, stablecoins have different approaches to peg management. Below we’ll explore the peg strategies of the major stablecoins and discuss that while Curve enabled new stablecoins to scale, it may not be the ultimate peg management solution. But first, let’s look back at peg management in TradFi.

Pivotal moments in TradFi peg management

Like many things in crypto, pegs are not new in finance, but have a long history:

Soros breaks the Bank of England. In 1990, the UK joined the European Exchange Rate Mechanism (ERM), which was intended to provide monetary continuity in Europe prior to the introduction of the Euro. The ERM enabled major European currencies to be exchanged for Deutsche Marks within a fixed band, which was enforced by each country’s central bank.

By 1992, the British Pound (GBP) was trading at the lower end of the band. The UK economy was weak and beset by high inflation, but the fixed rate regime of the ERM prevented market adjustments. That is, until George Soros and other currency speculators forced the Bank of England (BoE) to defend the peg by aggressively shorting the pound.

This culminated in “Black Wednesday” when the BoE and the government purchased more than GBP2 billion an hour from their foreign currency reserves and hiked interest rates by 500 bps in a day. Their aim was to protect the peg for the sake of continental unity, but inevitably they relented and allowed the pound to freely float. Soros reportedly pocketed $1.5 billion on the trade.

The Baht amongst the 1997 Asian Financial Crisis. A similar story unfolded in Thailand, where the Thai Baht had been pegged to the US dollar since the 1950s. This went swimmingly until the crisis, when exports slowed, the dollar strengthened as the Fed raised interest rates, and all of the “hot money” from foreign investors suddenly raced for the exits. The Thai Central Bank burned through its foreign reserves, and with contagion spreading to other currencies which did not have the foreign reserves to plug the investment outflows, the bank was forced to let the Baht freely float.

Breaking the buck. In 2008, the Reserve Primary Fund reported a net-asset value (NAV) below $1.00, because 1.5% of the $65 billion fund were in short-term loans from Lehman Brothers, which had just gone bankrupt. The slight dip in the peg to $0.97 led to over $40 billion in outflows, forcing the fund to halt redemptions. The panic quickly spread to other money market funds and only subsided after the US Treasury guaranteed that all money market funds could be redeemed for $1.00. The Reserve Primary Fund did not survive September 2008; the Board of Trustees voted to liquidate the fund at $0.991 NAV.

The Hong Kong Dollar peg defies the odds. As the old saying goes, “All pegs break….eventually”. The Hong Kong dollar has flouted this, having maintained a tight 7.75-7.85 HKD/USD peg for almost 40 years. It could be considered overcollateralized, since the Hong Kong Monetary Authority holds nearly twice as much in foreign exchange reserves compared to the monetary base. To date, it’s done an effective job of managing the currency, calmly weathering the storm of the Asian Financial Crisis. And yet, the peg is now under more pressure than ever, with a tightening monetary cycle kicking off in the US, and the Chinese economy slowing closer to home.

There are advantages to managing a peg, giving investors confidence to scale liquidity. But you can't defend a peg on just bravado and some reserves. Underlying economic forces will find a way to reach value parity, and that subsequently will mean the need for prudent peg management within a reasonable band that still reflects economic realities.

Not all fiat stablecoins are created equal

Long-term prudent monetary policy aren't exactly the terms that come to mind when we think stablecoins. After all, stablecoins aren't currencies backed by central banks, nor money market funds. But they are in a way, somewhere in between. As the idea of smart contracts and blockchain-based financial services have developed, so has the desire to insulate against the volatility of crypto assets. But can you have the same sovereignty and permissionless of BTC and ETH without the volatility? Here’s a closer look at the biggest stablecoins:

USDC and BUSD. These fiat-backed stablecoins come with the implicit promise that they can always be redeemed for a dollar in a bank. Both are tied to huge exchanges (Coinbase and Binance) and have a smooth arbitrage loop for when they’re trading below a dollar. When above a dollar, investors are incentivized to deposit from their bank account, mint more USDC or BUSD, and sell into the market.

USDT or Tether is a different story entirely, one that’s a bit like trying to nail jello to the wall. USDT is backed by off-chain assets, but not dollars in the bank; more like a money market fund, but one where you don’t know where it’s investing. The peg management strategy for USDT is dependent on an arbitrage loop for the largest exchanges and OTC desks. Regular users cannot redeem USDT for a dollar in a bank, but large traders can. So when USDT is trading below a dollar – like it was two weeks ago – Alameda, Three Arrows Capital, and other large players are incentivized to purchase USDT in large amounts from DEXs and CEXs, and then redeem for cash through Tether Inc. Peg management also entails taking to Twitter and proclaiming “Tether is fully backed” to inspire confidence among the masses.

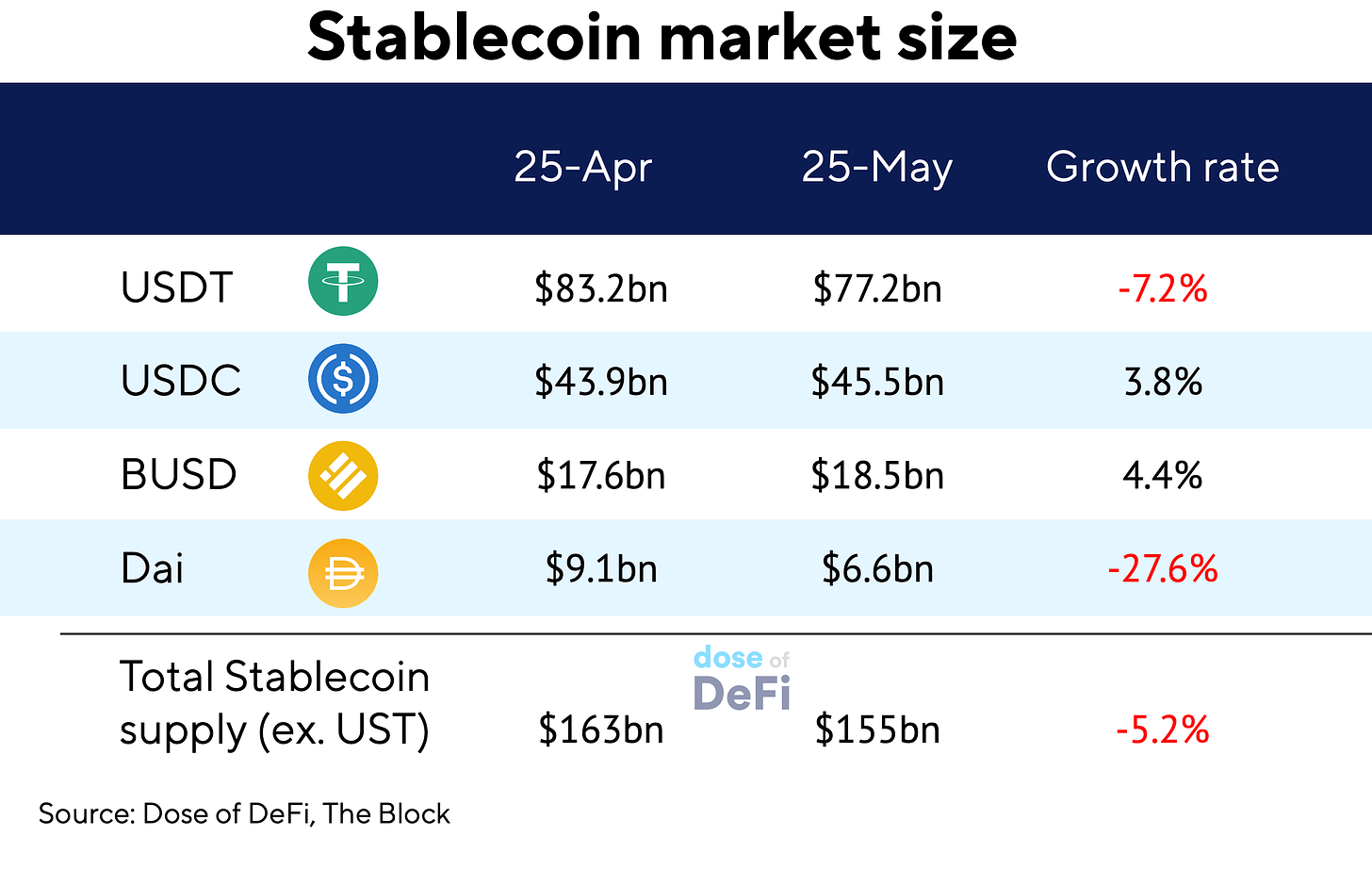

This is seigniorage plain and simple, with defense of the peg assigned to the cavalry of well-connected crypto traders. It’s not an awful peg management strategy, with USDT trading close to $1.00 now, but it clearly isn’t a winning strategy for stablecoin market cap. Over the last two weeks, USDT has seen heavy outflows, while USDC and BUSD both saw sizable inflows.

So it makes sense to hold USDT if you’re a big OTC desk or exchange that gets the seignorage rights for Tether, but not so much for anyone else. High-profile new entrants – perhaps a big American or Asian bank – may come, but USDC, USDT and BUSD are likely to remain the industry stalwarts for fiat-backed stablecoins for the foreseeable future.

Outside of fiat-backed stablecoins, more DeFi-native stablecoins, like Dai, have learned that just being backed is not a sufficient peg management strategy.

Dai: DeFi’s Dark Knight

Maker and Dai were conceived as a decentralized stablecoin ecosystem before fiat stablecoins were a thing. In the original design, Dai was backed by ETH and the only “peg enforcement” was when a Dai loan dipped beneath 150% collateralization ratio, when a liquidator could buy Dai and pay off the loan to get the collateral. If Dai was trading below $1.00, in theory (again!), it would make sense for traders to buy Dai to repay their Dai debt on Maker.

This was not a strong incentive, and initially, the only tool Maker had was interest rates on Dai debt (or as they stubbornly still call it, “the stability fee”). Raising the stability fee would encourage more debt repayment, and therefore, more Dai buying and peg support.

This worked like a dull knife throughout 2019, with the peg fluctuating and interest rates approaching 20%. While interest rates were clearly an insufficient tool for managing the peg, a change didn’t come until crisis struck with Black Thursday and the subsequent depegging of Dai.

Dai traded stubbornly above its peg for months after Black Thursday. Dai borrowers didn’t want to buy Dai above $1.00, and there were no borrowers to mint new Dai. Given the circumstances – the price of a barrel of oil traded below $0 during this time – it’s not surprising that market makers and arbitrageurs were not there to defend the Dai peg.

To solve the issue once and for all, Maker implemented the Peg Stability Module (PSM), which essentially is a modification to the protocol that always offers a 1:1 conversion between Dai and USDC. Maker learned the hard way an inescapable fact of stablecoins: access to dollar liquidity from the banking system is paramount to maintaining a peg.

Curve: Greasing the wheels, but not driving the train

Just a few months before Black Thursday in March 2020 came the launch of Curve. While Maker used the PSM to manage the Dai peg, almost all subsequent stablecoins’ peg management strategies centered on a stable pool on Curve.

Prior to Curve, starting a new currency was hard! Paying market-makers to provide liquidity on major exchanges is expensive. But Curve’s capital-efficient design, along with CRV rewards and new token emissions, has enabled a host of projects to attract millions of dollars in liquidity for new stablecoins.

But while Curve pools grease the wheels of peg management during normal times, they cannot do much if the underlying economic forces are working against the peg.

FRAX is loosely analogous to Terra, only because it’s not fully backed (currently 89% collateral). It managed its peg very well during the recent market drama, thanks to the Curve pool but more specifically the millions in USDC that FRAX has in reserves.

Rai has an entirely different approach to peg management: do nothing. Rai’s underlying protocol creates incentives for Rai to stay in a band through a negative interest rate, which should eventually draw Rai back into balance but there is no active market making in the protocol design to ensure adherence to a peg. Vitalik just wrote about Rai’s structure today.

At the extreme end of the spectrum, this approach will harden Rai over time. But USDC is 100-times the size of Rai and trying to scale another 10x and needs a tight peg to get there. How USDC and other stablecoins itching for global scale will have a large impact on the broader financial system, not just DeFi. As stablecoins proliferate, it becomes vital to understand their structure and what risk profile is appropriate.

Odds and Ends

PoolTogether rallying DeFi support for defense against class action Link

Ethereum Beacon Chain experiences seven-block reorg Link

Three largest undercollateralized loan platforms top $1.3bn Link

Uni v3 auto-balancer Arrakis surges to $800m in TVL Link

Thoughts and Prognostications

Why the merge will not lead to sell pressure on unlocked ETH [korpi]

Preparing for a long bear market and identifying the next growth opportunities [mhonkasalo]

Bots + Exchanges: A Perfect Storm [Michael Feng/Hummingbot]

How the Cryptocurrency Market is Connected to the Financial Market [Sang Rae Kim/Yale]

EIP-4844: The Setup For A Rollup-Centric Ethereum [Kevin Leffew/Decentral Park Capital]

The state of Ethereum Name Service ($ENS) [Token Terminal]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. Details soon on how to reserve tickets for Dose of DeFi: Brooklyn happy hour. Stay tuned.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to DXdao and benefit financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.