The Fed releases CBDC report (finally) and L2 gas consumption

Plus Odds & Ends and Thoughts & Prognostications

Tweet of the week: Fed’s CBDC report

A succinct, yet hot take from progressive Law professor Rohan Grey, on the highly anticipated Fed report on stablecoins, which was released on Thursday (after being promised last summer).

In short, the Fed recommends that a CBDC dollar be, “privacy-protected, intermediated, widely transferable, and identity-verified.” This means that individual users would not have an account with the Fed. Instead, intermediaries (banks?) will “offer services to individuals to manage their CBDC holdings and payments.”

This means the intermediaries would make the CBDC “identity-verified”, which makes us wonder how a CBDC with this design could also be “privacy-protected” and is likely why Mr. Grey is so upset with the report.

To us, the report misses the forest for the trees. As we’ve said before, the digital money revolution is not about faster payments, but the programmability of money. The report says that stablecoins are “outside the scope of this paper”, but that is where innovation in money will come from in the future. Stablecoins enable new credit markets that live on Ethereum and other blockchains, which are “widely transferable” by default.

At the end of the day, the Fed’s report is just that, a report. It admitted that it would not do anything without “clear support from the executive branch and from Congress”. Hopefully, when legislation finally arrives it will focus on the innovation that DeFi unlocks and not just faster payments.

Dose of DeFi rewind: Stablecoins, central banks and the new era of credit creation (June 2021) and The politics of stablecoin legislation in the US Congress (Nov 2021)

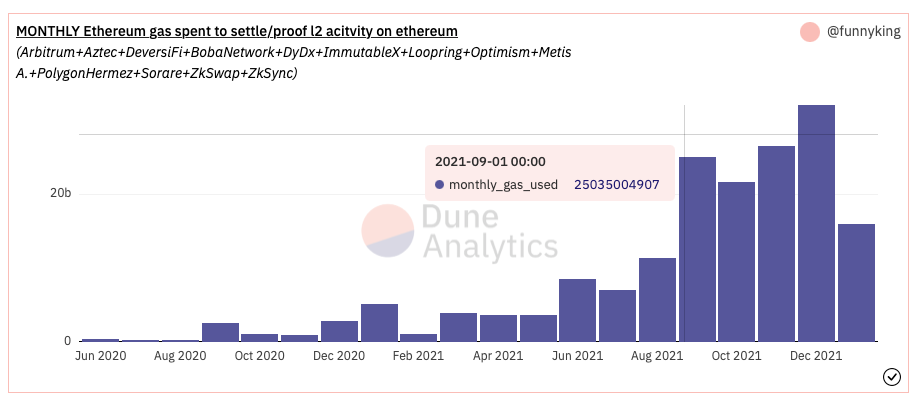

Chart of the week: L2’s gas expenditures

A Dune dashboard from @funnyking on how much mainnet gas Ethereum L2’s are spending. This grew steadily starting in the summer when Arbitrum, Optimism and other L2s went live. At the moment, the 20bn+ in gas from L2’s represents about 0.5-1% of all Ethereum gas. The % of gas paid by L2’s is a metric to monitor.

It can be deceiving though, because L2 designs are trying to optimize their networks to lose less gas (as Optimism announced this week). Transaction costs on Ethereum Layer 2’s are still too high. ETH transfers cost $2-5, making it difficult for L2s to compete with the ultra-cheap EVM chains.

L2s need more users and transactions, which will help decrease gas costs on Layer 2’s by spreading the L1 gas costs around.

Odds and Ends

USDC supply on Ethereum surpasses USDT Link

Nansen: # of active addresses by chain over last 30 days Link

OpenSea acquires Dharma Link

Flashbots transparency report Sept-Dec Link

A tool to calculate cross-chain arbitrage on Ethereum, Polygon & BSC Link

Kyber announces new CEO Link

0x ecosystem update Link

Resources to get started querying blockchain data with Dune Link

Thoughts and Prognostications

Dani’s vision: musings on ve(3,3) [The Knower]

Empirical Analysis of EIP-1559: Transaction Fees, Waiting Time, and Consensus Security [Liu, Lu, Nayak, etc.]

zkSNARKs vs zkSTARKs: a primer [pseudotheos]

Uniswap Q4 report [Jerry Sun/Messari]

OHM is battling in the war for decentralized liquidity [Jon Wu/Aztec]

A correct model of Olympus DAO [0xfbifemboy]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. ve(3,3) and Squeeth come from opposite ends of the DeFi spectrum, in culture and design.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to DXdao* and benefit financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.