The decline of yield aggregators and the chance of crypto legislation this year

Plus Odds & Ends and Thoughts & Prognostications from the last week

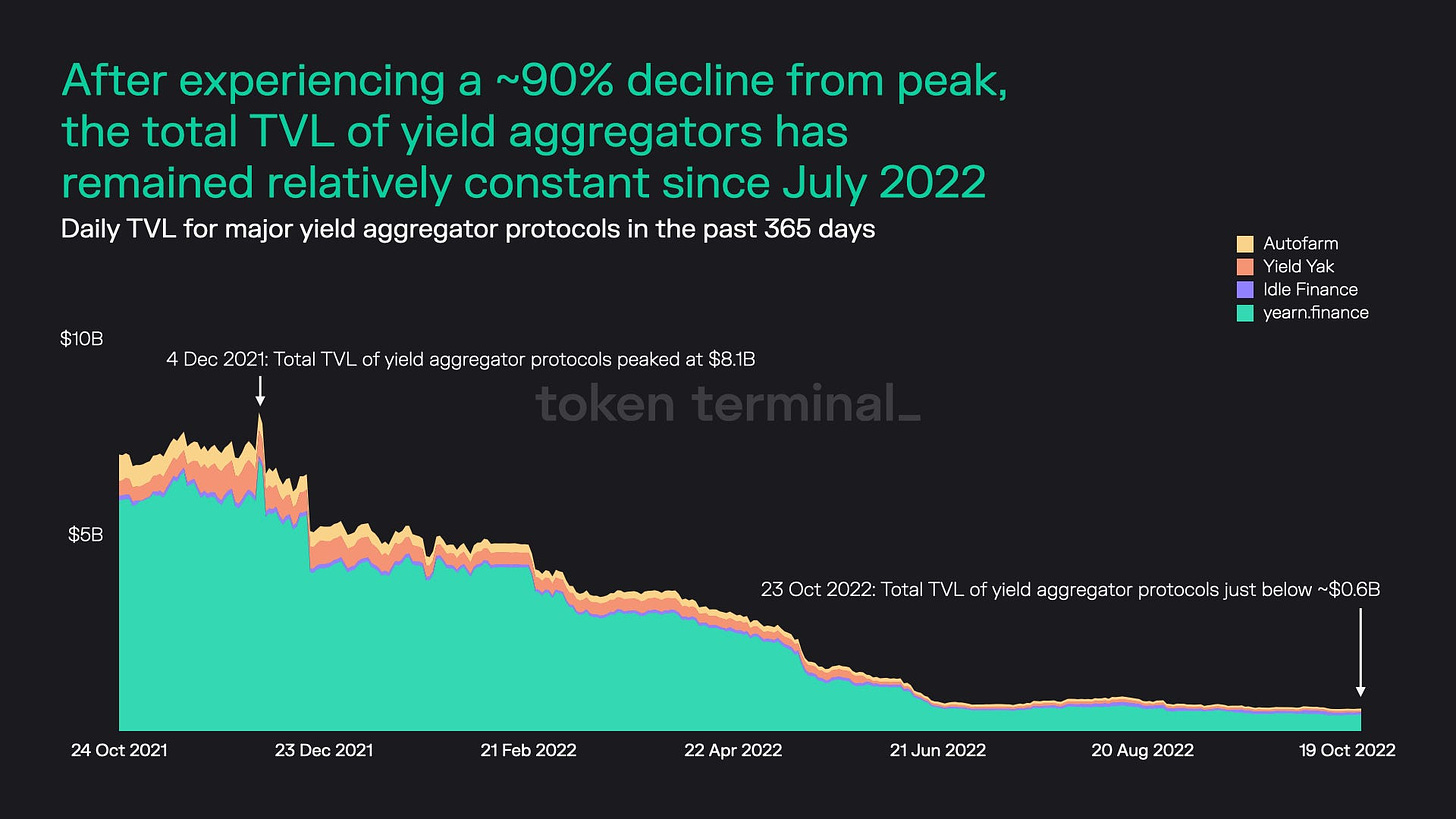

Chart of the week: Yield aggregator TVL

Token Terminal with an optimistic spin after a precipitous fall in TVL for all yield aggregators. Yes, declining crypto prices are partly responsible but the real culprit is the evaporation of yields due to declining token incentives. Yield aggregators were some of the most exciting DeFi projects when they came out - something that was only unlocked by the new tools of DeFi.

In the future, there will be automative ways for people to invest in DeFi, but it’s not clear they will look like the first wave of DeFi aggregators. Yearn has more than a 75% market share (and are revamping their tokenomics), but the question is who are going to be the long-term users of yield aggregators? Not DeFi power users chasing yield.

Tweet of the week: Will DCCPA pass?

Ron Hammond, Director of Government Relations at the Blockchain Association, puts the chances at 5-10%, which we think is still a bit high. The thread dives further into the political machinations going on in the background - although notably doesn’t mention Joe Biden’s 2nd largest political donor Sam Bankman-Fried.

The reason we say lower than 5-10% is that it only counts for the stars aligning in Washington, assuming that a bill of this magnitude would not lead to a gigantic media blitz that would slow it down and no longer make it an “easy win” to be included in end-of-year rider legislation. That was how crypto was treated last time there was a big, bipartisan bill going through congress with the Infrastructure Bill in August 2021. But the crypto piece ended up being one of the last things negotiated in the entire bill because of the emerging legitimacy of crypto as a political force, both from the on-the-ground army of lobbyists in D.C. and in campaign donations.

We are still optimistic because crypto remains stubbornly bipartisan in Washington. Still, crypto has grown in importance (it’s not just stablecoins) and major crypto legislation in the US will not happen through some midnight deal. That makes it harder to enact but ultimately better as it allows for a broader public discussion.

Odds & Ends

Coinbase now offering 1.5% yield on the $5bn USDC in MakerDAO Link

Crytpo data offerings by the blockchains they cover Link

Practical guide into analyzing MEV in PoS era Link

Coinbase skeptical of proposed changes to ATOM’s monetary policy Link

Thoughts & Prognostications

The only crypto story you need [Matt Levine/Bloomberg]

RIP Liquidity Mining [Tapioca DAO]

The Crypto Winter of 2022 [Andre Cronje]

Exploring the impact of MEV relays [Jim McDonald/Attestant]

A deep dive into Sui Network [White Star Capital]

MEV = centralization = censorship [Anna George/Cowswap]

State of crosschain swaps: A practical review [Michelle Lai]

That’s it! Feedback appreciated. Just hit reply. Written in Nashville, where it’s been great to be back home with the family.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.