Finance has always felt like a game. On Wall Street, the goal is to get a bigger number, while everyday investors are just trying to beat their neighbor down the street who is all in on TSLA.

Humans are competitive species, against ourselves and against others. As soon as something is quantified and a score attached to it, we instinctively want to track and improve the metric, and then if possible, compare to others.

The personal fitness industry grasped this quickly. Cycling classes prominently display screens with participants’ heart rates and RPMs. Wearables give fitness fanatics a steady stream of new data and just being aware of the numbers ends up leading to more activity.

Creators of these products and services understood human psychology and built a user experience around it to drive engagement. The key insight is that products can create more value not by optimizing the perfect workout, but instead by focusing on how to motivate a user to start, continue or advance an exercise regiment. “Are you working out?” is more important than “Are you working out correctly?”

As fees move to zero, financial services are increasingly becoming about investor psychology more than investment strategy. Financial advisors are no longer promoting hot stock tips, but figuring out the best ways to deliver widely held investment advice.

Often, financial advisors’ greatest value is to prevent a client from selling during a market rout. Likewise, some challenger banks encourage savings by rounding up every transaction and putting the extra change into a savings account.

The financial advice is basic (save more). It’s the encouragement of this activity that creates value for the user. “Are you saving?” is more important than “Are you saving correctly?”.

PoolTogether - a no-loss lottery

DeFi enables a new set of tools to design products and services to drive desired behavior and there is no better example of this than the no-loss lottery PoolTogether.

Humans love to gamble and lotteries are one of the most ubiquitous games across the world. For lotteries, the reward could come after 1 ticket, 5 tickets or n tickets. Famed psychologist B.F. Skinner referred to this reward model as a variable ratio schedule and found that it was the most effective way to reinforce a behavior.

According to Skinner, the unpredictability of the rewards’ timing reinforces behavior more so than if the rewards come on a fixed interval schedule, which gives a reward at predictable time intervals (like saving).

PoolTogether built its no-loss lottery on the same concept. In a standard lottery, funds would be pooled together and then a randomly selected winner would receive all proceeds. But in PoolTogether, the pooled funds are invested into Compound’s Dai market to earn interest for a week, and then a winner is randomly selected to receive the interest earned over one week from the entire pool, while the rest of participants receive back their initial investment. A user’s chance of being selected is commensurate with the proportion of his or her investment to the entire pool.

PoolTogether is using humans’ insatiable appetite for unexpected rewards to get them to do something that is important but boring (saving). Everyone joins the pool with the hope of winning the reward, but even if they lose, they save their initial investment.

And the rewards are getting bigger. There’s over $1m locked in the most recent pool ($250k is not eligible to win but subsidizes a bigger prize). PoolTogether dished out a $1400 prize to a lucky Ethereum address today, and with supply rates on Compound inching up thanks to the DSR hike, the prize (and attention on the project) is likely to grow further. Most interestingly, less than half of its traffic comes from English speaking countries (Indonesia and China, the biggest) according to CEO Leighton Cusack on Laura Shin’s Uncofirmed Podcast.

Social Trading at Set

Growing up, the easiest way to inspire me in sports and competition was to tell me how my brothers did. Comparing oneself to others is typically frowned upon but like gambling, it’s baked deep into the human psyche. Rather than try to fight it with will power, smart product designers are harnessing that urge to encourage a desired behavior.

Many friends now trade Apple Watch activity reports and the dopamine rush of beating a friend might power you to be more active during the week. And of course, Instagram and other social media platforms allow us to track our friends but also celebrities and people we want to emulate.

The automated asset manager, Set Protocol hopes to tap into this same psyche with the launch last week of the Set Social Trading Platform.

Sets are a smart basket of ERC20 tokens that can automatically rebalance according to certain parameters. The BTC ETH Equal Weight Set, for instance, automatically buys and sells WBTC or WETH to ensure that the Set is 50% ETH and 50% BTC.

On the Set Social Trading Platform, the same tools are used to create Sets that auto balance to the portfolio of a particular trader, be it friends and family or top influencers in the space.

The leaderboard gets the competitive juices flowing for traders, while retail investors gain the confidence of investing the same as a professional trader (or perhaps influencer is more apt here).

Go to market strategies

“Growth hackers” have long employed human psychology to attract new users by tapping into our inner fomo. Nothing motivates us like an opportunity closing and others capitalizing on it.

In crypto and DeFi, there have been some growth hacks, but the hurdle of downloading a wallet has always been difficult to overcome.

There was an interesting tactic employed last week by Maker and a new privacy encryption browser extension Maskbook for a free Dai giveaway. The campaign was targeted at Chinese users and was awfully similar to a WeChat campaign six years ago, which bears a deeper dive because of its crucial role in establishing WeChat pay as the juggernaut it is today.

Every Chinese Spring Festival, family members and friends exchange hongbao or “red envelopes”, which are filled with cash. Many companies even hand out bonuses to employees in a hongbao. Over the Spring Festival in 2014, WeChat, which was already the dominant messaging platform, rolled out a digital “hongbao”.

Instead of exchanging real envelopes with cash, anyone could send a digital one to any of their WeChat friends through the app’s nascent payment platform. Users were eager to connect their bank account (and identity) details to the app so they could take part in the holiday fun. In total, WeChat gained 100 million new users of its payment platform in a week, reaching critical mass for wider adoption.

During this Chinese Spring Festival, meanwhile, Maker and Maskbook, offered a Red Packet giveaway (sidenote: “hongbao” is so much better than “red packet/envelope”). The foundation tweeted out a link with an encrypted offer for a 100 Dai giveaway to the first 20 to claim a ticket. Users needed to download and install Maskbook in order to decrypt the link and claim the prize.

The UX was clumsy and there wasn’t much of a marketing push but the campaign tapped into a sense of fomo for those missing out on the drawing and also connected to a common activity (exchanging hongbaos).

Product design is seen by many as a silver bullet to mainstream adoption, but playing games and competing are just as motivating to humans as pretty objects.

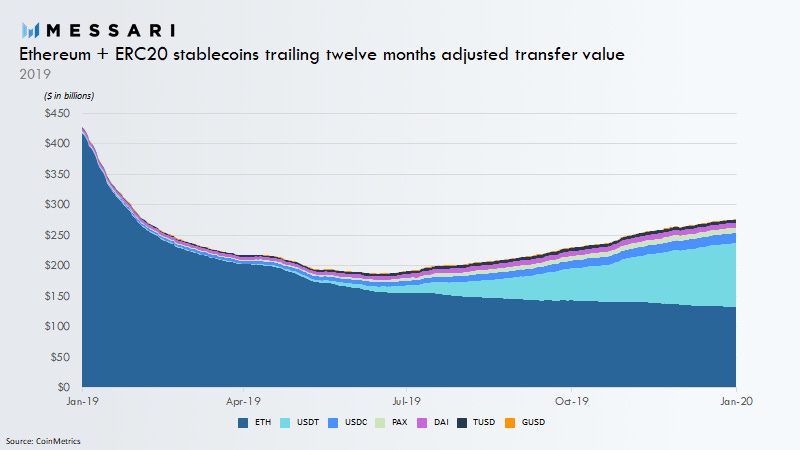

Chart of the Week: Stablecoins dominate ETH on Ethereum

A chart like this has been bouncing around since the use of Tether’s ERC20 token skyrocketed last summer, but it’s still an important chart that illustrates Ethereum’s value as a new financial system. Tether is obviously the biggest stablecoin and its success illustrates Ethereum’s penetration into mobile wallets. USDC, PAX, GUSD and TUSD represent a step forward for centralized exchanges, while scrappy Dai demonstrates that decentralization can find product-market-fit.

Odds and Ends

OasisDEX contract will be upgraded on Feb 8 Link

I took out a loan with cryptocurrency and didn’t sign a thing Link

Crypto accounting startup Gilded launches Open Finance Platform for businesses Link

OrFeed launches with own network of oracles + Kyber, Uniswap & Synthetix Link

Compound says Lendf.me copied its code without its permission Link

Dforce (owns Lendf.me) to introduce yield enhancing protocol Link

Consensys: Ethereum by the Numbers — January 2020 Link

Thoughts and Prognostications

Computers that can make commitments [Chris Dixon/a16z]

Staking Models for Productive Assets [Token Tuesday/Fitzner Blockchain]

Vulnerability disclosure: the discovery and the rescue [Michael Egorov/Curve]

Thin Applications [Joel Monegro/Placeholder]

The Life and Death of Plasma [Dragonfly]

Maker MCD: A Success in Protocol Upgrade & On-Chain Governance [Alethio]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where it’s not cold but I forgot my puffy coat.

Weekly Dose of DeFi is written by Chris Powers from Concourse Open. Opinions expressed are my own and do not necessarily reflect the opinions of Concourse Open. All content is for informational purposes and is not intended as investment advice.