The CRV governance wars, plus MEV comes for liquidity providers

Along with this week's Odds & Ends and Thoughts & Prognostications

Tweet of the Week: Emergencies, bribes and rugs

Tweet from Curve Finance early this morning that it was cutting off CRV rewards to a pool with USDM, a stablecoin from the project Mochi that is backed by NFTs and other long-tail assets. The allegations against Mochi have come from all corners (and former business partners), but the actions of the “emergency DAO” highlight how CRV governance has become the main source of drama in DeFi. The friction comes from the design of Curve’s governance system, which exists to distribute CRV rewards to whichever pool gets the most votes. Yearn and Convex have played this game with the most intensity, using their role as a yield aggregator to also aggregate votes that direct more rewards to their pools of choice.

Convex had been working with Mochi to make USDM more liquid, but Mochi was taking advantage of that liquidity to trade to Dai, purchase more CVX and increase rewards further - creating fears of a rug pull on USDM and ultimately attracting the ire of Tetranode, who threatened to “smash [their] pool”.

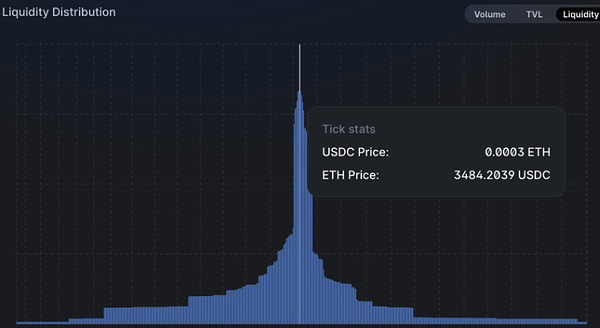

New stablecoins continue to pop up and almost all use Curve to build liquidity and help maintain a $1.00 peg. This makes Curve (and CRV holders) somewhat of a rainmaker in the stablecoin market. It’s unclear how long that will last, however, with Uniswap v3 offering the capital efficiency (without the CRV rewards), while Saddle Finance, which is built on the same math as Curve, just raised another $7.5m from Polychain and others.

The USDM/Mochi episode will raise questions about Curve governance, the role of the Emergency DAO and if they should still be considering getting rid of their permissioned list of contracts that can interact directly with Curve.

Chart of the week: Another MEV opportunity

Liberal with the usage of “chart” here, but great digging from Chainsight Analytica. It’s also a front-running attack, but instead of placing a trade before/after, a user sees an upcoming trade and then deposits liquidity to capture the fees. As some point out, this means that the traders get a better price. The losers are unsophisticated, passive liquidity providers who’s fees are getting crowded out by drive-by liquidity.

As DeFi matures and becomes more complex, another layer of best-execution products - both centralized and decentralized - will likely emerge to protect everyday users from the dangers of the Dark Forest.

Odds and Ends

MakerDAO implements no fee swaps between Dai, USDC & USDP Link

bZx post-mortem after $55m hack on Polygon, BSC Link

Gnosis proposes acquiring xDai, rebranding as Gnosis Chain Link

Congressional hearing next week on “Demystifying Digital Assets” Link

CoinDesk: $ENS soars after airdrop Link

Matter Labs raises $50m, led by a16z, for Layer 2 zkSync Link

Thoughts and Prognostications

Why Does DXdao* Use ENS and Why Is It Powerful? [Sky/DXdao]

CowSwap will increase the prevalence of off-chain orders [Supercycled]

Rocket Pool launches into Orbit [Chase Devens/Messari]

Ethereum Protocol Update - November 2021 [Trent Van Epps/Bankless]

Ethereum-powered ZK-Rollups: World Beaters [Canti]

The Perpetual SOL Rise [Dustin Teander/Messari]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, living the domesticated life. Congrats Jake!

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to DXdao* and benefit financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.