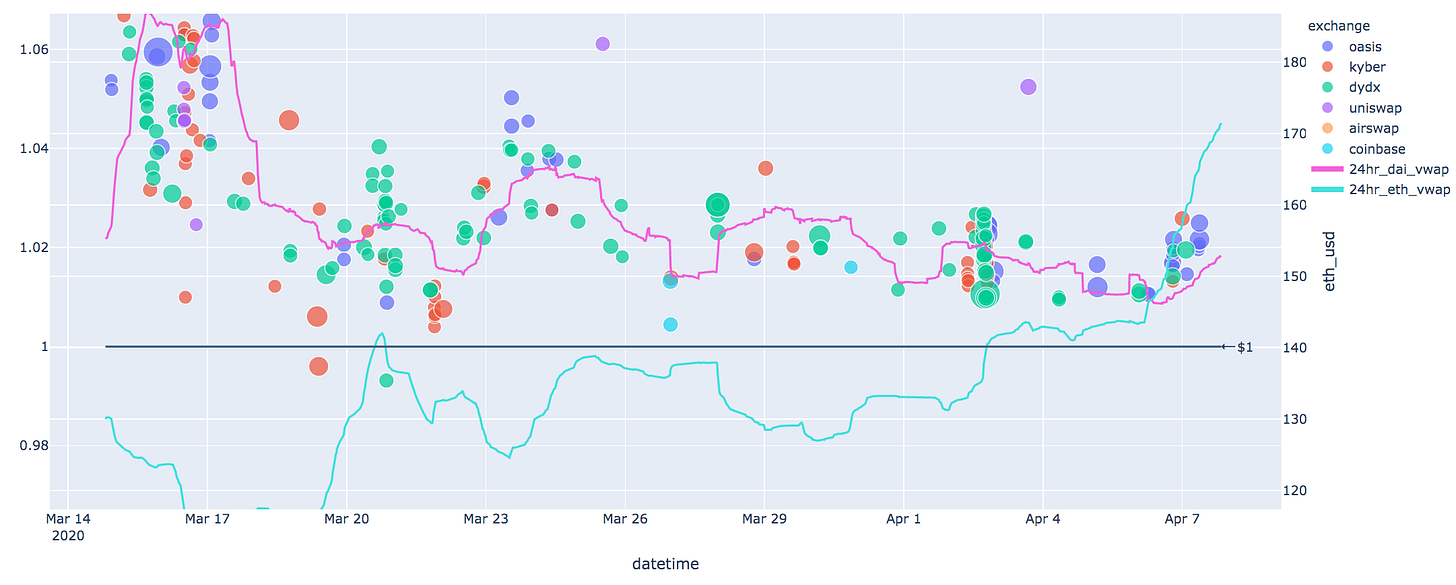

It’s been just over a month since Black Thursday, four weeks since the addition of USDC collateral and almost three weeks since MKR flop auctions recollateralized MakerDAO, but still Dai is trading at $1.02 and consistently above its $1 peg:

This excellent chart is from Vishesh (more at dai.descipher.io). The pink line is the price of Dai from Mar 14 - Apr 8, while the teal line is the price of ETH over the same time period. The circles represent at least $50k Dai-ETH trades on a DEX.

It doesn’t take a data scientist to see the negative correlation between the price of ETH and the price of Dai. When the price of ETH goes up, the price of Dai goes down and vice versa. Intuitively, this makes sense because Dai is primarily used as a leverage vehicle for ETH.

When people are bullish on ETH, they deposit ETH, mint Dai and use that to purchase ETH. You can see this correlation held true until April 6, when the price of ETH rose, but so did the price of Dai, a troubling sign that traders looking to lever up are not opening a vault and printing Dai.

That appears to be because there is less leverage in DeFi right now, and therefore diminished demand for Dai.

Dai is a debt instrument and there is decreased demand for debt, so it can’t maintain its peg.

This seems like a plausible story, but the longer that premium exists, the more it gets priced into traders’ expectations. Recent trade volume may be from speculation on the price of Dai.

Wanted: more collateral

While the community is clamoring for more action to restore the peg, the Maker Governance and Risk team has been cautious, hoping that the peg will gradually be restored through market forces. There are currently executive votes in the Maker governance que to raise both the USDC and Dai stability fee. Both of these were lowered to help restore the peg.

The solution Maker has settled on appears to be adding new collateral because it will increase the market for Dai loans. PAX Gold, TUSD and Uniswap Collateral tokens are all mentioned as a possibility. This fits into Maker’s long-term vision of Multi-Collateral Dai with real-world assets, but it doesn’t do much to change the demand for leverage now.

The concern for Maker is traders are going elsewhere for leverage. Some users may be hesitant to use Maker after some vaults had 100% of their collateral wiped out. Why use Maker, when Compound has the same Dai borrowing rate (presumably) with less risk of collateral loss?

More concerning is if users are opting for a different stablecoin entirely. While Dai’s circulating supply has shrunk, nearly every other stablecoin had one of its best months ever in March (USDC grew by 40%).

Dai has a level of penetration unmatched in DeFi. As a source of leverage, it was a necessity for decentralized exchanges and lending protocols, but if other platforms or stablecoins offer better liquidity and stability, Maker will need to find another market niche if it hopes to retain its DeFi premium.

Related: Stefan Ionescu published an ambitious new proposal for a new stablecoin that’s not pegged to any asset. It’s “stable” in relation to its underlying collateral rather than to the USD or the price of another asset. It builds off the ideas that former Maker architect Nikola Mushegian wrote about.

Balancer launches, speeds up liquidity wars

On the last day of March, Balancer launched its mainnet onto Ethereum. The Automated Market Maker (AMM) has built on the AMM model pioneered by Uniswap, Kyber and Bancor. Like those projects, Balancer is a decentralized exchange (DEX) that uses on-chain pools of liquidity and a pricing algorithm that adjusts price in line with the changing supply of the pools.

Whereas in those projects, the pricing algorithm uses the relationship between two pools of liquidity, in Balancer, it uses all on-chain pools for liquidity and price discovery. Rather than pooling liquidity 1:1 Dai-ETH pool on Uniswap, Balancer allows liquidity providers to deposit multiple assets of various weights into an index fund-like portfolio of tokens onto Balancer.

This index fund of tokens has a set % of allocation that each asset should make up of the overall portfolio. If the prices of the underlying tokens change, Balancer rebalances the portfolio according to the original percentages, like a roboadvisor. Instead of paying trading fees to rebalance, however, Balancer turns this on its head, getting traders to pay trading fees to the user for the right to rebalance their portfolio.

There’s a lot of alien magic math that manages the relationship between the pools, but this graphic helps explain how a trade might go through the system:

Balancer has already attracted $680k in liquidity, but as Kerman Kohli points out, their timing could not be better with the migration of liquidity to Uniswap v2. He goes further with some recommendations for Balancer:

Offer close to 0% fees for the first X amount of liquidity that enters the platform

Paying LP fees out of pocket until they generate meaningful revenue

Providing initial liquidity to a pool that's in high demand (steal Curve Finance's market share in stable coins)

Lining up as many influencers as they can to shill them once they launch before Uniswap (this is more of a softer tactic and will have less effectiveness since Balancer's investors are separate to Uniswap).

There’s only a finite amount of assets to go after right now, so competition will likely be fierce. And it’s not just other DEXs, Compound and other pool-based lending protocols may offer similar automatic portfolio rebalancing, creating a race for what Dan Elitzer said during his ETHDenver talk for a “Super-Fluid Protocol”

Related:

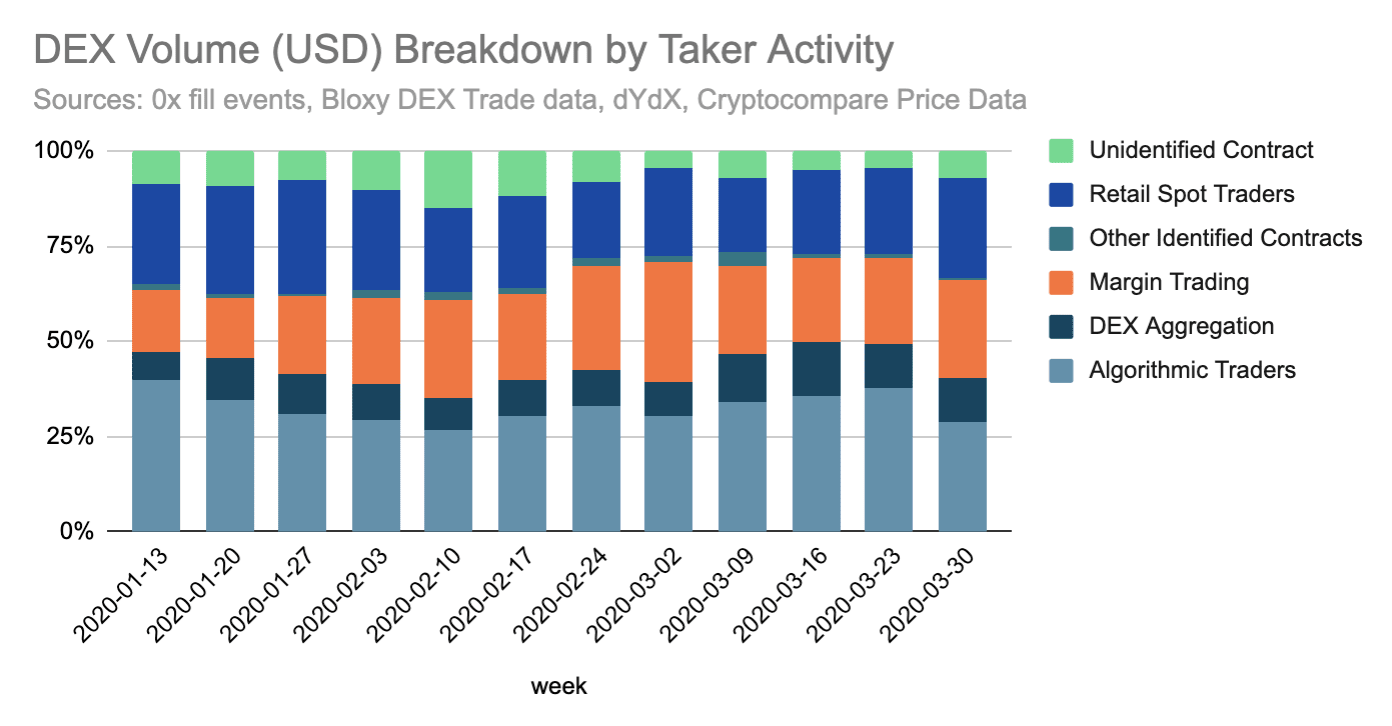

Chart of the week: DEX volume by source

0x’s Alex Kroeger with a great chart in the Our Network newsletter, which gives insight into who is actually using DEXs. The volume breakdown shows a relatively healthy industry without reliance on a single market segment. Aggregators are about 10% of volume, while non-trading smart contracts are not yet using DEX’s. There wasn’t much change during March’s volatility, but you can see a small increase in the share from algorithmic traders during the middle of March.

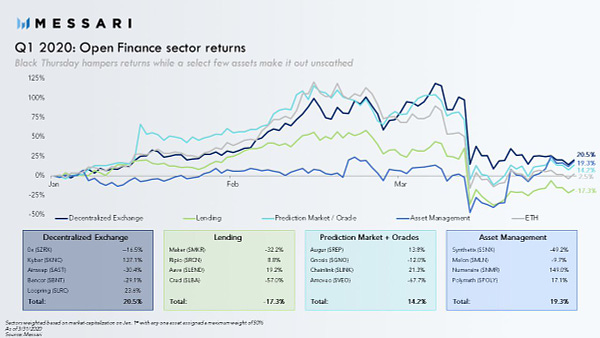

Tweet of the week: DeFi token performance

Still trying to make fetch happen, but Messari’s Jack Purdy looks at Q1 performance of major DeFi tokens. The growth in DeFi tokens makes a sector comparison worthwhile, even if it most are highly correlated to ETH. There were significant differences amongst DEX tokens and the most significant mover in the Q1 was Maker. Its 32% decline in Q1 brought down the lending category as a whole.

Related: The team behind Zerion just launched DeFiMarketCap.io. It tracks well-known DeFi tokens like MKR and SNX, but also the size of cTokens, Uniswap pool tokens and other DeFi products.

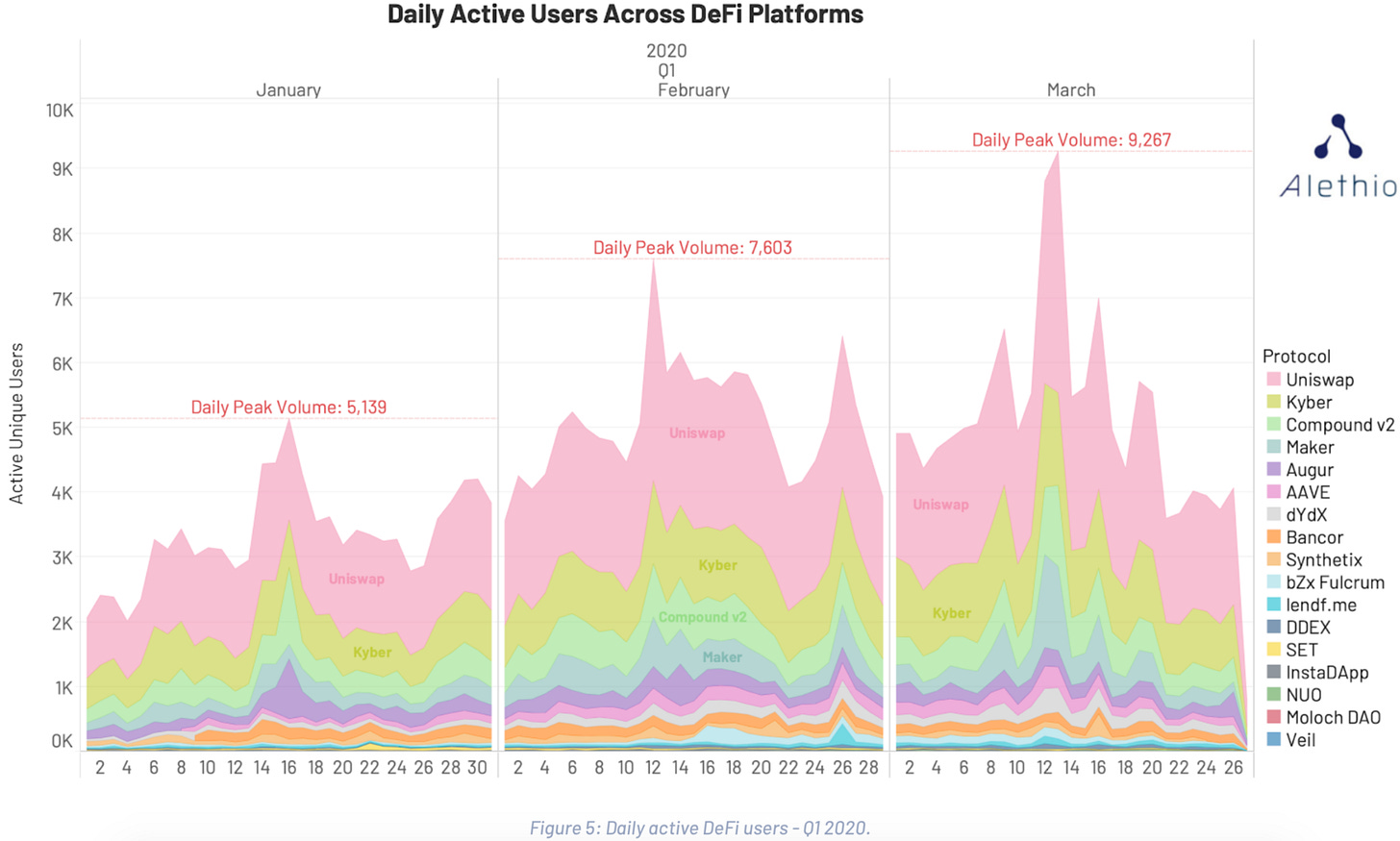

Chart of the week (#2): DeFi Users

Another chart this week because Alethio has released a Q1 DeFi report with lots of great info. The chart above breaks down the daily active users for all DeFi protocols. Assets in DeFi may be concentrated in Maker, Compound and Synthetix, but in terms of actual users, Uniswap and Kyber are far ahead. There’s no perfect metric, but it’s important to pair TVL with other data points.

Odds and Ends

ETHGlobal announces HackMoney, a 30 day virtual hackathon Link

PieDAO launches BTC++ on Uniswap Link

Chicago trading firms form DeFi alliance Link

The LAO aims to recreate The DAO in compliance with US Laws Link

Nexus Mutual proposes 2.5% revenue fee on protocol spread Link

Tezos launches tzBTC, a Bitcoin synthetic on Tezos Link

Synthetix clone launches on Tron Link

DeFi Saver releases Automation v2 with flash loan support Link

Thoughts and Prognostications

Crypto Dollars and the Evolution of Eurodollar Banking [Max Bronstein/Unexpected Values]

Open Optionality: Exploring the DeFi options market [Will Sheehan/Parsec]

Evolving Trends in Token Powered Networks [Mara Schmiedt/Codefi]

Crypto’s Business Model is Familiar. What Isn’t is Who Benefits [Jesse Walden/a16z]

2020 Q1 Dapp Market Report [Dapp Review]

The Most Forkable DeFi Protocols on Ethereum [Kyle Samani/UnChained]

Erasure Thesis: A New Staking Protocol, Powered by NMR [Joel Monegro/placeholder]

That’s it! Feedback appreciated. Just hit reply. Busy week. Written in Brooklyn (again) where I enjoy the slow march of spring and renewal.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.