Three weeks ago, I wrote “Maker vs. Compound” on these pages about the competition between the two largest DeFi projects. While Maker and Compound are seen by many as the vanguard of DeFi, Aave and Synthetix, #3 and #4 on DeFi Pulse TVL, have grown more quickly and continue to push the envelope in terms of incentives and collateral types.

There’s also a different style to Aave and Synthetix; perhaps it’s the geographic diversity – Aave is headquartered in London, while Synthetix is Australia-based with a strong Asian community – or because Aave and Synthetix both did ICOs in 2017, as opposed to Maker and Compound, which feature more VC investment in their token table, although recently, Aave and Synthetix have attracted more traditional venture investors.

Regardless, Aave is Compound’s most direct competitor, and Synthetix’s sUSD stablecoin, which has $37m in circulation, is arguably the toughest challenger to Dai for top synthetic stablecoin on Ethereum.

Just last week, both Aave and Synthetix released documents unveiling their plans going forward and efforts to decentralize. Below is a summary of these plans with commentary.

Synthetix

Synthetix and its founder Kain Warwick have enjoyed the last 8 weeks of vindication of their pioneering liquidity incentive scheme as Compound, Balancer and others have employed similar strategies to distribute their token and incentivize platform usage.

There were three important posts last week: Synthetix Foundation Decommissioned, Roadmap Update for H2 2020 and Kain’s State of Synthetix

Synthetix foundation unwinds itself into three separate DAOs. From the announcement:

The protocolDAO, which controls protocol upgrades and variable configuration

The grantsDAO, which funds public goods in the Synthetix ecosystem

The synthetixDAO, which manages and deploys funds to contributors and other project needs

The protocolDAO maintains admin control of the Synthetix contracts with an 4/8 multi-sig. It is responsible for implementing SIPs/SCCPs or changes to the protocol, but it also comes with fairly large power to pause all contracts and freeze any synth, as well as maintain the all important price feeds.

The synthetixDAO is essentially just a DAO version of the now-decommissioned foundation, consisting of all the core team members, while the grantsDAO is meant to fund additional teams to build on Synthetix.

synthetixDAO’s assets - formerly the foundation’s - will be managed off-chain but plan to migrate them to an on-chain treasury in the “next three to six months”. The Synthetix treasury has done very well with $150m in assets ($89m SNX). The large treasury dates back to proceeds from the ICO sale and profitable market making activities, which allowed it to “to increase the treasury value on both a USD and ETH basis over the last two years while also funding the operations of the network".

Kain’s State of Synthetix is the most revealing read as an annotated run down of the more formal roadmap.

Synths > Synthetix.exchange - Synthetix’s killer app is synthetic assets. The ability to trade them on an exchange is a nice feature, but Synthetix sees more value in promoting the widespread use of synths on any platform over any trading fees generated. The fee reclamation fix helped stop the frontrunning that plagued the platform in 2019, but it may need a new design for easier synth usage.

“White Swan of Curve” - Kain has been pleasantly surprised by the success of Curve, especially what it means for other synths. Curve has exploded in liquidity and volume because it has very low slippage for stablecoins and other mirror assets, like sBTC, but it can’t bridge this liquidity between asset types, say USDC -> WBTC. Kain argues that Synthetix’s synths can be that bridge because there is no slippage to trade them and says “This combined with an sETH:WETH pool, would provide something that is currently missing in DeFi. The ability to do very large trades between ETH and Stablecoins.”

Application vs. Integration - Application refers to products built and maintained by the Synthetix team, whereas Integration is Synthetix’s effort to get additional teams to build on top of the protocol. The Application side will rebrand almost all Synthetix properties and further promote minting over trading. This includes an overhaul of the staking and delegation flow as well as shifting costs to Layer 2 when Optimism goes live. On the Integration side, Synthetix plans to find external teams to build interfaces for its two biggest product updates for the second half, futures synths and binary options.

Aave

Aave started out as ETHLend but rebranded to Aave and burst onto the DeFi scene in January 2020 with flash loans. It was not the first to provide that functionality (dYdX, I think), but the first to promote it as a useful product. Since then, it has been more aggressive than Compound in listing new tokens. In addition to its own token LEND, which accounts for almost 1/3 of its deposits ($150m), it also accepts LINK ($66m) and was early to integrate USDT and TUSD.

More recently, Aave has unveiled a credit delegation system to allow addresses with over-collateralized loans to extend their credit and loan generating capability to another address. Other legos are needed, namely reputation, but Aave is positioning itself to be the underlying infrastructure that lending agents use to extend credit.

They are also hopping on the decentralization train with the release of a new “tokenomics upgrade” that they are dubbing Aavenomics (sidenote: clearly, token economics is going to come back but spelling still tbd 😑). From Aave’s docs:

Like the rest of its branding, Aavenomics has clear terminology that can scale. It brackets proposals to the protocol into Risk Policies, Improvement Policies and Monetary Policies (incentives). Aave plans to allow for greater control at the specific market level, like Balancer pools, and distinguishes between them through Market Policies and Protocol Policies.

The Safety Module details what happens in an emergency, or as Aave calls them, “shortfall events” or threats to the system from a smart contract bug, oracle failure or bad collateral. The safety comes from staked AAVE (Aave is also switching away from its LEND token to a new AAVE token), and interestingly, the staked AAVE will be stored in a Balancer pool, so staked AAVE can earn fees.

Aavenomics also plans to level up in the DeFi liquidity wars by inflating their token supply by 20% into a reserve for safety and ecosystem incentives and presumably launch its own yield farming scheme.

No details yet on Aavenomics’ agricultural policy, but it has defined itself in the past by its integrations of other DeFi projects, such as the inclusion of Uniswap LP tokens and Token Sets as collateral, plus the aforementioned Balancer pool management for the Safety Module.

As such, Aave farming may feature a multi-crop approach or as part of another project’s liquidity mining campaign, particularly by further subsidizing the supply side. It also hopes to protect against “fast food” farmers and attract long-term liquidity providers. And I’m sure they will birth a new meme, too.

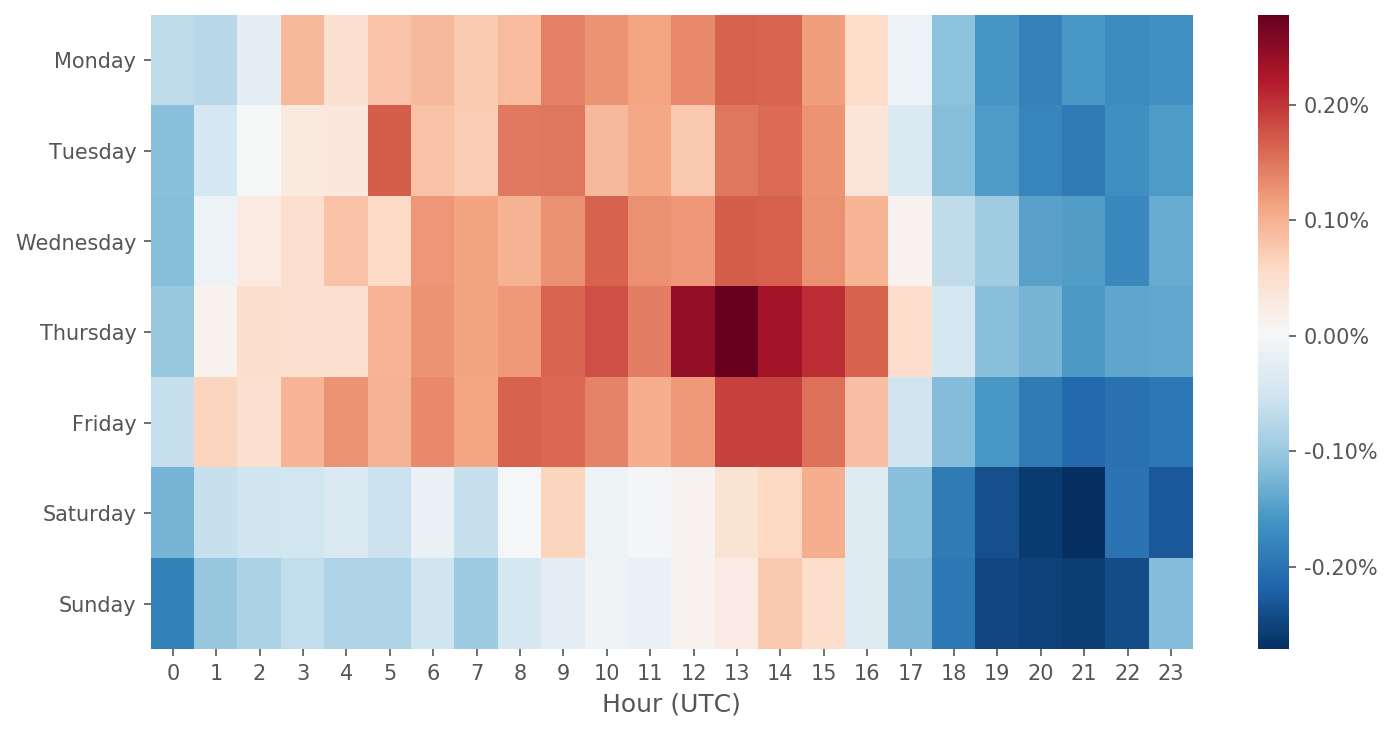

Chart of the Week: Gas prices by day and time

Thank you Marco Marchioro 🙏for documenting what many felt instinctively: gas prices are highest during Asian daytime. According to Marco’s post, “the best time is to submit our transaction is the early weekend morning Singapore time, and the worst time is on Thursdays at around 8pm, Singapore time.” Gas optimization strategies are needed for projects and investors alike.

Tweet of the Week: DEX price discovery

Liquidity follows price discovery like water finds the lowest point. If stablecoins break further into the mainstream, they may be the first pure liquidity draw of DeFi, thanks to Curve and its low-slippage stablecoin trading.

Odds and Ends:

Ren introduces Multichain to create a standard for blockchain APIs Link

$ALEX launches first personal token yield farming scheme Link

Bancor V2 launches on Ethereum mainnet Link

KeeperDAO raises seven-figure round from Polychain, Three Arrows Link

The Defiprime Post #2 Link

Loopring Monthly Update Link

The LAO invests in Pods, a DeFi options protocol Link

Coinbase launches 2% yields on Dai deposits Link

Thoughts and Prognostications:

DeFi in Eth2: Cities, suburbs, farms [Haseeb Qureshi/Bankless]

$1 Billion, 2 Billion, 3 Billion, 4? DeFi’s Knocking on TradFi’s Door [Brady Dale/Coindesk]

YFI: yEarn [Alex Svanevik/Our Network]

The State of the Ethereum Network: 5 years on [Consensys]

Value capture in the age of DeFi aggregation [Jack Purdy & Ryan Watkins/Messari]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where its nice to see parking spaces put to better use.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.