Ukraine's crypto donations and Biden's executive order

Mainstream events are now driving the crypto conversation

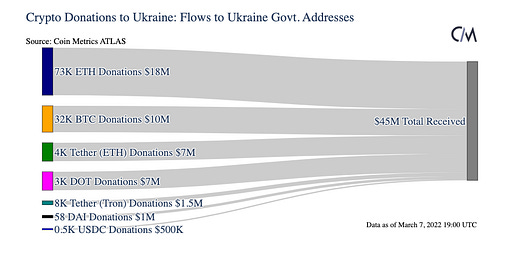

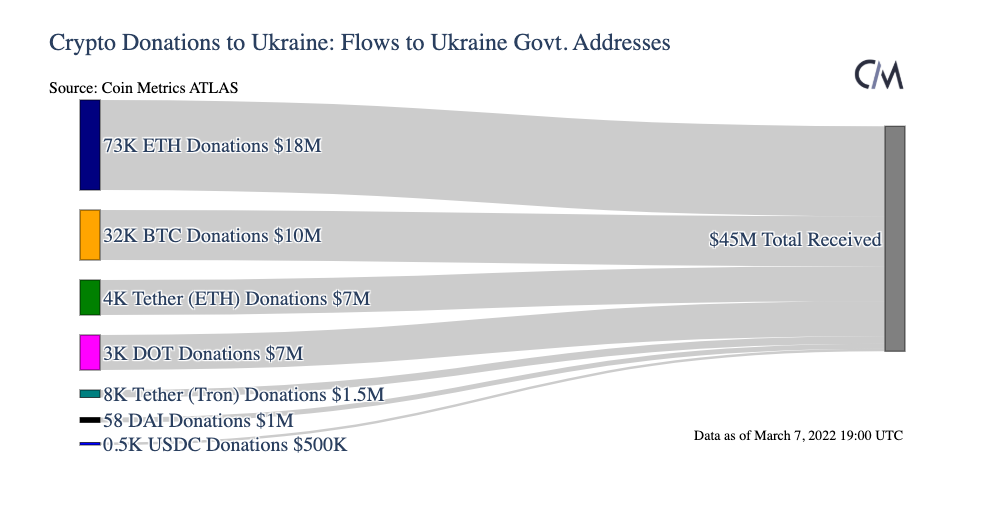

Chart of the week: Ukraine’s crypto fundraising

Very cool chart from the folks at Coin Metrics, which analyzed the on-chain activity across crypto donations ($50m+) that flowed to the Ukrainian government to help it fend off Russia’s invasion. The post goes on to examine what happened to the funds after they were received - selling some BTC, ETH and DOT (and TRON!) through the Ukrainian exchange Kuna, while some vendors have been willing to accept crypto directly.

It’s now clear that all major geopolitical events will now have some “crypto angle” as it becomes a tool for those to avoid repression as well as a potential bogeyman that could enable sanctions avoidance. For now, it seems the financial sanctions on Russia are demonstrating to regulators and politicians that crypto is not used to evade sanctions. It was easier to criticize a hypothetical world where blockchains enabled bad actors, but in an actual major crisis, it’s clear that’s not the reality.

The sanctions on Russia’s central bank are also a societal-wide learning opportunity on the age old question of “What is money and why is it valuable?” That education red pills swaths of society into cryptocurrencies and decentralized financial infrastructure.

Tweet of the week: D.C. warms up to crypto

The Biden Administration released a long-awaited Executive Order that aims to address wide swaths of the cryptocurrency space. Messari’s Ryan Selkis, Circle’s Jeremy Allaire and Coin Center’s Jerry Brito all had positive things to say after the reports release.

The EO lacks specifics but essentially tasks major governmental agencies to draft reports in the next 180 days. These will focus on:

Risks & benefits of a CBDC

Consumer Protection

Benefits of hosting new financial technology in the US

Money laundering concerns

Effects on Climate Change

Systemic financial risk

“CBDC” appears 34 times in the EO, compared to 6 for “stablecoins” but it did not come out in favor of a CBDC, but promised to research it. In the end, we expect stablecoin regulation to be the most significant piece of the puzzle.

Long-time Dose of DeFi readers will know that we’ve been bullish on the political prospects of crypto’s regulation. From December’s “The politics of stablecoin legislation in the US Congress”:

With [a gridlocked DC], it’s unsurprising that many industry observers are skeptical of the realization of stablecoin legislation. Yet such cynicism assumes that those in Washington are actively trying to get nothing done, versus the reality, which is that every single issue these days is a political lightning rod.

But crypto cuts across party lines like no other issue. Most importantly, it’s a new issue, so it doesn’t have any political baggage, which means politicians are free to stake out positions independent of the next election cycle.

Also check out: The Fed releases CBDC report and Stablecoins, central banks and the new era of credit creation

Odds & Ends

DXdao* month in review Link

The Verge: Doing shots with true believers at Ethereum’s biggest party Link

Evmos ecosystem projects list thread Link

Polychain and Arca propose Anchor yield reductions Link

NYTimes: Reality Intrudes on a Utopian Crypto Vision Link

Thoughts & Prognostications

Yield farming: A thread [Jump Crypto]

Yearn: Behind the yield [Storm Blessed 0x]

Implications of enabling fee switch on Uniswap [Juan Pellicer/Into The Block]

FRAX controls its stack [Duncan Reucassel/Delphi]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where I’m told it’s March. Macros….DeFi…which is more interesting?

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to DXdao* and benefit financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.