Token-economics is baaaack, Bancor's new strategy

The Dark Force Rises

Token or crypto-economics were one of the most painful parts of the 2017 ICO boom. For the uninitiated, token economics is the mix of cryptography, economics, computer science, game theory and whatever else may sound cool on a brochure.

It’s not that it's not important – Bitcoin showed that – but without a rich data set of blockchains to study, the wheat could not be separated from the chaff. ‘Token-economic’ ideas proliferated, not to build a functioning decentralized network, but to sell tokens.

But like the promised tokenization craze of 2017 that is now materializing on the lending side with cDai & cUSDC, token economics is emerging as a serious strategy for attracting liquidity and building a community. On Monday, Bancor announced a plan to airdrop all of its treasury’s ETH. Here’s the Defiant with more:

The decentralized liquidity network plans to airdrop all of BNT’s ether reserve to BNT holders, according to a Bancor statement shared exclusively with The Defiant. It will also allow token inflation so that network participants can be rewarded with BNT, the statement said. BNT, or Bancor’s network token, is used as a reserve token to facilitate exchanging other tokens listed in the network.

Technically, they’re not airdropping ETH to users – but I’m sure they’ll be hundreds of Twitter scams claiming otherwise. Decrypt does its best to put it in layman’s terms:

To encourage greater liquidity, Bancor recently released provisions allowing anybody to “stake” their own tokens in these reserves. Doing so grants them a “relay token,” which entitles them to a) small fees extracted from each trade in the relevant pool, and b) the ability to withdraw the funds deposited, with interest. As Bancor communications director Nate Hindman puts it, this allows the individual user to “become the exchange.”

How does this relate to the airdrop? Simple. Sort of. Anybody who holds BNT will soon receive a stake in the BNT-ETH liquidity pool—one of the largest—proportionate to how much BNT they hold at the time of the airdrop.

Liqduidity, liquidity, liquidity Decentralized exchanges are like any other exchange: they live and die off of liquidity. Bancor was the first project to launch the liquidity pool exchange model that Uniswap later replicated, but without a token.

Unlike a traditional exchange that must bootstrap liquidity through relationships with large investors and OTC desks, Uniswap and Bancor are designed so small investors can profit from being a liquidity provider (#DeFi). Yes, a lot of cryptoassets will be deposited on Compound or staked on PoS networks, but there’s an opportunity to put those idle tokens to work exchanging assets in a trustless way – cDai, for instance.

Of course, they’ll need to be rewarded for providing the service, especially if the exchanges want to scale to the billions of dollars. The challenge is figuring out the token and revenue model. Liquidity providers typically can get a clean profit/loss from the trades, but in a liquidity pool model, it’s unclear how profitable those trades are.

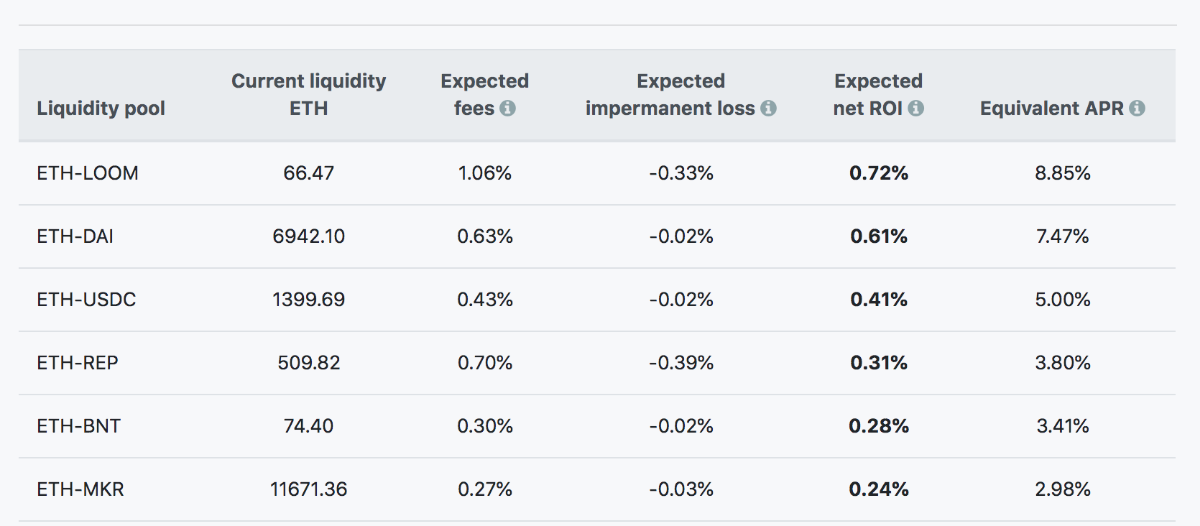

This helpful tool calculates the ROI from participating in different liquidity pools on Uniswap. Here are the most profitable pools currently:

The table is confusing, and it's not clear how “return” is calculated given the transaction-based profit model for Uniswap liquidity providers (Uniswap does not take any fee for the protocol). Regardless, the returns for liquidity providers are anemic. Everyone is talking about the 10% Dai rates on Compound. No one is talking about the 0.72% you can get in the ETH-Loom liquidity pool on Uniswap.

Bancor may have seen the successful token-economic strategies of Synthetix, which is third in total value locked (TVL) according to DeFiPulse. Synthetix is a decentralized exchange that allows anyone to create ‘synths’ or synthetic assets, like sETH or sUSD.

In order to increase the usage of its exchange, it started a program to incentivize liquidity pools on Uniswap. Any wallet address that deposited in the sETH-ETH Uniswap pool would receive a portion of the weekly inflation of the exchange’s native token, SNX.

Inflation to the Rescue. So it’s no surprise that Bancor also announced plans to ‘upgrade’ its BNT token to an inflation token, with an annual percentage to be voted upon by BNT holders. Inflation is anathema to the Bitcoin community, but its mining rewards are still almost entirely based on inflation.

Crypto-economics = go-to market strategy? User-acquisition subsidies have been foundational to the Silicon Valley playbook for the last 10 years. EOS, Stellar, MakerDAO have all used Coinbase Earn to pay its users to watch videos and answer questions about their projects. But, what Bancor and Synthetix demonstrate, is that crypto networks will not only have to subsidize user acquisition, but also user behavior that optimizes network growth and profitability.

Number of the Week: USDC Fund

That's the total amount that Coinbase announced it would invest in DeFi protocols through a new USDC Bootstrap Fund. Rather than investing directly into companies, Coinbase is seeding liquidity on platforms that utilize the USDC stablecoin. Compound and dYdX will both receive $1m USDC deposited on their protocols. While attracting small liquidity providers is important, there's nothing that can compete with large institutions. Other stablecoin providers may follow suit.

Tweet of the Week: Wallet Business Models

Tony Sheng asks a simple question that no one has answered yet: how to make money from a wallet? Chinese-based wallet imToken has probably done the best, but the tweet thread discusses the best strategies towards profitability that's relevant for all consumer-facing DeFi ideas.

Listen of the Week: The Immaculate ICO

Teo Leibowitz of The Block stops by the Into the Ether podcast to talk all things Ethereum. The well-known ETH bull discusses inflation, ETH2.0, Ethereum competitors and why he prefers Open Finance to DeFi.

Odds and Ends

UMA's Synthetic Token Builder launches on Rinkeby test net Link

ETHBoston project submissions Link

Nasdaq to list 'DeFi Index' but it's weird Link

Analysis of MakerDAO CDP liquidations Link

dYdX launches native ETH-Dai market with limit orders Link

Set Protocol's total value locked jumps 60% in 48 hours Link

7 Things you probably didn't know about China's Digital Currency Link

Thoughts and Prognostications

The Yield Protocol: On-Chain Lending With Interest Rate Discovery [Paradigm] Link

Synthetic Assets in DeFi: Use Cases & Opportunities [Zenith] Link

The History of Fintech in Nigeria [future.africa] Link

Ethereum is a world accounting system [a16z/Jesse Walden] Link

The Future of Proof-of-Stake [Chorus One] Link

The Evolution of Dharma 2017-present [Dharma Blog] Link

Information Asymmetry in Crypto [Jonathan Joseph] Link

Long Read of the Week: Next Hack Will Go After Oracles

"Smart contracts are not competitive because they can't be made private, which is a deal-breaker for many contract types. This privacy dynamic is like the only reason enterprise blockchains even exist.

And if we can get the public blockchain systems with their better security and better usability to have the privacy check box checked, we can go to a new level of adoption of public networks."

The Defiant's Camila Russo interviews Sergey Nazarov, CEO of Chainlink, an oracle provider. Nazarov has a sharp feel of obstacles in today's climate and thinks that tying private transactions to trusted oracles will solve some of blockchain's biggest headaches.

Last Week's Top 5 Most Clicked Links

[Tweet of the Week] Compound security features analyzed Link

[Tony Sheng] Five talks from the a16z crypto summit Link

[Fred Wilson] Some thoughts on crypto Link

[Listen of the Week] Vitalik on Ethereum and Beyond Link

[Tie] Gnosis Safe/Dapper Wallet