stETH Liquidation wall and the plethora of options protocols

Plus Odds & Ends and Thoughts & Prognostications

Check out my talk on the evolution off DAO sovereignty at the DAOist’s Global Governance Gathering in Amsterdam last month:

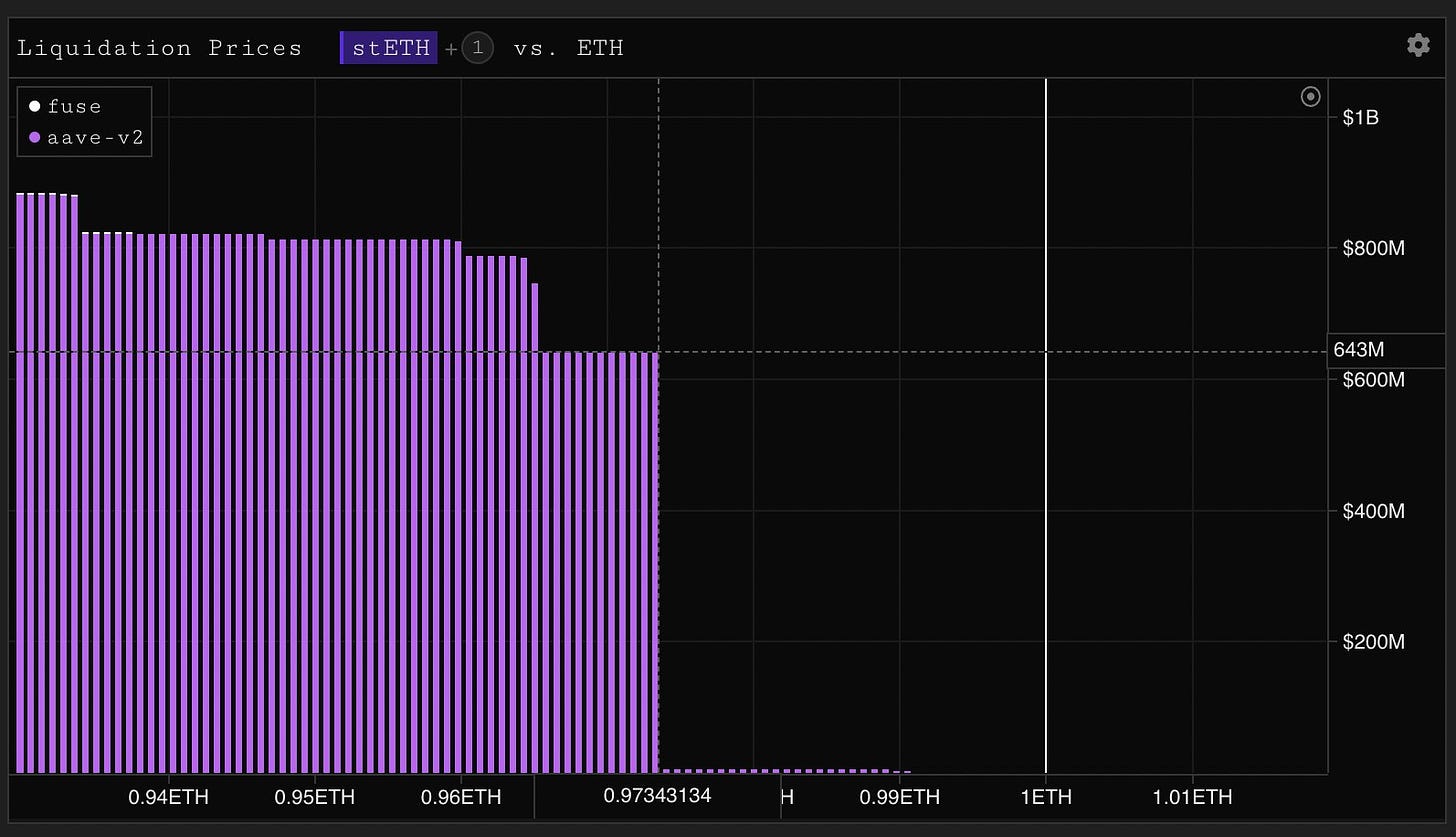

Chart of the week: stETH liquidation wall

A new chart (from a Tweet) from folks at Parsec that shows when liquidations would occur for the nearly $3.2bn in stETH deposited into Aave. The addition of stETH as collateral has been a boon for Aave, Lido and even Ethereum, which just passed 12m ETH staked (10% of total supply), but traders have enjoyed it the most. It’s an appealing position. Leverage on a yielding asset with high growth potential?

Like stablecoins, stETH must maintain a tight peg with deep liquidity with ETH, which it gets through a $4.5bn Curve ETH-stETH pool. But, as the chart above shows, the margin for error is thin. Even just a 3% deviation from the peg could lead to $600m of liquidations on Aave, which presumably the Curve pool can handle.

Tweet of the week: Searching for onchain degens

Just short and sweet from everyone’s favorite cartoon cat. Of course, options are instrumental to TradFi but no one has figured out how to make money underwriting them in DeFi (yet).

Odds and Ends

Fei Protocol governance discussion after $80m exploit in Rari Fuse pool Link

EU Commission features chapter on DeFi financial stability review Link

Why contracts deployed through Metamask showed inversebrah in the UI Link

Monetsupply proposes Dai enter the Curve wars Link

Early Coinbase employee critical of new NFT product Link

Solana experiences 7 hour outage over the weekend Link

Thoughts and Prognostications

In the Long Run, We Are All Dead: The Fate of Passive Retail Liquidity Provision in Uniswap v3 [semaji.eth]

Thoughts on VC optionality in a seemingly impending bear market [Regan Bozman/Lattice Fund]

Aurora: Another EVM Chain, or the Beginning of Near? [ceteris/Delphi Digital]

The BAYC Burn: Breaking Down the Otherside Gas War [Nate Maddrey & Kyle Waters/Coin Metrics]

Anatomy of a fund-raising (and the MKR capital raise) [Luca Prosperi/Dirt Roads]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn on a beautiful spring day that I was expecting in early April.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao* and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.