SNX vs KNC

Staking vs. Burning

I don’t like to talk price*. It seems crass.

Of course, in financial and economic systems, almost nothing about an asset could be more important than its value, and price is what the value is right now. Price movements are often noise, but sometimes they are a signal.

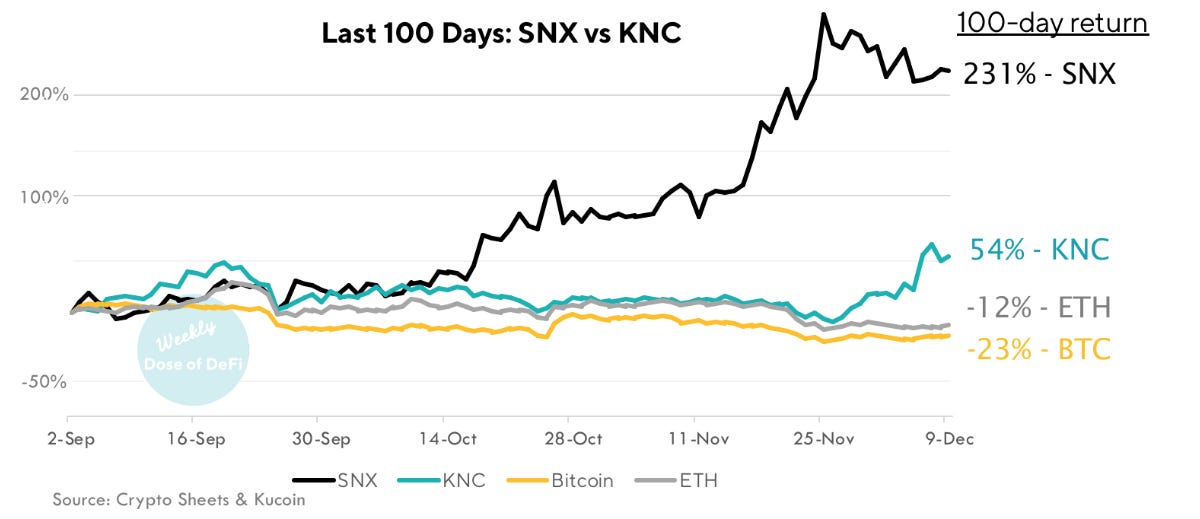

Below is the 100-day performance for the tokens of DeFi darlings Synthetix (SNX) and Kyber (KNC).

Synthetix has been one of the best performing tokens of 2019, which CEO Kain Warwick attributes to a change in their tokeneconomics. Like most 2017 ICOs, Synthetix launched initially with a fixed supply of tokens.

After it pivoted from a stablecoin to an exchange, it kept the same token structure but this model failed to deliver results. The trading platform had little traction and few token holders were staking their SNX.

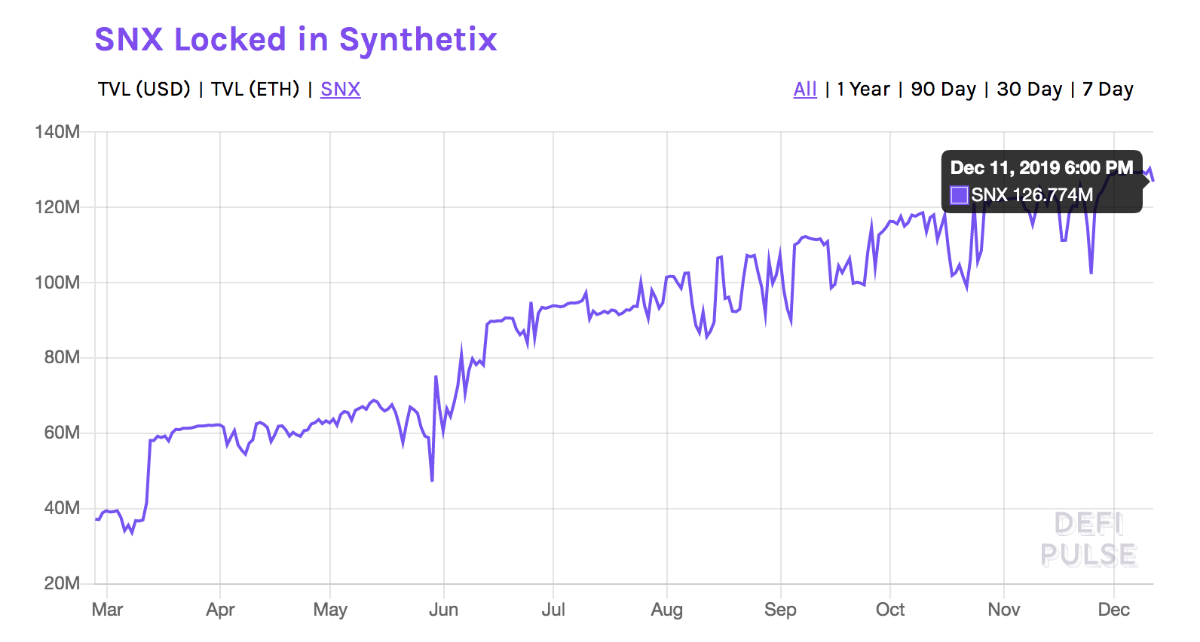

After a community-led discussion, Synthetix introduced inflationary rewards to encourage users to stake their SNX to trade on the platform. After the change, usage of the platform and the amount staked skyrocketed, according to Warwick.

The token’s rise has been aided by other token incentive strategies, like the sETH Uniswap pool, and the clear and consistent messaging of Warwick, who has been a regular on podcasts and crypto Twitter.

Price does not equal activity. The growth in DeFi in 2019 has largely been from actual usage, not price movements. Maker has had a busy and successful 2019, but MKR has been trading sideways for the past year. The story of Compound and Uniswap is about usage, and they don’t even have a token (yet).

Synthetix gives opportunities for traders to go short or long different 'synths' that are minted with debt from staked SNX. According to their online dashboard, $5.7m of synths were traded on the platform in the past 24 hours. Synthetix should be applauded for growing userbase in a bear market, and synthetic assets are a huge growth space, but SNX’s price increase is not because it has a good trading platform. The price increased because Synthetix made SNX a scarce asset.

Users purchase SNX and then stake it on Synthetix to receive a portion of the trading fees (in sUSD) and the inflationary rewards (in SNX). There is the risk of losing the collateral, but for many crypto traders, who are not exactly known for being risk-adverse, this was ‘free money’ because they also maintained the price upside of the underlying SNX.

The strategy worked. The amount of SNX locked is on a steady climb with over 80% of SNX staked on the platform, according to DeFi Pulse.

The thing you can’t do when your SNX is locked up is sell.

As interest in the project and the price rose, only a fraction of SNX was on exchanges. The lack of liquidity helped drive the price up further. What’s more, SNX isn’t available on many centralized exchanges and Uniswap is by far the most liquid market for SNX.

On the other end of the spectrum in terms of price and activity is Kyber.

Kyber has been around since before DeFi was a thing. The Singapore-based team launched in 2017 and pioneered the on-chain liquidity model along with Bancor. Kyber, like Bancor, launched an ICO and also used a native token (KNC) in its asset swap token model.

But Kyber has been far more successful than Bancor. It has processed more than $400m in trades since its launch, the most any DEX.

Despite the success, KNC hasn’t performed well. 0x processes less than half the volume of Kyber, but its token (ZRX) has a market cap that’s 5-times as large as KNC's.

KNC’s value was supposed to rise because the Kyber Network collects fees in KNC and then burns them. But, as Alex Svanevik brought up on Twitter, KNC burns at an anemic 2.8% of supply and has a glut of KNC tokens on Binance. Kyber Network is doing great, but KNC token holders are not benefiting.

Kyber CEO Loi Luu replied positively to the thread, “We are working on improving the KNC model to address all these concerns. Changes are on the way!”

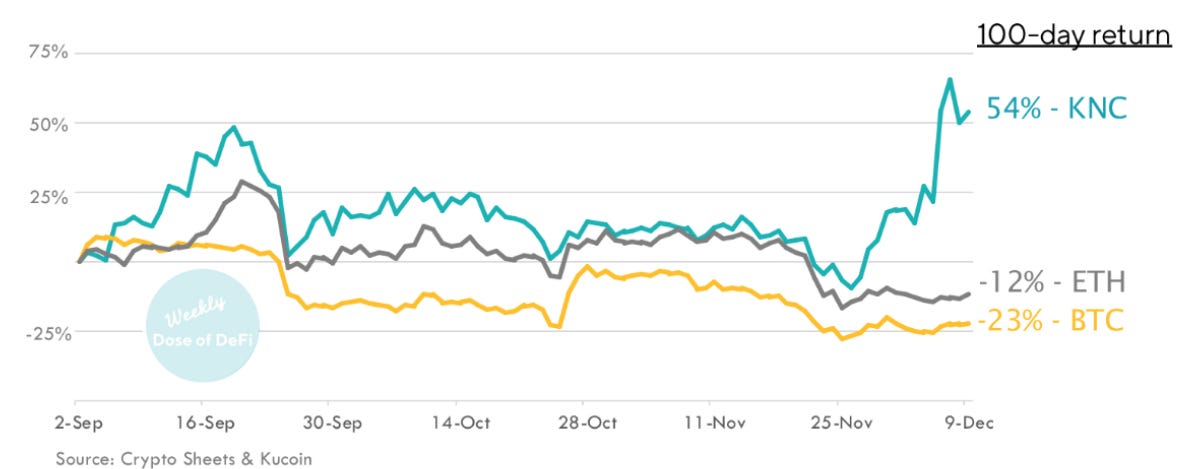

That was on November 25. Now, let’s look more closely at KNC against BTC and USD again:

KNC price was mirroring BTC and ETH until the Kyber CEO tweeted that they were considering changes to their tokenomics, and then the price increased 70% in two weeks.

Bitcoin’s political roots cast long shadows. The success and value of Bitcoin is tied to its scarcity. There will only be 21 million Bitcoins. Ever. But as cryptocurrencies moved beyond Bitcoin, many assumed that new digital assets needed a capped supply too (despite the fact that Bitcoin has benefited from inflationary rewards to miners). Synthetix and Kyber both raised money in 2017, when the fixed-supply narrative was at its peak.

Scarcity is important, but it's crucial to build a robust network first. And to do that, projects need to reward early supporters; staking and inflationary rewards seem to be the easiest way.

Token models will continue to get tweaked as new strategies are deployed, but expect to see less burning and more staking (and inflation). Synthetix just released details on its Capella upgrade, which smooths out inflation, while Kyber promised a new token model to be revealed in the next week.

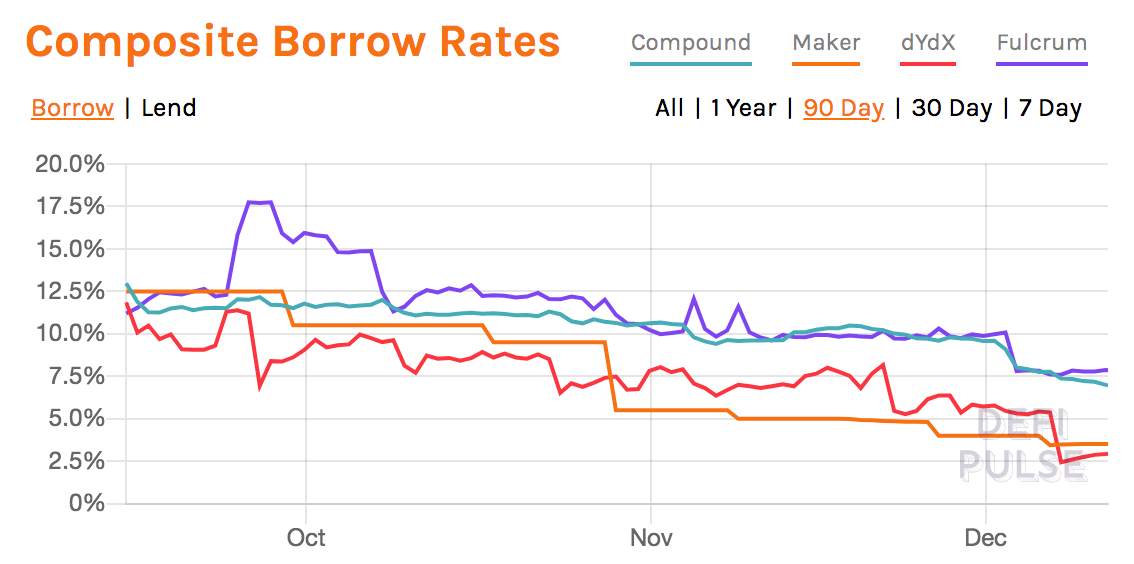

Chart of the Week: Interest rates decline

High deposit rates were considered a mainstream DeFi product, but lending rates have plummeted since the summer. Maker has consistently lowered the Dai stability fee over the last few months and the market followed. Low interest rate environment is good for traders but bad for the DeFi apps trying to compete with bank deposit rates.

Number of the Week: Web3 browser grows

That's the number of monthly active users of the privacy and crypto-first browser Brave. The number is small for browsers, but its seen as an easier on ramp for Web3 and DeFi DApps.

Tweet of the Week: Bonds on the Blockchain

New DeFi entrant Maple launched their SmartBonds protocol onto the Ethereum Mainnet last week. They announced on Twitter what they are calling the 'world's first crypto bond'. Maple aims to bring fixed-rate lending and allow hedging against changes in future interest rates.

Long Read of the Week: ZK Sync deep dive

ZK Syncs aims to address scalability and privacy concerns and are part of a growing trend of L2 solutions that may make their way to DeFi protocols. Alex Gluchowski at Matter Labs pens a technical but well-written piece on the proposed solution.

Odds and Ends

Coinbase Card adds Dai as its first stablecoin Link

New project, Echo, aims to "Bring DeFi to BTC" Link

tBTC creator submits proposal to create tZCash to be used in DeFi Link

imToken's TokenLon DEX expands to web app Link

DEX Loopring opens Golden Staking Window Link

The Block lists the best online data, tools and resources for crypto Link

Chainlink successfully deploys SNX price feeds to main net Link

Maker's security loophole highlighted by researcher Link

Thoughts and Prognostications

Libra: The opening act of a modern regulatory drama [American Banker]

DeFi in 10 Years [Bankless/Kain Warwick]

User-owned exchanges [Bancor]

ENS domains can solve Uniswap's restricted countries problem [eric.eth]

Cryptocurrency is most useful for breaking laws & social constructs [Jill Carlson]

Vertcoin's 51% attack - a case study for blockchain security [Deribit]

Stablecoins in 2019 [Outlier]

Listen of the Week: Tales from the Ethereum crypt

"It was a crisis. It was a reckoning for all of us.

At that time, Bitcoin was seen as the next payment later, but as the price crashed and the fallout from Mt. Gox. There was a reckoning. There was a collision between the OGs of Bitcoin, who were anarchistic, and the people who saw Bitcoin as the next payment layer.

I draw comparisons to that time (2015) and today. We haven’t had a Mt. Gox crisis, but we have had a reckoning. What are we trying to accomplish?”

MyCrypto CEO and MyEtherWallet co-founder Taylor Monahan goes on the Epicenter podcast to discuss the DAO hack, MEW, the ICO boom and bust and MyCrypto's DeFi plans. Taylor is personable, well-spoken and brings a fresh perspective to stale technical debates.