Wormhole fallout and the slowdown in DeFi lending

Plus Odds & Ends and Thoughts & Prognostications

Tweet of the week: Solana bridge exploit

DeFi security icon samczsun with the tldr on yesterday’s massive exploit, where hackers drained 120,000 ETH from the Wormhole bridge’s smart contract because it “spoof[ed] guardian signatures” on the Solana side. Read the thread to find out exactly what that means. The attack - the second largest in DeFi after the $600m Polynetwork hack - caps a month of bad news for Solana as the network struggled to maintain uptime during recent volatility, quickly implementing a fee market, reneging on earlier pronouncements.

The Solana’s community’s response to both of these incidents has been swift and forceful, demonstrating a capable validator set and more importantly, a deep pocket of financial backers with a vested interest in Solana’s success. Jump announced plans to make sure the weETH holders on Solana are made whole, while FTX, which now has a higher valuation than Coinbase, remains firmly committed to the Solana ecosystem.

Still, the biggest takeaway is the additional complexity and risk dynamics in a multichain world. A lot of the bridged ETH was collateral on Solana, creating fears of cascading liquidations and contagion spreading to the entire chain. Parsec founder Will Sheehan with a timely prediction/joke given the recent growth of Cosmos:

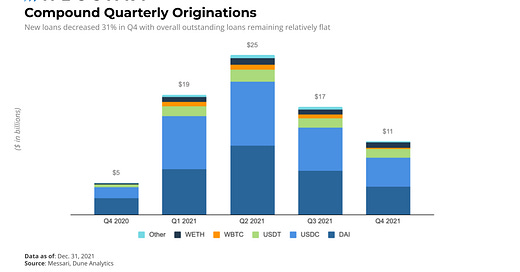

Chart of the week: Declining loan originations

DeFi lending grew to enormous heights following DeFi Summer and Compound’s launch of COMP token, which 5x’d TVL a week after launch. Compound, Aave and Maker inhaled assets at the beginning of 2021 and sharply increased loan originations as investors looked to lever up. The TVL remains steady (or in line with ETH prices) and there have not been substantial outflows, but new loans have slowed down considerably. For Compound, this may be because rising gas prices on Ethereum mainnet has crowded out everyday users.

Aave, which just released plans for a v3, has been much more aggressive in its multichain strategy, with markets on Polygon and Avalanche, but Robert Leshner posted in the Compound forum two weeks ago about a shift in strategy away from Gateway (an app chain) into a multichain strategy to drive growth in new markets.

In other DeFi lending news, Dai’s collateralization backed by USDC ticked back above 50% after the recent volatility.

Odds and Ends

Hacker loses 68 ETH trying to exploit Rari pool Link

SEC under Gensler has shortened public comment periods Link

Balancer considers shifting to veCRV lockup tokenomics Link

Ethereum overtakes Cardano as second-largest PoS network Link

Thoughts and Prognostications

You get the crypto rules you want [Matt Levine/Bloomberg]

Stablecoins: Growth potential and impact on banking [Gordon Liao & John Caramichael/The Fed]

Automated rebase farming on OHM forks [Derked/Mirror]

On tokenised marketplaces [Joel John/Decentralised.co]

Crypto down, NFTs up [David Hoffman/Bankless]

Deal structuring in early stage crypto [Regan Bozman/Lattice Fund]

A list of open problems in DeFi [emperor/Mirror]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where last weekend’s foot of snow is starting to melt. Looking forward to Denver and seeing everyone.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to DXdao* and benefit financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.