DeFi activity has rocketed over the last two months. While it’s easy to give all the credit to the yield farming craze, Uniswap, which doesn’t even have a token, has grown as fast as any protocol with usage heavily subsidized by yield farming.

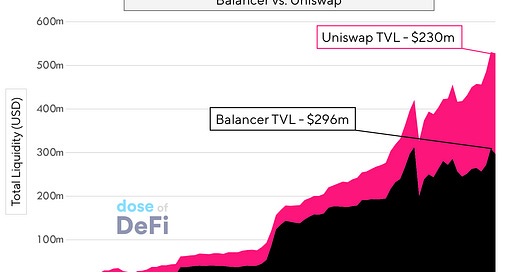

Outside of Compound, Balancer has been the most prolific agricultural producer, dishing out 145k a week of its BAL token ($3m) to liquidity providers (LPs) based upon trade volume of white-listed tokens through LP’s pools. It has been successful - as has BAL, but Uniswap v2 has managed to attract almost as much liquidity as Balancer without an incentive program.

Uniswap v2 launched about the same time as Balancer, but Uniswap was able to migrate liquidity from v1 and add more. While Balancer specializes in adjustable pools, Uniswap succeeds because of its simplicity, and Uniswap has emerged as the dominant decentralized exchange by trading volume (so far).

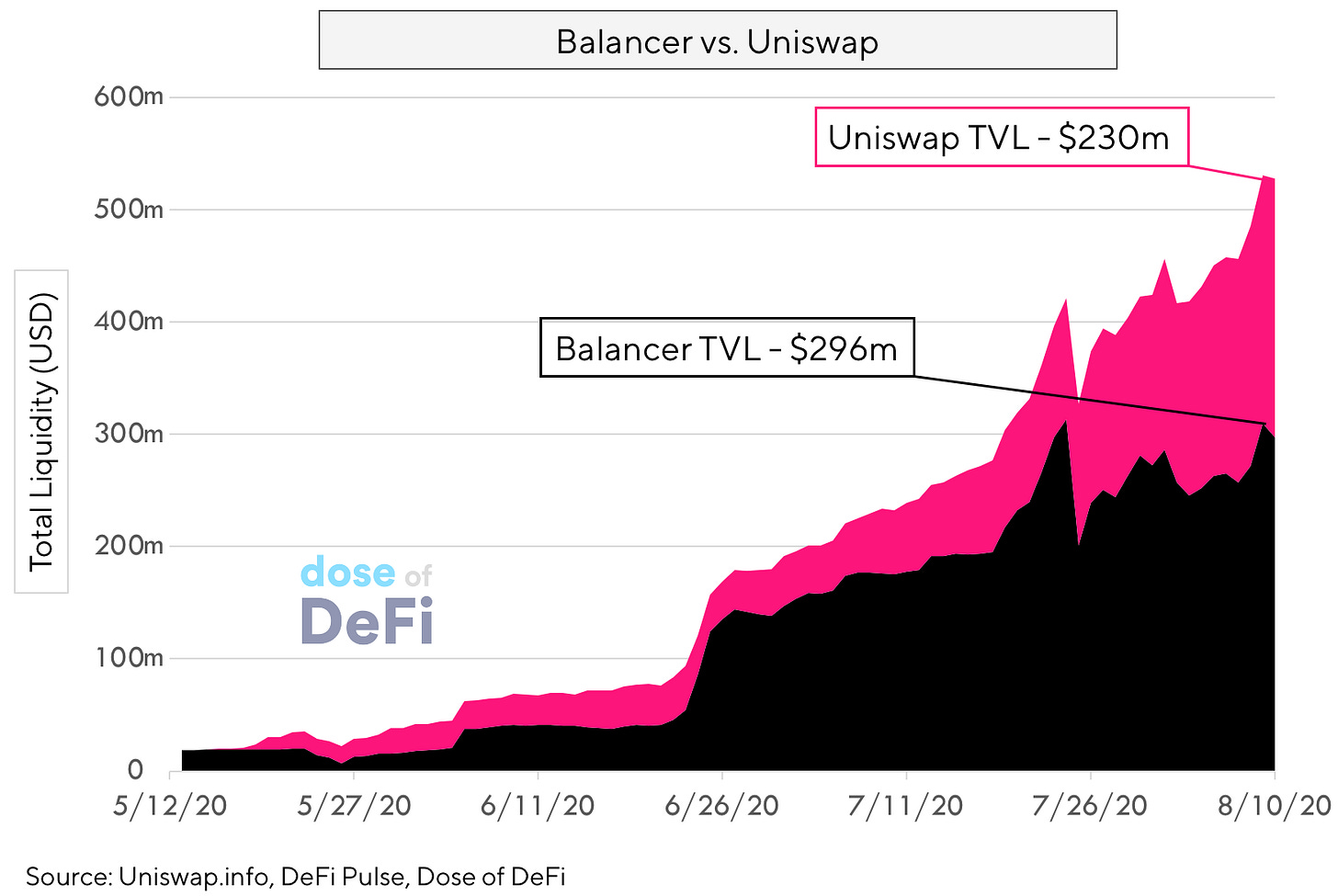

Balancer’s volume is still impressive after launching just three months ago, while dYdX has exploded in volume in the last few weeks too, but Uniswap sits comfortably above of all of them. As projects opt for a Uniswap listing soon after launching a token, initial liquidity builds there rather than on centralized exchanges.

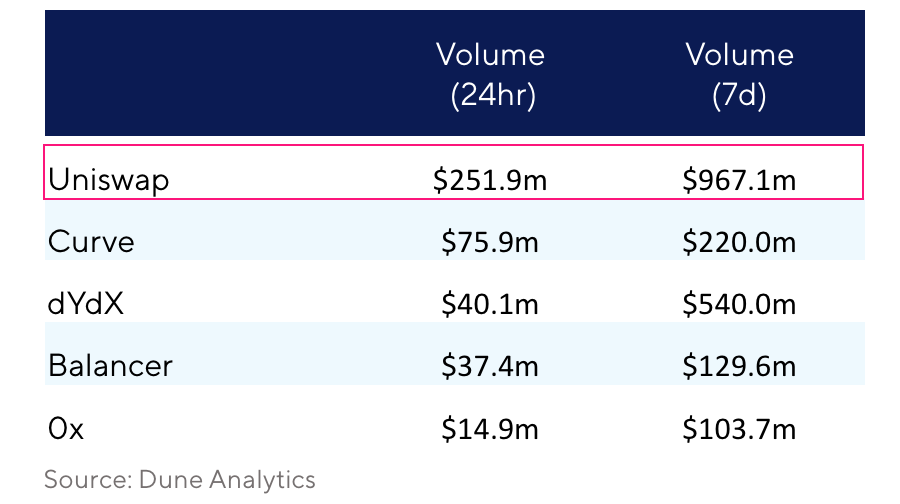

Top Uniswap trading pairs

While centralized trading is moving away from BTC as a base pair and toward stablecoins as the reserve currency, trading on Uniswap is moving in the opposite direction, with ETH as part of every one of the top 10 trade pairs. It does have good volume with ETH/stablecoin trades, but that’s only a fraction of their overall volume. It’s also hard for Uniswap to compete with Curve, so it’s no surprise there are no stablecoin-to-stablecoin swaps in the top 10.

ETH is the base currency for DeFi - in large part because it’s the most popular source of collateral and most traded asset. That is a closer connection than the tenuous relationship between BTC & alts in 2017, so it could have significant volume for the foreseeable. Uniswap has become the simplest place to provide an ETH pair for the long-tail of tokens.

It has a huge share of the volume for newly launched tokens’ ETH pairs and gives it a liquidity moat as those tokens grow and distribute further.

Uniswap deposits (or liquidity)

Deposits flow downstream of trading preferences, as most liquidity providers are not using Uniswap for asset management as they might Balancer or Set (or maybe?). As all platforms in DeFi, ETH dominates and still has roughly half of deposits in Uniswap, despite the v2 upgrade opening up pools to any two asset combination. The rest of the largest liquidity sources are stablecoins and the latest/hottest tokens (AMPL, MTA, LINK, ANT), underscoring Uniswap’s product market fit: a permissionless on and off ramp for new tokens to ETH and stablecoins. Also interesting ETH’s 24hr volume is twice the ETH pool’s size.

Uniswap Raises $11m in Series A

The news flew under the radar until devops199fan sniped it from an SEC form filed on June 19 and was later confirmed by Hayden in a blog post, with a slate of prominent investors - Paradigm, which previously invested in Uniswap’s seed round, along with A16Z, USV, Version One, Parafi Capital, Variant, SV Angel and A. Capital.

Amidst the current token frenzy for COMP and BAL - both of which launched by teams with heavy VC investment, it’s hard to imagine this fundraising round without plans to launch a UNI token, and presumably, another token distribution campaign through liquidity mining.

The funds will go towards developing Uniswap v3. Uniswap is ahead in the volume game, but Balancer’s design enables more flexibility long-term and there are other competitors, like Bancor v2 and Thorchain, but Hayden says that v3 “fixes everything”

Uniswap’s positioning

Uniswap is seen by most as a simple protocol to exchange tokens. It is this, of course, but it has never gotten the credit it deserves for it’s simplistic trading interface. Nothing could be a sharper contrast between the order book interface on a centralized exchange versus the simplistic swap on Uniswap. It doesn’t have the flashing lights of Robinhood, but it has paired back the trading interface to its bare bones. Uniswap.exchange is easy to trade on, so the Uniswap protocol has a lot of liquidity.

The UI ensures good retail flow and also why its a popular place for new tokens to list and gain distribution, but Uniswap is also attractive to power users because it has lower gas costs than its competitors.

If not from traders, competition to Uniswap will come for liquidity providers and fears over impermanent loss. There isn’t a whole lot of data yet, but Uniswap may not be the most capital efficient place for an investor to park funds. As investors turn bullish, they may move away from Uniswap because the 50/50 split dampens returns for a high-growth token.

The most underrated player in Uniswap are the bots that keep the market efficient; they are the ones who are taking the gains from impermanent loss. 1inch founder Anton Bukov claimed that arbitrage bots are earning higher fees than LP providers.

Most price discovery still occurs on centralized exchanges, so when there is a big move in say ETH-USDT on Binance downwards, the ETH in the ETH-USDT pool on Uniswap is now overvalued and arbitrage bots will sell ETH into the pool to make the prices the same.

Tweet of the week: It’s happening…?

Joe Weisenthal, the dean of finance Twitter, with the first signs of going mainstream:

Joe was rightfully castigated and asked to identify any “non-speculative applications” for traditional finance, as that’s kind of the name of the game.

Even though this bodes well for wider meme adoption, it is quite a shift to go from the intricacies of yield farming optimization to explaining DeFi to newbies, but mainstream flows will go to where narratives are easiest to understand. Products will need to find the “adjacent possible” to get people to make the plunge.

Crypto dollars, as I told myself I will call stablecoins, are easy to understand by a non techie (like Venmo), and now offer interesting functionality that could be appealing to the crypto curious.

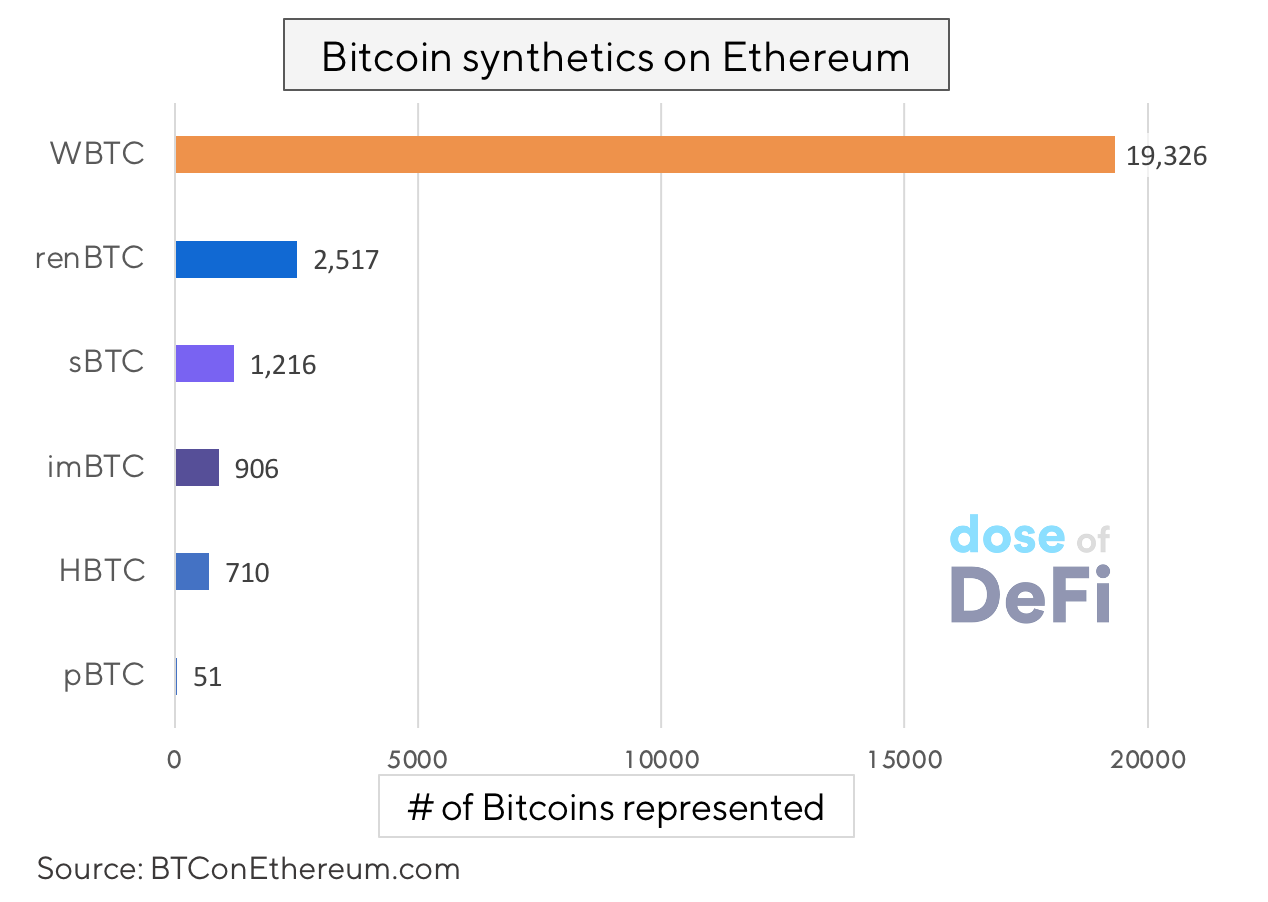

Chart of the week: BTC on ETH

Amidst the BTC vs. ETH debate, BTC on ETH continues to grow - stats above provided by BTConEthereum.com. WBTC has grown 10x in a few months and now manages more than $225m worth of BITC; almost half of which is going into MakerDAO, where it backs 14% of Dai. RenBTC is the easiest, trustless way to move onto Ethereum and have transacted more than $125m through the RenVM. And sBTC showing how Synthetix can compete in one of DeFi’s most promising markets.

Odds and Ends

1inch announces new AMM - Mooniswap Link

Curve Showcases Pre-Launch CRV Rewards for Liquidity Mining Link

Reflexer Labs, which aims to build decentralized stable collateral, announced fundraising round Link

yDai launches as first product from Yield Protocol Link

Introducing Set v2 Link

IDEX announces $2.5m funding round ahead of IDEX2.0 launch Link

APY.Finance aims to be “Wealthfront for DeFi” Link

Thoughts and Prognostications

8 things stopping CeFi from integrating DeFi [Calvin Liu/Bankless]

Synthetix soars but the demand side is conspicuously absent [Matteo Leibowitz/The Block]

What we look for: the 9 core value propositions of crypto networks [Jake Brukhman/Coin Fund]

Udi on BTC vs. ETH [Udi/Twitter]

New YFI Token Economic Model [yearn.governance]

Balancer – The Automated Market Maker Protocol for Programmable Liquidity [Fernando Martinelli/Epicenter.tv]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where it hasn’t felt like August. Hype rising.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.