Uniswap v3 and leverage, data on Ethereum gas usage

Plus Odds and Ends & Thoughts and Prognostications

No post this week, but last week’s “DeFi: The Liquidity Revolution” can be read in a new light after Uniswap v3’s announcement.

Tweet of the Week: Uniswap v3

Uniswap v3 was announced Tuesday and it has dominated the conversation since. Dragonfly’s Hasseb Qureshi has a reaction thread, while Hayden explains why v3 is the “only possible solution” to impermanent loss and Mikko Ohtang claims v3 is the ‘end of Automatic Market Making’.

The tweet above, meanwhile, is Hayden’s response to Hasu’s tweet about whether Uniswap v3 makes leverage yield-farm platform, AlphaHomora, obsolete. Hayden’s explanation shows how ‘concentrated liquidity’ accomplishes something similar to leverage.

When v3 was released, the immediate reaction was that it would threaten Curve’s dominance of stable swaps. They will definitely compete, but the bigger question is how the DeFi market structure will shift with such a drastic change at the base liquidity layer. It’s not just AlphaHomora; most DeFi projects have done some liquidity mining campaign on Uniswap/Sushiswap, but how will those liquidity mining campaigns work with v3? And what about projects (like AlphaHomora) that have built products on this market structure?

DeFi created a new market structure, different from traditional finance, and Uniswap v3 may do the same. “Liquidity managers”, or products that dynamically adjust Uniswap price range adjustments in bulk, are likely to be a new wave of DeFi projects.

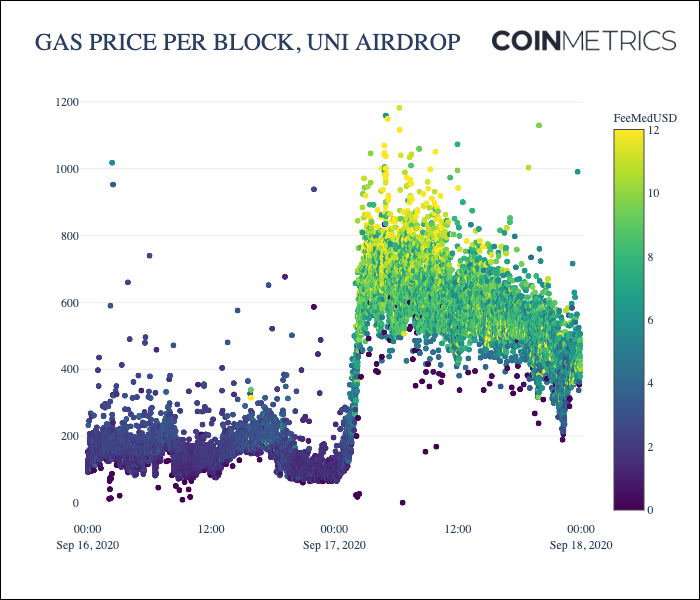

Chart of the Week: Gas after UNI airdrop

A colorful looking chart in CoinMetrics’ Ethereum Gas Report, which chronicles the surge in gas prices over the last year and how EIP 1559 will change the landscape. The chart looks at the average gas per block immediately after the UNI airdrop in September. It’s nice to see CoinMetrics expand their Ethereum coverage and lots of good info in the report, such as the clear decline in average gas per transaction over the last 3 months, as users shy away from more complex (and thus more gas intensive) transactions.

Odds and Ends:

Balancer teams up with Gauntlet to build dynamic fees for Balancer V2 Link

zkSync aims to have zkEVM, a L2 solution, launched on mainnet in August Link

CoinTelegraph: The ‘simposium’ eGirls storming crypto venture capital Link

Decrypt: Sushi faces an $880m dilemma over vested SUSHI Link

New lending protocol Liquity raises $6m, announces April 5 launch Link

Coindesk: EOS Loses Its ‘Largest’ DeFi Project to Binance Smart Chain Link

Bloomberg: Insurers come to crypto, promising 50% returns Link

Thoughts and Prognostications:

Can Decentralized Stablecoins Stabilize? [JP Koning/Coindesk]

Alchemix explainer and bull case [0xRafi/Heat Capital]

How to assess new community building hires for token networks [pet3rpan/1kx]

Ethereum L2 vs Lightning Network and a ‘lost bet’ [Eric Wall/Arcane Assets]

Ultra Sound Money [David Hoffman/Bankless]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn; sunshine in the evening but still a bit nippy. Looking closely for the first signs of spring in Brooklyn.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao. All content is for informational purposes and is not intended as investment advice.