Ahoy! Reporting back after a two month hiatus on a monumental day for DeFi and the crypto industry. I’m also firmly established now in Nashville, TN, but trying to maintain a presence on the crypto circuit. I’ll be in Colombia next month for Devcon, reach out if you’re around.

- Chris

Tweet of the week: The Merge’s narrative change

The biggest news of the day, week, year and decade in crypto, and the overarching feeling of the day was anti-climatic because nothing changed - except of course the massive reduction in Ethereum’s carbon footprint, ETH’s issuance and a new technical foundation for Ethereum to build on for the next decade.

The tweet above from Colorado Gov. Jared Polis praising the electricity consumption reduction is a harbinger for how Ethereum’s narrative will change in the eyes of the general public. It disarms blockchain critics’ favorite line of attack. In the long-run, the efficiency gain from not paying utility companies to secure Ethereum and the next generation of updates to make Ethereum more user-friendly may be the most important result of the merge, but in the hours after the historic upgrade, the rapid narrative shift is the most notable difference.

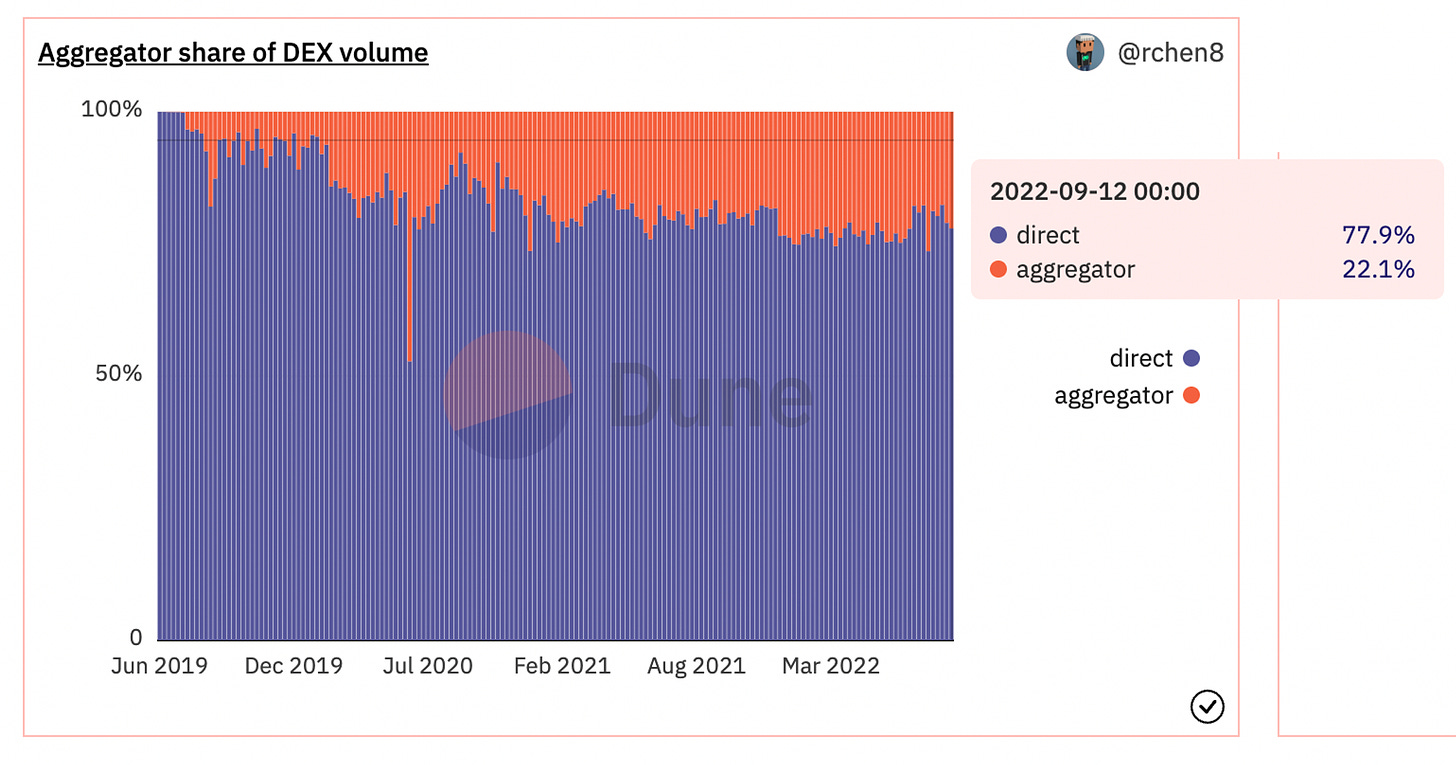

Chart of the week: DEX aggregators grow

One of several simple but great charts in a Dune dashboard created by 1confirmation’s Richard Chen. DEX aggregator % of overall DEX volume is a great metric to check in on during the dark doldrums of the bear market. By and large, aggregators have failed to meet expectations. Aggregators were a Web 2.0 staple but their uptake has been slower in DeFi. Most of this can be attributed to the runaway success of Uniswap, or more specifically app.uniswap.org, which is the most popular DeFi front-end.

The Dune dashboard also features great charts on the bridge and NFT aggregator market as well as the overall market share for DEXs, bridges and NFT exchanges.

Listen of the week: Sen. Toomey gets it

Retiring Senator Pat Toomey stopped by the Odd Lots podcast for one of the best conversations I’ve heard on crypto regulation. Sen. Toomey has been following crypto for several years but also speaks from the perspective of a lawmaker with a deep experience in traditional financial regulation. In terms of the overall political appetite in Washington, Sen. Toomey said the focus is on stablecoins, and he expects some legislation by the end of the year (something we said almost a year ago).

Today, Senator Toomey also grilled SEC Chair Gary Gensler in a congressional hearing over the lack of clarity from the SEC in regards to crypto. In particular, Chair Gensler was unable to comprehend that there may be other projects like Bitcoin that are not securities because the project is decentralized.

Sen. Toomey’s time in office will come to a close in January, but it will be interesting to see what he does until then (and after).

Odds and Ends

A list of MEV research and other resources Link

Frax launches its own borrowing market Link

MakerDAO's annualized fees drop to lowest level since Sep. 2020 Link

Notional announces leveraged vaults with fixed rates Link

What crvUSD might look like Link

Compound Treasury begins offering borrowing Link

Thoughts and Prognostications

Ethereum’s Successful Entry into the post-Merge Era [CoinMetrics]

Gary Gensler wants to regulate crypto [Matt Levine/Bloomberg]

Tribes & Endgames: DAOs stretching themselves [Luca Prosperi/Dirt Roads]

Finding a home for labs (examining different DeFi ecosystems) [Delphi Digital]

Post-Merge MEV: Modelling validator returns [pintail]

ve Gauges won’t fix tokenomics woes [Gabe Pol-Zaretsky/Gauntlet]

2022 Mid-year sandwich report [Eigenphi]

Bring back the fee escalator [Stephane Gosselin/Flashbots]

That’s it! Feedback appreciated. Just hit reply. Written in Nashville, where there is a slight chill in the air.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.